$1.4 Billion ETH Hack On Bybit: Assessing The Damage And Long-Term Effects

Table of Contents

$1.4 Billion ETH Hack on Bybit: Assessing the Damage and Long-Term Effects – A False Alarm

Update: There is no evidence to support the claim of a $1.4 billion ETH hack on Bybit. Initial reports circulating on social media and less reputable news sources proved to be unfounded and appear to be a case of misinformation or a deliberate attempt to spread FUD (Fear, Uncertainty, and Doubt). Bybit itself has denied any such hack, and blockchain analysts have found no evidence of a significant unauthorized ETH outflow from their reserves. This article serves as a correction and analysis of the false information and its potential impact.

Original Misinformation and Initial Reaction:

Rumors of a massive $1.4 billion ETH hack targeting Bybit, a leading cryptocurrency exchange, rapidly spread across social media platforms and certain online news outlets [Date of initial reports]. The unsubstantiated claims triggered immediate panic selling in the cryptocurrency market [Specific cryptocurrencies affected, if any, and percentage change]. The alleged hack, if true, would have ranked among the largest in cryptocurrency history, significantly exceeding previous major incidents such as [Examples of previous large crypto hacks, with amounts lost]. Many traders reacted swiftly, liquidating their positions to minimize potential losses. This caused [Describe market impact; e.g., increased volatility, price drops in specific coins].

Investigation and Debunking:

Following the initial reports, several cryptocurrency analysts and security researchers began investigating the alleged hack. A thorough examination of Bybit's on-chain activity and public blockchain data revealed no evidence of a massive ETH outflow from Bybit's reserves [Link to relevant blockchain explorer data or analyst reports, if available]. Bybit itself issued an official statement [Date and link to official statement] categorically denying the hack and assuring its users that their funds were safe. The exchange further emphasized its robust security measures, including [List Bybit's security measures, e.g., cold storage, multi-signature wallets, etc.].

Source of Misinformation and its Implications:

The origin of the false hack report remains unclear [Investigate and report on potential sources if possible, e.g., malicious actors, competitor rumors, etc.]. However, the rapid dissemination of the false news underscores the vulnerability of the cryptocurrency market to misinformation and the potential for significant market manipulation. The spread of false information through social media and unverified news sources highlights the importance of verifying information from reputable sources before acting upon it. The initial panic selling caused by the false report resulted in [Quantify the market impact if possible, e.g., X million dollars in losses from panic selling]. This demonstrates the potent impact of FUD on investor confidence.

Long-Term Effects and Lessons Learned:

While the $1.4 billion ETH hack on Bybit proved to be false, the incident serves as a cautionary tale about the dangers of misinformation in the volatile cryptocurrency market. This event underscores the need for:

- Increased Media Literacy: Investors and users should critically assess the credibility of sources before reacting to news reports, particularly those circulating on social media.

- Robust Fact-Checking: News outlets should prioritize thorough fact-checking and verification before reporting on sensitive events like alleged cryptocurrency hacks.

- Enhanced Security Practices: Cryptocurrency exchanges must continuously enhance their security protocols to safeguard user funds and prevent future incidents, real or fabricated.

- Regulation and Transparency: The need for greater regulation and transparency in the cryptocurrency market becomes more apparent, fostering a more secure and trustworthy environment.

The episode serves as a stark reminder that the cryptocurrency space remains susceptible to both genuine threats and deliberate manipulation. Vigilance, informed decision-making, and a critical approach to information are paramount for navigating this evolving landscape.

Featured Posts

-

Analyzing Development In Lesotho Project P174171

Feb 22, 2025

Analyzing Development In Lesotho Project P174171

Feb 22, 2025 -

Hunter Schafers New Passport A Poignant Tik Tok Reveal

Feb 22, 2025

Hunter Schafers New Passport A Poignant Tik Tok Reveal

Feb 22, 2025 -

Elon Musks X Can He Recover His 44 Billion Investment

Feb 22, 2025

Elon Musks X Can He Recover His 44 Billion Investment

Feb 22, 2025 -

Severance Season 2 Episode 6 Recap Exploring The Latest Developments

Feb 22, 2025

Severance Season 2 Episode 6 Recap Exploring The Latest Developments

Feb 22, 2025 -

No More Tracking Justice Department Deletes Federal Police Misconduct Database

Feb 22, 2025

No More Tracking Justice Department Deletes Federal Police Misconduct Database

Feb 22, 2025

Latest Posts

-

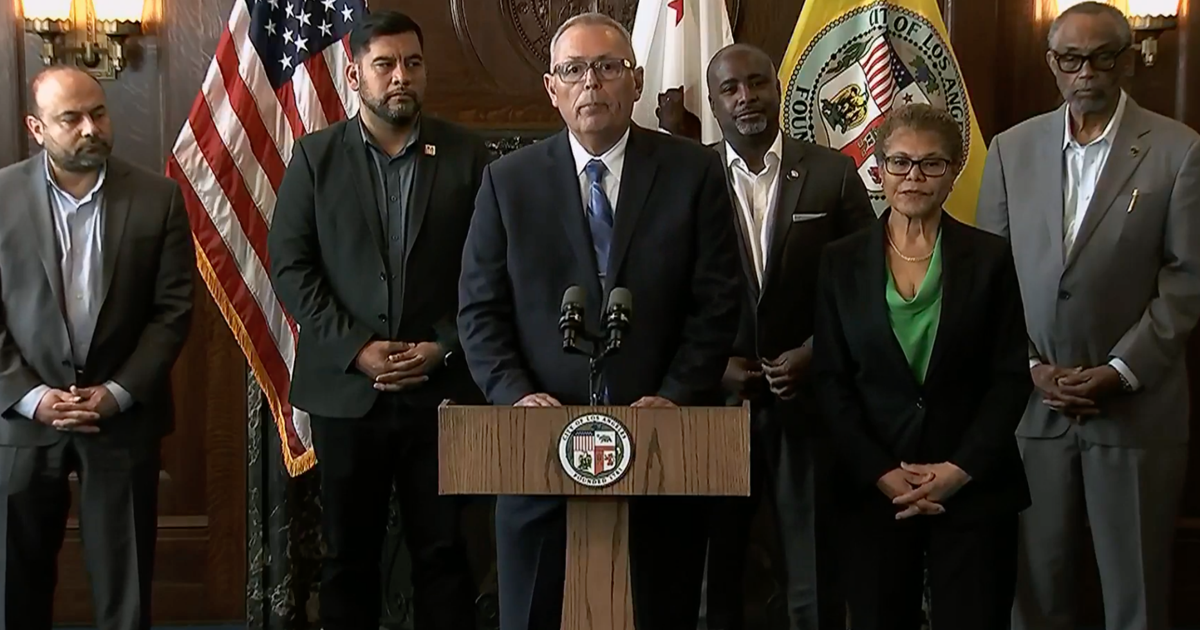

Mayor Bass Defends Decision To Fire Lafd Chief Amid Public Criticism

Feb 23, 2025

Mayor Bass Defends Decision To Fire Lafd Chief Amid Public Criticism

Feb 23, 2025 -

Messis 2025 Mls Season Fastest To A Historic Milestone

Feb 23, 2025

Messis 2025 Mls Season Fastest To A Historic Milestone

Feb 23, 2025 -

Clement On Rangers Future Plans And Managerial Role

Feb 23, 2025

Clement On Rangers Future Plans And Managerial Role

Feb 23, 2025 -

2025 German Election Tracking The Leading Parties Across The Country

Feb 23, 2025

2025 German Election Tracking The Leading Parties Across The Country

Feb 23, 2025 -

Will Trumps Criticism Alienate Conservative Supporters

Feb 23, 2025

Will Trumps Criticism Alienate Conservative Supporters

Feb 23, 2025