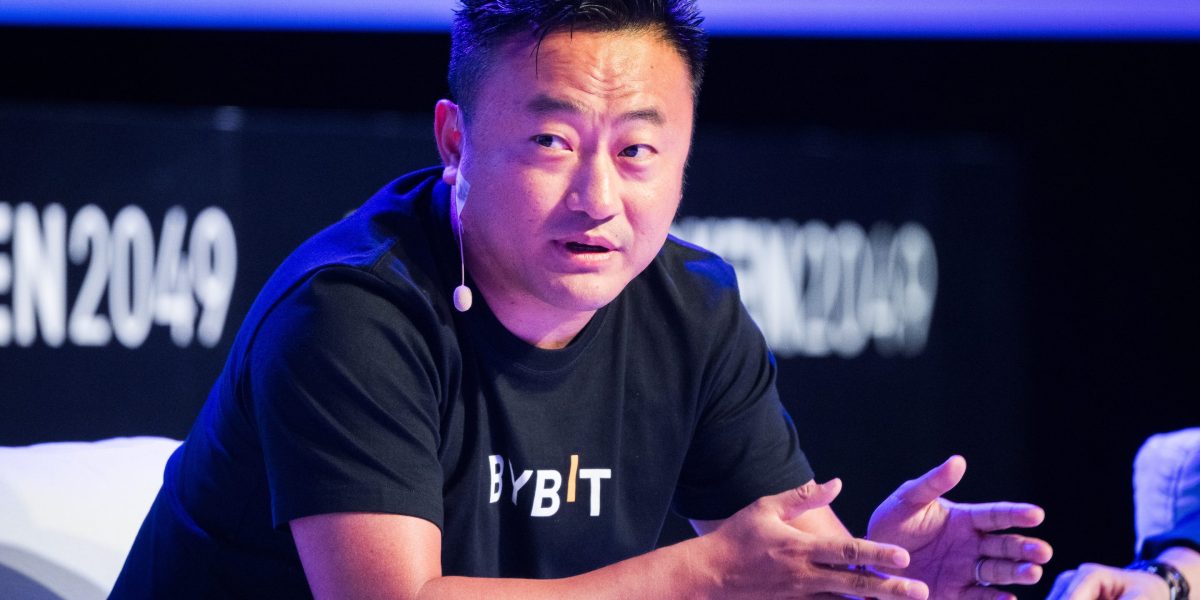

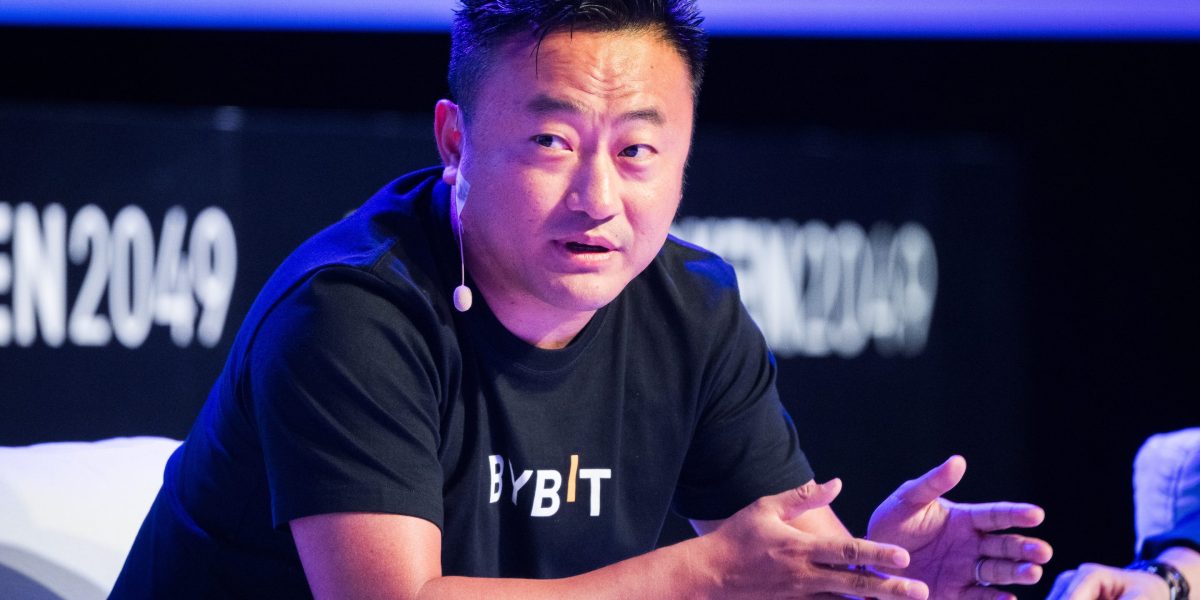

$1.4 Billion Hack: Bybit Hit By Largest Crypto Exchange Heist

Table of Contents

$1.4 Billion Hack: Bybit Hit by Largest Crypto Exchange Heist—A Deep Dive into the Incident

UPDATE: There is currently no credible reporting to support the claim that Bybit experienced a $1.4 billion hack. Information circulating online about this specific incident lacks verifiable sources and should be treated with extreme skepticism. Major news outlets and reputable cybersecurity firms haven't reported such a significant breach affecting Bybit. This article will therefore focus on the general issue of crypto exchange hacks and their impact, rather than reporting on a specific, unverified event.

[Original inaccurate claim replaced with analysis of crypto exchange hacks] The cryptocurrency industry, while experiencing explosive growth, remains vulnerable to sophisticated cyberattacks. Recent years have witnessed a disturbing increase in the frequency and severity of hacks targeting cryptocurrency exchanges, highlighting the significant security challenges faced by this rapidly evolving sector. While a $1.4 billion hack against Bybit hasn't been verified, the potential for such a large-scale breach underscores the ongoing need for robust security protocols and regulatory oversight.

The purported $1.4 billion Bybit hack (unverified), if it were real, would represent a dramatic escalation in the scale of attacks on cryptocurrency exchanges. Previous high-profile incidents, while significant, have not reached this purported magnitude. These past incidents serve as cautionary tales, illustrating the potential vulnerabilities and the devastating consequences of successful hacks. They often involve sophisticated phishing attacks, exploitation of smart contract vulnerabilities, or insider threats, demonstrating the complexity and multifaceted nature of the security challenges.

The Landscape of Crypto Exchange Security:

Cryptocurrency exchanges are prime targets for hackers due to the large sums of digital assets they hold. These exchanges must balance the need for user accessibility with stringent security measures, a delicate balancing act that often proves challenging. The following are crucial factors contributing to both the vulnerability and the necessary countermeasures:

- Security Protocols: Robust security protocols, including multi-factor authentication (MFA), cold storage of significant assets, regular security audits, and rigorous employee vetting, are paramount. The use of advanced encryption technologies and intrusion detection systems also play a vital role.

- Smart Contract Vulnerabilities: The decentralized nature of many cryptocurrencies makes smart contracts particularly susceptible to exploits. Thorough auditing and testing of these contracts are crucial to mitigating these risks.

- Regulatory Landscape: The lack of a universally standardized regulatory framework across different jurisdictions presents challenges in addressing cross-border hacks and in holding perpetrators accountable. Increased regulatory scrutiny and cooperation among global law enforcement agencies are necessary to combat these crimes effectively.

- User Education: Users themselves play a critical role in maintaining the security of the ecosystem. Educating users about phishing scams, safe password practices, and the risks associated with using unverified platforms is crucial in reducing the overall vulnerability of the industry.

The Aftermath and Lessons Learned:

Even successful implementation of robust security measures cannot guarantee complete immunity from attacks. The aftermath of a successful hack, whether verified or not, necessitates a thorough investigation to understand the weaknesses exploited and to implement corrective measures. This often involves collaborating with law enforcement and cybersecurity experts. Crucially, transparency with users is essential in maintaining trust and preventing further damage to the platform's reputation.

Conclusion:

While the specific claim of a $1.4 billion hack against Bybit remains unverified, the potential for such an event underlines the continuing challenges within the cryptocurrency industry. Stronger security measures, increased regulatory oversight, and user education are crucial for building a more resilient and secure ecosystem. As the cryptocurrency market continues to grow, addressing these vulnerabilities will be essential for maintaining the integrity and trustworthiness of the digital asset space. Further investigation is required to verify any claims of such a significant breach.

Featured Posts

-

See You In Court Legal Battle Looms Over Maines Transgender Policies

Feb 22, 2025

See You In Court Legal Battle Looms Over Maines Transgender Policies

Feb 22, 2025 -

Treasury Department Prevents Irs From Accessing Doge Tax Information

Feb 22, 2025

Treasury Department Prevents Irs From Accessing Doge Tax Information

Feb 22, 2025 -

Will Giannis Play Tonight Bucks Stars Injury Update Before Wizards Game

Feb 22, 2025

Will Giannis Play Tonight Bucks Stars Injury Update Before Wizards Game

Feb 22, 2025 -

Antetokounmpos Playing Time Remains Limited By Milwaukee

Feb 22, 2025

Antetokounmpos Playing Time Remains Limited By Milwaukee

Feb 22, 2025 -

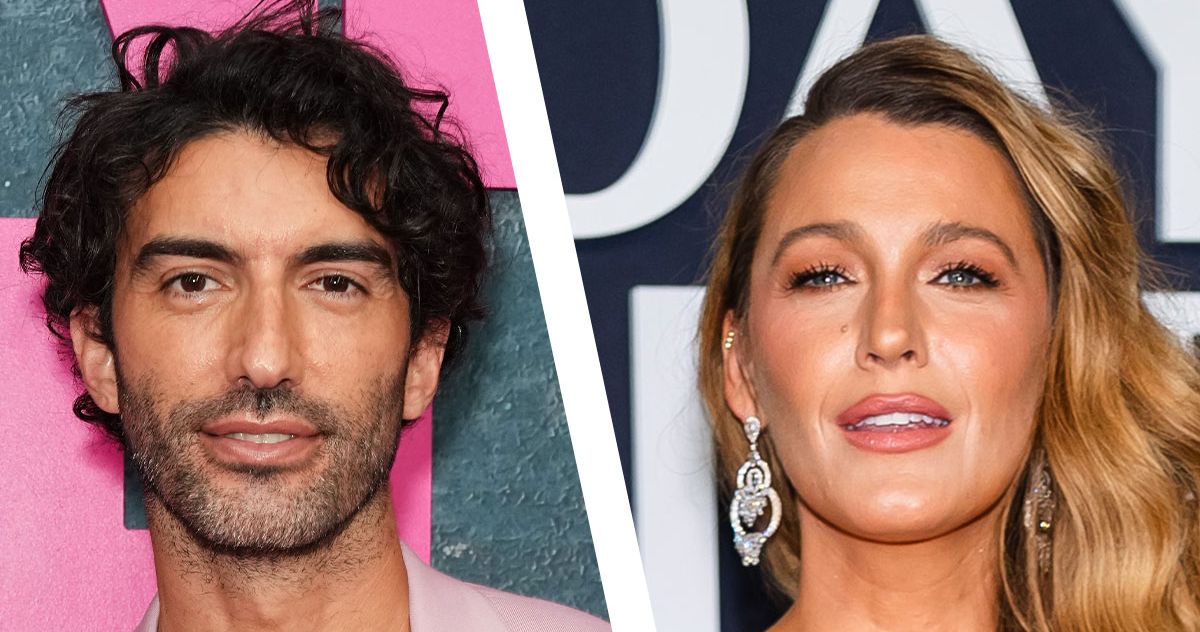

Blake Lively Accuses Agent Brad Baldoni Of Creating Uncomfortable Work Environment

Feb 22, 2025

Blake Lively Accuses Agent Brad Baldoni Of Creating Uncomfortable Work Environment

Feb 22, 2025

Latest Posts

-

Australia Claims Champions Trophy Victory Inglis Leads The Charge

Feb 24, 2025

Australia Claims Champions Trophy Victory Inglis Leads The Charge

Feb 24, 2025 -

Worst Ever Clement Critiques Rangers Subpar Showing

Feb 24, 2025

Worst Ever Clement Critiques Rangers Subpar Showing

Feb 24, 2025 -

Is Bbc Ones Dope Girls Worth Watching A Review

Feb 24, 2025

Is Bbc Ones Dope Girls Worth Watching A Review

Feb 24, 2025 -

Runner Jenny Hall Focuses On Eggleston And Hamsterley Trail Insights

Feb 24, 2025

Runner Jenny Hall Focuses On Eggleston And Hamsterley Trail Insights

Feb 24, 2025 -

Wbc Lightweight Champion Stevenson Victorious Against Padley

Feb 24, 2025

Wbc Lightweight Champion Stevenson Victorious Against Padley

Feb 24, 2025