$1.5 Billion Stolen: Bybit Exchange Hit By Largest-Ever Crypto Hack

Table of Contents

$1.5 Billion Heist: Bybit Exchange Suffers Record-Breaking Crypto Hack

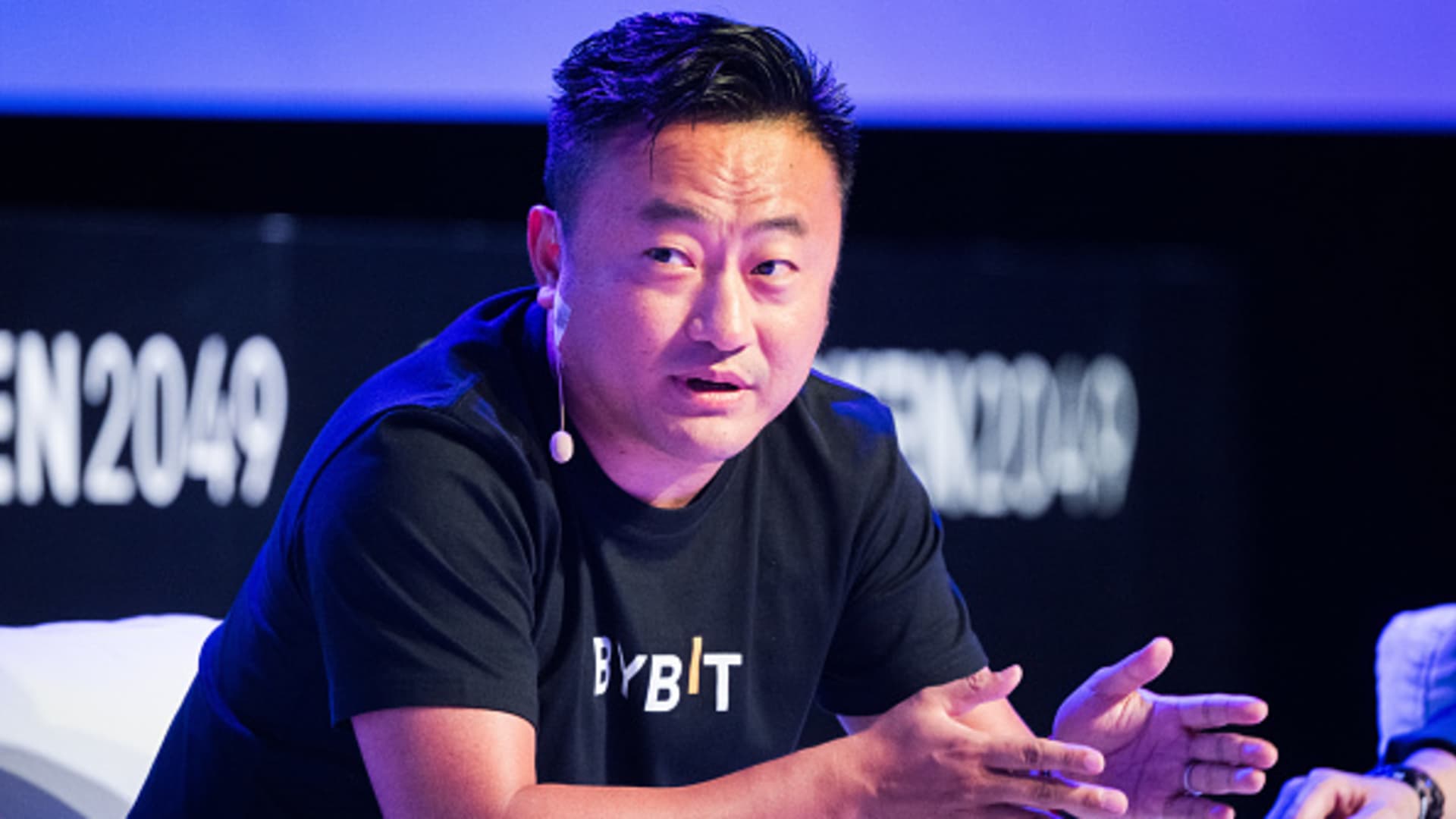

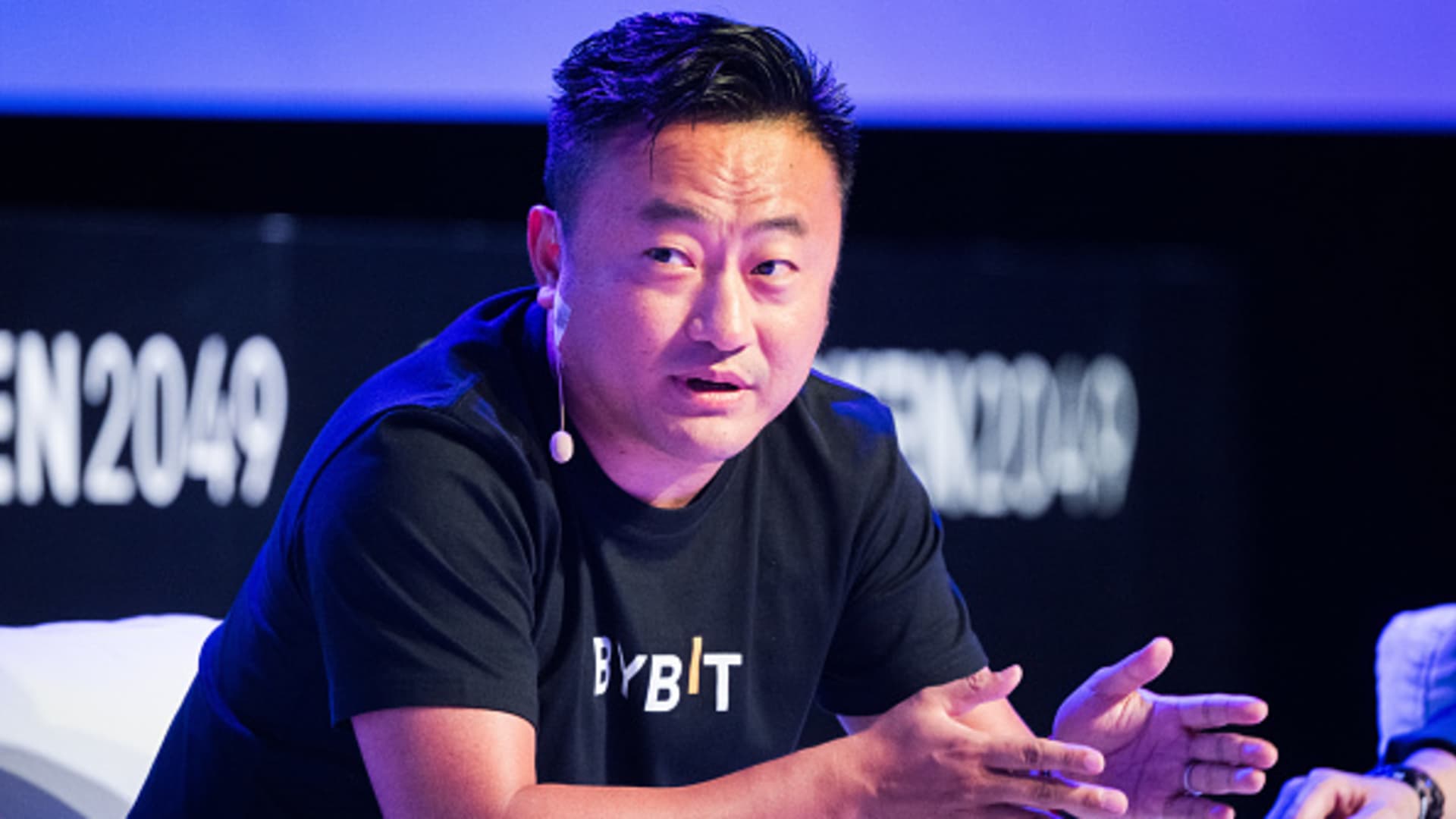

HONG KONG, [Date of Publication] – In a stunning blow to the cryptocurrency world, Bybit, a leading cryptocurrency exchange, has confirmed a massive security breach resulting in the theft of approximately $1.5 billion worth of digital assets. The incident marks the largest-ever cryptocurrency exchange hack in history, surpassing the previous record held by [Previous Record Holder and Amount]. Details surrounding the hack are still emerging, but initial reports suggest a sophisticated attack exploiting [Specific Vulnerability Exploited, e.g., a zero-day exploit, a weakness in smart contracts, etc.].

The exchange announced the breach in a terse statement released [Time of Statement Release] [Time Zone], confirming the loss and assuring users that investigations are underway in collaboration with cybersecurity experts and law enforcement agencies. Bybit emphasized its commitment to recovering the stolen funds and compensating affected users. However, specifics regarding the timeline for recovery and compensation remain unclear. The statement notably lacked detail on the specific cryptocurrencies stolen, the number of affected users, or the precise nature of the security breach. This lack of transparency has fueled speculation and concern within the crypto community.

This unprecedented theft has sent shockwaves throughout the cryptocurrency industry, underscoring the persistent vulnerability of even the largest exchanges to sophisticated cyberattacks. Experts warn that the incident could further erode investor confidence, already shaken by recent market volatility and high-profile failures. The sheer scale of the theft highlights the urgent need for robust security measures and regulatory oversight within the crypto space.

The Fallout:

The immediate aftermath of the hack has witnessed a sharp drop in Bybit's trading volume and a significant decline in the price of several cryptocurrencies, particularly those allegedly stolen in the heist. Social media has been abuzz with discussions about the incident, with many users expressing anger, frustration, and uncertainty about the future of their investments. The incident has also sparked renewed debate over the security of centralized exchanges versus decentralized alternatives.

While Bybit has pledged to fully investigate the incident, questions remain unanswered. Crucially, the exchange has yet to confirm whether user funds were directly compromised or if the stolen assets were held within Bybit's own reserves. This distinction is critical in determining the extent of user liability and the potential for compensation. The lack of detailed information is fueling speculation and further eroding trust.

Law Enforcement Involvement:

[Name of Relevant Law Enforcement Agency], along with international cybersecurity agencies, are reportedly involved in the investigation. However, the complexities of tracking cryptocurrency transactions across borders present significant challenges. The international nature of the cryptocurrency market makes tracing and recovering stolen funds a highly complex and time-consuming process. Experts suggest the recovery of the stolen funds is highly unlikely, with a significant portion likely to be laundered through various means.

Industry Implications:

The Bybit hack serves as a stark reminder of the inherent risks associated with cryptocurrency investments. The incident is likely to intensify calls for greater regulation and oversight of the crypto industry, particularly regarding security standards and consumer protection. Exchanges will likely face increased pressure to implement more robust security measures, including multi-factor authentication, cold storage solutions, and advanced threat detection systems.

This unprecedented breach will undoubtedly shape the future of cryptocurrency security, prompting a critical reassessment of existing practices and protocols across the entire industry. The long-term consequences of this monumental theft are still unfolding, but its impact on investor confidence and the overall perception of the cryptocurrency market is undeniable.

[Add any updates or further information as it becomes available. This section should be regularly updated.]

Featured Posts

-

Investigation Launched Hunter Schafers Case And The Trump Administrations Actions

Feb 22, 2025

Investigation Launched Hunter Schafers Case And The Trump Administrations Actions

Feb 22, 2025 -

Sunwing Airlines Crash Settlement Offers Reach 30 000 Per Passenger

Feb 22, 2025

Sunwing Airlines Crash Settlement Offers Reach 30 000 Per Passenger

Feb 22, 2025 -

Monkey Movie Review Brutal Violence Lackluster Plot

Feb 22, 2025

Monkey Movie Review Brutal Violence Lackluster Plot

Feb 22, 2025 -

Monkey High On Gore Low On Substance A Movie Review

Feb 22, 2025

Monkey High On Gore Low On Substance A Movie Review

Feb 22, 2025 -

Legal Recognition Hunter Schafers Updated Passport Details

Feb 22, 2025

Legal Recognition Hunter Schafers Updated Passport Details

Feb 22, 2025

Latest Posts

-

Britains Got Talent Ksi Judges Auditions First Look

Feb 24, 2025

Britains Got Talent Ksi Judges Auditions First Look

Feb 24, 2025 -

Barcelona Secure 2 0 Win Against Ud Las Palmas Goals And Analysis

Feb 24, 2025

Barcelona Secure 2 0 Win Against Ud Las Palmas Goals And Analysis

Feb 24, 2025 -

Fallen Virginia Officer Honored Politicians And Police Pay Tribute

Feb 24, 2025

Fallen Virginia Officer Honored Politicians And Police Pay Tribute

Feb 24, 2025 -

Snls 50th Anniversary The Impact Of Covid On Cast Appearances

Feb 24, 2025

Snls 50th Anniversary The Impact Of Covid On Cast Appearances

Feb 24, 2025 -

Lafc And Minnesota United Player Availability For 2025 Mls Match

Feb 24, 2025

Lafc And Minnesota United Player Availability For 2025 Mls Match

Feb 24, 2025