6% Drop For Palantir: Retail Investors Fuel Stock Slide

Table of Contents

Palantir Plunges 6%: Retail Investors Drive Stock Slide

New York, NY – October 26, 2023 – Shares of data analytics firm Palantir Technologies (PLTR) plummeted 6% on [Date of Stock Drop], fueled by a wave of selling pressure primarily attributed to retail investors. The sharp decline erased billions of dollars in market capitalization, leaving many wondering about the future trajectory of the controversial tech giant. The stock closed at [Closing Price on Date of Stock Drop], marking its lowest point in [Number] weeks/months.

The sudden drop wasn't triggered by any significant negative news from the company itself. Palantir's recent earnings report, released on [Date of Earnings Report], showed [Summary of Key Earnings Data, e.g., better-than-expected revenue growth, profitability figures, guidance]. While analysts had varying opinions on the results, there were no major downgrades or negative assessments that could justify such a dramatic market reaction. This leads many analysts to believe that the sell-off was driven largely by sentiment, specifically among individual investors.

Several contributing factors are cited for the retail investor exodus. One prominent theory points to the broader market correction, with tech stocks generally experiencing a downturn in recent weeks due to [Reasons for broader market correction, e.g., rising interest rates, inflation concerns]. This negative sentiment spilled over into Palantir, a company that has historically attracted a significant retail investor following, some of whom are known for their short-term trading strategies and susceptibility to market volatility.

Another factor could be profit-taking. Palantir's stock price had experienced a period of relative strength leading up to the drop, allowing retail investors who had bought at lower prices to secure profits. The timing coincided with the broader market downturn, exacerbating the selling pressure. The high short interest in Palantir (at approximately [Percentage]% as of [Date]) might have also played a role, as short sellers might have amplified the downward momentum.

The company itself has remained relatively silent on the sudden price drop. While Palantir doesn't typically comment on daily market fluctuations, the substantial decline is undoubtedly a concern for the company's long-term outlook. The drop raises questions about investor confidence and the sustainability of Palantir's growth trajectory, especially given its reliance on government contracts and its history of volatile stock performance.

Despite the recent setback, some analysts maintain a positive outlook on Palantir's long-term prospects. They point to the company's growing presence in the rapidly expanding government and commercial data analytics sectors, its innovative technology, and its strong relationships with key clients. However, the recent volatility highlights the risks inherent in investing in this relatively young and often unpredictable company. The coming weeks will be crucial in determining whether this sell-off represents a temporary correction or a more significant shift in investor sentiment towards Palantir. The company's next earnings report and any further announcements will be closely scrutinized by investors and analysts alike. The question remains: will retail investors return, or has the tide turned against Palantir for now?

Featured Posts

-

Leicester City Fall To Brentford Full Match Report And Result

Feb 22, 2025

Leicester City Fall To Brentford Full Match Report And Result

Feb 22, 2025 -

Trump Vows To Stop Nyc Congestion Pricing Plan

Feb 22, 2025

Trump Vows To Stop Nyc Congestion Pricing Plan

Feb 22, 2025 -

Trumps Actions Push Close To Open Defiance Of Court Orders Say Experts

Feb 22, 2025

Trumps Actions Push Close To Open Defiance Of Court Orders Say Experts

Feb 22, 2025 -

Kayaker Survives Being Swallowed By Whale Bbc News Quiz

Feb 22, 2025

Kayaker Survives Being Swallowed By Whale Bbc News Quiz

Feb 22, 2025 -

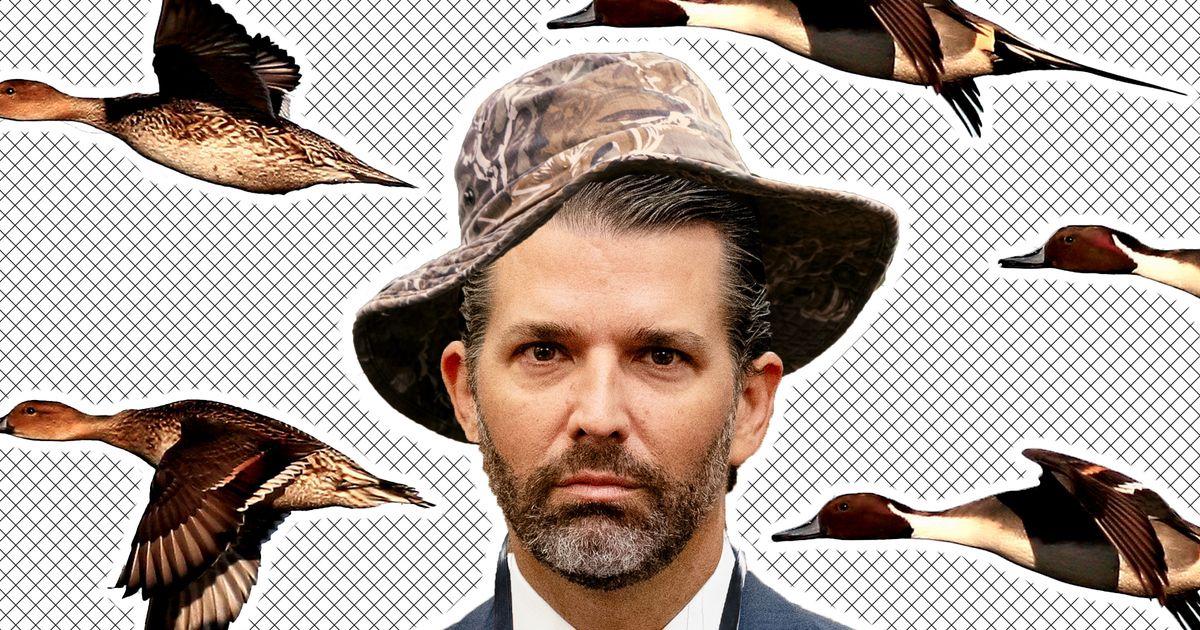

Donald Trump Jr Faces Backlash After Alleged Shooting Of Endangered Italian Duck

Feb 22, 2025

Donald Trump Jr Faces Backlash After Alleged Shooting Of Endangered Italian Duck

Feb 22, 2025

Latest Posts

-

Close Game Jimmies Defeat Bruins In Final Regular Season Matchup

Feb 24, 2025

Close Game Jimmies Defeat Bruins In Final Regular Season Matchup

Feb 24, 2025 -

Late Var Decision Denies Man Utd Win At Everton

Feb 24, 2025

Late Var Decision Denies Man Utd Win At Everton

Feb 24, 2025 -

La Mayor Bass Fires Fire Chief Crowley The Chiefs Response

Feb 24, 2025

La Mayor Bass Fires Fire Chief Crowley The Chiefs Response

Feb 24, 2025 -

Fallen Officers Girvin And Reese Community Reeling After Execution Style Killings

Feb 24, 2025

Fallen Officers Girvin And Reese Community Reeling After Execution Style Killings

Feb 24, 2025 -

Live Results Beterbiev Vs Bivol Uk Start Time And Full Undercard

Feb 24, 2025

Live Results Beterbiev Vs Bivol Uk Start Time And Full Undercard

Feb 24, 2025