A DOGE Dividend: Economic Concerns And Potential Consequences Of Trump's Proposal

Table of Contents

A DOGE Dividend: Economic Concerns and Potential Consequences of a Hypothetical Trump Proposal

[Update: No credible evidence exists to suggest that Donald Trump has proposed a Dogecoin dividend. This article explores the hypothetical economic consequences of such a proposal, based on the known characteristics of Dogecoin and the potential impacts of large-scale unconventional monetary policies.]

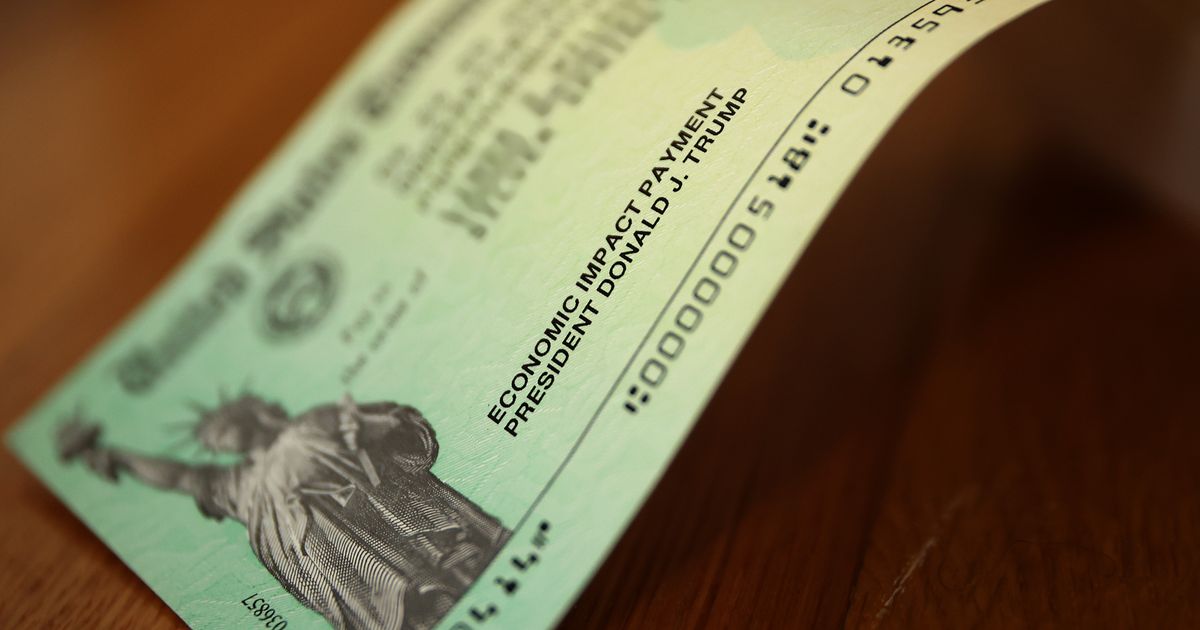

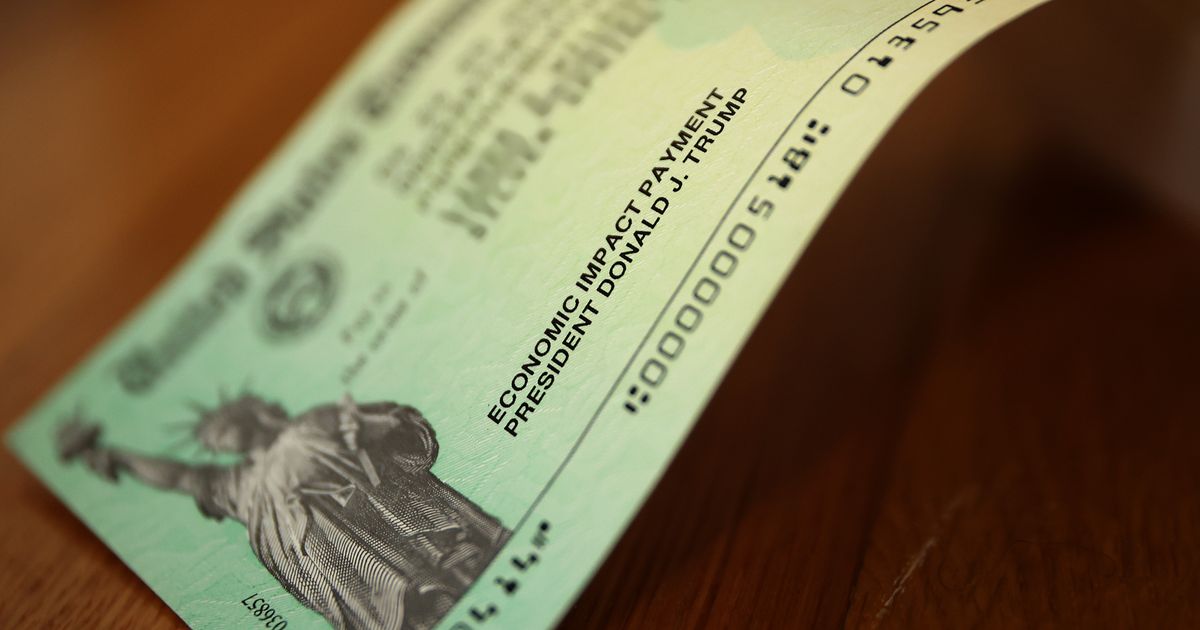

Washington, D.C. – The idea of a Dogecoin dividend, even as a hypothetical policy proposal, has sparked intense debate among economists and financial analysts. While no such proposal has been officially put forth by any prominent political figure, exploring its potential ramifications offers a valuable lens through which to examine the complexities of cryptocurrency and unconventional monetary policies. A hypothetical scenario where a major political figure, such as former President Donald Trump, were to propose distributing Dogecoin to US citizens would have profound and potentially destabilizing effects on the economy.

The core concern revolves around the inherent volatility of Dogecoin. Unlike fiat currencies backed by governments, Dogecoin's value is subject to extreme fluctuations, driven largely by speculation and social media trends. A mass distribution, potentially involving trillions of Dogecoins, could dramatically inflate the supply, leading to a sharp and potentially catastrophic devaluation. This would not only wipe out the value of the distributed coins but could also trigger a broader sell-off in the cryptocurrency market, causing significant losses for investors.

Furthermore, the logistical challenges of such a distribution would be immense. Identifying and verifying eligible recipients, ensuring secure and timely delivery of the Dogecoin, and managing the associated tax implications would represent an unprecedented logistical undertaking. The sheer scale of the operation would almost certainly require significant investment in new infrastructure and technologies, placing a further strain on public resources.

Economists warn of potential inflationary pressures. While some argue that the distribution could stimulate economic activity by injecting money into the system, this effect would likely be dwarfed by the inflationary consequences of a rapidly depreciating asset. The increased money supply, without a corresponding increase in the production of goods and services, could fuel price hikes across the board, eroding purchasing power and potentially leading to a period of economic instability.

Beyond the economic consequences, a Dogecoin dividend could have significant political and social ramifications. The decision to distribute a cryptocurrency, rather than a stable fiat currency, would raise serious questions about the government's commitment to financial stability and its understanding of monetary policy. It could also exacerbate existing societal divisions, pitting those who benefit from the distribution against those who see it as unfair or economically unsound. The potential for widespread distrust in government institutions would be a significant risk.

Furthermore, the international implications should not be underestimated. The unprecedented action would likely trigger global uncertainty in financial markets, potentially impacting currency exchange rates and cross-border investments. International confidence in the US dollar, a cornerstone of the global financial system, could suffer, with far-reaching repercussions for international trade and economic cooperation.

[In conclusion, while the prospect of a Dogecoin dividend remains a hypothetical scenario, analyzing its potential consequences highlights the crucial importance of sound monetary policy and the risks associated with unconventional approaches to economic stimulus. The volatility of cryptocurrencies, coupled with the logistical and economic challenges of mass distribution, suggests that such a proposal would carry significant and potentially devastating risks.] Further research into the effects of large-scale cryptocurrency distributions on established economic systems is vital to ensure informed policymaking and protect against unintended consequences.

Featured Posts

-

Declining Sales Push Artists Toward Kennedy Center Performance Cancellations

Feb 25, 2025

Declining Sales Push Artists Toward Kennedy Center Performance Cancellations

Feb 25, 2025 -

Musks X Post Explain Last Weeks Actions Or Be Fired

Feb 25, 2025

Musks X Post Explain Last Weeks Actions Or Be Fired

Feb 25, 2025 -

Usps Changes Under Trump A Look At Potential Delivery Delays And Efficiency

Feb 25, 2025

Usps Changes Under Trump A Look At Potential Delivery Delays And Efficiency

Feb 25, 2025 -

New Dog Breeds Pose Public Safety Concerns

Feb 25, 2025

New Dog Breeds Pose Public Safety Concerns

Feb 25, 2025 -

Palestinian Prisoner Release Delayed After Israeli Hostage Rescue

Feb 25, 2025

Palestinian Prisoner Release Delayed After Israeli Hostage Rescue

Feb 25, 2025

Latest Posts

-

Actors Off Camera Behind The Scenes Photos From Film Sets

Feb 25, 2025

Actors Off Camera Behind The Scenes Photos From Film Sets

Feb 25, 2025 -

Pharaoh Thutmose Ii Archaeological Find Hints At A Second Tomb

Feb 25, 2025

Pharaoh Thutmose Ii Archaeological Find Hints At A Second Tomb

Feb 25, 2025 -

Elon Musk And Steve Bannons Ties To Germanys Far Right Af D

Feb 25, 2025

Elon Musk And Steve Bannons Ties To Germanys Far Right Af D

Feb 25, 2025 -

The Trump Factor Will A Restored Relationship Help Zelensky Secure Ukraine

Feb 25, 2025

The Trump Factor Will A Restored Relationship Help Zelensky Secure Ukraine

Feb 25, 2025 -

Artists Weigh Kennedy Center Boycott As Sales Plummet

Feb 25, 2025

Artists Weigh Kennedy Center Boycott As Sales Plummet

Feb 25, 2025