A Dogecoin Dividend: Why This Idea Could Be Financially Devastating

Table of Contents

Dogecoin Dividend: A Financially Devastating Idea?

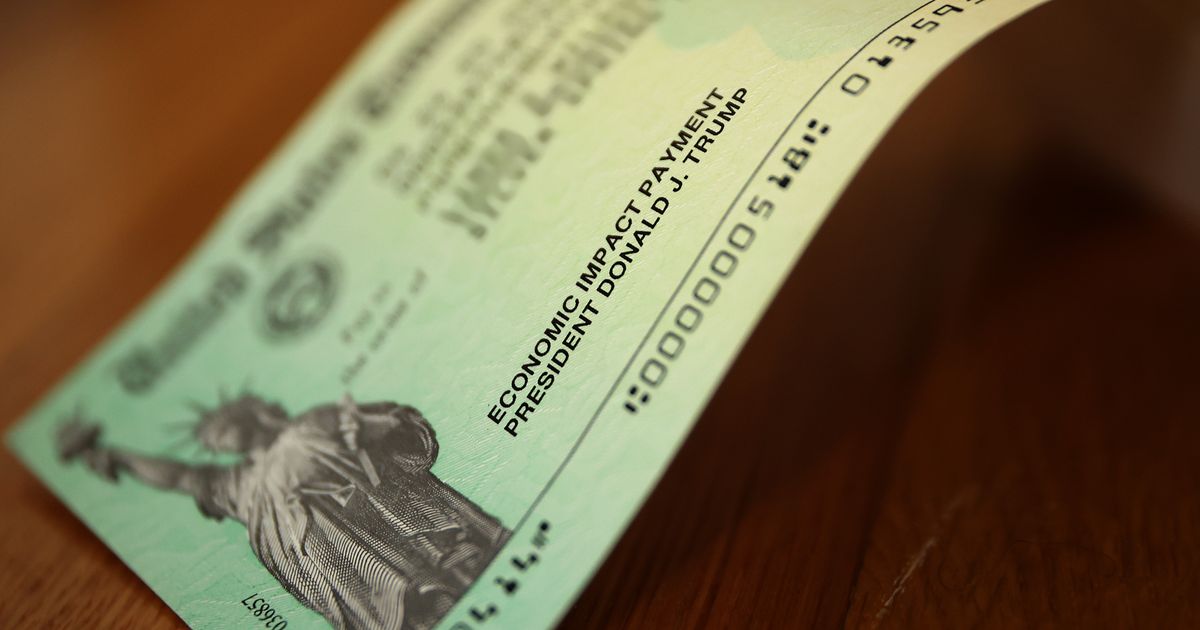

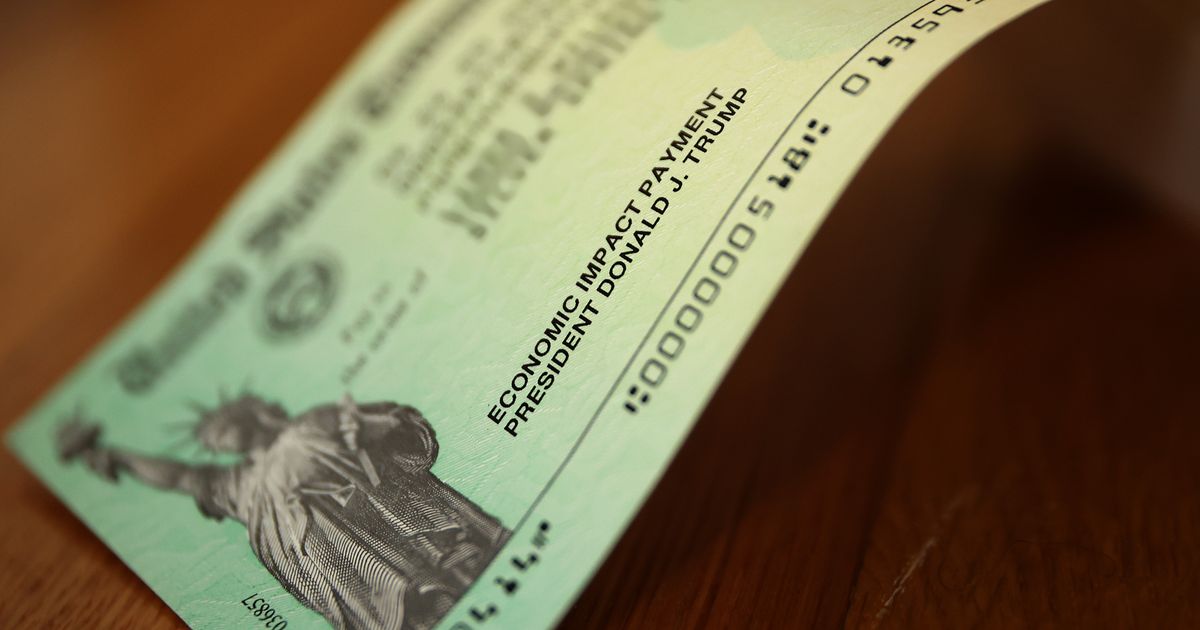

A proposal for a Dogecoin dividend has sparked intense debate within the cryptocurrency community, raising concerns about its potential for widespread financial damage. Experts warn that such a move would likely be disastrous for the meme-based cryptocurrency and its holders.

NEW YORK – The idea of a Dogecoin dividend, while seemingly novel, carries significant risks that could severely impact the cryptocurrency’s value and the financial well-being of its holders. The proposal, which has gained some traction within certain online forums, suggests distributing a portion of Dogecoin’s holdings (if any exist in a centralized manner) or newly mined coins to its holders. While proponents argue this could boost adoption and value, financial analysts and cryptocurrency experts overwhelmingly warn against it, citing several critical flaws.

The most immediate concern revolves around the sheer scale of Dogecoin's circulating supply. With over 139 billion DOGE coins currently in circulation, distributing even a small percentage as a dividend would require an enormous amount of newly minted coins or a significant redistribution from existing holders – a process that would likely severely dilute the value of existing holdings. This dilution could trigger a massive sell-off as holders attempt to recoup their losses, resulting in a sharp and potentially catastrophic price drop. The inherent volatility of Dogecoin, already known for its wild price swings driven by speculation and social media trends, would only be exacerbated by such a massive influx of coins onto the market.

Furthermore, a Dogecoin dividend faces significant logistical hurdles. Unlike traditional company dividends paid out through established financial systems, distributing a dividend to millions of Dogecoin holders worldwide presents complex challenges related to tracking ownership, preventing fraud, and ensuring fair distribution. The decentralized nature of the cryptocurrency makes this process exponentially more difficult and potentially susceptible to manipulation or exploitation.

Beyond the practical challenges, the proposal lacks any sound economic rationale. Dividends typically represent a portion of a company's profits, providing a return on investment for shareholders. Dogecoin, however, does not generate profits in the traditional sense. Its value is largely speculative, fueled by social media trends and the whims of its community. Distributing a dividend in this context would be akin to a company giving away a portion of its inventory without any corresponding increase in value or profitability.

The proposal also ignores the potential impact on regulatory scrutiny. Such a massive redistribution of coins could attract unwanted attention from financial regulators worldwide, who might view it as a violation of securities laws or other regulations. This heightened regulatory scrutiny could further undermine Dogecoin's value and potentially lead to more stringent controls on its use and trading.

Finally, a Dogecoin dividend could severely damage the credibility of the cryptocurrency itself. Many see Dogecoin as a playful, meme-based coin lacking the underlying fundamentals of a sound investment. A disastrous attempt at a dividend distribution would only reinforce this perception, potentially driving away investors and further diminishing its long-term viability.

In conclusion, the proposal for a Dogecoin dividend presents significant financial risks with little to no discernible benefits. Experts strongly advise against such a move, warning that it could prove financially devastating for the cryptocurrency and its holders. The inherent volatility, logistical challenges, lack of economic rationale, regulatory concerns, and potential damage to credibility all point to the idea being a recipe for disaster. The cryptocurrency community would be well-advised to reject this proposal before it causes irreparable harm.

Featured Posts

-

Predicting The 2025 German Federal Election Trends And Analysis

Feb 24, 2025

Predicting The 2025 German Federal Election Trends And Analysis

Feb 24, 2025 -

Europes Future At Stake Merzs Final Bid For German Chancellorship

Feb 24, 2025

Europes Future At Stake Merzs Final Bid For German Chancellorship

Feb 24, 2025 -

Freed Thai Hostages Receive Spiritual Blessings After Gaza Release

Feb 24, 2025

Freed Thai Hostages Receive Spiritual Blessings After Gaza Release

Feb 24, 2025 -

Tel Aviv Receives Remains Potentially Belonging To Shiri Bibas

Feb 24, 2025

Tel Aviv Receives Remains Potentially Belonging To Shiri Bibas

Feb 24, 2025 -

Trumps Doge Dividend A Risky Gamble For The Economy

Feb 24, 2025

Trumps Doge Dividend A Risky Gamble For The Economy

Feb 24, 2025

Latest Posts

-

Elon Musk Demands Federal Employee Work Justifications

Feb 24, 2025

Elon Musk Demands Federal Employee Work Justifications

Feb 24, 2025 -

Covid 19 Disrupts Snl 50th Anniversary Celebration Rudolph And Short Affected

Feb 24, 2025

Covid 19 Disrupts Snl 50th Anniversary Celebration Rudolph And Short Affected

Feb 24, 2025 -

Snls 50th How Covid 19 Prevented Maya Rudolph And Martin Short From Participating

Feb 24, 2025

Snls 50th How Covid 19 Prevented Maya Rudolph And Martin Short From Participating

Feb 24, 2025 -

Paris Mourns Cycling Activist Paul Varry After Fatal Crash

Feb 24, 2025

Paris Mourns Cycling Activist Paul Varry After Fatal Crash

Feb 24, 2025 -

Lost Hikers Survive Utah Wilderness Abandoned Backpack Saves Father And Son

Feb 24, 2025

Lost Hikers Survive Utah Wilderness Abandoned Backpack Saves Father And Son

Feb 24, 2025