Analysis: The Bybit $1.4 Billion ETH Hack And Its Ripple Effect On Crypto

Table of Contents

Bybit's $1.4 Billion ETH Hack: A Ripple Effect Through the Crypto World

HONG KONG – October 26, 2023 – The cryptocurrency exchange Bybit was rocked by a staggering $1.4 billion ETH hack on [Date of Hack - Insert Accurate Date Here], sending shockwaves through the already volatile digital asset market. The incident, initially reported on [Source of Initial Report - Insert Reliable News Source Here], highlights the persistent vulnerabilities within the cryptocurrency ecosystem and raises crucial questions about security protocols and regulatory oversight. The scale of the theft represents one of the largest cryptocurrency heists in history, surpassing previous incidents like the [Mention comparable hacks, e.g., Mt. Gox hack] in terms of financial losses.

The hack, according to preliminary reports from [Source of Preliminary Report – Insert Reliable Source Here], involved the exploitation of a [Specific Vulnerability Exploited - Insert Detailed Explanation of Vulnerability, e.g., smart contract flaw, phishing attack, insider job]. Bybit has yet to release a comprehensive statement detailing the precise nature of the breach, but initial communications indicate that [Quote from Bybit Official Statement - Insert Accurate Quote Here]. The exchange has pledged to cooperate fully with law enforcement agencies [List of Agencies Involved – Insert Names of Relevant Agencies, e.g., Hong Kong Police Force, Interpol, FBI] in their investigation.

The immediate aftermath of the attack saw a significant drop in the price of Ethereum (ETH), though the market quickly rebounded somewhat. However, the psychological impact on investor confidence remains considerable. Analysts at [Name of Financial Analytics Firm - Insert Name of Reputable Firm] noted a surge in withdrawals from various cryptocurrency exchanges following the news, suggesting a broader distrust in the security of centralized platforms. The volatility also triggered a sell-off in other cryptocurrencies, highlighting the interconnectedness of the digital asset market.

The long-term consequences of the Bybit hack remain to be seen. However, the incident is likely to intensify calls for stricter regulation within the cryptocurrency industry. Critics argue that the lack of robust regulatory frameworks has created a breeding ground for illicit activities, making cryptocurrency exchanges vulnerable to such large-scale attacks. Proponents of decentralized finance (DeFi), on the other hand, might point to the inherent risks associated with centralized platforms as a reason to shift towards more decentralized models.

The investigation into the hack is ongoing, and law enforcement agencies are currently working to trace the stolen funds. While the recovery of the $1.4 billion in ETH remains uncertain, the success of the investigation will be crucial in determining the future trajectory of the cryptocurrency market and its regulatory landscape. Bybit’s response, particularly its transparency and cooperation with authorities, will also play a significant role in rebuilding investor trust. The longer-term impact on Bybit's reputation and market share also remains to be seen. This incident serves as a stark reminder of the ongoing battle between innovation and security within the world of cryptocurrency.

[Add a concluding paragraph summarizing the key takeaways and future implications. Include calls to action or expert opinions where possible.] For instance: Experts at [Name of Crypto Security Firm] warn that similar attacks are likely unless the industry adopts more robust security measures and regulatory oversight. The Bybit hack underscores the urgent need for increased vigilance and proactive measures to mitigate future risks within the cryptocurrency ecosystem. The incident should act as a catalyst for improved security protocols across the board, fostering a more secure and trustworthy environment for investors.

Featured Posts

-

Leicester Citys Heavy Loss To Brentford Post Match Analysis

Feb 22, 2025

Leicester Citys Heavy Loss To Brentford Post Match Analysis

Feb 22, 2025 -

Death Of Andrew Lester Delays Sentencing In Ralph Yarl Shooting Case

Feb 22, 2025

Death Of Andrew Lester Delays Sentencing In Ralph Yarl Shooting Case

Feb 22, 2025 -

My Chemical Romance S Analyzing Severances Sixth Episode

Feb 22, 2025

My Chemical Romance S Analyzing Severances Sixth Episode

Feb 22, 2025 -

25 Game Suspension For Bobby Portis Details On Milwaukee Bucks Players Ban

Feb 22, 2025

25 Game Suspension For Bobby Portis Details On Milwaukee Bucks Players Ban

Feb 22, 2025 -

Michigan Basketball Coach Dusty May Secures Multi Year Contract Extension

Feb 22, 2025

Michigan Basketball Coach Dusty May Secures Multi Year Contract Extension

Feb 22, 2025

Latest Posts

-

From Boozing To Cocaine A Story Of Addiction

Feb 24, 2025

From Boozing To Cocaine A Story Of Addiction

Feb 24, 2025 -

Late Goal Gives Millwall Win Over Derby County Coburns Heroics

Feb 24, 2025

Late Goal Gives Millwall Win Over Derby County Coburns Heroics

Feb 24, 2025 -

Joshua Buatsi And Callum Smiths Absolute War What It Means For Anthony Joshua

Feb 24, 2025

Joshua Buatsi And Callum Smiths Absolute War What It Means For Anthony Joshua

Feb 24, 2025 -

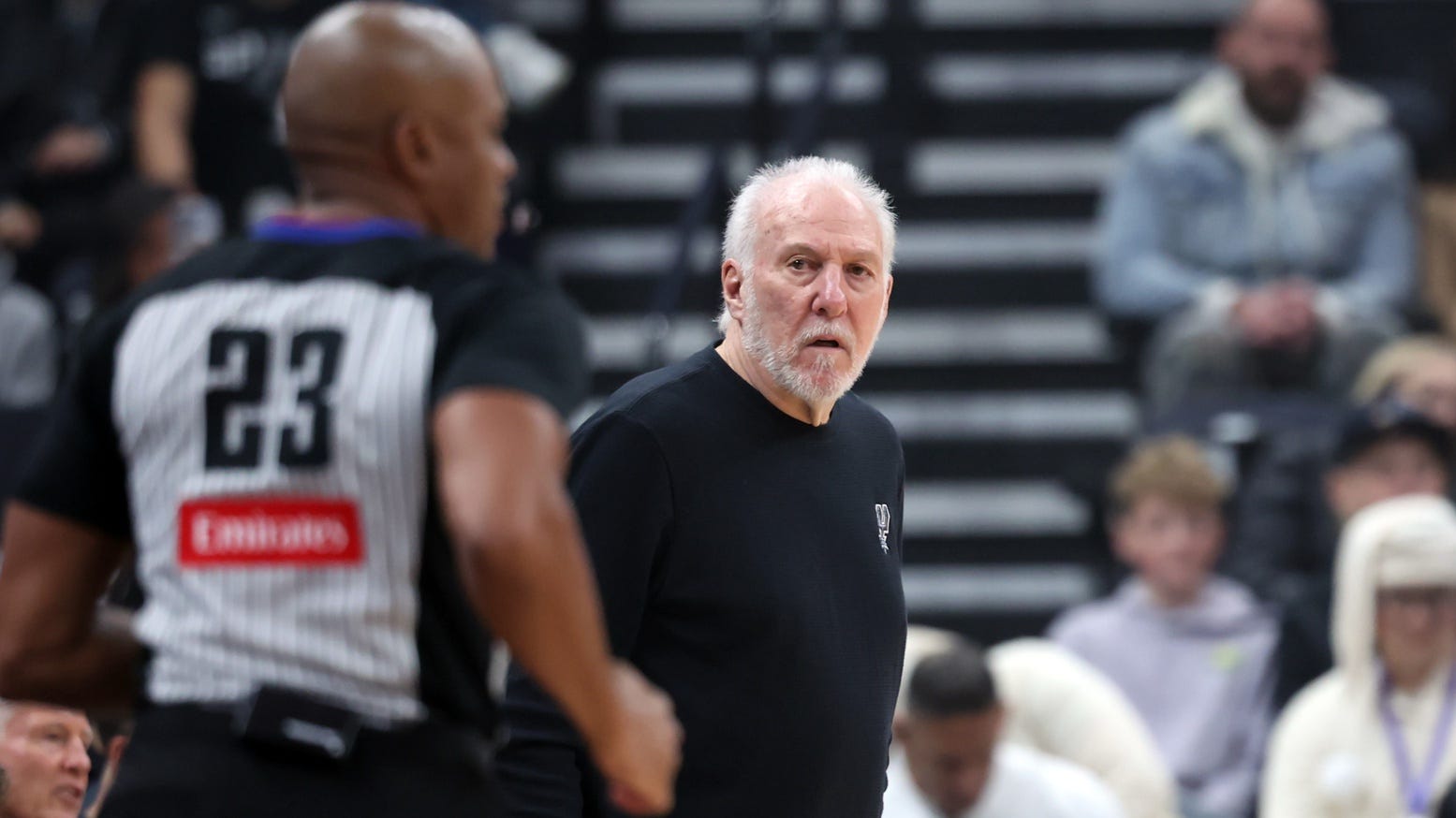

Spurs Coach Gregg Popovich No Expected Return Date For Health Issues

Feb 24, 2025

Spurs Coach Gregg Popovich No Expected Return Date For Health Issues

Feb 24, 2025 -

Como Ver El Partido La Palmas Vs Barcelona En Vivo Por Streaming

Feb 24, 2025

Como Ver El Partido La Palmas Vs Barcelona En Vivo Por Streaming

Feb 24, 2025