Analysis: The Economic Implications Of A Trump Dogecoin Dividend

Table of Contents

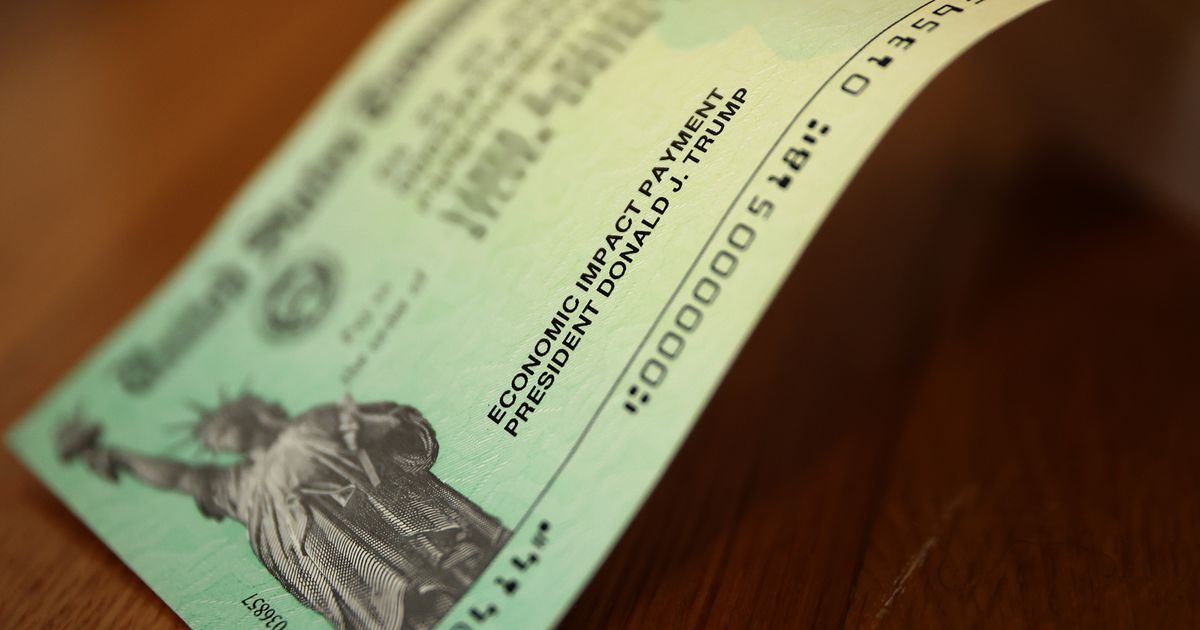

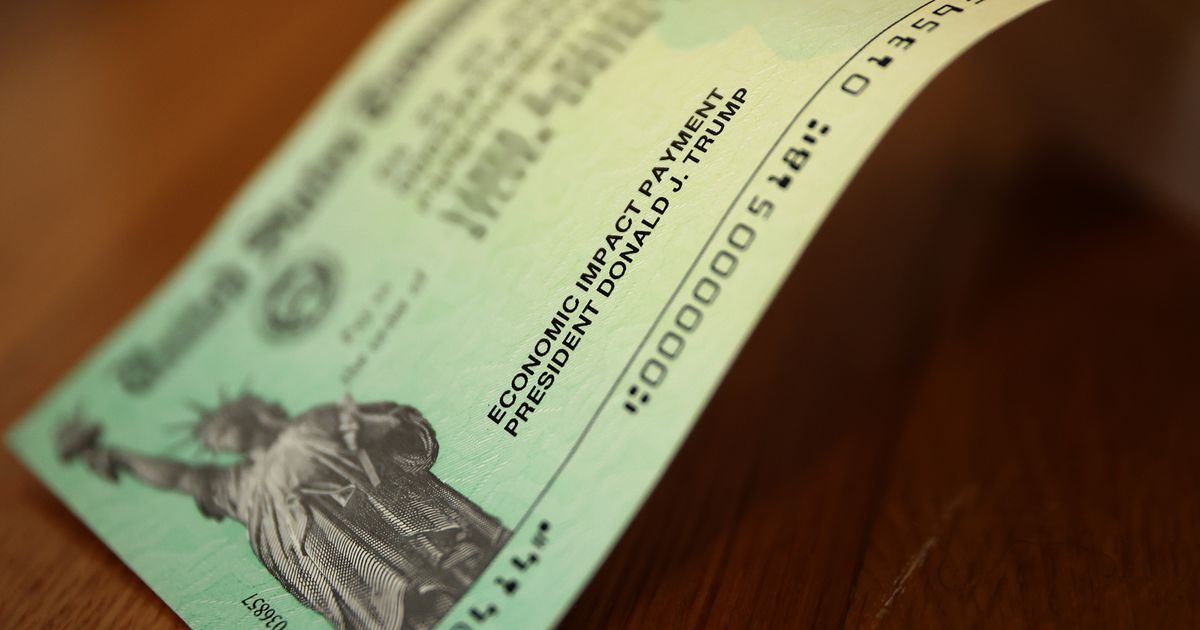

Trump's Dogecoin Dividend: A Risky Economic Gamble?

WASHINGTON, D.C. – The notion of a Donald Trump presidency issuing a Dogecoin dividend to American citizens, once relegated to the fringes of internet speculation, has resurfaced, sparking intense debate among economists and political analysts. While details remain scarce and the likelihood of such a policy remains highly uncertain, examining the potential economic implications is crucial. The sheer novelty of the concept – a cryptocurrency dividend distributed by a major world power – introduces unparalleled risks and uncertainties into the already complex global financial landscape.

The core issue isn't simply the unconventional nature of Dogecoin itself. While it enjoys a fervent online community, Dogecoin lacks the intrinsic value and stability of established currencies. Its price is highly volatile, susceptible to market manipulation and speculative bubbles. A mass distribution of Dogecoin, therefore, would likely cause immediate and potentially dramatic fluctuations in its value, potentially wiping out significant portions of its value and leaving recipients with worthless digital tokens.

The scale of such an undertaking is staggering. Assuming a hypothetical dividend of [Let's assume, for the sake of example, $100 per adult citizen], the cost to the US government would be astronomical. With approximately [260 million adults in the U.S. as of 2023], this would represent a total outlay of [$26 billion] in Dogecoin at the time of distribution. This figure doesn't account for the costs of the logistical and technological infrastructure required to distribute the cryptocurrency to millions of individuals, a feat that would present significant challenges.

Further complicating matters is the unpredictable nature of cryptocurrency markets. The value of Dogecoin, at the time of hypothetical distribution, could significantly diverge from its value after the distribution, either inflating or deflating the real value of the dividend. If the price of Dogecoin crashes after the distribution (a highly probable scenario given the sudden increase in supply), the recipients could experience substantial financial losses. The resulting economic fallout could be significant, potentially triggering market panic and further destabilizing the already fragile global economy.

Beyond the immediate financial impact, a Dogecoin dividend would raise serious questions about the role of government in managing the economy. The move could be perceived as a reckless gamble, undermining the credibility of the US dollar and creating uncertainty in the global financial system. This loss of confidence could lead to capital flight, currency depreciation, and increased inflation. Furthermore, the precedent set by such an unprecedented policy could have unforeseen long-term consequences, potentially encouraging other nations to adopt similar, equally risky strategies.

Critics argue that such a plan would be fiscally irresponsible, undermining economic stability, and potentially exacerbating existing economic inequalities. Those who support the idea, however, often cite the potential for stimulating the economy through increased consumer spending. However, this argument overlooks the potential for speculative bubbles and the inherent risks associated with volatile cryptocurrencies.

The economic implications of a Trump Dogecoin dividend remain highly speculative, yet the potential for significant negative consequences warrants serious consideration. While the proposal itself remains highly unlikely, its very existence underscores the growing need for a deeper understanding of the economic implications of integrating cryptocurrencies into mainstream financial systems. The uncertainty surrounding such a policy highlights the importance of robust regulatory frameworks and a cautious approach to integrating cryptocurrencies into established economic models. Further research and analysis are crucial to fully comprehend the potential ramifications of such a radical policy shift.

Featured Posts

-

Potential Changes To The Us Postal Service Under Trumps Administration

Feb 25, 2025

Potential Changes To The Us Postal Service Under Trumps Administration

Feb 25, 2025 -

Ukraine A Nations Peril Three Years On

Feb 25, 2025

Ukraine A Nations Peril Three Years On

Feb 25, 2025 -

Paris Cyclist Paul Varrys Dream Of Cycling Revolution Ends In Tragedy

Feb 25, 2025

Paris Cyclist Paul Varrys Dream Of Cycling Revolution Ends In Tragedy

Feb 25, 2025 -

Abandoned Backpack Key To Utah Father Son Hiking Survival

Feb 25, 2025

Abandoned Backpack Key To Utah Father Son Hiking Survival

Feb 25, 2025 -

Suspect In Police Officers Death Took Pennsylvania Hospital Hostage Details Emerge

Feb 25, 2025

Suspect In Police Officers Death Took Pennsylvania Hospital Hostage Details Emerge

Feb 25, 2025

Latest Posts

-

Three Years On The Wars Intergenerational Trauma In Ukraine

Feb 25, 2025

Three Years On The Wars Intergenerational Trauma In Ukraine

Feb 25, 2025 -

Europe Seeks Stronger Ties With Us As Trump Meets Macron

Feb 25, 2025

Europe Seeks Stronger Ties With Us As Trump Meets Macron

Feb 25, 2025 -

Sag Awards Complete List Of Winners Including Moore Chalamet And Conclave

Feb 25, 2025

Sag Awards Complete List Of Winners Including Moore Chalamet And Conclave

Feb 25, 2025 -

Russian Opposition Politician Challenges Narrative On Us Role In Ukraine

Feb 25, 2025

Russian Opposition Politician Challenges Narrative On Us Role In Ukraine

Feb 25, 2025 -

The Impact Of Russias Invasion An Analysis Of The Changing Ukraine U S Political Ties

Feb 25, 2025

The Impact Of Russias Invasion An Analysis Of The Changing Ukraine U S Political Ties

Feb 25, 2025