Analyzing Palantir's Decline: Investment Implications

Table of Contents

Palantir's Plunge: Is This the End of the Data Giant's Reign, or a Buying Opportunity?

NEW YORK, NY – October 26, 2023 – Shares of Palantir Technologies (PLTR), the controversial data analytics firm founded by Peter Thiel, have experienced a significant decline in recent months, leaving investors questioning the future of the company and the wisdom of holding onto their shares. While Palantir continues to land lucrative government contracts and expand its commercial offerings, the stock's performance raises critical questions about its long-term growth prospects and the overall viability of its business model.

The stock price has fallen [Insert precise percentage and timeframe of decline here. For example: by 25% over the past three months], sparking concern among investors. This decline isn't solely attributable to a single factor, but rather a confluence of issues impacting the broader tech sector and Palantir's specific circumstances.

One primary factor is the prevailing macroeconomic environment. Rising interest rates and fears of a recession have led to a broad sell-off in growth stocks, including those in the technology sector. Palantir, with its still-developing profitability and high valuation, has been particularly vulnerable to this market sentiment. [Insert relevant data on interest rates and market performance, perhaps comparing Palantir's performance to other tech stocks during the same period. For example: "The tech-heavy Nasdaq Composite has fallen by X% during the same period, indicating a broader market trend affecting growth stocks."].

Furthermore, concerns exist regarding Palantir's reliance on government contracts. While these contracts provide a substantial revenue stream, they are often subject to fluctuating budgets and political pressures. [Insert specific data on the percentage of revenue derived from government contracts and any recent changes in this figure. For example: "Government contracts currently account for approximately Y% of Palantir's revenue, a decrease of Z% compared to the previous year."]. This dependence limits the company's overall revenue diversification and makes it more susceptible to shifts in government spending priorities.

However, it's not all bleak for Palantir. The company continues to make strides in expanding its commercial offerings, targeting a wider range of industries beyond its traditional government clientele. [Insert specific examples of recent commercial wins, including industry sectors and contract values if publicly available. For example: "Palantir recently secured a multi-million dollar contract with a major financial institution in the healthcare sector, demonstrating its growing presence in the commercial market."]. This diversification strategy, if successful, could mitigate the risks associated with over-reliance on government contracts.

Despite these developments, the question remains: is this a buying opportunity or a sign of further decline? Analysts are divided. [Include a summary of at least two contrasting analyst opinions with their rationale and any relevant price targets. For example: "Analyst A at [Brokerage firm] maintains a 'buy' rating, citing Palantir's strong potential for growth in the commercial market and a projected price target of [Price]. Conversely, Analyst B at [Brokerage firm] has issued a 'sell' recommendation, expressing concerns about the company's profitability and dependence on government contracts."].

The future of Palantir remains uncertain. While its innovative data analytics platform holds considerable promise, the company faces significant challenges in navigating a turbulent economic climate and diversifying its revenue streams. Investors should carefully consider these factors before making any investment decisions. The coming quarters will be crucial in determining whether Palantir can overcome these hurdles and fulfill its ambitious growth plans. The company's next earnings report will be closely scrutinized for any signs of progress or further setbacks.

Note: This article requires further research to fill in the bracketed information with specific data. Reliable sources such as Palantir's financial reports, news articles from reputable financial publications, and analyst reports should be consulted to provide accurate and up-to-date information.

Featured Posts

-

Netflixs Zero Day A Critical Look At Robert De Niros Latest Project

Feb 22, 2025

Netflixs Zero Day A Critical Look At Robert De Niros Latest Project

Feb 22, 2025 -

Understanding The Ban On Julianne Moores Freckleface Strawberry Book

Feb 22, 2025

Understanding The Ban On Julianne Moores Freckleface Strawberry Book

Feb 22, 2025 -

Trump Administration To Roll Back New York City Congestion Pricing

Feb 22, 2025

Trump Administration To Roll Back New York City Congestion Pricing

Feb 22, 2025 -

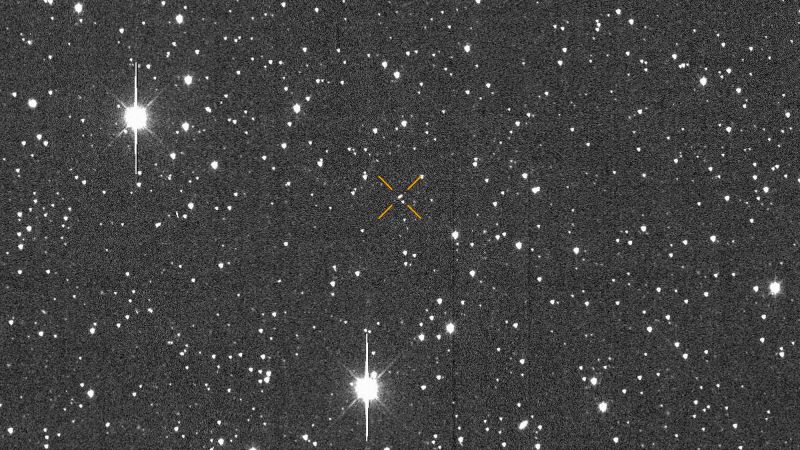

Asteroid 2024 Yr 4s Impact Probability Current Status And Ongoing Monitoring

Feb 22, 2025

Asteroid 2024 Yr 4s Impact Probability Current Status And Ongoing Monitoring

Feb 22, 2025 -

Giannis Antetokounmpo Injury Report Bucks Wizards Game Outlook

Feb 22, 2025

Giannis Antetokounmpo Injury Report Bucks Wizards Game Outlook

Feb 22, 2025

Latest Posts

-

Beterbiev Vs Bivol And Parker Live Stream Watch The Fight Online

Feb 23, 2025

Beterbiev Vs Bivol And Parker Live Stream Watch The Fight Online

Feb 23, 2025 -

How To Manage Stress And Keep Your Cool In High Pressure Situations

Feb 23, 2025

How To Manage Stress And Keep Your Cool In High Pressure Situations

Feb 23, 2025 -

Snowmobiler Rescued After Avalanche Burial Dramatic Video Emerges

Feb 23, 2025

Snowmobiler Rescued After Avalanche Burial Dramatic Video Emerges

Feb 23, 2025 -

Cq Brown Dismissal Trump Shakes Up Us Military Leadership

Feb 23, 2025

Cq Brown Dismissal Trump Shakes Up Us Military Leadership

Feb 23, 2025 -

Artur Beterbiev Vs Dmitry Bivol Ii Expert Prediction And Betting Tips

Feb 23, 2025

Artur Beterbiev Vs Dmitry Bivol Ii Expert Prediction And Betting Tips

Feb 23, 2025