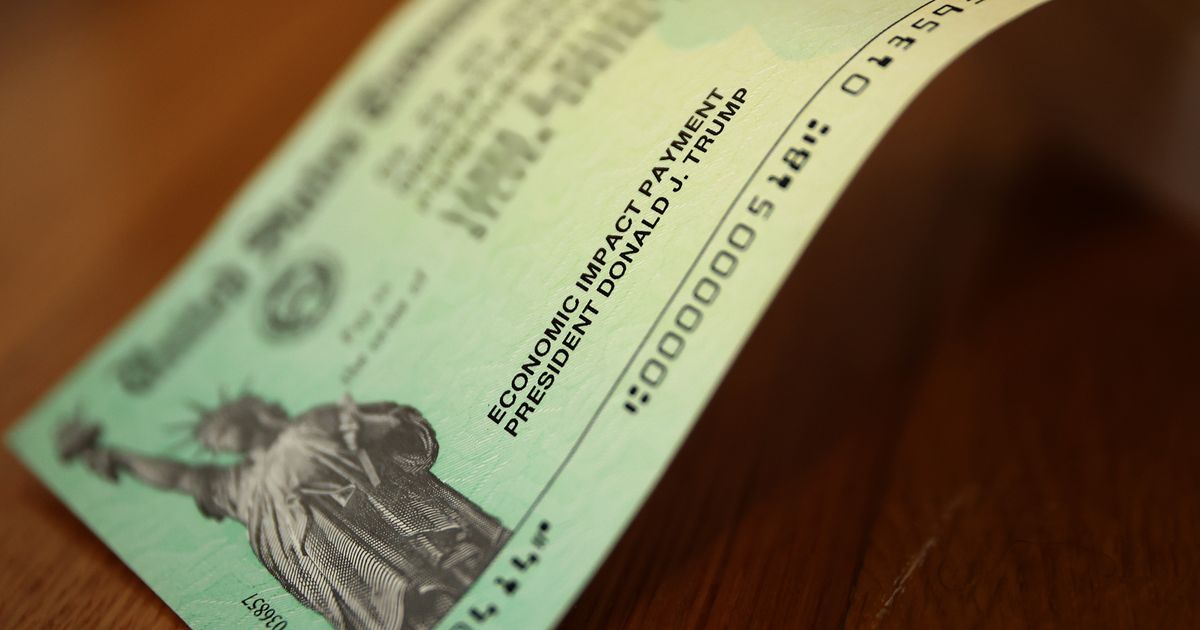

Analyzing The Potential Fallout Of A Trump Dogecoin Dividend

Table of Contents

Trump Dogecoin Dividend: A Speculative Storm Brewing? Analyzing the Unlikely Fallout

A hypothetical Trump Dogecoin dividend, a concept gaining traction in some online circles, presents a complex web of potential consequences, ranging from market volatility to legal challenges. While currently purely speculative, examining its potential ramifications offers valuable insights into the intersection of politics, cryptocurrency, and financial markets.

Market Volatility: A Dogecoin Rollercoaster?

The immediate and most significant consequence of a Trump Dogecoin dividend (assuming such a dividend were legally possible and distributed) would be a potentially massive surge in Dogecoin's price. Dogecoin, currently trading at [insert current Dogecoin price and market cap data], is already known for its volatility, often driven by social media trends and celebrity endorsements. A Trump endorsement, let alone a dividend linked to his name, could amplify this volatility exponentially. This surge could attract new investors, driven by speculation and the allure of a "Trump-backed" cryptocurrency. However, it could also lead to a rapid and sharp correction, leaving many investors with significant losses. The scale of this price swing would depend on several factors, including the size of the dividend, the methods of distribution, and the overall market sentiment towards both Dogecoin and Trump himself. [Insert data about historical Dogecoin price volatility and correlation with social media trends].

Legal and Regulatory Hurdles: A Minefield for Trump and his Team

The legal landscape surrounding such a dividend is fraught with uncertainties. First, the mechanism for distributing such a dividend remains unclear. Would it involve a direct transfer of Dogecoin to supporters? Would it require the creation of a complex infrastructure to handle such a distribution? The logistics alone would pose a significant challenge. [Insert information about existing laws and regulations regarding cryptocurrency distribution and taxation in the US, particularly as they might apply to a political figure distributing cryptocurrency]. Furthermore, questions arise concerning potential tax implications for both Trump and recipients. The IRS currently treats cryptocurrency as property, meaning any dividend would likely be subject to capital gains tax. [Add details about potential tax implications for both Trump and recipients based on current IRS guidelines on cryptocurrency]. The legal complexities, coupled with potential securities laws violations, could expose Trump and his associates to substantial legal risks.

Political Fallout: Impact on the 2024 Election and Beyond

The political consequences of a Trump Dogecoin dividend are equally uncertain but potentially significant. It could be viewed by some as an innovative and populist approach to fundraising and voter engagement. For others, it may raise concerns about the influence of cryptocurrency on political campaigns and potentially expose vulnerabilities to foreign interference. [Include analysis of public opinion on cryptocurrencies and their use in politics based on recent polls or surveys]. The potential for fraud and manipulation, as well as accusations of money laundering, could also damage Trump's reputation and his standing within the Republican party. [Include analysis from political experts or commentators on the likely political ramifications of such a move]. The impact on the 2024 election, if it were to occur before the election, could range from minimal to significant depending on how voters perceive this action and its accompanying controversies.

Conclusion: A Speculative but Significant Scenario

While the probability of a Trump Dogecoin dividend remains low, analyzing its potential consequences is crucial for understanding the evolving relationship between politics, cryptocurrency, and finance. The unpredictable nature of both Dogecoin and Trump himself only heightens the uncertainty. The potential for both market instability and legal challenges underscores the need for caution and thorough consideration before any such initiative is undertaken. A comprehensive understanding of the legal, financial, and political implications is paramount. [Summarize the key takeaways and highlight the need for further research and observation on this emerging scenario].

Featured Posts

-

Uncertainty Remains Latest On Gregg Popovichs Health And Return To Spurs

Feb 24, 2025

Uncertainty Remains Latest On Gregg Popovichs Health And Return To Spurs

Feb 24, 2025 -

Next James Bond Amazon Faces Difficult Casting Decision

Feb 24, 2025

Next James Bond Amazon Faces Difficult Casting Decision

Feb 24, 2025 -

Bakoles Title Dream Shattered By Parkers Powerful Punch

Feb 24, 2025

Bakoles Title Dream Shattered By Parkers Powerful Punch

Feb 24, 2025 -

Buatsi Smith Showdown An Absolute War With Implications For Joshua

Feb 24, 2025

Buatsi Smith Showdown An Absolute War With Implications For Joshua

Feb 24, 2025 -

Car Theft Prevention Ban On Electronic Hacking Tools Announced

Feb 24, 2025

Car Theft Prevention Ban On Electronic Hacking Tools Announced

Feb 24, 2025

Latest Posts

-

Trumps Proposed Dogecoin Dividend Experts Weigh In On The Risks And Rewards

Feb 25, 2025

Trumps Proposed Dogecoin Dividend Experts Weigh In On The Risks And Rewards

Feb 25, 2025 -

Germanys 2025 Election Dates Candidates And Key Policy Debates

Feb 25, 2025

Germanys 2025 Election Dates Candidates And Key Policy Debates

Feb 25, 2025 -

Doctors Viral Cnn Video The Grim Reality Of 2025 Insurance

Feb 25, 2025

Doctors Viral Cnn Video The Grim Reality Of 2025 Insurance

Feb 25, 2025 -

Paul Varry Paris Cycling Advocate Killed In Road Accident

Feb 25, 2025

Paul Varry Paris Cycling Advocate Killed In Road Accident

Feb 25, 2025 -

Pressure Mounts Us Urges Ukraine To Replace Anti Russia Un Resolution

Feb 25, 2025

Pressure Mounts Us Urges Ukraine To Replace Anti Russia Un Resolution

Feb 25, 2025