Bybit $1.4B ETH Hack: Market Fallout And Long-Term Effects

Table of Contents

Bybit's $1.4B ETH Hack: Market Fallout and Long-Term Effects – A Deep Dive

Bybit, a prominent cryptocurrency exchange, recently faced a significant security breach resulting in the theft of approximately $1.4 billion worth of Ether (ETH). This incident sent shockwaves through the cryptocurrency market, raising crucial questions about the security of centralized exchanges and the long-term implications for investor confidence.

The hack, which occurred on [Date of hack – needs verification from reputable sources like reputable news outlets or Bybit's official statements], involved [Specific method of hack – e.g., exploit of a smart contract vulnerability, phishing attack, insider job. Needs verification]. Initial reports suggested [Initial number of ETH stolen – needs verification from reputable sources], but subsequent investigations revealed the full extent of the loss to be around $1.4 billion based on the ETH price at the time of the theft. [Further details about the hack, if available – e.g., was a private key compromised? Were any other assets affected besides ETH? Specific smart contract exploited (if applicable)?].

The immediate fallout was dramatic. The price of ETH experienced a [Percentage] drop in the hours following the announcement, mirroring similar plunges seen in other major cryptocurrencies. [Mention specific price movements of other cryptocurrencies if available from credible sources]. Trading volume on Bybit plummeted as users hesitated, unsure of the platform's security and the potential for further losses. This drop in trading activity impacted liquidity, creating wider bid-ask spreads and making it more challenging for traders to execute transactions at desired prices.

Beyond the immediate market reaction, the hack raises several critical long-term concerns. Firstly, it underscores the vulnerability of centralized exchanges to sophisticated attacks. Despite significant investments in security measures, breaches like this highlight the inherent risks involved in entrusting large sums of cryptocurrency to third-party platforms. This event could fuel the ongoing debate about the merits of decentralized exchanges (DEXs) which, while having their own challenges, offer a potentially more secure alternative through the elimination of single points of failure.

Secondly, the incident is likely to damage Bybit's reputation and erode user trust. Rebuilding confidence will require a transparent and comprehensive investigation, along with concrete steps to enhance security protocols and compensate affected users. [Mention any statements or actions taken by Bybit in response to the hack – e.g., investigations, compensation plans, security upgrades]. The long-term impact on Bybit's market share remains to be seen, but it will undoubtedly face increased competition from other exchanges emphasizing security and transparency.

The larger implications extend to the entire cryptocurrency ecosystem. The hack could fuel regulatory scrutiny, particularly concerning the need for stronger cybersecurity standards and consumer protection measures. Governments worldwide may view this as a further justification for increased regulatory oversight of the cryptocurrency market. [Mention any regulatory responses or statements, if any, from relevant authorities].

Furthermore, the incident may impact the overall perception of cryptocurrency investments. For less sophisticated investors, such events can reinforce negative narratives around the volatility and insecurity of the crypto market, potentially hindering mainstream adoption.

In conclusion, the Bybit hack serves as a stark reminder of the inherent risks involved in the cryptocurrency space. While blockchain technology offers decentralized and secure possibilities, the centralized nature of many exchanges creates vulnerabilities. The long-term consequences will depend on Bybit's response, the regulatory landscape, and the broader market's ability to absorb such shocks. The impact on investor confidence, market stability, and the future trajectory of the cryptocurrency industry will be closely watched in the coming months and years. [Add concluding thoughts or predictions about the future impact of the hack].

Note: This article requires verification of bracketed information from reliable sources before publication. Replace bracketed information with accurate details obtained from official statements, reputable news outlets, and blockchain analytics firms. Remember to cite all sources appropriately.

Featured Posts

-

Is Giannis Playing Tonight Latest On Bucks Stars Status

Feb 22, 2025

Is Giannis Playing Tonight Latest On Bucks Stars Status

Feb 22, 2025 -

Congestion Pricing In Nyc Faces Trumps Opposition

Feb 22, 2025

Congestion Pricing In Nyc Faces Trumps Opposition

Feb 22, 2025 -

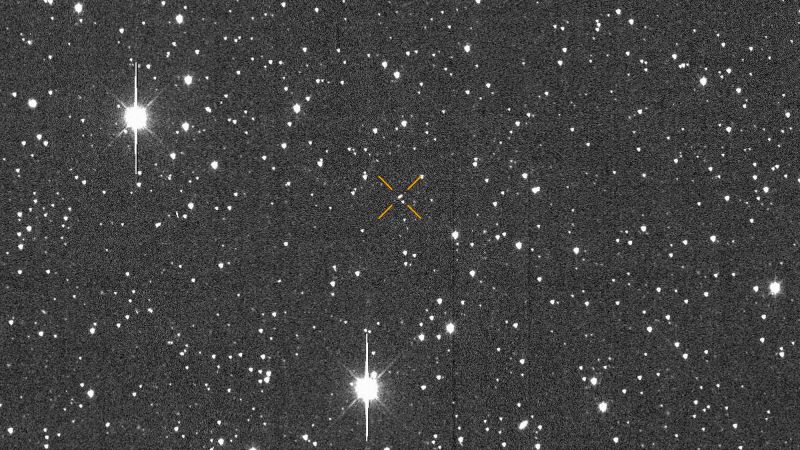

Asteroid 2024 Yr 4s Impact Probability Current Status And Ongoing Monitoring

Feb 22, 2025

Asteroid 2024 Yr 4s Impact Probability Current Status And Ongoing Monitoring

Feb 22, 2025 -

Indianas Loss Michigans Gain Dusty May Inks Contract Extension

Feb 22, 2025

Indianas Loss Michigans Gain Dusty May Inks Contract Extension

Feb 22, 2025 -

Msu Um Basketball Game Your Complete Viewing Guide For Friday

Feb 22, 2025

Msu Um Basketball Game Your Complete Viewing Guide For Friday

Feb 22, 2025

Latest Posts

-

World Championship Loss Hamzah Sheerazs Cautious Approach

Feb 24, 2025

World Championship Loss Hamzah Sheerazs Cautious Approach

Feb 24, 2025 -

Beterbiev Vs Bivol Live Fight Updates From Riyadh

Feb 24, 2025

Beterbiev Vs Bivol Live Fight Updates From Riyadh

Feb 24, 2025 -

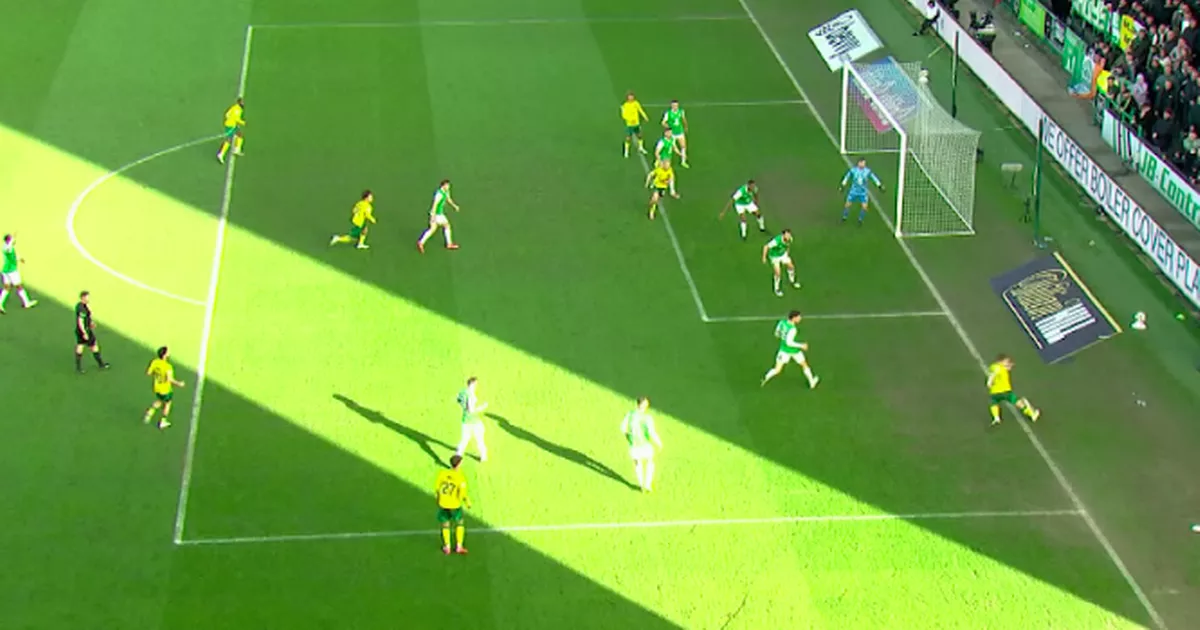

Daizen Maeda And The Defining No Goal Call Celtics Match Breakdown

Feb 24, 2025

Daizen Maeda And The Defining No Goal Call Celtics Match Breakdown

Feb 24, 2025 -

Aston Villa Edges Chelsea After Another Goalkeeping Blunder

Feb 24, 2025

Aston Villa Edges Chelsea After Another Goalkeeping Blunder

Feb 24, 2025 -

Jimmies Secure Victory Over Bruins To End Regular Season

Feb 24, 2025

Jimmies Secure Victory Over Bruins To End Regular Season

Feb 24, 2025