Bybit $1.4B ETH Hack: Ripple Effects On The Crypto Market

Table of Contents

Bybit $1.4B ETH Hack: Ripple Effects on the Crypto Market

HONG KONG, [Date of Publication] – The cryptocurrency market is reeling after a reported $1.4 billion ETH hack targeting Bybit, a major cryptocurrency exchange. While Bybit has yet to officially confirm the full extent of the breach, [Source confirming the $1.4B figure, preferably an official statement from Bybit or a reputable news agency] reports indicate that a significant amount of Ether (ETH) was stolen in a sophisticated attack. The incident has sent shockwaves through the crypto community, raising concerns about platform security and the overall stability of the market.

The alleged hack, which reportedly occurred on [Date of Hack], [Brief description of how the hack occurred, e.g., exploit of a smart contract vulnerability, phishing attack, etc., cite sources if available]. [Details about the affected users, if known: e.g., were all users impacted, or was it a targeted attack? Was it a hot or cold wallet breach?]. The lack of immediate transparency from Bybit initially fueled speculation and amplified the negative impact on market sentiment. While Bybit eventually acknowledged an incident, [Quote from official Bybit statement regarding the incident, if available], the specifics surrounding the hack remain shrouded in some mystery.

The immediate aftermath saw a sharp decline in the price of Ethereum (ETH), [Specific percentage drop and time frame]. Other cryptocurrencies also experienced a sell-off, reflecting a broader market downturn fueled by fear and uncertainty. [Specific data on other cryptocurrencies affected, including percentage drops]. The total market capitalization of cryptocurrencies, already down significantly from its peak, [Specific data on the total market cap decrease after the hack].

The hack has raised serious questions about the security protocols employed by cryptocurrency exchanges. Experts are now scrutinizing Bybit's security measures and calling for greater transparency and accountability within the industry. [Quote from a crypto security expert analyzing the situation]. The incident highlights the persistent vulnerability of even large, established exchanges to sophisticated cyberattacks. This reinforces the need for robust security measures, including multi-factor authentication, cold storage solutions, and regular security audits.

[Mention any regulatory responses or investigations triggered by the hack]. The impact on user trust is significant. Many users are questioning the safety of their funds on various exchanges, potentially leading to withdrawals and a further decline in market confidence. [Anecdotal evidence or quotes from users expressing concerns].

The long-term consequences of the Bybit hack are still unfolding. The incident could accelerate the development and adoption of improved security technologies within the cryptocurrency space. It could also lead to greater regulatory scrutiny of exchanges and the implementation of stricter compliance measures. However, the immediate effect is a palpable sense of uncertainty, underlining the inherent risks associated with investing in cryptocurrencies.

[Concluding paragraph summarizing the impact and future outlook, including potential implications for market regulation and user behavior]. The investigation into the Bybit hack is ongoing, and further details are expected to emerge in the coming days and weeks. The cryptocurrency community awaits answers and a demonstrable commitment to enhancing security measures to prevent future incidents.

Featured Posts

-

Dan Aykroyd Explains His Absence From Snls 50th Anniversary Special

Feb 23, 2025

Dan Aykroyd Explains His Absence From Snls 50th Anniversary Special

Feb 23, 2025 -

German Election 2025 A State By State Breakdown Of The Race

Feb 23, 2025

German Election 2025 A State By State Breakdown Of The Race

Feb 23, 2025 -

Chelsea Fall To Aston Villa 2 1 Match Analysis And Highlights

Feb 23, 2025

Chelsea Fall To Aston Villa 2 1 Match Analysis And Highlights

Feb 23, 2025 -

Arsenal Vs West Ham Match Report Hammers Secure 1 0 Win

Feb 23, 2025

Arsenal Vs West Ham Match Report Hammers Secure 1 0 Win

Feb 23, 2025 -

Michigan Mens Basketball Coach Dusty May Receives Contract Extension

Feb 23, 2025

Michigan Mens Basketball Coach Dusty May Receives Contract Extension

Feb 23, 2025

Latest Posts

-

Callum Smith Triumphant After Tough Fight With Buatsi

Feb 23, 2025

Callum Smith Triumphant After Tough Fight With Buatsi

Feb 23, 2025 -

Supreme Court Awaits On Case Regarding Trumps Removal Of Watchdog

Feb 23, 2025

Supreme Court Awaits On Case Regarding Trumps Removal Of Watchdog

Feb 23, 2025 -

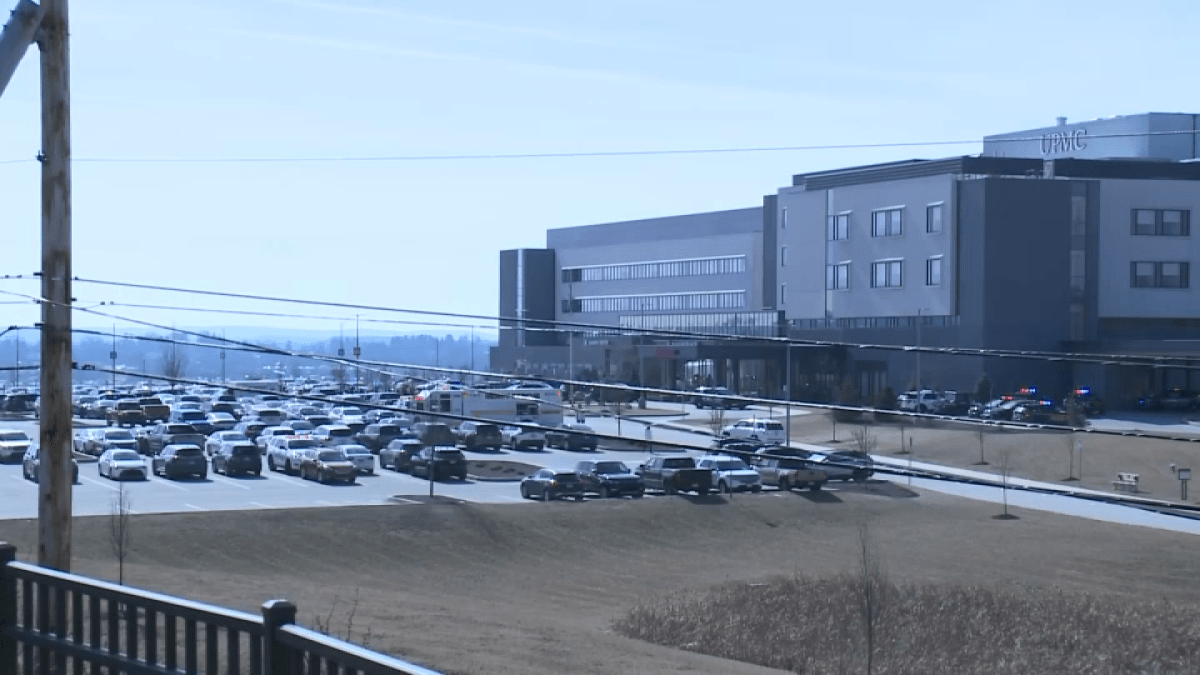

Officer Fatally Shot At Pennsylvania Hospital Gunman Found Dead

Feb 23, 2025

Officer Fatally Shot At Pennsylvania Hospital Gunman Found Dead

Feb 23, 2025 -

Celtics 13 Point Lead Prompts Angry Reaction From Sutton

Feb 23, 2025

Celtics 13 Point Lead Prompts Angry Reaction From Sutton

Feb 23, 2025 -

Key German Election Scholzs Vision For Europes Direction

Feb 23, 2025

Key German Election Scholzs Vision For Europes Direction

Feb 23, 2025