Bybit's $1.4B ETH Hack: Assessing The Impact On Cryptocurrency Markets

Table of Contents

Bybit's $1.4B ETH Hack: Assessing the Impact on Cryptocurrency Markets – A Deeper Dive

[Date of Publication] – The cryptocurrency market experienced a significant shock recently with news of a purported $1.4 billion ETH hack targeting Bybit, a leading cryptocurrency exchange. While initial reports painted a picture of widespread chaos and significant market downturn, a more nuanced understanding reveals a complex situation with evolving details and less dramatic consequences than initially feared. This article will dissect the event, analyzing the purported impact on the cryptocurrency markets and exploring the broader implications for investor confidence.

The Alleged Hack and Initial Fallout:

Early reports, circulating widely across social media and several crypto news outlets, claimed that Bybit suffered a massive exploit resulting in the theft of approximately $1.4 billion worth of Ether (ETH). [Specify the date and time the initial reports emerged]. These reports cited [Source of the initial report – e.g., a specific tweet, a blog post, etc.], triggering immediate concern among investors. The price of ETH, along with other major cryptocurrencies, experienced a [Percentage] dip in the immediate aftermath [Specify timeframe]. This initial reaction was fueled by fears of a major security breach at a large and influential exchange.

However, [Insert information clarifying the nature of the alleged hack - was it a direct breach of Bybit's systems, a phishing scam affecting users, or a completely different scenario? Provide specifics if available. Cite credible sources]. Crucially, Bybit itself [State Bybit's official response to the alleged hack – did they confirm, deny, or issue a statement addressing the situation? Provide a direct quote or paraphrase their official response]. The absence of a confirmed official statement from Bybit fueled speculation and contributed to the initial market volatility.

Unraveling the Discrepancies and Examining the Evidence:

It's important to note that [Explain any inconsistencies or conflicting information regarding the alleged hack. For instance, were there any differing amounts reported? Were there independent verifications of the alleged theft?]. Several crypto analysts and security experts [Quote or paraphrase relevant statements from analysts and experts who have analyzed the situation]. [Include links to relevant reports or analyses if available]. The lack of conclusive evidence regarding the scale and nature of the alleged hack has led to questions about the veracity of the initial reports. [Mention if any investigations are underway by authorities or independent security firms].

Market Impact and Long-Term Implications:

While the initial price dip was noteworthy, the cryptocurrency market showed remarkable resilience. The price of ETH, as well as other major cryptocurrencies, [Describe the recovery, including percentages and timeframes]. This suggests that the market's reaction was largely driven by initial fear and uncertainty, rather than a fundamental shift in investor sentiment. However, the long-term impact remains to be seen. [Discuss the potential impact on Bybit's reputation, its user base, and the broader trust in cryptocurrency exchanges]. The incident highlights the ongoing importance of robust security measures for all cryptocurrency exchanges and the need for transparent and timely communication during crises.

Conclusion:

The alleged $1.4 billion ETH hack targeting Bybit remains a developing story with numerous unanswered questions. While the initial reaction from the cryptocurrency market was dramatic, the subsequent recovery and lack of concrete evidence suggest a more nuanced situation. A thorough investigation is crucial to ascertain the truth and prevent similar incidents in the future. The event serves as a reminder of the inherent risks associated with cryptocurrency investing and the importance of conducting thorough due diligence before entrusting funds to any exchange. Further updates will be provided as more information becomes available.

[Note: This article template requires filling in the bracketed information with accurate and verifiable data. Thorough research is essential to ensure the accuracy and credibility of the final article. Always cite credible sources for all information provided.]

Featured Posts

-

Predicting The 2025 Knicks Vs Cavaliers Nba Game Odds Start Time And Score

Feb 22, 2025

Predicting The 2025 Knicks Vs Cavaliers Nba Game Odds Start Time And Score

Feb 22, 2025 -

Bybit Eth Hack A 1 4 Billion Loss What Now For The Exchange And The Market

Feb 22, 2025

Bybit Eth Hack A 1 4 Billion Loss What Now For The Exchange And The Market

Feb 22, 2025 -

Espn And Mlb Part Ways No More Baseball After 2025

Feb 22, 2025

Espn And Mlb Part Ways No More Baseball After 2025

Feb 22, 2025 -

Ex Army Boss Demands More Uk And Eu Involvement In Ukraine Crisis

Feb 22, 2025

Ex Army Boss Demands More Uk And Eu Involvement In Ukraine Crisis

Feb 22, 2025 -

Coach Dusty Mays Future Secured Multi Year Extension With Michigan Basketball

Feb 22, 2025

Coach Dusty Mays Future Secured Multi Year Extension With Michigan Basketball

Feb 22, 2025

Latest Posts

-

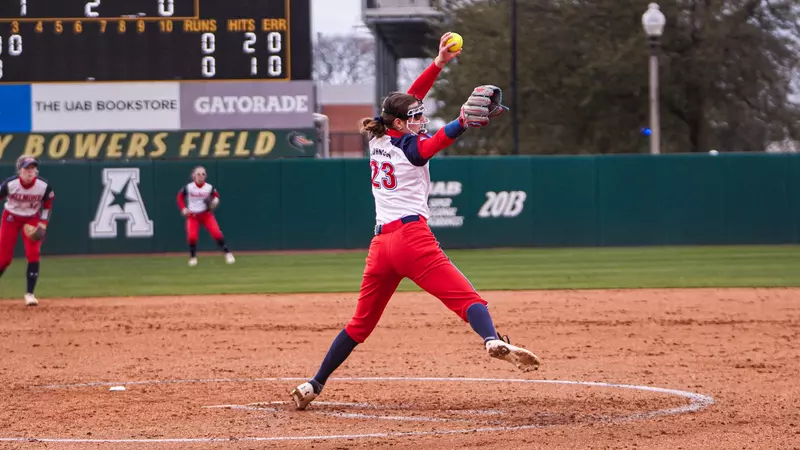

Undefeated Softball Team Continues Winning Ways

Feb 23, 2025

Undefeated Softball Team Continues Winning Ways

Feb 23, 2025 -

Active Shooter Situation At Upmc Memorial Hospital In West Manchester Twp Resolved

Feb 23, 2025

Active Shooter Situation At Upmc Memorial Hospital In West Manchester Twp Resolved

Feb 23, 2025 -

National Margarita Day 2025 Date Deals And Celebrations

Feb 23, 2025

National Margarita Day 2025 Date Deals And Celebrations

Feb 23, 2025 -

Southampton 0 4 Brighton Mitoma And Pedro Seal Dominant Away Win

Feb 23, 2025

Southampton 0 4 Brighton Mitoma And Pedro Seal Dominant Away Win

Feb 23, 2025 -

Coach Auriemma On Butlers Impressive New Womens Basketball Building

Feb 23, 2025

Coach Auriemma On Butlers Impressive New Womens Basketball Building

Feb 23, 2025