Bybit's $1.4 Billion ETH Hack: Analysis And Market Impact

Table of Contents

Bybit's $1.4 Billion ETH Hack: A Deep Dive into the Incident and its Market Fallout

[Date of Publication]: October 26, 2023

HONG KONG – The cryptocurrency exchange Bybit has weathered a significant blow, revealing a massive security breach resulting in the loss of approximately $1.4 billion worth of Ether (ETH). While Bybit hasn't officially confirmed the exact figure or details, sources close to the investigation and blockchain analysis firms have pointed to a sophisticated exploit targeting a substantial portion of the exchange's ETH reserves. The incident, which remains shrouded in some mystery, has sent shockwaves through the crypto market, raising crucial questions about security protocols within major exchanges and the overall stability of the digital asset ecosystem.

The initial reports of the breach surfaced on [Date of first report], triggering a period of intense speculation and uncertainty. Early indications suggested that hackers had exploited a vulnerability in Bybit's [Specify the exploited system, e.g., smart contract, hot wallet system, etc.], gaining unauthorized access and swiftly transferring the stolen ETH to various mixer addresses. [Details about the nature of the exploit, if available, e.g., zero-day exploit, social engineering, insider threat]. The speed and efficiency of the operation hint at a highly organized and well-resourced hacking group.

Blockchain tracking firms such as [Name specific firms involved in the analysis] have meticulously traced the movement of the stolen ETH across the blockchain, identifying a series of transactions designed to obfuscate the funds' origin and intended destination. [Insert specific details from blockchain analysis, e.g., number of transactions, approximate value of ETH moved per transaction, types of mixers used]. While law enforcement agencies are likely involved in the investigation, the decentralized and often pseudonymous nature of cryptocurrency transactions makes recovery efforts challenging.

The immediate impact on the cryptocurrency market was significant. The price of ETH experienced a [Percentage change and direction] drop in the hours following the news, mirroring a broader decline in market sentiment. Other major cryptocurrencies also experienced [Percentage change and direction] declines as investors reacted to the perceived risk within the exchange ecosystem. The incident served as a stark reminder of the inherent vulnerabilities in the world of digital assets, especially in the face of sophisticated cyberattacks.

Bybit, in its initial public statement, acknowledged a "security incident" but refrained from providing specific details about the extent of the losses or the nature of the exploit. [Include exact quote from Bybit’s official statement, if available]. This lack of transparency has fueled criticism from some quarters, with concerns being raised about the exchange's commitment to transparency and user protection. The company has promised a full investigation and [mention any promised actions such as compensation plans or improved security measures]. However, the long-term consequences for Bybit's reputation and user base remain to be seen.

The $1.4 billion ETH hack serves as a pivotal moment for the cryptocurrency industry. It underscores the ongoing need for robust security protocols, comprehensive auditing, and increased transparency from exchanges to build and maintain user trust. The incident also highlights the challenges faced by law enforcement in combating sophisticated cryptocurrency-related crimes. As the investigation unfolds, the crypto community will be closely watching for developments and the potential impact on future regulations and security standards. The long-term consequences of this breach, both for Bybit and the broader crypto market, are still unfolding and will undoubtedly shape the future landscape of digital asset trading.

Featured Posts

-

Watch Leicester City Vs Brentford Todays Premier League Game

Feb 23, 2025

Watch Leicester City Vs Brentford Todays Premier League Game

Feb 23, 2025 -

The Last Of Us Season 2 Confirmed Cast Trailer Speculation And Release Date

Feb 23, 2025

The Last Of Us Season 2 Confirmed Cast Trailer Speculation And Release Date

Feb 23, 2025 -

Mls 2025 Where To Watch Full Schedule And Key Dates

Feb 23, 2025

Mls 2025 Where To Watch Full Schedule And Key Dates

Feb 23, 2025 -

Monkey Film Review High On Gore Low On Impact

Feb 23, 2025

Monkey Film Review High On Gore Low On Impact

Feb 23, 2025 -

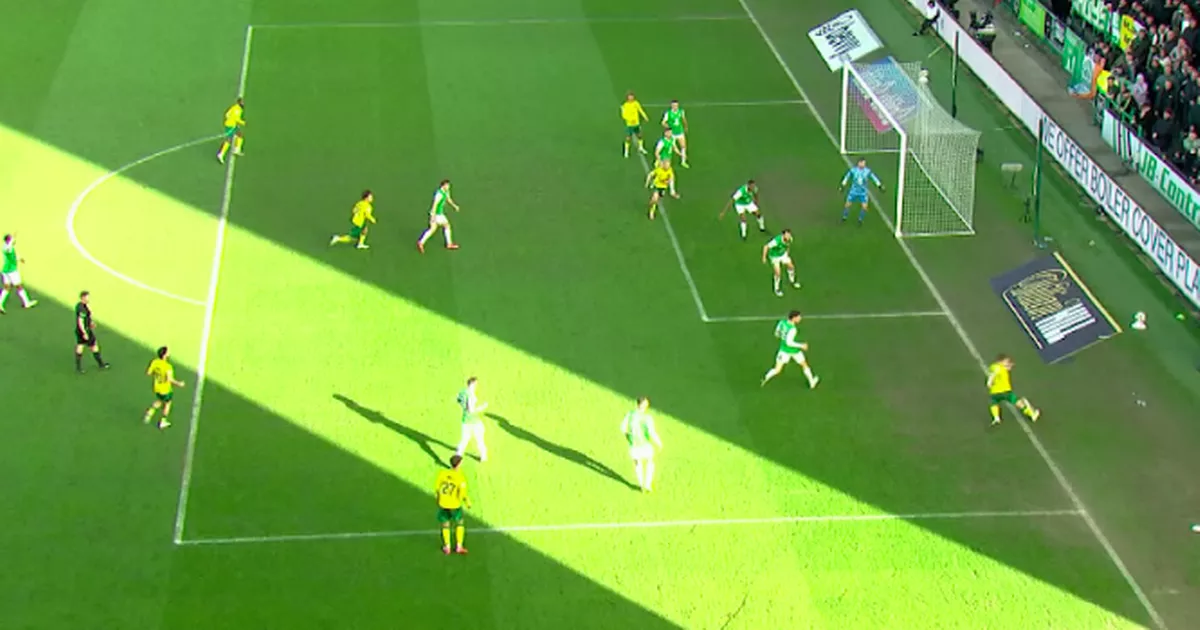

Celtics Controversial No Goal Maedas Impact And The Referees Decision

Feb 23, 2025

Celtics Controversial No Goal Maedas Impact And The Referees Decision

Feb 23, 2025

Latest Posts

-

Social Media Post Alleges Ex Ravens Players Infidelity

Feb 23, 2025

Social Media Post Alleges Ex Ravens Players Infidelity

Feb 23, 2025 -

Beterbiev Loses Light Heavyweight Crown To Bivol In Unification Bout

Feb 23, 2025

Beterbiev Loses Light Heavyweight Crown To Bivol In Unification Bout

Feb 23, 2025 -

Ufc Fight Night Cejudo Vs Song Yadong A Comprehensive Prediction

Feb 23, 2025

Ufc Fight Night Cejudo Vs Song Yadong A Comprehensive Prediction

Feb 23, 2025 -

Manchester United At Everton Kick Off Time Tv Coverage And Live Streaming Details

Feb 23, 2025

Manchester United At Everton Kick Off Time Tv Coverage And Live Streaming Details

Feb 23, 2025 -

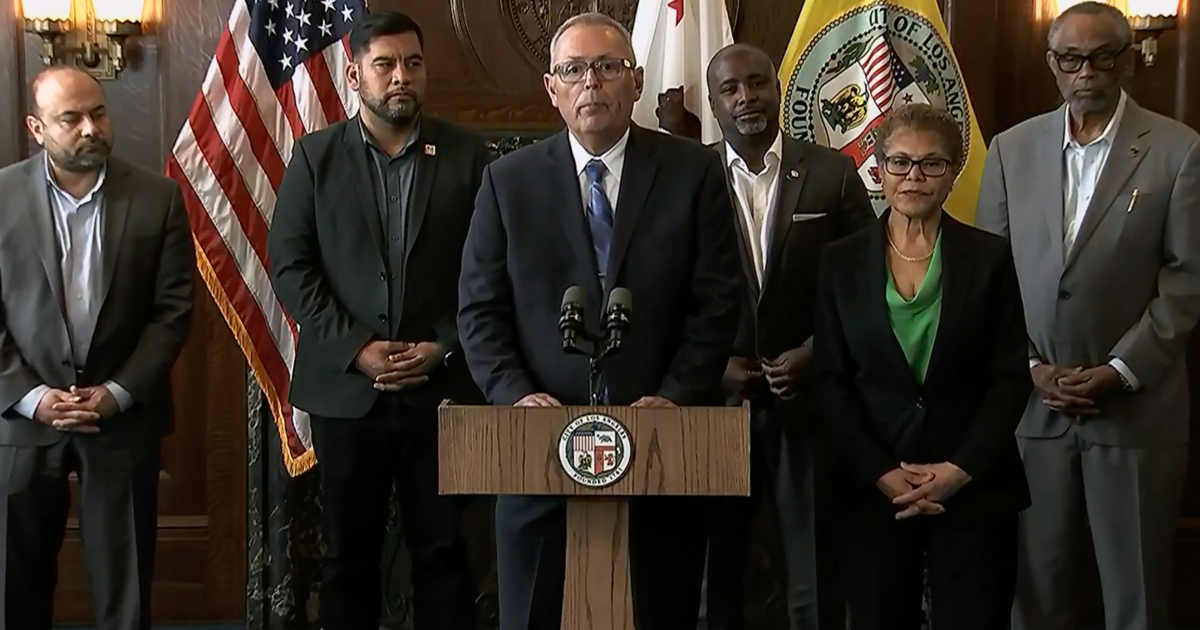

Bass Faces Backlash Over Controversial Firing Of Lafd Chief Crowley

Feb 23, 2025

Bass Faces Backlash Over Controversial Firing Of Lafd Chief Crowley

Feb 23, 2025