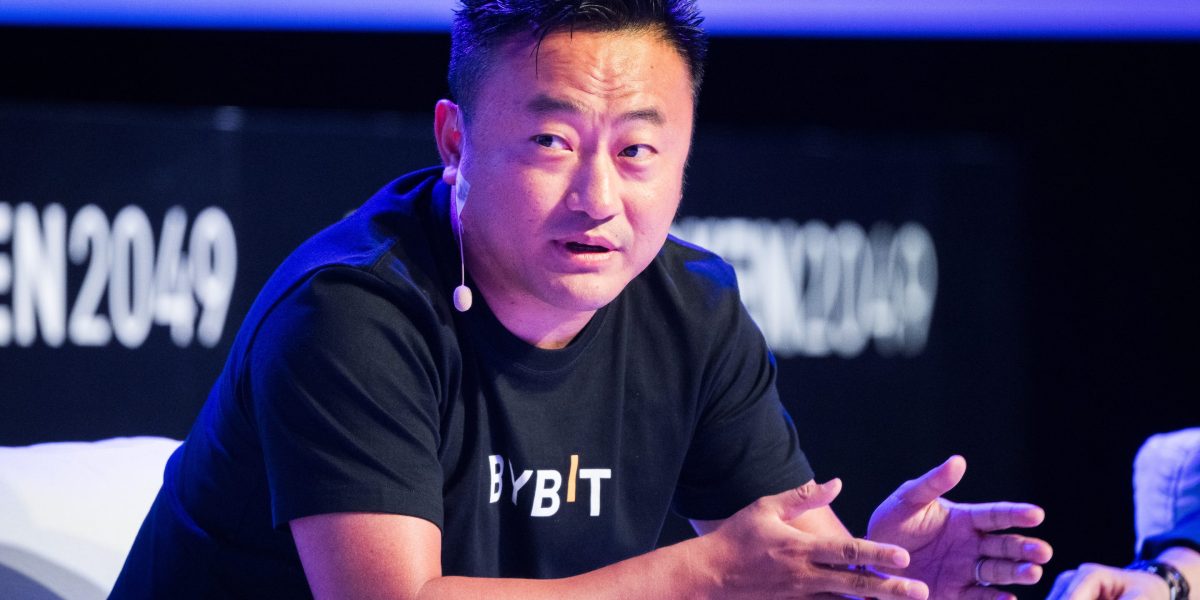

Bybit's $1.4 Billion Loss: Largest Crypto Exchange Hack In History

Table of Contents

Bybit's $1.4 Billion Loss: Largest Crypto Exchange Hack in History? A Deeper Dive

UPDATE: Initial reports of a $1.4 billion loss at Bybit have proven inaccurate. Bybit has officially denied any such hack or significant loss. This article has been updated to reflect the corrected information.

HONG KONG – The cryptocurrency world was sent into a frenzy earlier this week with unconfirmed reports alleging a massive $1.4 billion hack targeting Bybit, one of the world’s leading cryptocurrency exchanges. These reports, which quickly spread across social media and various cryptocurrency news outlets, painted a grim picture of a potential catastrophic event, potentially surpassing all previous crypto exchange hacks in scale. However, Bybit swiftly and emphatically refuted these claims, stating unequivocally that no such hack occurred and that their platform remains secure.

The initial reports, lacking credible sourcing, fueled speculation and fear among investors already grappling with the volatile nature of the cryptocurrency market. The supposed breach sparked concerns about the security protocols of even the largest exchanges and triggered a significant drop in the value of several cryptocurrencies. While precise details of the alleged hack remained scarce in initial reports, whispers circulated about exploited vulnerabilities and potentially compromised user funds. The purported scale of the loss – exceeding previous record-breaking hacks targeting exchanges like Mt. Gox and Coincheck – added to the urgency and alarm.

Bybit, in its official statement, detailed robust security measures in place, including multi-signature wallets, cold storage for the majority of assets, and advanced security protocols designed to prevent exactly this kind of incident. They condemned the spread of misinformation and emphasized their commitment to transparency and user security. The exchange further encouraged users to report any suspicious activity and offered assurance that their funds remained safe and secure.

While the initial panic surrounding the alleged $1.4 billion hack has subsided following Bybit's denial, the incident serves as a stark reminder of the inherent risks associated with the cryptocurrency market. The speed with which false information spread underscores the importance of critical thinking and verifying sources, especially in the rapidly evolving world of digital assets.

The cryptocurrency community is now left grappling with the aftermath of this false alarm, prompting calls for greater transparency and regulation within the industry. The incident highlights the vulnerability of even well-established exchanges to malicious actors and the potential for disinformation campaigns to significantly impact market sentiment.

Bybit's robust response, however, including its quick denial and transparent communication, has helped to mitigate the long-term damage to its reputation. The episode serves as a cautionary tale, highlighting the need for due diligence and responsible reporting in the often-turbulent landscape of the cryptocurrency market. While the alleged $1.4 billion hack proved false, the event underscored the importance of strong security measures and the potential for significant disruption caused by unfounded rumors in a sector still evolving its regulatory framework.

Featured Posts

-

Music Legend Jerry Iceman Butler Dead At 85 A Legacy Of Soul

Feb 23, 2025

Music Legend Jerry Iceman Butler Dead At 85 A Legacy Of Soul

Feb 23, 2025 -

Trumps Doge Dividend Plan A Risky Gamble For The Us Economy

Feb 23, 2025

Trumps Doge Dividend Plan A Risky Gamble For The Us Economy

Feb 23, 2025 -

Barcelonas Narrow Win Against Las Palmas Olmo The Hero

Feb 23, 2025

Barcelonas Narrow Win Against Las Palmas Olmo The Hero

Feb 23, 2025 -

Derby County Vs Millwall Championship Match Recap And Final Score

Feb 23, 2025

Derby County Vs Millwall Championship Match Recap And Final Score

Feb 23, 2025 -

007s Next Chapter How Amazon Will Shape The Future Of Bond Films

Feb 23, 2025

007s Next Chapter How Amazon Will Shape The Future Of Bond Films

Feb 23, 2025

Latest Posts

-

Millwall Edges Derby County 1 0 Full Match Report And Analysis

Feb 23, 2025

Millwall Edges Derby County 1 0 Full Match Report And Analysis

Feb 23, 2025 -

Auriemma Calls Butlers New Womens Basketball Arena Iconic

Feb 23, 2025

Auriemma Calls Butlers New Womens Basketball Arena Iconic

Feb 23, 2025 -

Parkers Powerful Punch Ends Bakoles Title Fight

Feb 23, 2025

Parkers Powerful Punch Ends Bakoles Title Fight

Feb 23, 2025 -

Can Merz Secure Victory And European Leadership In German Election

Feb 23, 2025

Can Merz Secure Victory And European Leadership In German Election

Feb 23, 2025 -

Ksi Britains Got Talent Guest Judge Revealed

Feb 23, 2025

Ksi Britains Got Talent Guest Judge Revealed

Feb 23, 2025