Can Elon Musk Recover His $44 Billion In The X Acquisition?

Table of Contents

Can Elon Musk Recover His $44 Billion X Acquisition Gamble?

SAN FRANCISCO, CA – Elon Musk's $44 billion acquisition of Twitter, now rebranded as X, is facing intense scrutiny as questions mount regarding the platform's financial viability and Musk's ability to recoup his massive investment. While initial projections painted a rosy picture of future revenue streams, a complex interplay of factors – including significant debt burdens, declining advertising revenue, and rising operational costs – casts a shadow on the likelihood of a substantial return on his investment.

The deal, finalized in October 2022, immediately plunged X into a tumultuous period. Musk's controversial leadership style, marked by rapid-fire policy changes and mass layoffs, alienated advertisers, a crucial revenue source for the platform. Reports suggest that major brands significantly reduced or completely halted advertising spending in the wake of these upheavals, contributing to a reported decline in advertising revenue. [Specific figures on advertising revenue decline should be inserted here, sourced from reliable financial news outlets like the Wall Street Journal, Bloomberg, or Reuters. For example: "According to a recent Bloomberg report, X's advertising revenue plummeted by X% in the first quarter of 2024, compared to the same period last year."]

Musk's attempts to diversify revenue streams, including the introduction of a paid verification system – X Premium – and the expansion of payment processing capabilities within the platform, have yielded mixed results. While X Premium subscriptions have generated some revenue, the numbers are reportedly insufficient to offset the massive losses incurred in other areas. [Specific data on X Premium subscriber numbers and revenue generated should be included here, cited from reputable sources. For example: "X Premium currently boasts [Number] subscribers, generating an estimated [Dollar amount] in revenue per quarter, according to a recent analysis by [Source]."]

The significant debt incurred to finance the acquisition poses a considerable challenge. Musk leveraged substantial personal wealth and secured considerable debt financing, leaving him heavily indebted and facing substantial interest payments. [The exact amount of debt, its interest rate, and repayment schedule should be inserted here, with citations to relevant financial filings or news reports. For example: "Musk financed the acquisition with approximately [Dollar amount] in debt, carrying an interest rate of [Percentage] and requiring repayment within [Timeframe], according to filings with the SEC."] These obligations create significant pressure on the platform's financial performance, demanding substantial profit generation to remain solvent.

Further complicating the situation are rising operational costs. While Musk's cost-cutting measures, including extensive layoffs, have aimed to reduce expenses, the platform still faces significant infrastructure, maintenance, and content moderation costs. [Information on specific operational costs, including specifics on employee compensation, infrastructure maintenance, and content moderation expenses should be included, citing sources like X's financial reports or credible news articles.]

Despite these challenges, Musk remains optimistic about X's long-term prospects, pointing to potential future revenue streams from emerging technologies and expanded services. However, analysts remain largely skeptical, citing the need for a substantial turnaround in advertising revenue and improved cost management to make the acquisition financially viable. [Include quotes from at least two prominent financial analysts or experts offering their perspective on Musk's chances of recouping his investment. Clearly attribute the quotes to the individuals and their affiliations.]

The future of X and Musk's $44 billion investment remains uncertain. The platform's ability to adapt to a rapidly evolving social media landscape, attract advertisers, and manage its substantial debt load will be crucial in determining whether this audacious gamble will ultimately pay off. The coming months will be critical in assessing the viability of Musk's vision and the fate of his significant financial stake in X.

Featured Posts

-

Three Defining Moments Wisconsin Badgers Close Loss To Oregon 77 73

Feb 23, 2025

Three Defining Moments Wisconsin Badgers Close Loss To Oregon 77 73

Feb 23, 2025 -

Rangers St Mirren Loss Sparks Fan Outrage

Feb 23, 2025

Rangers St Mirren Loss Sparks Fan Outrage

Feb 23, 2025 -

Uniteds Man Of The Match Performance Against Everton Highlighted

Feb 23, 2025

Uniteds Man Of The Match Performance Against Everton Highlighted

Feb 23, 2025 -

Trump Announces Joint Chiefs Chairman Replacement Amid Pentagon Shakeup

Feb 23, 2025

Trump Announces Joint Chiefs Chairman Replacement Amid Pentagon Shakeup

Feb 23, 2025 -

Premier League Leicester City Vs Brentford Live Stream And Tv Info

Feb 23, 2025

Premier League Leicester City Vs Brentford Live Stream And Tv Info

Feb 23, 2025

Latest Posts

-

Germanys Election Merz Seeks European Leadership In Final Stretch

Feb 23, 2025

Germanys Election Merz Seeks European Leadership In Final Stretch

Feb 23, 2025 -

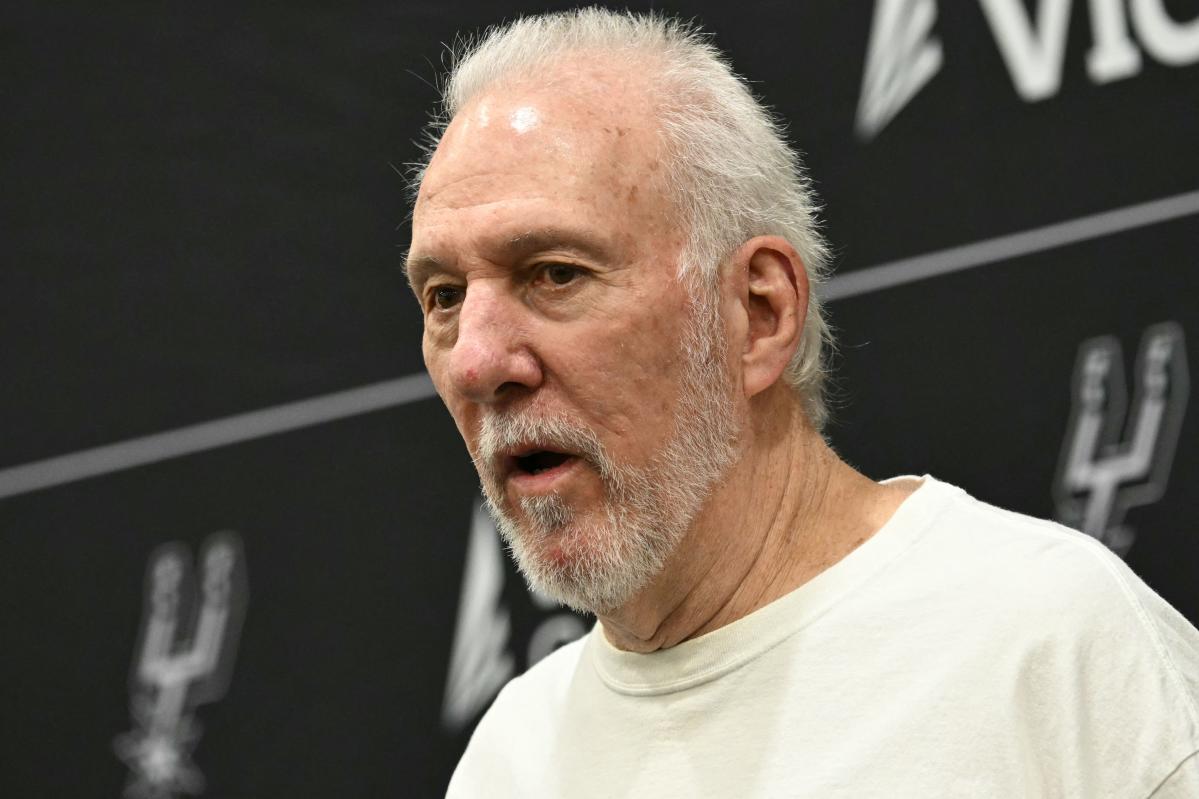

Is Gregg Popovich Stepping Down From The San Antonio Spurs

Feb 23, 2025

Is Gregg Popovich Stepping Down From The San Antonio Spurs

Feb 23, 2025 -

German Election 2025 A State By State Breakdown Of The Race

Feb 23, 2025

German Election 2025 A State By State Breakdown Of The Race

Feb 23, 2025 -

Minnesota United Falls Short In Season Opener

Feb 23, 2025

Minnesota United Falls Short In Season Opener

Feb 23, 2025 -

Henry Cejudo Vs Song Yadong A Detailed Ufc Seattle Fight Report

Feb 23, 2025

Henry Cejudo Vs Song Yadong A Detailed Ufc Seattle Fight Report

Feb 23, 2025