Can Elon Musk's X Generate Profit After A $44 Billion Investment?

Table of Contents

Can Elon Musk's X Generate Profit After a $44 Billion Investment? A Deep Dive into the Platform's Financial Future

SAN FRANCISCO, CA – Elon Musk's audacious $44 billion acquisition of Twitter, now rebranded as X, continues to generate intense speculation about its financial viability. While the platform boasts a massive user base and significant brand recognition, its path to profitability remains a complex and uncertain one. Initial data suggests a steep uphill climb.

Musk's initial vision centered on transforming X into an "everything app," akin to China's WeChat, offering a wide range of services beyond microblogging. This ambitious strategy, however, requires substantial investment in infrastructure, new features, and staff – a significant hurdle given the company's current financial state.

Revenue Streams Under Scrutiny:

X's primary revenue stream historically has been advertising. However, Musk's controversial leadership and policy changes have led to advertiser flight, impacting this crucial income source significantly. [While precise figures are not publicly available, various reports suggest a double-digit percentage drop in advertising revenue since the acquisition.] This drop is attributable to concerns about brand safety and a perceived increase in hate speech and misinformation on the platform. Internal documents leaked to the press also reveal struggles with maintaining revenue per user (ARPU).

Beyond advertising, X is exploring subscription services through X Premium (formerly Twitter Blue). While this avenue holds potential, the current subscriber base remains relatively small compared to the overall user count, making it insufficient to compensate for the advertising revenue decline. [Estimates put the number of X Premium subscribers at significantly less than 10% of total monthly active users, although precise numbers are proprietary.]

Other potential revenue streams, such as payments integration and e-commerce functionalities, are still in their nascent stages. While these offer long-term prospects, they are unlikely to generate substantial income in the immediate future. The development and implementation of these features require considerable investment, adding further pressure to the company's already strained finances.

Challenges and Uncertainties:

The debt incurred during the acquisition remains a significant burden on X's financial health. [Reports indicate that Musk leveraged significant personal assets and secured substantial debt financing to fund the purchase, resulting in substantial interest payments.] This debt servicing, coupled with the decline in advertising revenue, creates a substantial financial strain.

Musk's aggressive cost-cutting measures, including widespread layoffs, have been met with criticism and legal challenges. While they have undoubtedly reduced expenses, they have also led to disruptions in service and negatively impacted employee morale, potentially hindering the company's ability to innovate and adapt.

The Road to Profitability:

The path to profitability for X is fraught with challenges. While the ambitious "everything app" vision holds potential, its success hinges on several factors:

-

Rebuilding Advertiser Trust: Restoring confidence among advertisers is paramount. This requires demonstrable improvements in content moderation and brand safety.

-

Subscriber Growth: Significant growth in X Premium subscriptions is crucial to offsetting the advertising revenue shortfall. This necessitates offering compelling value propositions to attract and retain subscribers.

-

Successful Product Diversification: The development and adoption of new revenue streams, such as payment processing and e-commerce, are essential for long-term sustainability.

-

Effective Cost Management: Maintaining a balance between cost-cutting and investing in crucial areas like product development and infrastructure will be critical.

Conclusion:

The prospects for X generating profit after its $44 billion investment remain highly uncertain. While the platform holds significant potential, its current financial challenges are substantial. The success of Musk's vision depends on effectively addressing the critical issues of advertiser trust, subscriber growth, and revenue diversification, all while managing the significant debt burden. The coming years will be crucial in determining whether X can transform itself into a profitable entity. The current data suggests a long, arduous journey lies ahead.

Featured Posts

-

Michigan Basketball Dusty May Agrees To Terms As Head Coach

Feb 23, 2025

Michigan Basketball Dusty May Agrees To Terms As Head Coach

Feb 23, 2025 -

Michigan Mom Faces 250 Million Bond In Child Neglect Case

Feb 23, 2025

Michigan Mom Faces 250 Million Bond In Child Neglect Case

Feb 23, 2025 -

Ufc Seattle Live Blog Henry Cejudos Return Against Song Yadong

Feb 23, 2025

Ufc Seattle Live Blog Henry Cejudos Return Against Song Yadong

Feb 23, 2025 -

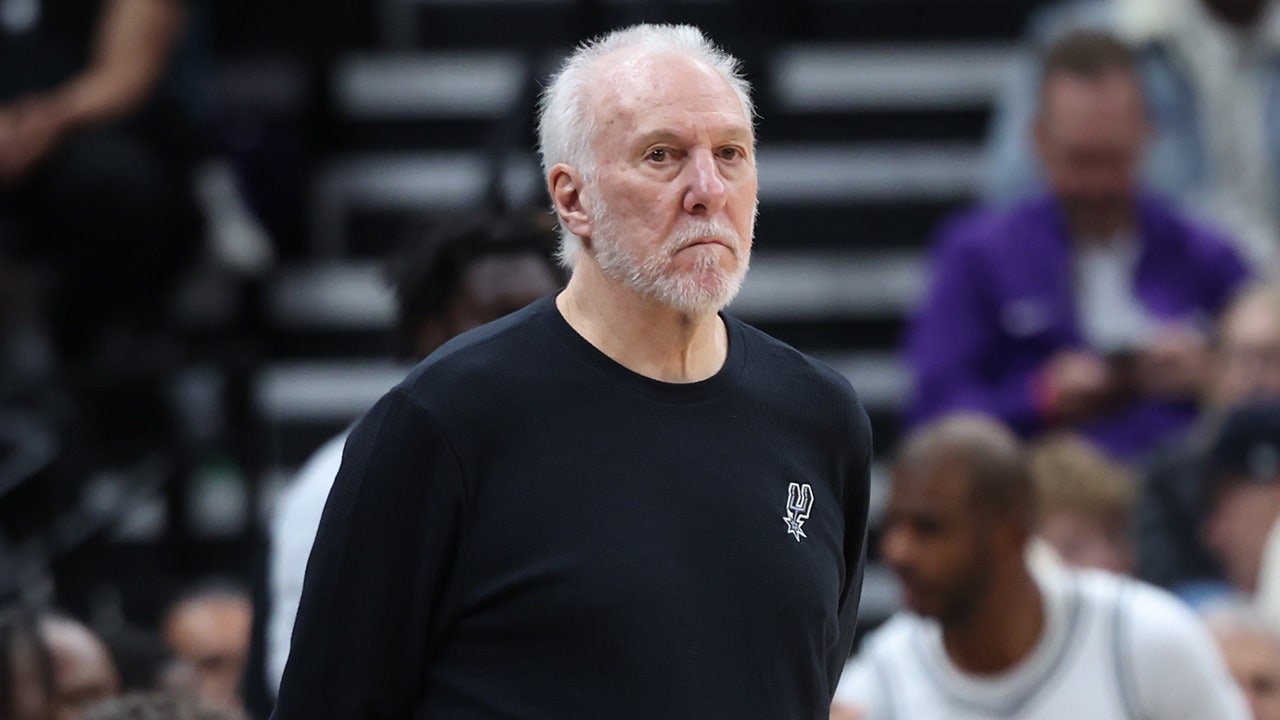

Sources Gregg Popovich Not Returning To Nba Coaching

Feb 23, 2025

Sources Gregg Popovich Not Returning To Nba Coaching

Feb 23, 2025 -

National Margarita Day 2025 Date Deals And Celebrations

Feb 23, 2025

National Margarita Day 2025 Date Deals And Celebrations

Feb 23, 2025

Latest Posts

-

Ksi Meets Britains Got Talent Judges A First Look

Feb 23, 2025

Ksi Meets Britains Got Talent Judges A First Look

Feb 23, 2025 -

Wisconsin Basketball Stumbles Against Opponent Lessons Learned

Feb 23, 2025

Wisconsin Basketball Stumbles Against Opponent Lessons Learned

Feb 23, 2025 -

86 47 Victory For U Conn Womens Basketball Against Butler

Feb 23, 2025

86 47 Victory For U Conn Womens Basketball Against Butler

Feb 23, 2025 -

Suspect Sought Two Police Officers Shot Dead In Tragic Incident

Feb 23, 2025

Suspect Sought Two Police Officers Shot Dead In Tragic Incident

Feb 23, 2025 -

Foreign Aid Freeze Halted By Judge But Ngos Report Ongoing Issues

Feb 23, 2025

Foreign Aid Freeze Halted By Judge But Ngos Report Ongoing Issues

Feb 23, 2025