Data Analytics Firm Palantir Experiences Second Day Of Stock Drop

Table of Contents

Palantir Plunges Again: Stock Suffers Second Consecutive Day of Heavy Losses Amidst Investor Concerns

New York, NY – Shares of data analytics giant Palantir Technologies (PLTR) plummeted for a second consecutive day on [Date], extending a recent period of volatility for the controversial company. The stock closed down [Percentage]% at [Closing Price], following a [Percentage]% drop on [Previous Day's Date]. This latest downturn brings Palantir's stock price to its lowest point in [Number] months, wiping out [Dollar Amount] in market capitalization since [Date of Peak].

The continued sell-off reflects growing investor anxieties surrounding several key factors. Firstly, the company's recent earnings report, released on [Date of Earnings Report], fell short of analysts' expectations. While Palantir reported [Revenue Figure] in revenue, a [Percentage]% increase year-over-year, this figure lagged behind the projected [Projected Revenue Figure]. Analysts pointed to [Specific Reason for Revenue Miss, e.g., slower-than-expected growth in a key sector, increased competition] as a primary driver of the shortfall.

Further fueling investor skepticism is Palantir's heavy reliance on government contracts. While these contracts have historically been a significant source of revenue for the company, concerns persist about the potential for future budget cuts or shifts in government priorities that could negatively impact future earnings. [Specific details about government contract concerns, if applicable, e.g., potential delays in contract awards, competition from other firms].

Adding to the pressure, the broader technology sector has seen a recent period of turbulence, with many high-growth stocks experiencing significant corrections. The current macroeconomic climate, marked by [Current Macroeconomic Conditions, e.g., rising interest rates, inflation concerns], has further dampened investor sentiment towards riskier investments, impacting companies like Palantir, known for its high valuation and relatively high growth trajectory.

Despite the recent declines, some analysts remain bullish on Palantir’s long-term prospects. [Analyst Quote and Affiliation, e.g., "While the short-term outlook is challenging, Palantir's innovative technology and strong government relationships position it for long-term growth," said [Analyst Name], senior analyst at [Investment Bank].]. They highlight the company's expanding presence in the commercial sector and its continued investment in artificial intelligence and machine learning as potential catalysts for future growth.

However, the immediate future for Palantir appears uncertain. The company will need to demonstrate tangible progress in meeting its revenue projections and diversifying its revenue streams to regain investor confidence and stem the tide of declining share prices. The next few weeks will be crucial in determining whether this recent dip represents a temporary setback or the beginning of a more sustained downturn. All eyes will be on the company's upcoming investor presentations and any potential strategic announcements that could influence market sentiment. Further analysis is needed to assess the full implications of the current market trend and its impact on Palantir's future trajectory.

Featured Posts

-

Uncovering Severances Macrodata Refiner Salaries

Feb 22, 2025

Uncovering Severances Macrodata Refiner Salaries

Feb 22, 2025 -

Disappointing Walmart Forecast Fuels Concerns About Us Consumer Spending

Feb 22, 2025

Disappointing Walmart Forecast Fuels Concerns About Us Consumer Spending

Feb 22, 2025 -

Cyberattack On Bybit 1 5 Billion Crypto Hack Traced To North Korea

Feb 22, 2025

Cyberattack On Bybit 1 5 Billion Crypto Hack Traced To North Korea

Feb 22, 2025 -

Knicks Vs Cavaliers Nba Game Date Time And Broadcast Details

Feb 22, 2025

Knicks Vs Cavaliers Nba Game Date Time And Broadcast Details

Feb 22, 2025 -

A Life Cut Short The Death Of Victims Name And Putins Responsibility

Feb 22, 2025

A Life Cut Short The Death Of Victims Name And Putins Responsibility

Feb 22, 2025

Latest Posts

-

Beyond The Music Exploring The Complex Lives Of Fleetwood Mac Stars

Feb 23, 2025

Beyond The Music Exploring The Complex Lives Of Fleetwood Mac Stars

Feb 23, 2025 -

Pennsylvania Hospital Police Officer Killed In Shooting Gunman Dead

Feb 23, 2025

Pennsylvania Hospital Police Officer Killed In Shooting Gunman Dead

Feb 23, 2025 -

Pope Francis Condition Worsens Vatican Announces Critical Status

Feb 23, 2025

Pope Francis Condition Worsens Vatican Announces Critical Status

Feb 23, 2025 -

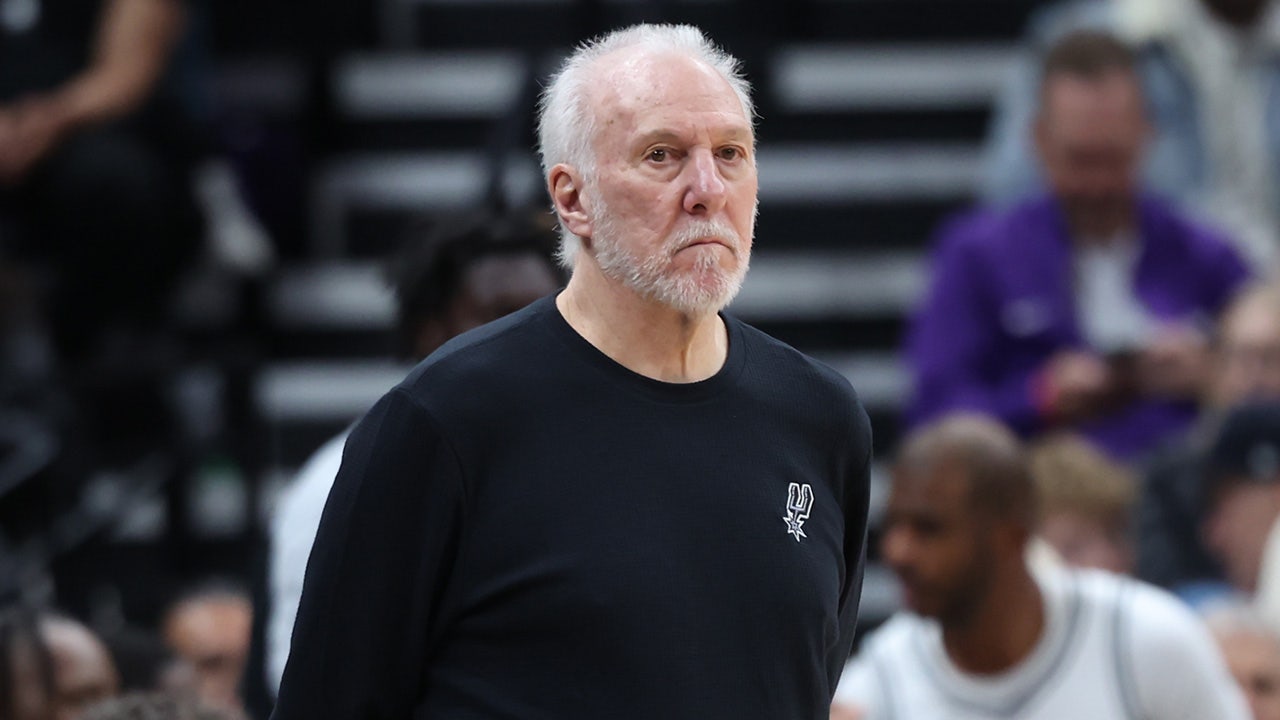

End Of An Era Gregg Popovichs Coaching Career May Be Over

Feb 23, 2025

End Of An Era Gregg Popovichs Coaching Career May Be Over

Feb 23, 2025 -

Parkers Explosive Knockout Ends Bakole Fight Early

Feb 23, 2025

Parkers Explosive Knockout Ends Bakole Fight Early

Feb 23, 2025