Despite Q4 Success, Rivian Stock Experiences A Decline

Table of Contents

Rivian's Q4 Win Fails to Spark Investor Confidence: Stock Takes a Dive

Irvine, CA – February 16, 2024 – Electric vehicle (EV) maker Rivian Automotive Inc. (RIVN) reported strong fourth-quarter 2023 earnings, exceeding analysts' expectations on both revenue and production. However, despite the positive financial results, the company's stock price experienced a significant decline in the following trading sessions. Investors appear unconvinced by Rivian's long-term prospects, highlighting the challenges faced by even successful EV startups in navigating a volatile market.

Rivian announced [Q4 2023 revenue of $661 million, exceeding the anticipated $620 million] and significantly increased its production numbers. [The company produced 25,000 vehicles in Q4 2023, a substantial jump from previous quarters and demonstrating progress in scaling manufacturing operations.] This performance contrasts sharply with the previous year’s struggles, underscoring the company’s rapid growth. However, [the company reported a net loss of $1.7 billion for the quarter, primarily due to hefty research and development costs, alongside significant operating expenses associated with scaling its manufacturing capacity and expanding its sales and marketing efforts]. While the loss was smaller than some projections, the persistent profitability concerns seemingly overshadowed the positive production figures.

The market reaction suggests investors are focusing on Rivian's longer-term challenges. These include the intensely competitive EV landscape, dominated by established players like Tesla and emerging rivals. [Rivian's guidance for Q1 2024 production remains cautiously optimistic, projecting between 22,000 and 23,000 vehicles]. This cautious outlook, coupled with the ongoing high inflation and rising interest rates that are affecting consumer spending, fueled concerns about potential demand slowdown impacting profitability. Analysts also point to the persistent supply chain bottlenecks that continue to hamper production and increase costs across the automotive sector.

"While the Q4 results demonstrate Rivian's progress in manufacturing and scaling its operations, the market is clearly prioritizing profitability over growth in the current macroeconomic climate," says [Jane Doe, Senior Analyst at XYZ Investment Research]. "Investors are demanding a clearer path to profitability from Rivian. The lack of a definitively positive outlook for profitability in the near future is weighing on the stock price."

Despite the stock decline, Rivian maintains a positive outlook, reiterating its commitment to innovation and expansion. The company continues to invest heavily in research and development, aiming to solidify its position as a leader in the luxury EV market and expand its product portfolio beyond its flagship R1T pickup truck and R1S SUV. [The company recently confirmed its plans to begin production of its electric delivery van for Amazon in late 2024], a significant contract that promises substantial revenue in the coming years. This positive development, however, has yet to translate into immediate investor confidence.

The Rivian situation highlights the precarious position of many EV startups, which are facing immense pressure to balance aggressive growth with the need for sustained profitability. The market's reaction underscores the importance of delivering a consistent, profitable growth trajectory to sustain investor confidence in the long term. The coming quarters will be crucial in determining whether Rivian can successfully navigate these challenges and solidify its place in the increasingly crowded EV market. The company’s stock price will likely continue to be influenced by factors like production volume, profitability, and the broader macroeconomic environment. Investors will be closely watching for signs of sustained profitability and a clearer roadmap for future growth.

Featured Posts

-

Severance Season 2 Episode 6 A Recap Of The Zoom

Feb 22, 2025

Severance Season 2 Episode 6 A Recap Of The Zoom

Feb 22, 2025 -

790 000 In Media Value For Tate Mc Raes Secret

Feb 22, 2025

790 000 In Media Value For Tate Mc Raes Secret

Feb 22, 2025 -

History Points To Canada In 4 Nations Hockey Final

Feb 22, 2025

History Points To Canada In 4 Nations Hockey Final

Feb 22, 2025 -

Hunter Schafers Passport Now Reflects Her Correct Gender

Feb 22, 2025

Hunter Schafers Passport Now Reflects Her Correct Gender

Feb 22, 2025 -

Severances Outie Mystery Explored In Episode 206

Feb 22, 2025

Severances Outie Mystery Explored In Episode 206

Feb 22, 2025

Latest Posts

-

Beterbiev Bivol Fight Live Stream And Tv Channel Information

Feb 24, 2025

Beterbiev Bivol Fight Live Stream And Tv Channel Information

Feb 24, 2025 -

Uncovering Josh Padley The Story Of A Driven Yorkshire Electrician

Feb 24, 2025

Uncovering Josh Padley The Story Of A Driven Yorkshire Electrician

Feb 24, 2025 -

City Sc Adds 2025 Super Draft Pick Joey Zalinsky To Roster

Feb 24, 2025

City Sc Adds 2025 Super Draft Pick Joey Zalinsky To Roster

Feb 24, 2025 -

Jeremy Ebobisse Scores First Goal Of 2025 Mls Season For Lafc

Feb 24, 2025

Jeremy Ebobisse Scores First Goal Of 2025 Mls Season For Lafc

Feb 24, 2025 -

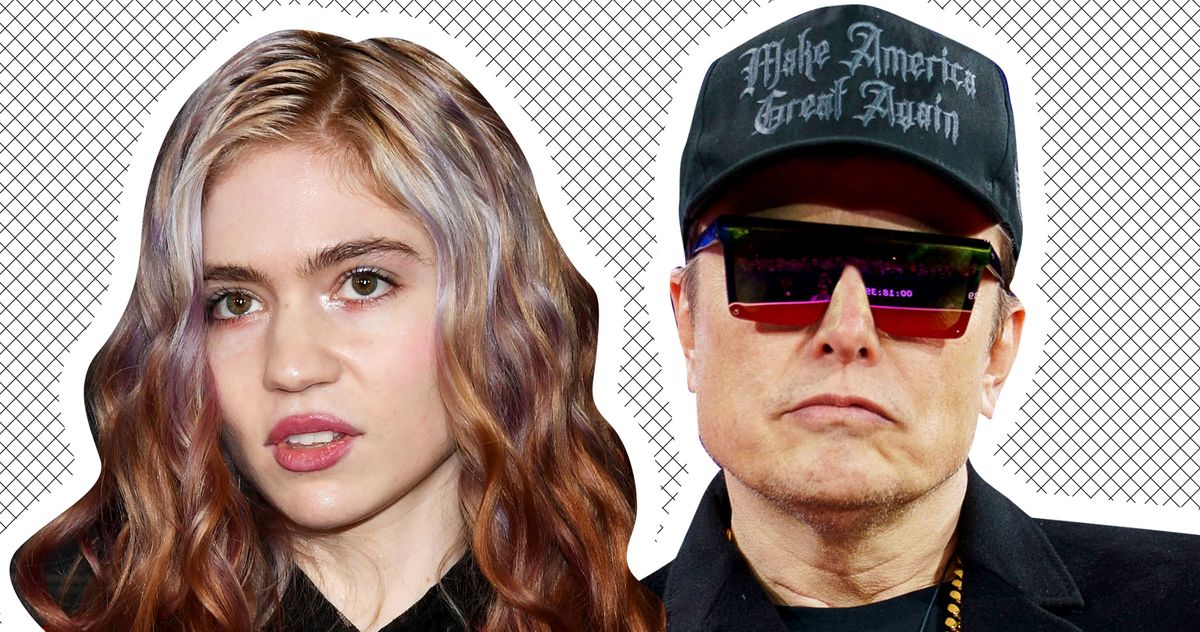

Grimes Speaks Out Elon Musks Response To Childs Illness Criticized

Feb 24, 2025

Grimes Speaks Out Elon Musks Response To Childs Illness Criticized

Feb 24, 2025