Despite Q4 Success, Rivian Stock Price Slides

Table of Contents

Rivian's Q4 Beat Doesn't Stop Stock Slide: Production Hurdles and Market Headwinds Dampen Investor Enthusiasm

Irvine, CA – February 16, 2024 – Rivian Automotive, Inc. (RIVN) reported better-than-expected fourth-quarter earnings on [February 14, 2024], exceeding production targets and showcasing revenue growth. However, the positive news failed to ignite investor confidence, with the company's stock price sliding [by approximately X% (replace X with the actual percentage)] in after-hours trading. Analysts attribute the muted response to persistent challenges in scaling production, ongoing supply chain disruptions, and broader concerns about the electric vehicle (EV) market.

Rivian announced it delivered [Insert Actual Q4 2023 Delivery Numbers] vehicles in Q4 2023, surpassing its own guidance of [Insert Company's Q4 2023 Delivery Guidance]. Revenue for the quarter reached [Insert Actual Q4 2023 Revenue Figure], a significant increase compared to the same period last year, but slightly below some analyst projections. The company also reported a narrower-than-expected loss, [Insert Actual Q4 2023 Loss Figure] signaling some progress in managing costs. CEO RJ Scaringe highlighted the company's achievements in production ramp-up and technological advancements, emphasizing its commitment to delivering innovative EVs.

Despite these positive operational metrics, several factors contributed to the stock's decline. The EV market remains fiercely competitive, with established automakers aggressively launching their own electric models and vying for market share. Rivian faces intense pressure from industry giants like Tesla, Ford, and General Motors, all of whom possess significantly larger production capacity and established distribution networks.

Furthermore, Rivian continues to grapple with supply chain issues, particularly regarding the procurement of critical components like battery cells and semiconductors. These bottlenecks have hampered the company's ability to meet its ambitious production targets consistently, leading to delays and impacting overall profitability. The company acknowledged ongoing supply chain challenges during its earnings call, emphasizing its efforts to diversify its supplier base and mitigate risks.

Investor sentiment also reflects broader concerns about the macroeconomic environment and rising interest rates. The overall market volatility has impacted the valuations of growth stocks, including those in the EV sector, leading to a more cautious approach from investors. Rivian's high valuation relative to its current production levels and profitability also contributes to this cautiousness. While the company has a strong order book and a compelling product lineup, concerns remain regarding its ability to translate its ambitious plans into sustained profitability and significant market share.

Looking ahead, Rivian is focused on expanding its production capacity, enhancing its supply chain resilience, and accelerating the development of new vehicle models. The company's long-term vision remains ambitious, but the near-term challenges are significant. Analysts are divided on the future prospects of Rivian's stock price, with some expressing optimism about the company's long-term potential, while others maintain a more cautious stance, citing the need for consistent production improvements and navigating the fiercely competitive EV landscape. The company's ability to effectively address these challenges will be crucial in determining its future success and regaining investor confidence.

In short: Rivian's Q4 earnings beat expectations but failed to prevent a stock price drop due to ongoing production challenges, intense market competition, and macroeconomic headwinds. While the company showcases progress, its path to sustained profitability remains a key focus for investors.

Featured Posts

-

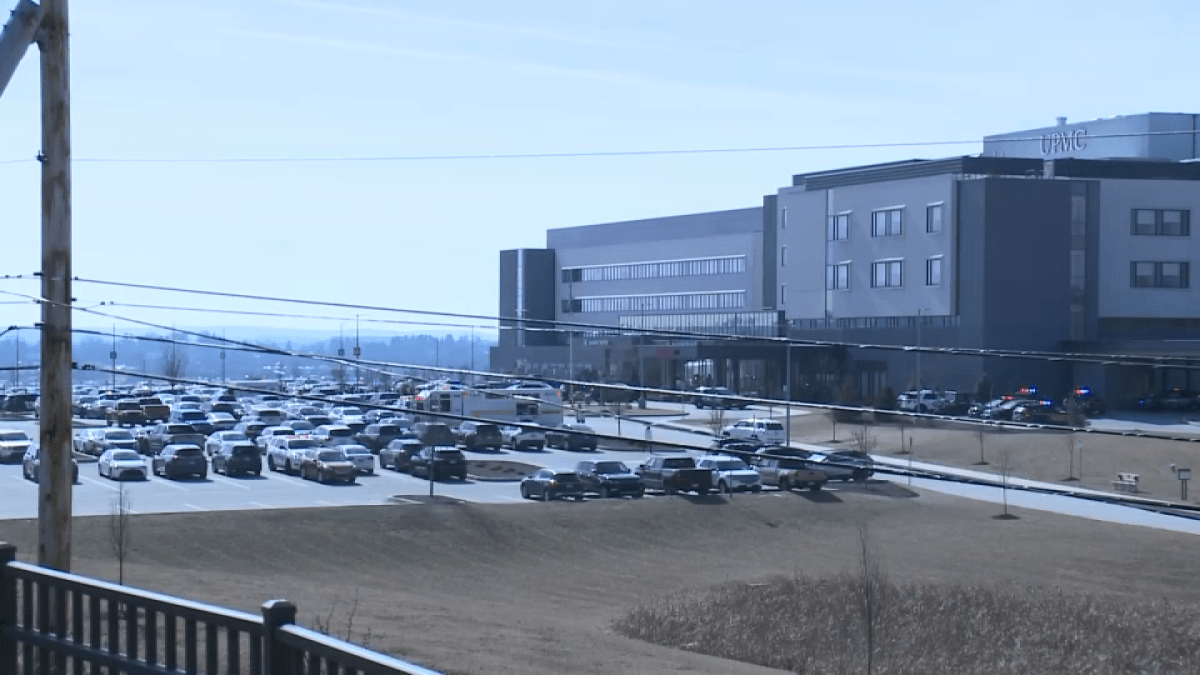

Deadly Hospital Shooting In Pennsylvania Officer Killed

Feb 23, 2025

Deadly Hospital Shooting In Pennsylvania Officer Killed

Feb 23, 2025 -

Movie Guru Review Comparing The Monkey And The Gorge

Feb 23, 2025

Movie Guru Review Comparing The Monkey And The Gorge

Feb 23, 2025 -

Milwaukee Bucks Vs Wizards Giannis Prop Bet Predictions

Feb 23, 2025

Milwaukee Bucks Vs Wizards Giannis Prop Bet Predictions

Feb 23, 2025 -

Pope Francis Condition Serious Following Respiratory Emergency

Feb 23, 2025

Pope Francis Condition Serious Following Respiratory Emergency

Feb 23, 2025 -

Major Crypto Exchange Bybit Hit By 1 5 Billion Hack Analysts

Feb 23, 2025

Major Crypto Exchange Bybit Hit By 1 5 Billion Hack Analysts

Feb 23, 2025

Latest Posts

-

2024 Mls Season Lafc Opening Weekend Schedule And Broadcast Info

Feb 23, 2025

2024 Mls Season Lafc Opening Weekend Schedule And Broadcast Info

Feb 23, 2025 -

Top Spots For Margaritas On Happy Margarita Day 2025

Feb 23, 2025

Top Spots For Margaritas On Happy Margarita Day 2025

Feb 23, 2025 -

Germanys Election Merz Seeks European Leadership In Final Stretch

Feb 23, 2025

Germanys Election Merz Seeks European Leadership In Final Stretch

Feb 23, 2025 -

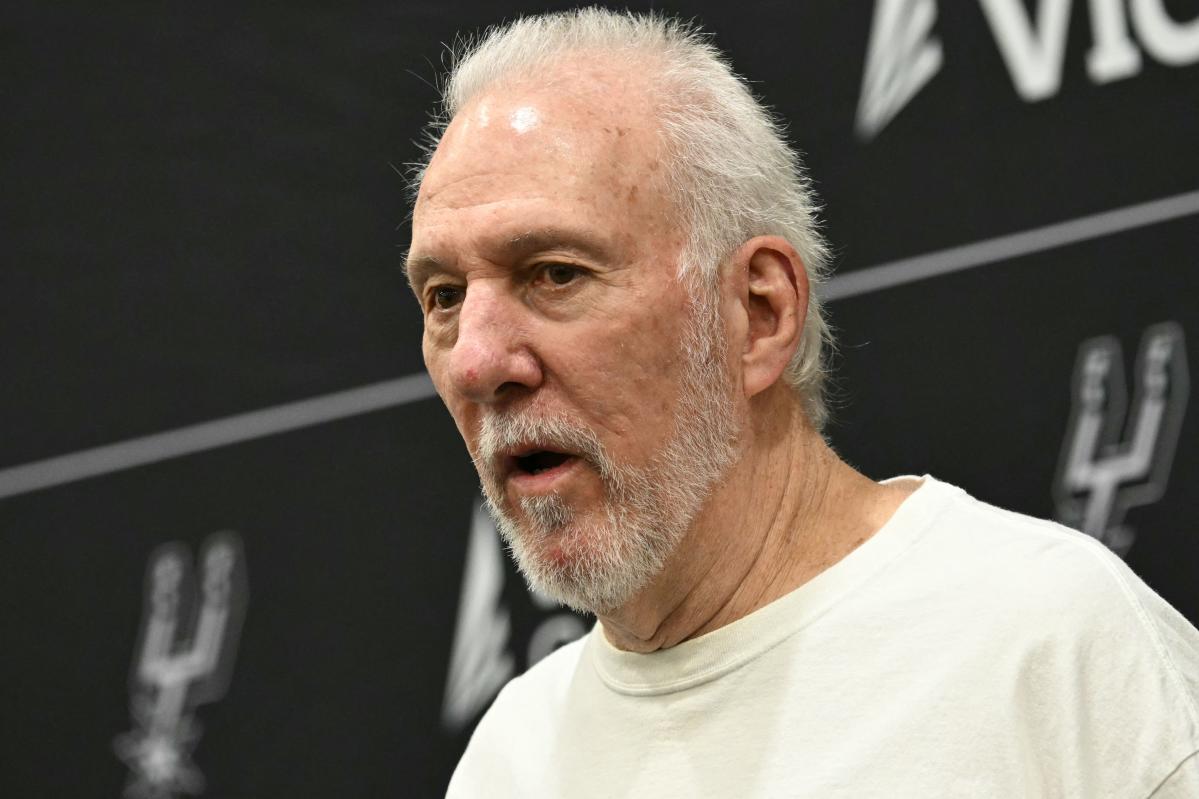

Is Gregg Popovich Stepping Down From The San Antonio Spurs

Feb 23, 2025

Is Gregg Popovich Stepping Down From The San Antonio Spurs

Feb 23, 2025 -

German Election 2025 A State By State Breakdown Of The Race

Feb 23, 2025

German Election 2025 A State By State Breakdown Of The Race

Feb 23, 2025