Despite Strong Q4, Rivian Stock Suffers 3% Decline

Table of Contents

Rivian's Rocky Road: Strong Q4 Earnings Fail to Impress Investors, Stock Dips 3%

Irvine, California – Rivian Automotive, the electric vehicle (EV) maker, reported a better-than-expected fourth quarter, exceeding analysts' predictions on both revenue and production. However, the positive news failed to ignite investor enthusiasm, with the company's stock price falling by approximately 3% in after-hours trading on [Date of earnings release – Insert Date Here]. The dip highlights the ongoing challenges facing Rivian, even as it demonstrates progress in its production ramp-up and financial performance.

Rivian announced [Insert Q4 2023 Revenue Figure Here] in revenue for the fourth quarter of [Insert Year Here], surpassing the consensus analyst estimate of [Insert Analyst Estimate Here]. The company also produced [Insert Q4 2023 Production Figure Here] vehicles, a significant increase from previous quarters and exceeding its own internal targets. This production surge primarily involved its flagship R1T pickup truck and R1S SUV, with deliveries reaching [Insert Q4 2023 Delivery Figure Here] units. [Insert CEO name Here], CEO of Rivian, attributed the strong performance to improved supply chain stability and increased manufacturing efficiency. The company also highlighted its progress in expanding its charging infrastructure and strengthening its strategic partnerships.

Despite these positive results, several factors likely contributed to the market's lukewarm response. Firstly, the overall EV market remains volatile, with persistent concerns about slowing consumer demand and rising interest rates impacting consumer spending. Rivian, as a relatively young company with a limited product lineup, is particularly susceptible to these broader economic headwinds.

Secondly, the company's substantial losses continue to weigh on investor sentiment. While the Q4 results showcased improved financial performance, Rivian reported a net loss of [Insert Q4 2023 Net Loss Figure Here], albeit lower than some analysts' predictions. This underscores the considerable financial challenges facing the company as it navigates the expensive process of scaling production and establishing itself in a fiercely competitive market. The persistent losses raise concerns about the company's long-term profitability and its ability to generate sufficient cash flow to fund its future growth plans.

Furthermore, Rivian's ambitious expansion plans, including the development of new vehicle platforms and the construction of a new manufacturing facility, require significant capital investment. Securing additional funding, either through debt or equity financing, could potentially dilute existing shareholders' ownership and further dampen investor enthusiasm.

Looking ahead, Rivian faces a crucial period. Maintaining its production momentum, managing its costs effectively, and demonstrating a clear path to profitability will be key to regaining investor confidence. While the fourth-quarter results paint a picture of progress, the market's reaction highlights the need for Rivian to deliver consistently strong performance to overcome its ongoing challenges and secure its position in the increasingly crowded EV landscape. The company's future performance will be closely scrutinized, with investors keenly watching its progress in achieving profitability and scaling its operations sustainably. Any unforeseen disruptions to its supply chain or further economic downturns could significantly impact the company's prospects. The coming quarters will be critical in determining whether Rivian can successfully navigate these challenges and capitalize on the growing demand for electric vehicles.

Featured Posts

-

Uncovering The Salaries Of Severances Macrodata Refiners

Feb 22, 2025

Uncovering The Salaries Of Severances Macrodata Refiners

Feb 22, 2025 -

Actor Hunter Schafer Addresses Passport Gender Discrepancy

Feb 22, 2025

Actor Hunter Schafer Addresses Passport Gender Discrepancy

Feb 22, 2025 -

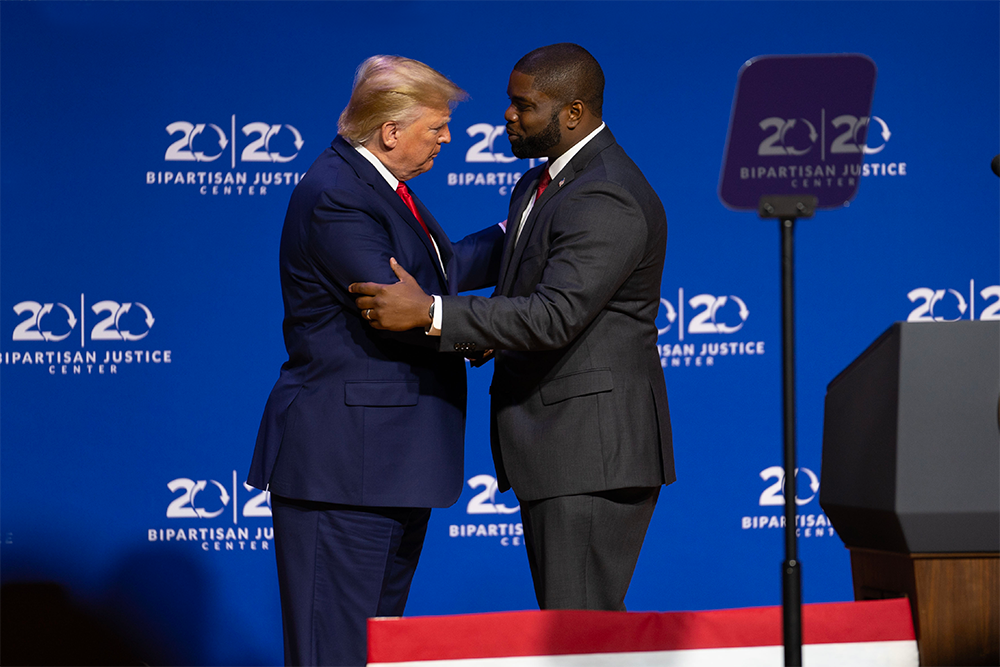

House Speakership Race Trumps Backing For Byron Donalds

Feb 22, 2025

House Speakership Race Trumps Backing For Byron Donalds

Feb 22, 2025 -

Can The Us Overtake Canada As A Hockey Powerhouse

Feb 22, 2025

Can The Us Overtake Canada As A Hockey Powerhouse

Feb 22, 2025 -

Watch Michigan Vs Michigan State Game Time Tv Coverage And Announcers

Feb 22, 2025

Watch Michigan Vs Michigan State Game Time Tv Coverage And Announcers

Feb 22, 2025

Latest Posts

-

2025 Premier League Chelsea Aston Villa Match Odds And Prediction

Feb 23, 2025

2025 Premier League Chelsea Aston Villa Match Odds And Prediction

Feb 23, 2025 -

Lafd Chief Kristin Crowley Removed Full Statement Released

Feb 23, 2025

Lafd Chief Kristin Crowley Removed Full Statement Released

Feb 23, 2025 -

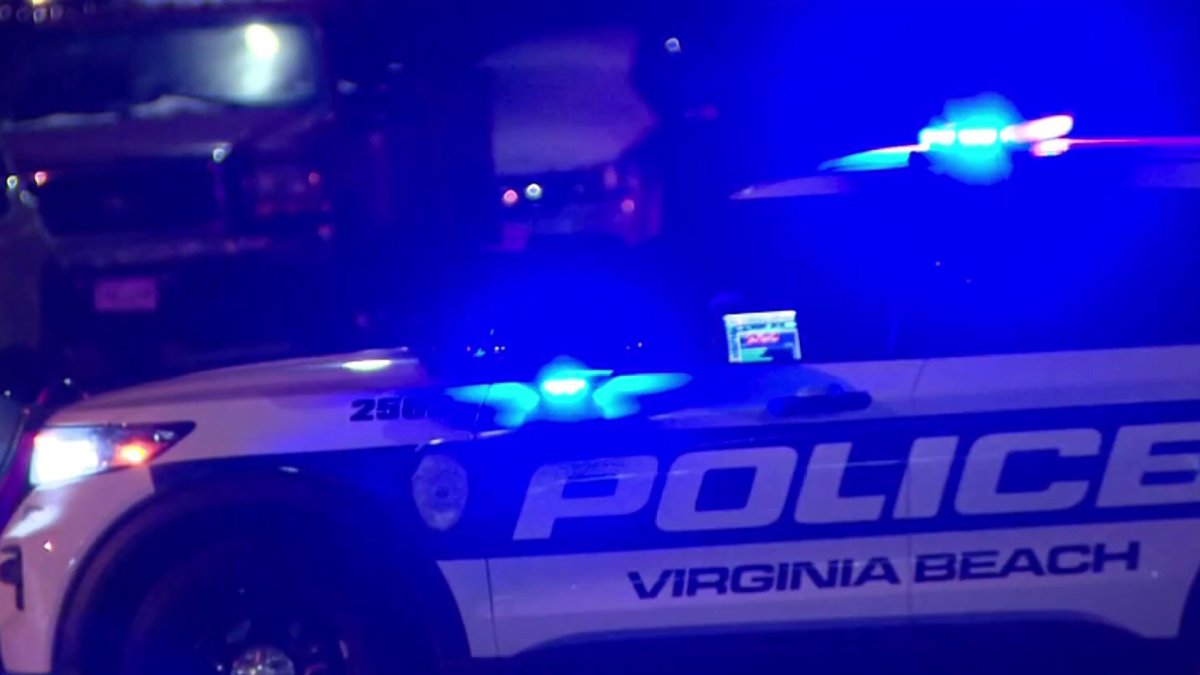

Virginia Beach Traffic Stop Ends In Death Of Two Police Officers

Feb 23, 2025

Virginia Beach Traffic Stop Ends In Death Of Two Police Officers

Feb 23, 2025 -

Colleagues And Officials Grieve Fallen Virginia Police Officer

Feb 23, 2025

Colleagues And Officials Grieve Fallen Virginia Police Officer

Feb 23, 2025 -

Tottenhams Winning Streak Continues 4 0 Triumph Over Ipswich

Feb 23, 2025

Tottenhams Winning Streak Continues 4 0 Triumph Over Ipswich

Feb 23, 2025