DOGE Dividend: Potential Pitfalls Of Trump's Unconventional Policy

Table of Contents

Trump's Dogecoin Dividend: A Risky Gamble with Unclear Payoffs

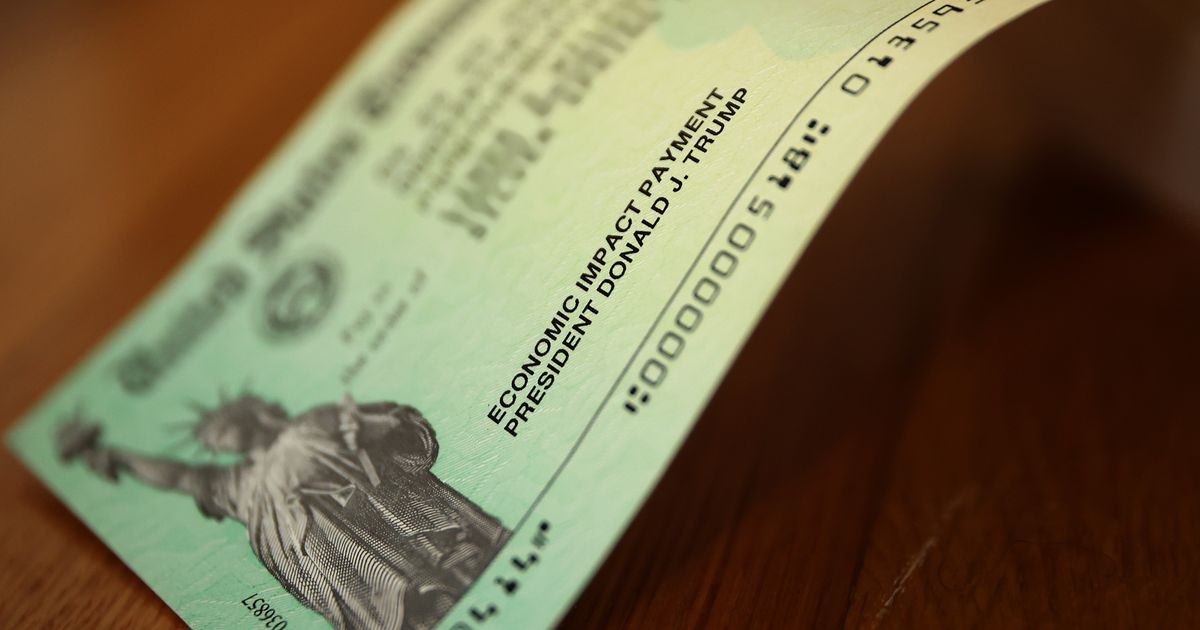

WASHINGTON, D.C. – The potential for a Dogecoin dividend, a policy floated by former President Donald Trump during his recent presidential campaign, has sparked widespread debate among economists and financial experts. While the idea has generated significant buzz on social media, a closer examination reveals several potential pitfalls that could outweigh any perceived benefits. The lack of concrete details surrounding Trump's proposal further exacerbates the uncertainty.

The core concept, as vaguely outlined by Trump, involves distributing a dividend of Dogecoin to American citizens. The source of these Dogecoins, the mechanics of distribution, and the overall economic impact remain largely unspecified. This lack of clarity is a major cause for concern, as experts caution against implementing such a radical policy without a thorough understanding of its consequences.

One of the most significant challenges lies in the inherent volatility of Dogecoin. Unlike traditional fiat currencies backed by governments, Dogecoin is a cryptocurrency with a highly fluctuating value. Its price is susceptible to market manipulation, social media trends, and speculative bubbles. Distributing a dividend in such a volatile asset would expose recipients to considerable financial risk, potentially leading to significant losses for many, particularly those less financially savvy.

The sheer logistical hurdles of implementing such a program are also substantial. Determining eligibility, setting up a secure and efficient distribution system, and combating potential fraud and scams would require a massive undertaking. The scale of the operation, involving potentially millions of recipients, would strain existing governmental infrastructure and likely necessitate the creation of entirely new systems. The cost of this infrastructure development alone could easily outweigh any perceived benefits of the dividend.

Furthermore, the economic impact of a Dogecoin dividend is uncertain and likely to be negative in the long run. Introducing a substantial amount of Dogecoin into the economy could lead to inflation, devaluing both the cryptocurrency and the U.S. dollar. Economists worry that such a policy would erode public trust in the financial system and undermine the stability of the American economy. There's no precedent for a similar policy, making any prediction of its effect purely speculative.

The international implications are also noteworthy. A significant U.S. embrace of Dogecoin, even in the form of a dividend, could destabilize global currency markets and impact international trade relations. The move could be perceived as a reckless disregard for established financial norms, potentially damaging the U.S.'s reputation as a reliable economic partner.

While proponents argue that a Dogecoin dividend could boost economic activity and stimulate innovation in the cryptocurrency space, the risks associated with such a policy appear to significantly outweigh any potential benefits. The lack of concrete details, the volatility of Dogecoin, the logistical challenges, and the uncertain economic consequences all point towards a highly risky and potentially disastrous gamble. Further, the absence of any credible economic model to support the claim of positive economic impact renders the proposal even more concerning. Until Trump or his team provides significantly more detail and analysis, the Dogecoin dividend remains a highly speculative and potentially damaging policy proposition.

Featured Posts

-

No Match Dna Tests Reveal Body From Gaza Is Not Bibas Mother

Feb 23, 2025

No Match Dna Tests Reveal Body From Gaza Is Not Bibas Mother

Feb 23, 2025 -

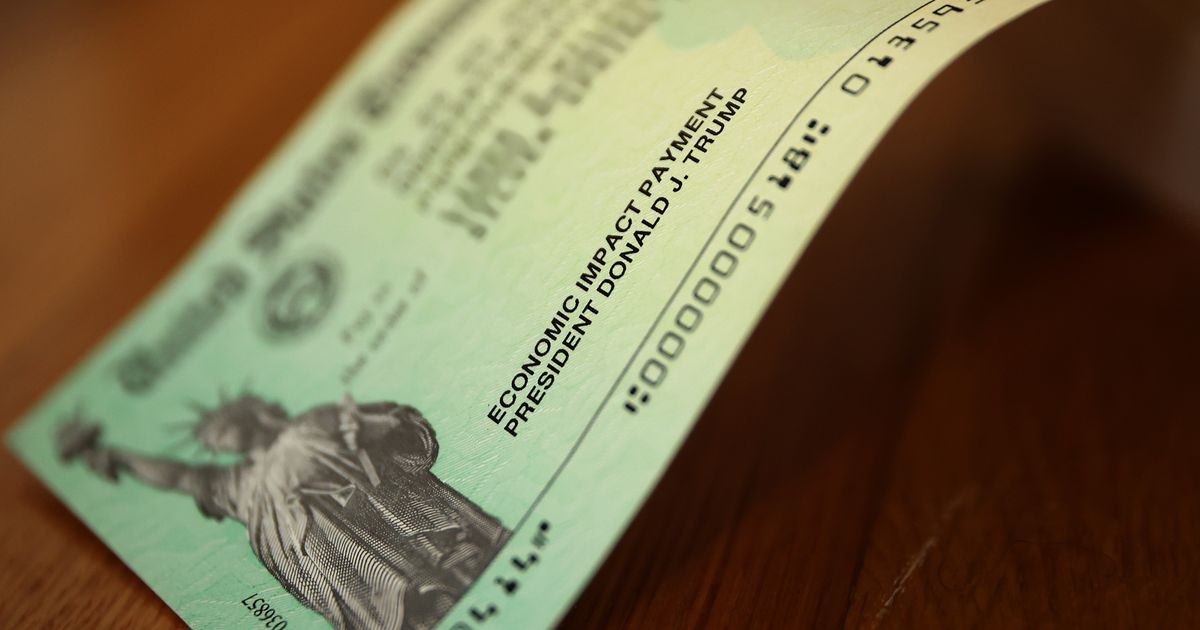

Byron Donalds Speakership Bid Trumps Influence

Feb 23, 2025

Byron Donalds Speakership Bid Trumps Influence

Feb 23, 2025 -

Musks Doge Related Firings A Pattern Of Unintentional Dismissals

Feb 23, 2025

Musks Doge Related Firings A Pattern Of Unintentional Dismissals

Feb 23, 2025 -

Expert Prediction Chelsea Vs Aston Villa 2025 Premier League Match Odds

Feb 23, 2025

Expert Prediction Chelsea Vs Aston Villa 2025 Premier League Match Odds

Feb 23, 2025 -

Steve Smith Faces Infidelity Accusations Viral X Post Claims Ex Nfl Player Cheated

Feb 23, 2025

Steve Smith Faces Infidelity Accusations Viral X Post Claims Ex Nfl Player Cheated

Feb 23, 2025

Latest Posts

-

Beterbiev Vs Bivol 2 Fight Card Date Time And How To Watch

Feb 23, 2025

Beterbiev Vs Bivol 2 Fight Card Date Time And How To Watch

Feb 23, 2025 -

Double Homicide Virginia Beach Police Officers Shot And Killed During Traffic Stop

Feb 23, 2025

Double Homicide Virginia Beach Police Officers Shot And Killed During Traffic Stop

Feb 23, 2025 -

Snl 50th Anniversary Covid 19 Impacts Maya Rudolph And Martin Shorts Appearances

Feb 23, 2025

Snl 50th Anniversary Covid 19 Impacts Maya Rudolph And Martin Shorts Appearances

Feb 23, 2025 -

Watch Southampton Vs Brighton Live Stream And Match Preview

Feb 23, 2025

Watch Southampton Vs Brighton Live Stream And Match Preview

Feb 23, 2025 -

Perrie Edwards Life With Fiance Alex Oxlade Chamberlain Family Career And More

Feb 23, 2025

Perrie Edwards Life With Fiance Alex Oxlade Chamberlain Family Career And More

Feb 23, 2025