DOGE Dividend: Why A Trump-Proposed Payment Is A Bad Idea

Table of Contents

DOGE Dividend: Why a Trump-Proposed Payment Is a Bad Idea

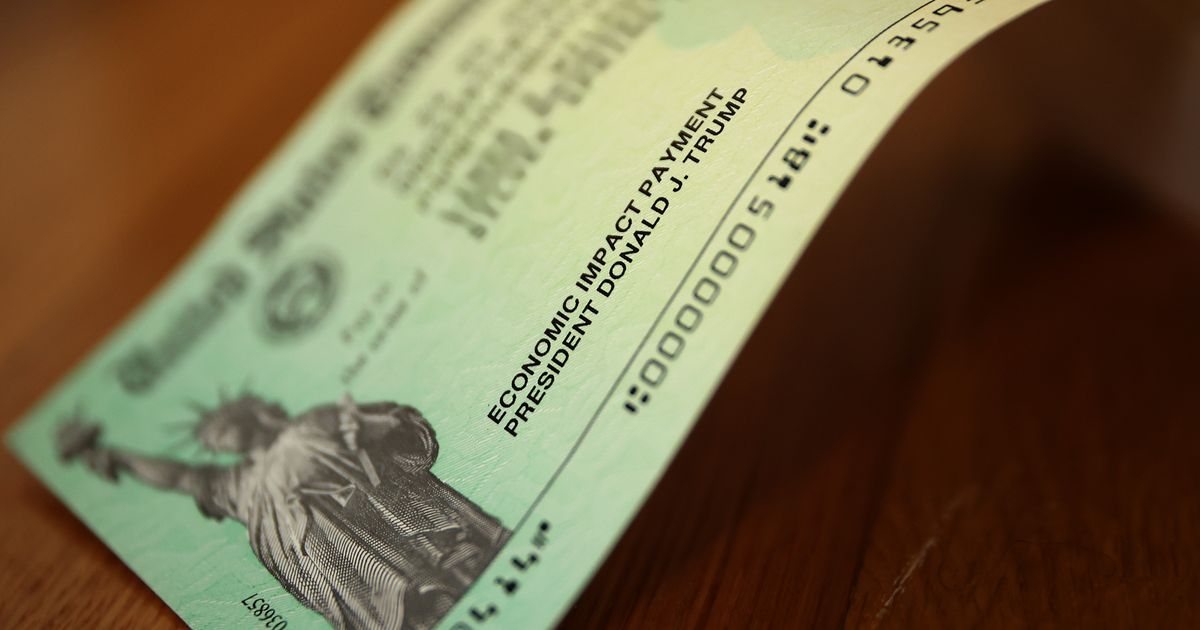

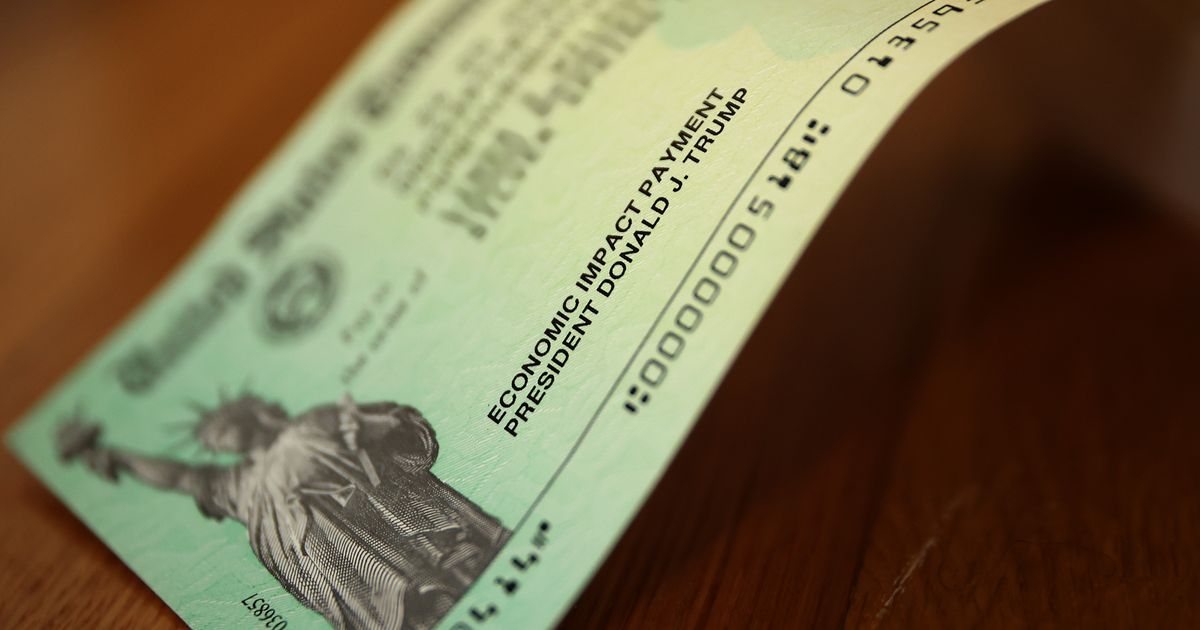

A proposed Dogecoin dividend as part of a Trump economic plan has sparked widespread criticism from economists and financial experts, raising concerns about market volatility, inflationary pressures, and the overall feasibility of such an unconventional policy.

Washington, D.C. – The 2024 presidential race is heating up, and with it, the proposals are becoming increasingly audacious. Former President Donald Trump's latest economic plan, which includes a proposed dividend payout to every American citizen in the form of Dogecoin (DOGE), has ignited a firestorm of debate among economists and financial analysts. While the specifics of the plan remain somewhat vague, the core idea – distributing a cryptocurrency to the population – has been met with near-universal condemnation.

The proposal, outlined [during a recent campaign rally/interview/press release – Source needed to fill this blank], suggests that a significant sum of Dogecoin would be purchased and distributed equally among all US citizens. While the exact amount of DOGE per citizen remains unspecified [specify amount if available, otherwise state "unspecified" – Source needed to fill this blank], the sheer scale of such an undertaking, coupled with the inherent volatility of cryptocurrencies, presents significant challenges.

Critics argue that the plan is economically unsound on multiple levels. First, the inherent volatility of Dogecoin poses a substantial risk. Unlike traditional fiat currencies, DOGE's price fluctuates dramatically, subject to market speculation and lacking the backing of a central bank or government. Distributing it as a dividend would leave recipients vulnerable to potentially massive losses if the price were to plummet after the distribution. The unpredictable nature of the cryptocurrency market makes any attempt at calculating the "value" of such a dividend extremely difficult, if not impossible.

Further fueling concerns, the proposal ignores the inflationary risks. Injecting a large sum of a volatile asset into the economy could potentially trigger runaway inflation. The massive influx of DOGE into circulation, without a corresponding increase in goods and services, could significantly devalue both the cryptocurrency itself and the US dollar, leading to widespread economic instability.

Beyond the economic concerns, logistical challenges abound. The implementation of such a plan would require a sophisticated and secure system for distributing the Dogecoin to millions of Americans. This process would be incredibly complex, potentially prone to errors and fraud, and require substantial investment in infrastructure. Moreover, the question of how the government would acquire such a massive amount of DOGE without significantly impacting the cryptocurrency’s market price remains unanswered.

Furthermore, the legal and regulatory implications of such a scheme are far-reaching and largely unexplored. The Securities and Exchange Commission (SEC) and other regulatory bodies would likely face significant challenges in navigating the legal complexities of a government-sponsored cryptocurrency dividend. The lack of clear regulatory framework surrounding cryptocurrencies adds another layer of uncertainty and risk to this already controversial proposal.

Several prominent economists have already publicly criticized the plan, citing concerns about market manipulation, financial instability, and the overall impracticality of the proposal. [Quote from at least one prominent economist critical of the plan – Source needed to fill this blank]. The lack of detailed analysis and feasibility studies associated with the plan further fuels skepticism among experts.

In conclusion, while the allure of a free cryptocurrency dividend might seem appealing, a closer examination reveals significant economic and logistical challenges. The inherent volatility of Dogecoin, the potential for inflation, and the lack of a clear regulatory framework render this proposal a highly risky and impractical solution to any economic problems. Experts widely agree that the potential negative consequences far outweigh any perceived benefits. This proposal highlights the need for careful consideration and robust economic analysis before implementing such radical and unconventional policies.

Featured Posts

-

Messi Provides Late Assist As Inter Miami Salvage 2 2 Draw

Feb 24, 2025

Messi Provides Late Assist As Inter Miami Salvage 2 2 Draw

Feb 24, 2025 -

New Law Targets Electronic Devices Used In Car Thefts

Feb 24, 2025

New Law Targets Electronic Devices Used In Car Thefts

Feb 24, 2025 -

The Af Ds Influence Examining The German Far Right Partys Impact

Feb 24, 2025

The Af Ds Influence Examining The German Far Right Partys Impact

Feb 24, 2025 -

2025 Mls Season Full Schedule Broadcast Information And Viewing Guide

Feb 24, 2025

2025 Mls Season Full Schedule Broadcast Information And Viewing Guide

Feb 24, 2025 -

Steve Smith Faces Infidelity Accusations Viral X Post Shakes Nfl World

Feb 24, 2025

Steve Smith Faces Infidelity Accusations Viral X Post Shakes Nfl World

Feb 24, 2025

Latest Posts

-

Mothers Grief A Massive Sculpture Honors Victims Of 1988 Lockerbie Bombing

Feb 24, 2025

Mothers Grief A Massive Sculpture Honors Victims Of 1988 Lockerbie Bombing

Feb 24, 2025 -

Musk Challenges Federal Workforce To Explain Their Roles

Feb 24, 2025

Musk Challenges Federal Workforce To Explain Their Roles

Feb 24, 2025 -

State Level Resistance To Trumps National Policies Grows

Feb 24, 2025

State Level Resistance To Trumps National Policies Grows

Feb 24, 2025 -

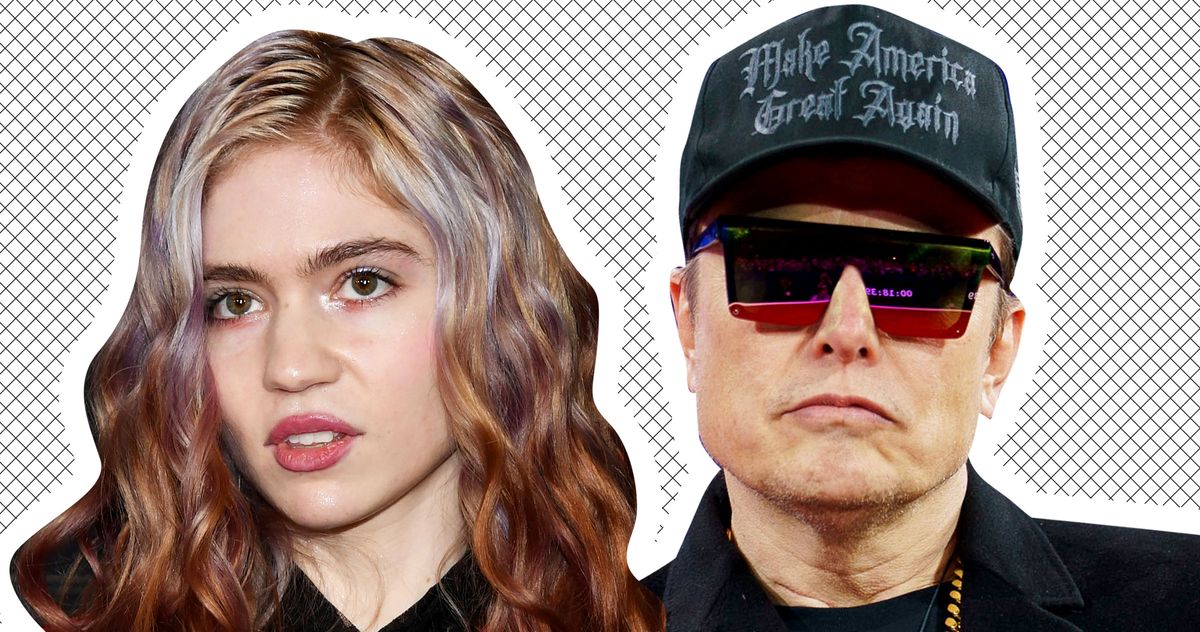

Grimes Claims Elon Musk Is Unresponsive During Childs Medical Emergency

Feb 24, 2025

Grimes Claims Elon Musk Is Unresponsive During Childs Medical Emergency

Feb 24, 2025 -

Avoiding Peak District Parking Fines Practical Advice

Feb 24, 2025

Avoiding Peak District Parking Fines Practical Advice

Feb 24, 2025