DOGE Dividend: Why Trump's Idea Could Be Financially Disastrous

Table of Contents

Trump's DOGE Dividend: A Recipe for Financial Disaster?

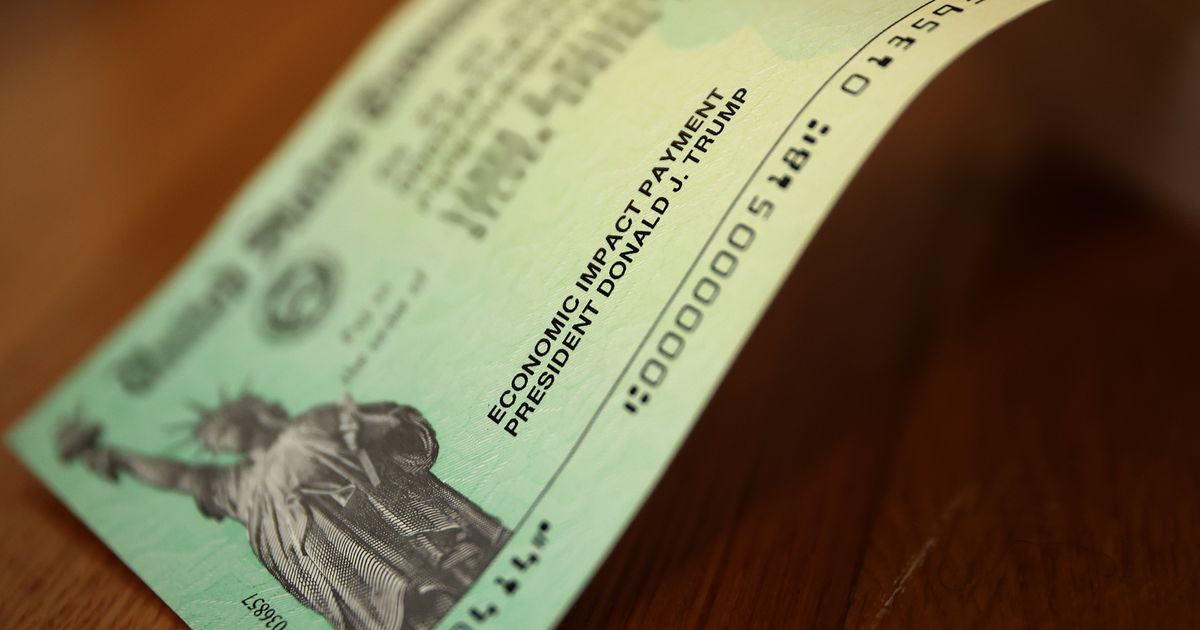

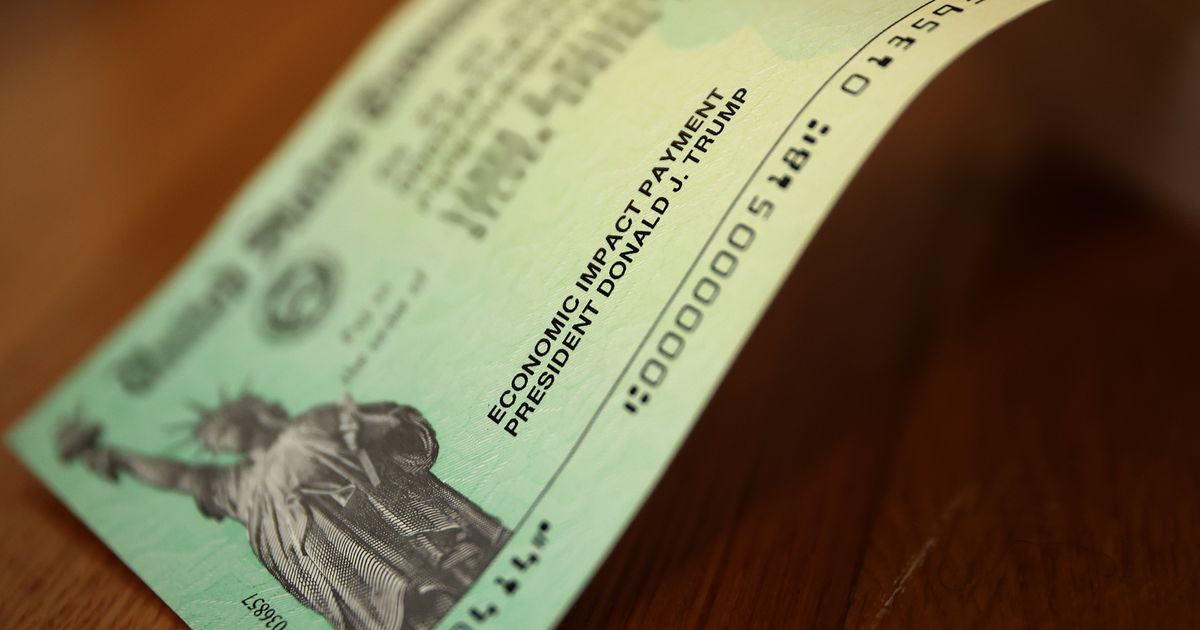

Washington, D.C. – Former President Donald Trump's recent suggestion of paying a dividend in Dogecoin (DOGE) to eligible Americans has sparked widespread criticism from economists and financial experts, who warn of potentially catastrophic consequences for the US economy and the cryptocurrency market itself. While the specifics of Trump's proposal remain vague, the mere suggestion has ignited a firestorm of debate, highlighting the inherent risks associated with integrating a volatile cryptocurrency into government fiscal policy.

The core of the concern centers around Dogecoin's extreme volatility and its fundamentally different nature compared to traditional fiat currencies. Unlike the US dollar, which is backed by the government and subject to robust regulatory oversight, DOGE is a decentralized digital currency with a fluctuating value heavily influenced by speculation and market sentiment. Its price has experienced dramatic swings in the past, plummeting and soaring by significant percentages within short periods. A government-backed distribution of DOGE, therefore, would expose taxpayers to unpredictable losses, potentially eroding their savings and impacting broader economic stability.

Experts point to several key risks:

-

Market Manipulation: A massive government injection of DOGE into the market could trigger extreme price volatility, potentially creating a speculative bubble that bursts spectacularly, leaving taxpayers holding worthless assets. The sheer scale of such a distribution would dwarf any previous market interventions, potentially overwhelming existing trading mechanisms and leading to chaotic market conditions.

-

Inflationary Pressures: While the exact mechanics of Trump's proposed dividend remain unclear, any large-scale distribution of a digital asset would introduce significant inflationary pressures. The increased demand for DOGE, coupled with its limited supply, could drive up its price artificially, leading to a broader increase in the cost of goods and services. This could exacerbate existing inflationary concerns within the US economy.

-

Security Risks: The digital nature of DOGE introduces inherent security vulnerabilities. Distributing millions, if not billions, of DOGE to US citizens would necessitate robust and secure infrastructure to prevent fraud, hacking, and the misallocation of funds. The complexity of managing such a large-scale distribution presents significant technical challenges and opens up potential avenues for exploitation.

-

Lack of Regulatory Framework: The cryptocurrency market currently lacks a comprehensive regulatory framework in the US. A government-backed DOGE dividend would highlight the urgent need for such a framework, but its absence makes the proposal particularly perilous. The lack of clear guidelines and oversight would leave taxpayers vulnerable to potential scams and manipulation.

Furthermore, the suggestion ignores the fundamental principles of sound fiscal policy. Government dividends should ideally be paid in stable and predictable assets, not in highly volatile speculative instruments. The inherent unpredictability of DOGE contradicts the responsible management of public funds, potentially undermining public trust in government institutions.

While the proposal’s specifics remain unclear and the likelihood of its implementation is low, the mere suggestion highlights the critical importance of informed policymaking when dealing with emerging technologies and volatile markets. The potential economic and social ramifications of such a radical initiative underscore the need for caution and a thorough understanding of the risks involved before integrating cryptocurrencies into government programs. The debate surrounding Trump’s DOGE dividend serves as a stark reminder of the critical need for careful consideration and expert analysis before implementing any policies that could have such significant consequences for the national and global economy.

Featured Posts

-

Germanys Af D Analyzing The Far Right Partys Platform And Supporters

Feb 25, 2025

Germanys Af D Analyzing The Far Right Partys Platform And Supporters

Feb 25, 2025 -

Impending Shutdown Looms As Congress Focuses On Tax Cuts Budget Cuts

Feb 25, 2025

Impending Shutdown Looms As Congress Focuses On Tax Cuts Budget Cuts

Feb 25, 2025 -

Dogecoins Creator Calls On Us Federal Workers To Document Work Or Resign

Feb 25, 2025

Dogecoins Creator Calls On Us Federal Workers To Document Work Or Resign

Feb 25, 2025 -

Invisible Casualties Russias Unreported Losses In Ukraine

Feb 25, 2025

Invisible Casualties Russias Unreported Losses In Ukraine

Feb 25, 2025 -

Electronic Gadgets Used In Car Thefts To Face Nationwide Ban

Feb 25, 2025

Electronic Gadgets Used In Car Thefts To Face Nationwide Ban

Feb 25, 2025

Latest Posts

-

Declining Sales Prompt Artist Protests Against Kennedy Center Performances

Feb 25, 2025

Declining Sales Prompt Artist Protests Against Kennedy Center Performances

Feb 25, 2025 -

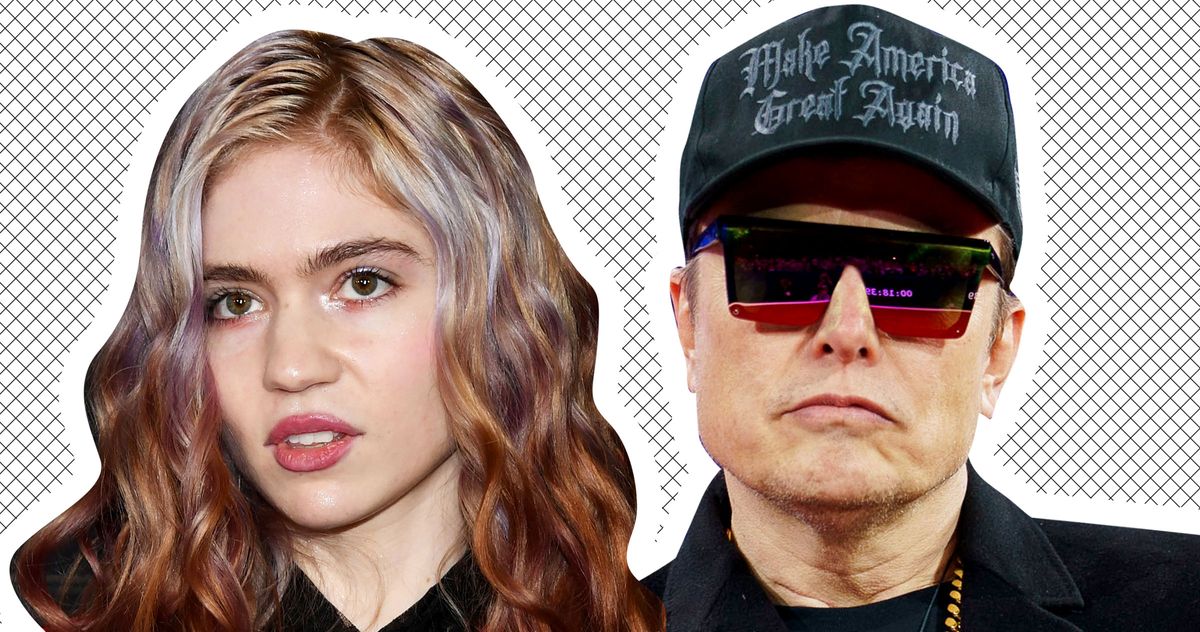

Grimes Details Elon Musks Alleged Neglect Of Childs Health

Feb 25, 2025

Grimes Details Elon Musks Alleged Neglect Of Childs Health

Feb 25, 2025 -

The Covid Curse On Snls 50th Missing Maya Rudolph And Martin Short

Feb 25, 2025

The Covid Curse On Snls 50th Missing Maya Rudolph And Martin Short

Feb 25, 2025 -

Trumps Presidency A Story Of Federal State Conflict

Feb 25, 2025

Trumps Presidency A Story Of Federal State Conflict

Feb 25, 2025 -

Popes Condition Critical But Showing Signs Of Rest Following Peaceful Night

Feb 25, 2025

Popes Condition Critical But Showing Signs Of Rest Following Peaceful Night

Feb 25, 2025