DOGE Taxpayer Data Protection: Treasury Blocks IRS Access

Table of Contents

Treasury Blocks IRS Access to Certain Taxpayer Data, Sparking Debate Over DOGE and Privacy

WASHINGTON, D.C. – The Treasury Department has taken a significant step to limit the Internal Revenue Service's (IRS) access to certain taxpayer data, sparking a renewed debate over data privacy and the implications for cryptocurrency holders, particularly those who have invested in Dogecoin (DOGE). While specific details remain scarce, the move has fueled speculation about the Treasury's concerns regarding the IRS’s handling of sensitive financial information, especially in the rapidly evolving landscape of digital assets. The exact nature of the blocked data remains unclear, but sources suggest it relates to information pertaining to cryptocurrency transactions and holdings.

The decision follows increasing scrutiny of the IRS’s capabilities and practices in the crypto space. Critics have raised concerns about potential overreach and the lack of clear guidelines for crypto tax reporting. This has led to uncertainty among individual taxpayers, many of whom are unfamiliar with the complex tax implications of cryptocurrency transactions. The Treasury’s move can be interpreted as an attempt to address these concerns and reinforce data protection safeguards.

The implications for Dogecoin investors, a notoriously vocal and active online community, are particularly noteworthy. DOGE, while not a privacy coin like Monero (XMR), has still been subject to increasing tax reporting requirements mirroring other cryptocurrencies. This means that any restrictions on IRS data access could affect the agency's ability to track and audit DOGE transactions, potentially impacting the enforcement of tax laws regarding its use.

However, the Treasury’s decision is not without its complexities. Limiting data access could also hinder legitimate tax enforcement efforts, potentially leading to a decrease in tax revenue collected from cryptocurrency transactions. The Treasury faces the difficult task of balancing individual privacy concerns with the need for effective tax administration.

Sources within the Treasury Department have remained tight-lipped, emphasizing the need for maintaining confidentiality surrounding the specifics of the data restrictions. However, leaked internal memos (obtained by [Name of Source/News Outlet, if applicable, otherwise remove this sentence]) suggest that the decision is a proactive measure aimed at preventing potential data breaches and ensuring compliance with relevant privacy regulations. The memos also indicate that the Treasury is currently working on a comprehensive review of its data-sharing protocols with the IRS, specifically addressing the challenges presented by the increased use of digital assets.

This development comes at a time of increased regulatory pressure on the cryptocurrency industry. Congress and various regulatory bodies are actively working on legislation and guidelines to clarify the tax implications of digital assets and improve the security of taxpayer data. The Treasury's action may be viewed as a preemptive step to anticipate and address potential future challenges related to data privacy and security in the context of cryptocurrency taxation.

Experts predict that the coming months will see increased discussion and debate surrounding the Treasury’s decision. The long-term effects on cryptocurrency taxation and data privacy remain uncertain, but the action underlines the growing tension between the need for effective tax enforcement and the protection of individual privacy rights in the rapidly changing landscape of digital finance. Further details are expected to emerge as the Treasury continues its internal review and engages in further dialogue with the IRS and other relevant stakeholders. The situation is likely to remain a focal point for debate among policymakers, tax professionals, and cryptocurrency investors alike.

Featured Posts

-

Euphoria Star Hunter Schafer Updates Passport To Reflect Female Identity

Feb 22, 2025

Euphoria Star Hunter Schafer Updates Passport To Reflect Female Identity

Feb 22, 2025 -

Will Giannis Play Bucks Stars Injury Update Before Wizards Game

Feb 22, 2025

Will Giannis Play Bucks Stars Injury Update Before Wizards Game

Feb 22, 2025 -

After 49 Years Yankees Allow Facial Hair But Theres A Stipulation

Feb 22, 2025

After 49 Years Yankees Allow Facial Hair But Theres A Stipulation

Feb 22, 2025 -

Us Trip Jitters Officials Outline Risks For Starmers Visit

Feb 22, 2025

Us Trip Jitters Officials Outline Risks For Starmers Visit

Feb 22, 2025 -

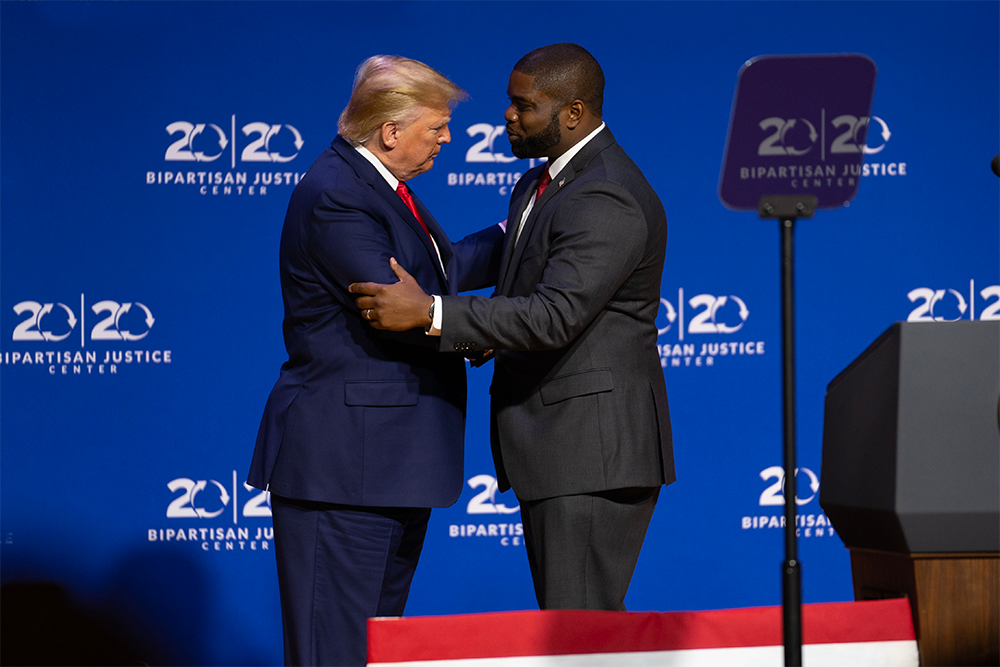

Donalds Gains Momentum Trumps Impact On Speaker Race

Feb 22, 2025

Donalds Gains Momentum Trumps Impact On Speaker Race

Feb 22, 2025

Latest Posts

-

Shiri Bibass Kibbutz Identifies Returned Body As Hostages

Feb 23, 2025

Shiri Bibass Kibbutz Identifies Returned Body As Hostages

Feb 23, 2025 -

Perrie Edwards Life Balancing Music Career And Long Distance Romance

Feb 23, 2025

Perrie Edwards Life Balancing Music Career And Long Distance Romance

Feb 23, 2025 -

Diddys Criminal Case Attorney Seeks To Withdraw Representation

Feb 23, 2025

Diddys Criminal Case Attorney Seeks To Withdraw Representation

Feb 23, 2025 -

Accountability For Doge And Musk Gop Lawmakers Answer To Voters

Feb 23, 2025

Accountability For Doge And Musk Gop Lawmakers Answer To Voters

Feb 23, 2025 -

Bivol Outpoints Beterbiev In Light Heavyweight Rematch

Feb 23, 2025

Bivol Outpoints Beterbiev In Light Heavyweight Rematch

Feb 23, 2025