Dogecoin Dividend: Why A Trump Promise Could Be Financially Reckless

Table of Contents

Dogecoin Dividend: Trump's Promise Is Financially Reckless – A Deep Dive

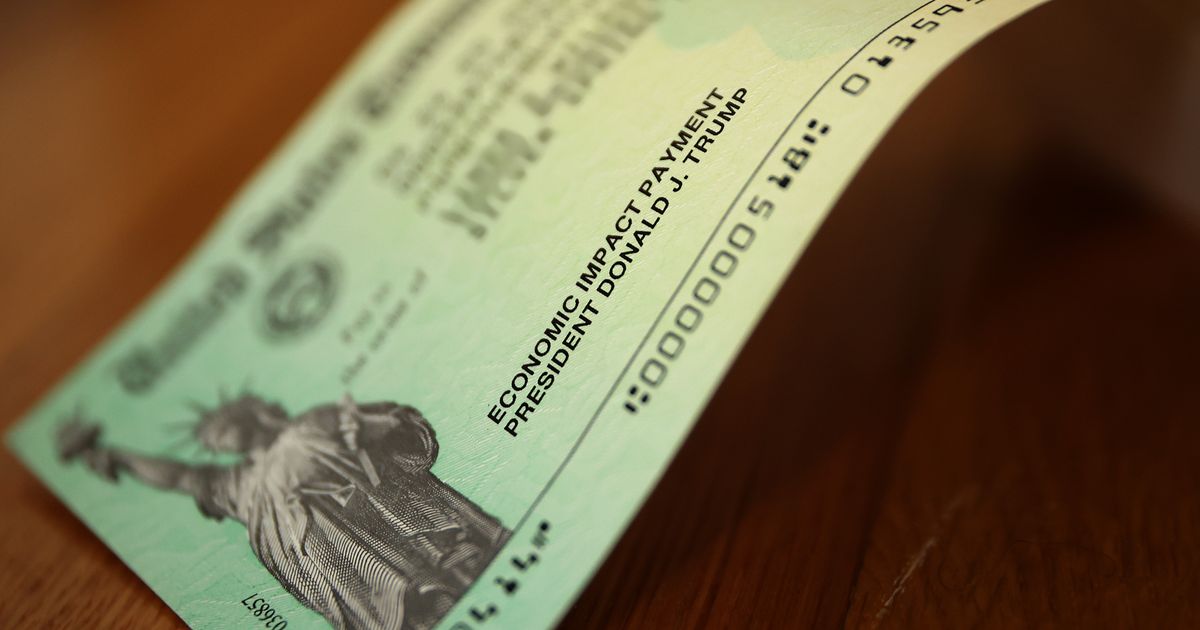

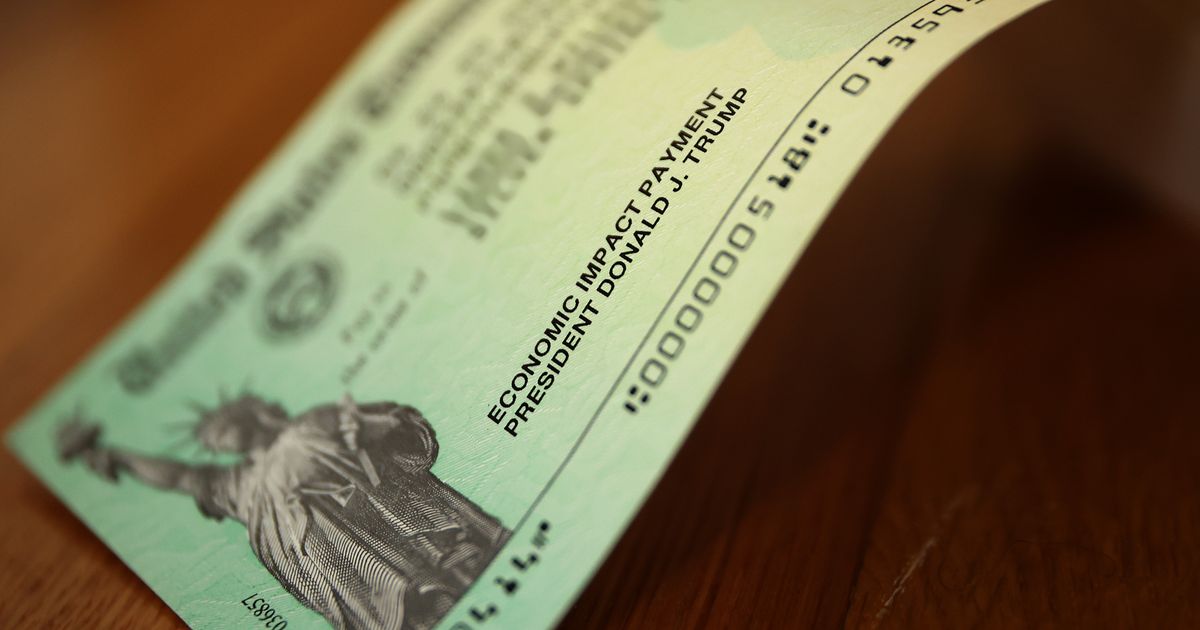

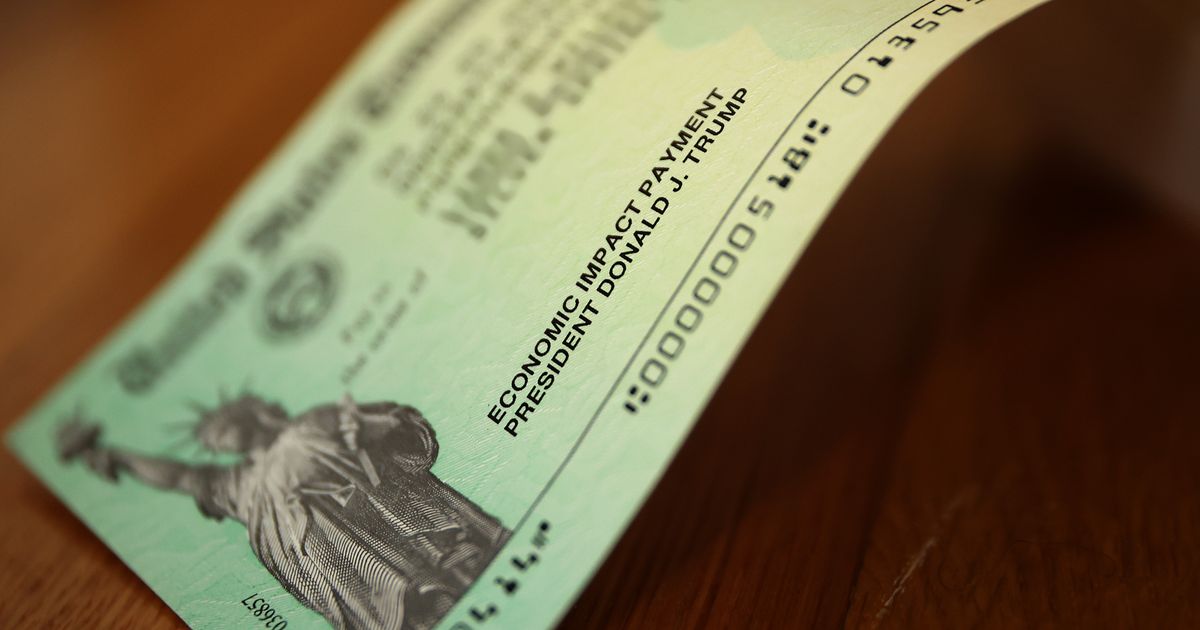

[City, State] – [Date] – During a recent campaign event, Republican presidential candidate Donald Trump reiterated his intention to distribute a Dogecoin dividend to American citizens if elected. While the exact details remain vague – the proposed amount, distribution method, and funding source remain unspecified – the promise has sparked significant debate among economists and financial experts. This article will delve into the potential economic ramifications of such a policy, highlighting why many consider it a financially reckless proposition.

The core issue lies in the inherent volatility and speculative nature of Dogecoin, a cryptocurrency with no intrinsic value. Unlike traditional fiat currencies backed by a government or assets, Dogecoin's value is driven entirely by market sentiment and speculation. This inherent instability poses substantial risks if integrated into a national economic policy.

Uncertain Funding and Inflationary Pressures:

Trump's plan lacks clarity regarding its funding mechanism. [Add details about any statements made by the Trump campaign on how they intend to fund this – e.g., tax increases, budget cuts, increased national debt, etc. If no specifics are available, state this explicitly]. The absence of a credible funding plan raises serious concerns about the potential for massive inflation. Distributing a significant amount of Dogecoin, regardless of its fluctuating value at the time of distribution, would inject a vast amount of new "money" into the economy. This sudden surge in the money supply could significantly devalue the dollar, erode purchasing power, and trigger a period of runaway inflation. Economists have warned that such a policy could be disastrous for the US economy, potentially undoing decades of economic stability.

Market Manipulation and Economic Instability:

The cryptocurrency market is notoriously susceptible to manipulation. A large-scale government distribution of Dogecoin could easily be exploited by speculators, artificially inflating its price in the short term before a likely crash. This volatility would create significant uncertainty for businesses and consumers, hindering economic growth and potentially triggering a financial crisis. The unpredictable nature of the cryptocurrency market makes it an unsuitable vehicle for a national dividend program, particularly given the potential for significant losses for recipients should the value of Dogecoin plummet.

Inequitable Distribution and Technological Challenges:

Even if the logistical challenges of distributing a cryptocurrency dividend to millions of Americans were overcome, questions of equitable distribution remain. How would the government ensure fair access for all citizens, particularly those without digital wallets or access to the internet? [Add details on any proposed distribution methods mentioned by the Trump campaign. If no specifics are available, clearly state this]. The implementation would require significant investment in digital infrastructure and robust security measures to prevent fraud and cyberattacks.

Lack of Transparency and Accountability:

The lack of transparency surrounding Trump's Dogecoin dividend proposal further exacerbates concerns. The absence of concrete details regarding funding, distribution, and risk mitigation strategies makes it difficult to assess the true cost and potential consequences of such a policy. This lack of transparency undermines public trust and raises serious questions about the candidate’s understanding of basic economic principles and fiscal responsibility.

Conclusion:

Trump's proposal to distribute a Dogecoin dividend represents a significant departure from established economic policy and poses considerable risks to the US economy. The inherent volatility of Dogecoin, the uncertain funding mechanisms, the potential for market manipulation, and the logistical challenges involved all point to a financially reckless proposition with potentially catastrophic consequences. Experts across the political spectrum have expressed serious reservations, emphasizing the need for informed and responsible economic policies. Further detailed analysis and public discussion are urgently needed to fully evaluate the potential repercussions of this unconventional proposal.

Featured Posts

-

Federal Employees Face Work Justification Demand From Musk

Feb 25, 2025

Federal Employees Face Work Justification Demand From Musk

Feb 25, 2025 -

Pope Francis Health Critical Condition Persists Peaceful Sleep Offers Hope

Feb 25, 2025

Pope Francis Health Critical Condition Persists Peaceful Sleep Offers Hope

Feb 25, 2025 -

Impending Shutdown Ignored Congress Focused On Tax Cuts And Spending Cuts

Feb 25, 2025

Impending Shutdown Ignored Congress Focused On Tax Cuts And Spending Cuts

Feb 25, 2025 -

Father And Sons Survival Abandoned Backpack Saves Lives In Utah

Feb 25, 2025

Father And Sons Survival Abandoned Backpack Saves Lives In Utah

Feb 25, 2025 -

Palestinian Prisoner Release Delayed After Israeli Hostage Rescue

Feb 25, 2025

Palestinian Prisoner Release Delayed After Israeli Hostage Rescue

Feb 25, 2025

Latest Posts

-

Suspect In Police Officer Killing Took Pennsylvania Hospital Staff Hostage Prior Icu Visit

Feb 25, 2025

Suspect In Police Officer Killing Took Pennsylvania Hospital Staff Hostage Prior Icu Visit

Feb 25, 2025 -

Possible Second Tomb Of Egyptian Pharaoh Thutmose Ii Unearthed

Feb 25, 2025

Possible Second Tomb Of Egyptian Pharaoh Thutmose Ii Unearthed

Feb 25, 2025 -

Beauty Spot Parking In Peak District Lessons Learned The Hard Way

Feb 25, 2025

Beauty Spot Parking In Peak District Lessons Learned The Hard Way

Feb 25, 2025 -

Trumps Dogecoin Dividend Experts Weigh In On The Potential Consequences

Feb 25, 2025

Trumps Dogecoin Dividend Experts Weigh In On The Potential Consequences

Feb 25, 2025 -

Peak District Hikes Parking Tips To Avoid Trouble

Feb 25, 2025

Peak District Hikes Parking Tips To Avoid Trouble

Feb 25, 2025