Dogecoin Dividend: Why Trump's Idea Could Be Financially Devastating

Table of Contents

Dogecoin Dividend: Trump's Idea Could Be Financially Devastating

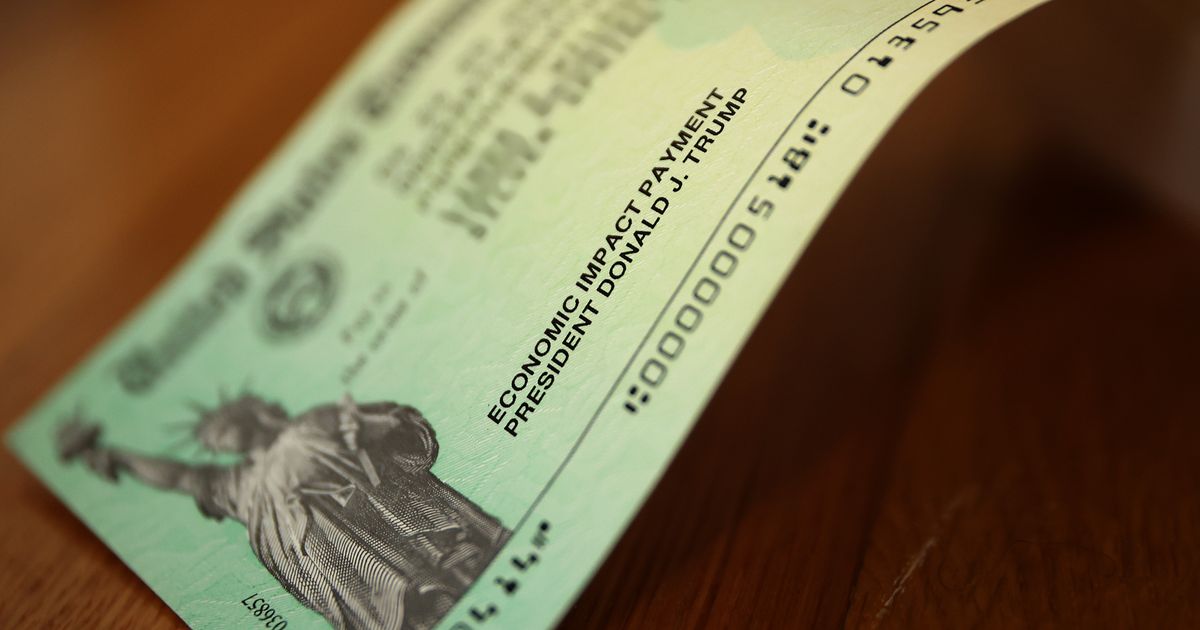

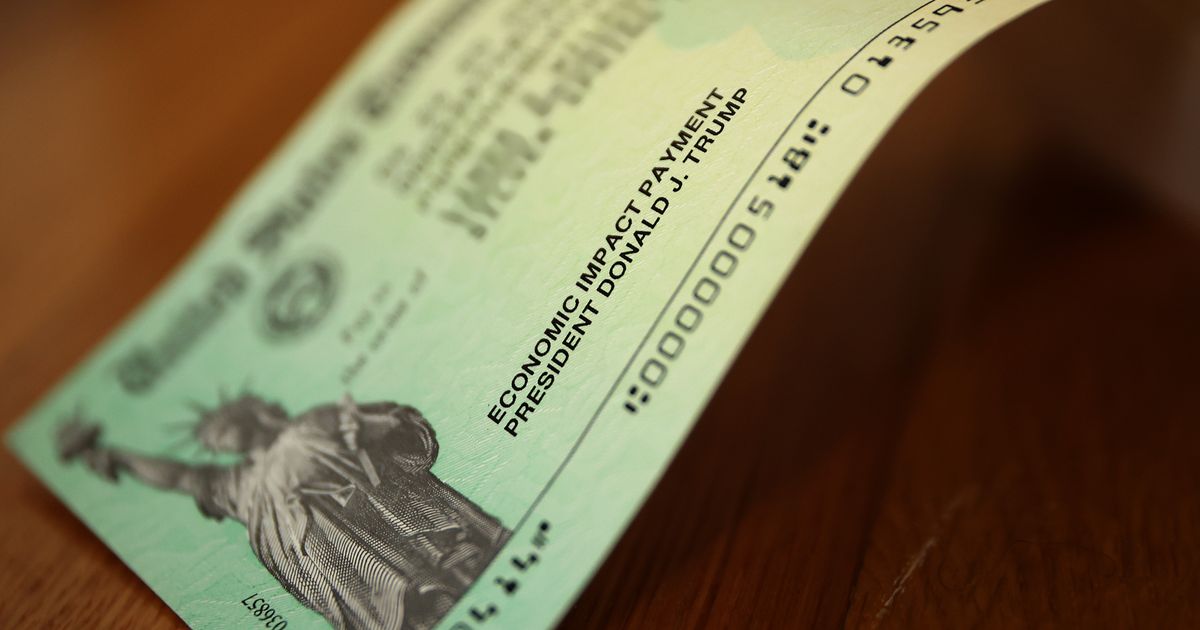

A potential Dogecoin dividend proposed by Donald Trump has sent shockwaves through the financial world, raising concerns about its feasibility, market impact, and potential for devastating consequences. While the exact details of Trump's proposal remain somewhat vague, the core concept—distributing Dogecoin to Americans as a dividend—presents a multitude of complex challenges. This article explores the potential financial fallout of such a plan.

The core proposal, as understood from various public statements, suggests a one-time distribution of Dogecoin to eligible US citizens. The specific amount of Dogecoin per person hasn't been definitively stated, leading to considerable uncertainty about its overall financial impact. However, even a seemingly small distribution could trigger significant market volatility and potentially inflict substantial damage on the US economy.

The primary concern revolves around the inherent volatility of Dogecoin. Unlike traditional currencies backed by governments or assets, Dogecoin is a cryptocurrency with a highly speculative nature. Its price is subject to wild swings, influenced by social media trends, celebrity endorsements, and market speculation. A sudden influx of Dogecoin into the market, driven by a government-backed dividend, could massively inflate the supply, potentially causing a dramatic crash in its value. This would render the dividend essentially worthless for recipients, representing a significant loss of public funds and eroding trust in government initiatives.

Beyond the direct impact on Dogecoin's value, wider economic consequences are also anticipated. The sheer scale of a nationwide Dogecoin dividend distribution would necessitate massive logistical and technological hurdles. The cost of distributing the cryptocurrency, securing its transfer, and addressing potential technical glitches would be substantial, adding to the financial burden on taxpayers. Furthermore, the potential for fraud and misuse is considerable, as unscrupulous individuals could exploit the system to acquire disproportionate amounts of Dogecoin.

Experts across various fields have expressed strong reservations about the proposal. Economists warn of inflationary pressures and the potential disruption of existing financial systems. Blockchain and cryptocurrency specialists highlight the technical challenges involved in such a large-scale distribution, citing the potential for network congestion and security vulnerabilities. Legal scholars raise concerns about the legality and constitutionality of such a program, questioning whether the government has the authority to distribute a volatile digital asset as a dividend.

The lack of transparency surrounding the details of Trump's proposal further exacerbates these concerns. The absence of concrete information regarding the source of funding, the distribution mechanism, and the intended beneficiaries adds to the uncertainty and raises questions about its overall feasibility.

While the idea of a Dogecoin dividend may hold a certain appeal for some, a deeper analysis reveals the potential for widespread financial chaos. The inherent volatility of Dogecoin, coupled with the logistical, technological, and legal challenges, paints a grim picture of potential economic damage. Without significantly more detailed and rigorously analyzed plans, the proposal remains a high-risk gamble with potentially devastating consequences for the US economy and its citizens.

Further research is needed to fully assess the multifaceted risks associated with such an unprecedented program. The potential for negative repercussions far outweighs the perceived benefits, making the Dogecoin dividend proposal a serious cause for concern amongst economic and financial experts. The discussion should shift from the feasibility of the plan itself to the urgent need for a thorough assessment of its potential consequences and a reconsideration of its merits.

Featured Posts

-

Premier League Thriller Everton And Manchester United Share Spoils In 2 2 Draw

Feb 24, 2025

Premier League Thriller Everton And Manchester United Share Spoils In 2 2 Draw

Feb 24, 2025 -

Steve Smith Sr And Baltimore Ravens Allegations Of An Affair Surface

Feb 24, 2025

Steve Smith Sr And Baltimore Ravens Allegations Of An Affair Surface

Feb 24, 2025 -

U Conns Auriemma Lauds Butlers Impressive New Womens Basketball Center

Feb 24, 2025

U Conns Auriemma Lauds Butlers Impressive New Womens Basketball Center

Feb 24, 2025 -

Joshua Buatsi And Callum Smiths Absolute War What It Means For Anthony Joshua

Feb 24, 2025

Joshua Buatsi And Callum Smiths Absolute War What It Means For Anthony Joshua

Feb 24, 2025 -

Dmitry Bivol Vs Artur Beterbiev Ii Full Fight Recap And Analysis

Feb 24, 2025

Dmitry Bivol Vs Artur Beterbiev Ii Full Fight Recap And Analysis

Feb 24, 2025

Latest Posts

-

National Elections In Germany A Deep Dive Into The Candidates And Platforms

Feb 24, 2025

National Elections In Germany A Deep Dive Into The Candidates And Platforms

Feb 24, 2025 -

On Set Candids A Different Look At Your Favorite Actors

Feb 24, 2025

On Set Candids A Different Look At Your Favorite Actors

Feb 24, 2025 -

Israel Frees Hostages Amidst Delayed Palestinian Prisoner Release

Feb 24, 2025

Israel Frees Hostages Amidst Delayed Palestinian Prisoner Release

Feb 24, 2025 -

Musk Issues Jobs On The Line Demand For Explanation Of Federal Actions

Feb 24, 2025

Musk Issues Jobs On The Line Demand For Explanation Of Federal Actions

Feb 24, 2025 -

Smoke In Cabin Forces Delta Plane From Lax To Make Emergency Landing

Feb 24, 2025

Smoke In Cabin Forces Delta Plane From Lax To Make Emergency Landing

Feb 24, 2025