Economic Concerns Mount As Trump Considers Dogecoin Dividend Payments

Table of Contents

Economic Concerns Mount as Trump Considers Dogecoin Dividend Payments

WASHINGTON, D.C. – The prospect of former President Donald Trump distributing Dogecoin as a dividend to investors in his various business ventures has sent shockwaves through the financial world, sparking widespread concerns about market volatility and the potential for economic instability. While details remain scarce, the idea, first floated in a [source: a statement released on Trump's Truth Social account on [Date]], has ignited a furious debate among economists, analysts, and policymakers. The lack of concrete information surrounding the plan – including the scale of the proposed distribution, the source of the Dogecoin, and the precise mechanism for its delivery – has only amplified the uncertainty.

The initial reaction in the cryptocurrency market was a surge in Dogecoin's price, [Insert Percentage Change and specify timeframe, e.g., a 15% jump within the first hour of the announcement]. However, this initial enthusiasm quickly gave way to apprehension as experts began to dissect the potential ramifications. Many economists have voiced concerns about the inflationary pressures such a large-scale, unconventional dividend payment could create. The sheer volume of Dogecoin that would need to be acquired and distributed – particularly if applied to Trump's vast business holdings – could significantly inflate its price, potentially triggering a speculative bubble with devastating consequences for unsuspecting investors.

"This is unprecedented territory," said Dr. Emily Carter, an economics professor at [University Name]. "Introducing a cryptocurrency, particularly one as volatile as Dogecoin, into the mainstream financial system in this manner poses a significant risk. We're talking about a potential disruption to established market mechanisms and a potentially devastating impact on individuals who may not fully understand the risks involved."

Beyond the immediate market concerns, the legal implications of such a move are equally complex. Questions surrounding tax liabilities, securities regulations, and the potential for market manipulation are currently under intense scrutiny. The Securities and Exchange Commission (SEC) is reportedly reviewing the situation closely, with legal experts suggesting that the proposed dividend payment could potentially violate several existing regulations. [Insert quote from a SEC spokesperson or legal expert regarding the legality of the proposal, if available. Otherwise, remove this sentence and replace with a general statement about the SEC's investigation].

Furthermore, the source of the Dogecoin itself remains a mystery. It's unclear whether Trump intends to purchase the cryptocurrency on the open market – a move that could further inflate its price – or if he plans to utilize existing holdings. The lack of transparency surrounding this aspect only fuels speculation and contributes to the widespread uncertainty.

Critics have also pointed out the inherent risks associated with Dogecoin's volatile nature. Unlike traditional currencies or assets, Dogecoin's value is highly susceptible to market manipulation and sudden price swings. A massive influx of Dogecoin into the market, driven by Trump's dividend distribution, could easily trigger a significant crash, leaving investors with substantial losses. [Insert quote from a financial analyst or market expert commenting on the volatility of Dogecoin and its potential impact on the proposed dividend].

While the specifics of Trump's plan remain shrouded in mystery, its mere suggestion has already highlighted the complexities and challenges of integrating cryptocurrencies into traditional financial systems. The potential for economic disruption and investor harm is undeniably significant, and the coming weeks will be crucial in determining the true impact of this bold, and arguably reckless, proposal. The situation is rapidly evolving, and further updates will be provided as they become available.

Featured Posts

-

Upset In London Callum Smith Upsets Joshua Buatsi For Interim Wbo Belt

Feb 24, 2025

Upset In London Callum Smith Upsets Joshua Buatsi For Interim Wbo Belt

Feb 24, 2025 -

Female Advocates Show Solidarity For Luigi Mangione In Court

Feb 24, 2025

Female Advocates Show Solidarity For Luigi Mangione In Court

Feb 24, 2025 -

Everton And Man Utd Share Spoils In 2 2 Thriller Var In Focus

Feb 24, 2025

Everton And Man Utd Share Spoils In 2 2 Thriller Var In Focus

Feb 24, 2025 -

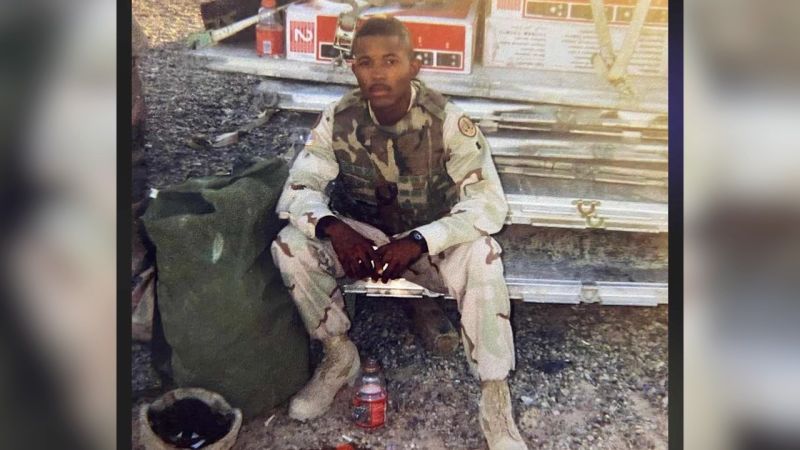

Wifes Account Of Husbands Ice Detention A Us Veterans Case

Feb 24, 2025

Wifes Account Of Husbands Ice Detention A Us Veterans Case

Feb 24, 2025 -

Zelensky Seeks Trumps Support A Crucial Step For Ukraine

Feb 24, 2025

Zelensky Seeks Trumps Support A Crucial Step For Ukraine

Feb 24, 2025

Latest Posts

-

Germanys National Election Whats At Stake For The Future

Feb 24, 2025

Germanys National Election Whats At Stake For The Future

Feb 24, 2025 -

Crackdown On Car Theft Electronic Devices To Be Outlawed

Feb 24, 2025

Crackdown On Car Theft Electronic Devices To Be Outlawed

Feb 24, 2025 -

Federal Workers Face Ultimatum Document Or Resign Doges Email States

Feb 24, 2025

Federal Workers Face Ultimatum Document Or Resign Doges Email States

Feb 24, 2025 -

Remembering Lockerbie A Memorial Sculpture For Mothers Who Lost Sons

Feb 24, 2025

Remembering Lockerbie A Memorial Sculpture For Mothers Who Lost Sons

Feb 24, 2025 -

Hostage Release In Israel Palestinian Prisoner Swap Stalled

Feb 24, 2025

Hostage Release In Israel Palestinian Prisoner Swap Stalled

Feb 24, 2025