Economic Fallout? Analyzing The Potential Impact Of A Trump Dogecoin Dividend

Table of Contents

Trump Dogecoin Dividend: Economic Fallout or Farce? Analyzing the Unlikely Impact

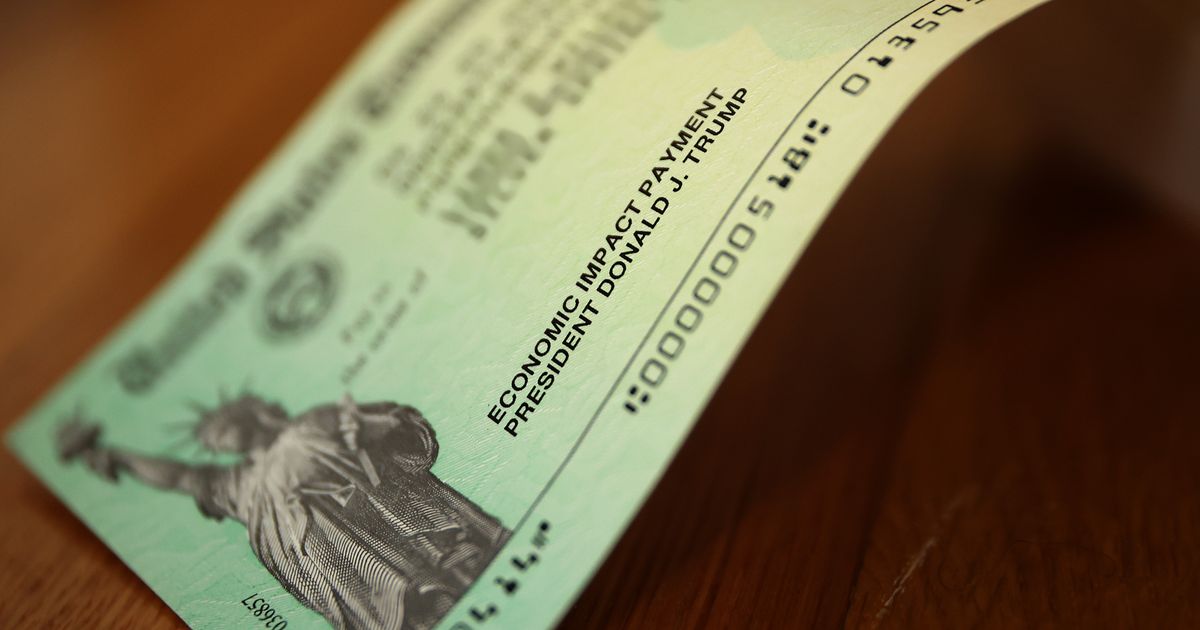

Washington, D.C. – The notion of a Donald Trump presidential campaign distributing a Dogecoin dividend has ignited a firestorm of speculation, sparking debate about its potential economic ramifications. While the idea remains largely a social media phenomenon, its implications – both real and perceived – warrant examination. [Insert date of initial Dogecoin dividend proposal/mention, if available. If no specific date, remove this sentence]. The sheer novelty of such a proposal, coupled with the inherent volatility of cryptocurrencies and Trump’s significant political influence, creates a complex scenario with uncertain economic consequences.

The core question is whether a hypothetical Dogecoin dividend, if actually implemented, could trigger significant economic disruption. The answer is multifaceted. Firstly, the scale of such a dividend is crucial. Trump's campaign has [Insert number, if available, of potential recipients; otherwise, state "not specified"] potential recipients. Assuming [Insert average amount of Dogecoin, if available. If unavailable, use a plausible range and state this clearly. E.g., "an average dividend of between 100 and 1,000 Dogecoins per recipient"], the total Dogecoin market capitalization would need to absorb a substantial influx of demand. This could lead to a short-term surge in the Dogecoin price, benefiting early holders while potentially creating a speculative bubble.

However, the longer-term effects are less clear. Dogecoin's inherent volatility and lack of intrinsic value make it a risky asset. A sudden surge in demand driven by a political dividend could be followed by a rapid correction, potentially leaving many recipients with substantial losses. The scale of this correction would depend on several factors, including the overall market sentiment toward Dogecoin and the broader cryptocurrency market at the time. [Insert data on Dogecoin's market cap and volatility in the period leading up to the proposal, if available. If not, insert generalized market data from a reputable source, clearly stating this is generalized information]. Furthermore, any significant price fluctuation could have ripple effects across the cryptocurrency market, impacting the value of other digital assets.

Beyond the cryptocurrency market, the economic impact of a Trump Dogecoin dividend would depend heavily on the perception of the event. A successful distribution could be seen as a publicity stunt, boosting Trump's image and potentially attracting new donors to his campaign. Conversely, a chaotic distribution or a significant price crash could damage his credibility and reinforce skepticism around his economic policies. The psychological impact on investor confidence, particularly in the cryptocurrency market, should not be underestimated. [Insert expert quotes from economists or financial analysts on the potential economic impact. Source these quotes with links to the original publications].

Economically, the most significant concern would be the potential for market manipulation. The distribution of a significant amount of Dogecoin via a political campaign raises red flags regarding market integrity. Regulatory bodies would likely scrutinize the event for potential violations of securities laws. [Insert details of any relevant securities laws or regulations that might be affected, if applicable. If no specific information available, state this].

In conclusion, the idea of a Trump Dogecoin dividend presents a fascinating case study in the intersection of politics, economics, and the volatile world of cryptocurrencies. While the likelihood of such a plan being implemented remains uncertain, analyzing its potential impact highlights the complexities and risks associated with using cryptocurrencies in the political arena. The ultimate economic fallout will depend on a multitude of factors, making any definitive prediction highly speculative at this time. Further analysis, including detailed modelling and expert opinion, is needed to fully assess the potential consequences of this unconventional political strategy.

Featured Posts

-

Luigi Mangiones Court Case The Women Who Stand By Him

Feb 24, 2025

Luigi Mangiones Court Case The Women Who Stand By Him

Feb 24, 2025 -

St Mirren Defeat Sparks Rangers Outrage Fans Blast Clement And Team

Feb 24, 2025

St Mirren Defeat Sparks Rangers Outrage Fans Blast Clement And Team

Feb 24, 2025 -

Dangerous Dog Breeds Understanding The Risks And Regulations

Feb 24, 2025

Dangerous Dog Breeds Understanding The Risks And Regulations

Feb 24, 2025 -

U S Urges Ukraine To Replace Un Resolution On Russia

Feb 24, 2025

U S Urges Ukraine To Replace Un Resolution On Russia

Feb 24, 2025 -

Britains Got Talent A First Look At Ksi With The Judges

Feb 24, 2025

Britains Got Talent A First Look At Ksi With The Judges

Feb 24, 2025

Latest Posts

-

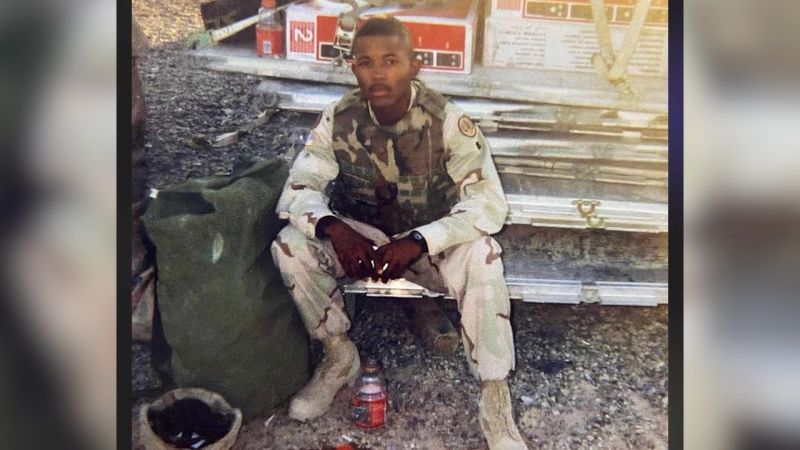

Ice Detains Us Veteran Husband Wife Recounts Arrest

Feb 24, 2025

Ice Detains Us Veteran Husband Wife Recounts Arrest

Feb 24, 2025 -

Paris Cycling Community Grieves Loss Of Visionary Paul Varry

Feb 24, 2025

Paris Cycling Community Grieves Loss Of Visionary Paul Varry

Feb 24, 2025 -

Remembering Lockerbie Sculptural Memorial To The 1988 Plane Disaster

Feb 24, 2025

Remembering Lockerbie Sculptural Memorial To The 1988 Plane Disaster

Feb 24, 2025 -

10 Wry And Controversial New Yorker Covers That Went Viral

Feb 24, 2025

10 Wry And Controversial New Yorker Covers That Went Viral

Feb 24, 2025 -

Israeli Hostage Crisis Resolved But Prisoner Exchange Delayed

Feb 24, 2025

Israeli Hostage Crisis Resolved But Prisoner Exchange Delayed

Feb 24, 2025