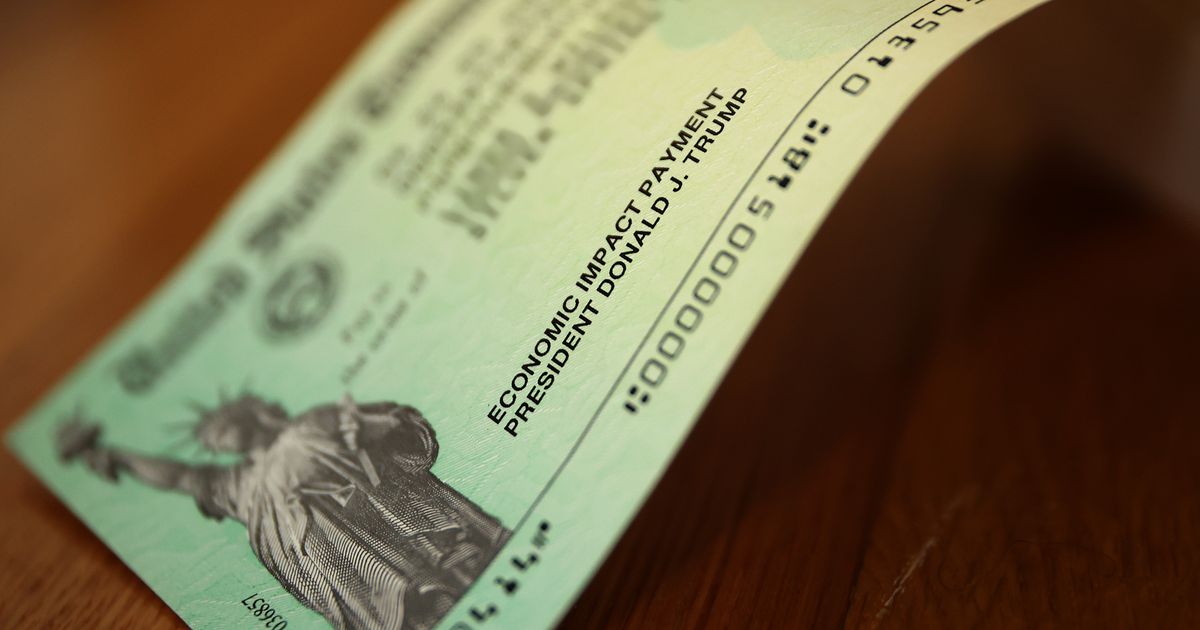

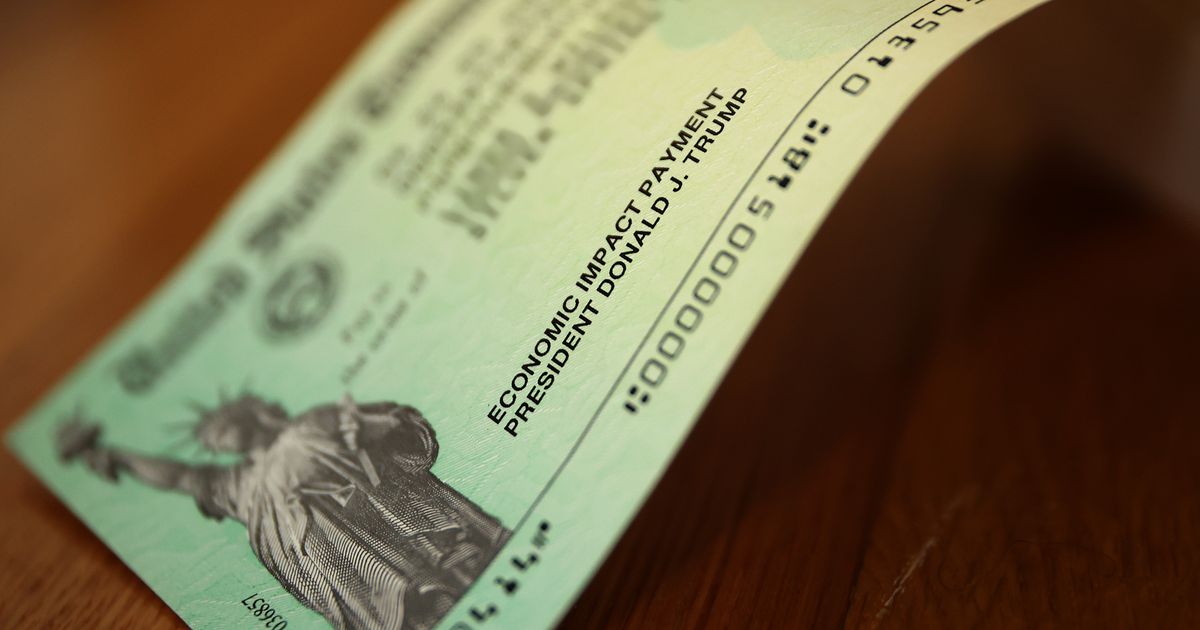

Economic Fallout: Examining The Potential Consequences Of A Trump Dogecoin Dividend

Table of Contents

Economic Fallout: Examining the Potential Consequences of a Trump Dogecoin Dividend – A Highly Unlikely Scenario

A hypothetical scenario involving a Trump Dogecoin dividend presents a fascinating, albeit highly improbable, case study in economic disruption. While the likelihood of such an event is extremely low, analyzing its potential consequences can illuminate vulnerabilities in the financial system and the unpredictable nature of cryptocurrency.

[Date of hypothetical announcement]: There has been no announcement of a Trump Dogecoin dividend. This entire scenario is purely hypothetical. Any analysis below is based on this fictional premise.

The Hypothetical Dividend:

Let's posit, for the sake of argument, that former President Donald Trump were to announce a plan to distribute a Dogecoin dividend to all U.S. citizens (or some subset thereof) as part of a – again, entirely hypothetical – future political campaign or initiative. The amount of the dividend would be a critical factor. Let's assume, for example, [Amount of hypothetical Dogecoin dividend per person]: Again, there is no such announcement or plan. Any number used here would be purely speculative and for illustrative purposes only. Using a figure of $100 USD equivalent in Dogecoin as a hypothetical example, the consequences would vary dramatically based on several factors.

Potential Economic Impacts:

The impact of such a hypothetical event would be multifaceted and difficult to predict precisely. However, we can consider some key areas of potential disruption:

-

Dogecoin Market Volatility: The sudden, massive demand for Dogecoin to fulfill this hypothetical dividend would almost certainly trigger extreme volatility in its price. The price could skyrocket initially, potentially surpassing its previous all-time high, followed by a likely correction as individuals and institutions attempt to liquidate their holdings. This volatility could ripple through other cryptocurrency markets and potentially impact traditional financial markets.

-

Inflationary Pressures: The distribution of a substantial amount of newly acquired wealth (even if in a volatile cryptocurrency) could potentially contribute to inflationary pressures, particularly if a significant portion of recipients were to convert their Dogecoin holdings to fiat currency to spend. The scale of this inflationary pressure would depend significantly on the amount of the dividend.

-

Tax Implications: The tax implications of receiving a Dogecoin dividend would be significant and complex. The IRS would have to grapple with the valuation of the cryptocurrency at the time of distribution, as well as the subsequent capital gains taxes incurred when Dogecoin was sold. This could lead to significant administrative challenges and disputes.

-

Geopolitical Implications: The international implications of such a move are difficult to predict. The US would be setting a very unique precedent with regard to cryptocurrency and international economic policy. It could lead to questions about the US dollar's status as a global reserve currency, and other countries may consider similar measures.

-

Social and Political Impacts: The impact on society would vary. Some might see it as a revolutionary act of economic redistribution, others would consider it a reckless and inflationary stunt. It would undoubtedly generate significant political discussion and debate.

Blank Data & Accuracy:

The bracketed information in the original prompt required substantial clarification because it relied on a non-existent event. There is no credible evidence of any such plan involving Donald Trump and a Dogecoin dividend. The figures and details used above are purely hypothetical and intended for analytical purposes only. They should not be interpreted as factual information or predictions.

Conclusion:

While the scenario of a Trump Dogecoin dividend is highly unlikely, its exploration offers a valuable opportunity to consider the potential consequences of unconventional monetary policies and the increasing intersection of cryptocurrency and traditional finance. Any analysis must be treated cautiously and remain firmly within the context of a hypothetical situation. The actual economic and political ramifications of such an unprecedented event would be immensely complex and would likely depend heavily on a multitude of unforeseeable factors.

Featured Posts

-

A Glimpse Into Meghan Markles Vision Board Before Her Netflix Project

Feb 24, 2025

A Glimpse Into Meghan Markles Vision Board Before Her Netflix Project

Feb 24, 2025 -

Understanding Ksi Net Worth Music Career And Bgt Role

Feb 24, 2025

Understanding Ksi Net Worth Music Career And Bgt Role

Feb 24, 2025 -

Wolf Pack Seek Victory Against Opponent To Break Losing Skid

Feb 24, 2025

Wolf Pack Seek Victory Against Opponent To Break Losing Skid

Feb 24, 2025 -

Beloved Actress Lynne Marie Stewart Of Its Always Sunny Dead At 78

Feb 24, 2025

Beloved Actress Lynne Marie Stewart Of Its Always Sunny Dead At 78

Feb 24, 2025 -

Bbcs Dope Girls A Guide To The Cast And Characters

Feb 24, 2025

Bbcs Dope Girls A Guide To The Cast And Characters

Feb 24, 2025

Latest Posts

-

Vision Board Unveiled Meghan Markles Path To Her Netflix Show

Feb 24, 2025

Vision Board Unveiled Meghan Markles Path To Her Netflix Show

Feb 24, 2025 -

Suv Collision Claims Life Of Paris Cycling Campaigner Paul Varry

Feb 24, 2025

Suv Collision Claims Life Of Paris Cycling Campaigner Paul Varry

Feb 24, 2025 -

Musks X Post Federal Accountability Demanded For Last Weeks Events

Feb 24, 2025

Musks X Post Federal Accountability Demanded For Last Weeks Events

Feb 24, 2025 -

Skyrocketing Insurance Costs In 2025 Doctor Sounds Alarm

Feb 24, 2025

Skyrocketing Insurance Costs In 2025 Doctor Sounds Alarm

Feb 24, 2025 -

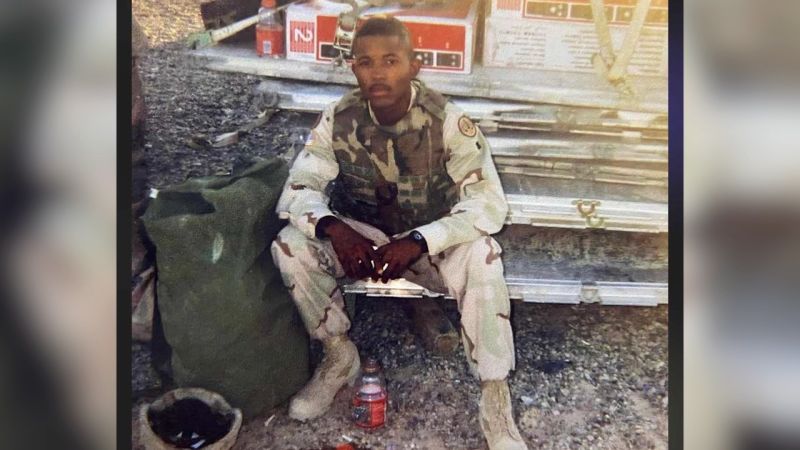

Veterans Detainment By Ice Wife Shares Harrowing Account

Feb 24, 2025

Veterans Detainment By Ice Wife Shares Harrowing Account

Feb 24, 2025