Economic Fallout: Examining The Potential Costs Of A DOGE Dividend

Table of Contents

Dogecoin Dividend Disaster? Examining the Potential Economic Fallout of a DOGE Distribution

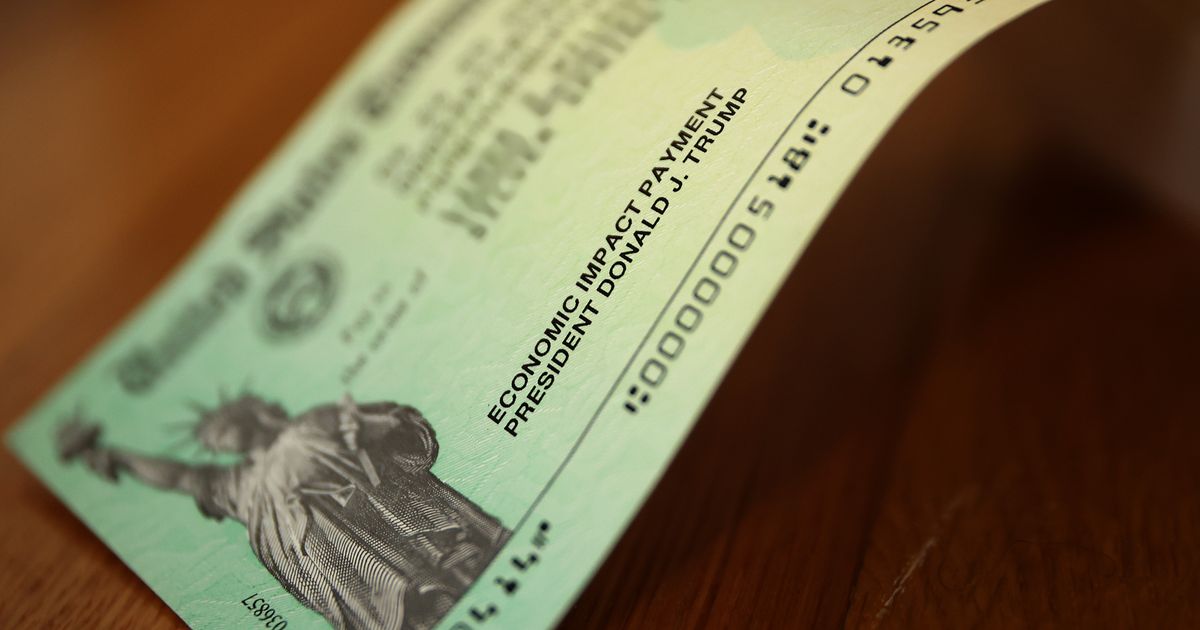

[CITY, STATE] – The idea of a Dogecoin dividend, while seemingly whimsical, carries significant potential for economic disruption. While no major entity has officially announced such a plan, the hypothetical scenario has sparked debate among economists and financial analysts, prompting a closer look at the potential fallout. The core problem lies in Dogecoin's inherent volatility and lack of intrinsic value, making any large-scale distribution a risky proposition for both recipients and the broader economy.

The speculative nature of Dogecoin, a cryptocurrency often touted as a "meme coin," is a central concern. Unlike traditional dividends paid out in stable assets like company stock or cash, a DOGE dividend would expose recipients to significant price fluctuations. The price of DOGE is notoriously volatile, experiencing dramatic swings based on social media trends and speculation, rather than fundamental economic factors. [Insert data on DOGE's price volatility over the past year, including percentage changes and significant price swings. Example: "Over the past year, DOGE has experienced price swings exceeding [X]% on multiple occasions, including a [Y]% drop in [Month, Year] and a [Z]% rise in [Month, Year]."]

This volatility presents several key risks. Firstly, recipients of a DOGE dividend would immediately face uncertainty regarding the value of their payout. The value could plummet shortly after distribution, leaving recipients with a significantly reduced asset. Secondly, a massive influx of DOGE into the market, driven by a dividend payout to potentially millions of people, could trigger a sharp price decline due to increased supply overwhelming demand. [Insert data on Dogecoin's market capitalization and circulating supply. Example: "With a current market capitalization of [X] and a circulating supply of [Y] coins, a widespread DOGE dividend could drastically increase the supply, potentially leading to a significant price drop."]

Furthermore, the economic impact extends beyond individual recipients. A sudden devaluation of DOGE following a large-scale distribution could negatively impact cryptocurrency markets as a whole, potentially triggering a wider sell-off and eroding investor confidence. [Insert data on the correlation between DOGE's price and the broader cryptocurrency market. Example: "Studies show a [X]% correlation between DOGE's price and the overall cryptocurrency market cap, suggesting that a significant DOGE price drop could trigger a broader market downturn."]

Beyond the immediate market impact, there are concerns about the broader implications for financial literacy and responsible investment. A DOGE dividend could inadvertently encourage reckless investment behavior, particularly among individuals unfamiliar with the risks associated with cryptocurrencies. This could lead to significant financial losses for individuals and contribute to a climate of speculative investment rather than informed decision-making. [Insert data or expert quotes about the risks of speculative investment in cryptocurrencies. Example: "Professor [Name], an economist at [University], warns that 'a DOGE dividend could exacerbate the already present risks of speculative crypto investment, potentially leading to widespread financial losses among uninformed investors.'"]

Finally, the practical challenges of distributing a DOGE dividend on a large scale are considerable. The transaction fees associated with transferring a significant number of DOGE coins could be substantial, impacting the actual value received by recipients. [Insert data on typical DOGE transaction fees and how these might scale with a large-scale distribution. Example: "Current average DOGE transaction fees are approximately [X] DOGE. Distributing [Y] DOGE to [Z] individuals would incur fees potentially exceeding [W] DOGE."]

In conclusion, while the idea of a DOGE dividend may seem appealing on the surface, a closer examination reveals a high-risk scenario with the potential for significant economic fallout. The inherent volatility of DOGE, the risks associated with large-scale distribution, and the potential impact on financial literacy all point to the need for caution and a thorough understanding of the potential consequences before any such initiative is considered. The lack of intrinsic value in Dogecoin further exacerbates these risks, underscoring the speculative nature of the proposal and the potential for widespread financial losses.

Featured Posts

-

Police Investigate Shooting Incident At Upmc Memorial Hospital West Manchester Twp

Feb 24, 2025

Police Investigate Shooting Incident At Upmc Memorial Hospital West Manchester Twp

Feb 24, 2025 -

Wifes Allegations Former Ravens Star Involved In Affair

Feb 24, 2025

Wifes Allegations Former Ravens Star Involved In Affair

Feb 24, 2025 -

Late Fernandes Double Earns Manchester United A Point At Everton

Feb 24, 2025

Late Fernandes Double Earns Manchester United A Point At Everton

Feb 24, 2025 -

England Vs Australia Champions Trophy 2025 Highlights Ingliss Impact Decides The Match

Feb 24, 2025

England Vs Australia Champions Trophy 2025 Highlights Ingliss Impact Decides The Match

Feb 24, 2025 -

Suspect Executed Virginia Officers Then Left Scene Calmly

Feb 24, 2025

Suspect Executed Virginia Officers Then Left Scene Calmly

Feb 24, 2025

Latest Posts

-

Supporters Stand By Luigi Mangione During Legal Battle

Feb 24, 2025

Supporters Stand By Luigi Mangione During Legal Battle

Feb 24, 2025 -

Steve Smith Sr Involved In Extramarital Affair Husbands Reaction And The Fallout

Feb 24, 2025

Steve Smith Sr Involved In Extramarital Affair Husbands Reaction And The Fallout

Feb 24, 2025 -

Late Drama As Manchester United Defeat Everton In Premier League Clash

Feb 24, 2025

Late Drama As Manchester United Defeat Everton In Premier League Clash

Feb 24, 2025 -

Manchester United At Everton Kick Off Time Live Stream Details And Predicted Lineups

Feb 24, 2025

Manchester United At Everton Kick Off Time Live Stream Details And Predicted Lineups

Feb 24, 2025 -

Southampton 0 4 Brighton Dominant Seagulls Cruise To Victory

Feb 24, 2025

Southampton 0 4 Brighton Dominant Seagulls Cruise To Victory

Feb 24, 2025