Elon Musk, Dogecoin, And The Problem Of Unintended Personnel Changes

Table of Contents

Elon Musk's Dogecoin Tweets and the Ripple Effect of Unintended Personnel Changes

SAN FRANCISCO, CA — Elon Musk's influence on cryptocurrency markets, particularly Dogecoin (DOGE), is well-documented. His tweets, often cryptic and unpredictable, have repeatedly sent the meme-coin's price soaring and plummeting, impacting not only investors but also the individuals and companies indirectly caught in the crossfire. While Musk’s actions are rarely explicitly linked to specific personnel changes, the volatile nature of the market he influences has demonstrably caused disruptions in various sectors, leading to unforeseen and sometimes detrimental personnel shifts within companies involved in cryptocurrency or related technologies.

The most prominent example of this indirect impact can be traced to the fluctuating value of Dogecoin itself. Companies that have accepted DOGE as payment, or those with significant investments tied to its performance, have experienced drastic shifts in their financial stability. These fluctuations can trigger cost-cutting measures, including layoffs and restructuring, even if not directly related to Musk's tweets themselves. [Specific examples of companies affected by DOGE's volatility and subsequent personnel changes would be inserted here. This requires research into publicly available financial reports of companies with significant DOGE exposure and news reports on their restructuring or personnel decisions. Data on which companies saw layoffs or restructuring directly or indirectly related to DOGE price fluctuations following a Musk tweet should be found and detailed here. For example, were there any small businesses that had to lay off staff after a Musk tweet tanked the price of DOGE, negatively affecting their revenue stream?].

Beyond direct economic impact, Musk's pronouncements on Dogecoin have created a climate of uncertainty for businesses operating in the cryptocurrency space. This uncertainty can discourage investment, hindering growth and leading to personnel decisions focused on streamlining operations and reducing risk. [Specific examples of companies that altered hiring or investment strategies due to the uncertainty created by Musk's pronouncements on Dogecoin should be detailed here. This requires research into press releases, financial reports, and business news articles. For example, did any cryptocurrency exchanges or blockchain development companies scale back hiring or investment after a particularly volatile period driven by a Musk tweet?].

Furthermore, the impact extends beyond the direct financial sphere. The attention generated by Musk’s actions attracts increased regulatory scrutiny to the cryptocurrency market. This heightened regulatory environment, often resulting from public pressure fueled by the volatility induced by high-profile individuals like Musk, can force companies to divert resources to compliance, potentially affecting staffing decisions in areas such as legal and risk management. [Data showing the increased regulatory activity following periods of significant DOGE volatility due to Musk's tweets and correlating it to personnel changes in affected companies must be added. This involves researching regulatory actions, company responses, and the impact on personnel. For instance, were there specific compliance-related hires or layoffs at companies because of increased regulatory scrutiny triggered by Musk's actions?].

While proving a direct causal link between a specific Musk tweet and a specific personnel change is difficult, the circumstantial evidence strongly suggests a correlation. The volatile nature of the cryptocurrency market, heavily influenced by Musk's actions, creates a ripple effect that impacts companies and their employees in unpredictable ways. This highlights the broader societal implications of the power wielded by influential figures in the tech industry and the need for greater transparency and regulatory oversight in the volatile world of cryptocurrencies. [Further research into the broader regulatory landscape around cryptocurrencies and the influence of high-profile figures should be included here. For example, what are the ongoing discussions regarding regulating influential figures' impacts on crypto markets?] The ongoing debate surrounding the regulation of social media influence on financial markets necessitates a deeper investigation into the unintended consequences of such influence.

Featured Posts

-

Fc Barcelonas 2 0 Win Keeps Them On Top

Feb 23, 2025

Fc Barcelonas 2 0 Win Keeps Them On Top

Feb 23, 2025 -

Latest On Giannis Antetokounmpos Injury Playing Status For Wizards Game

Feb 23, 2025

Latest On Giannis Antetokounmpos Injury Playing Status For Wizards Game

Feb 23, 2025 -

In Depth Analysis The Monkey Movie Review

Feb 23, 2025

In Depth Analysis The Monkey Movie Review

Feb 23, 2025 -

Adames Retains Title After Controversial Draw Against Sheeraz

Feb 23, 2025

Adames Retains Title After Controversial Draw Against Sheeraz

Feb 23, 2025 -

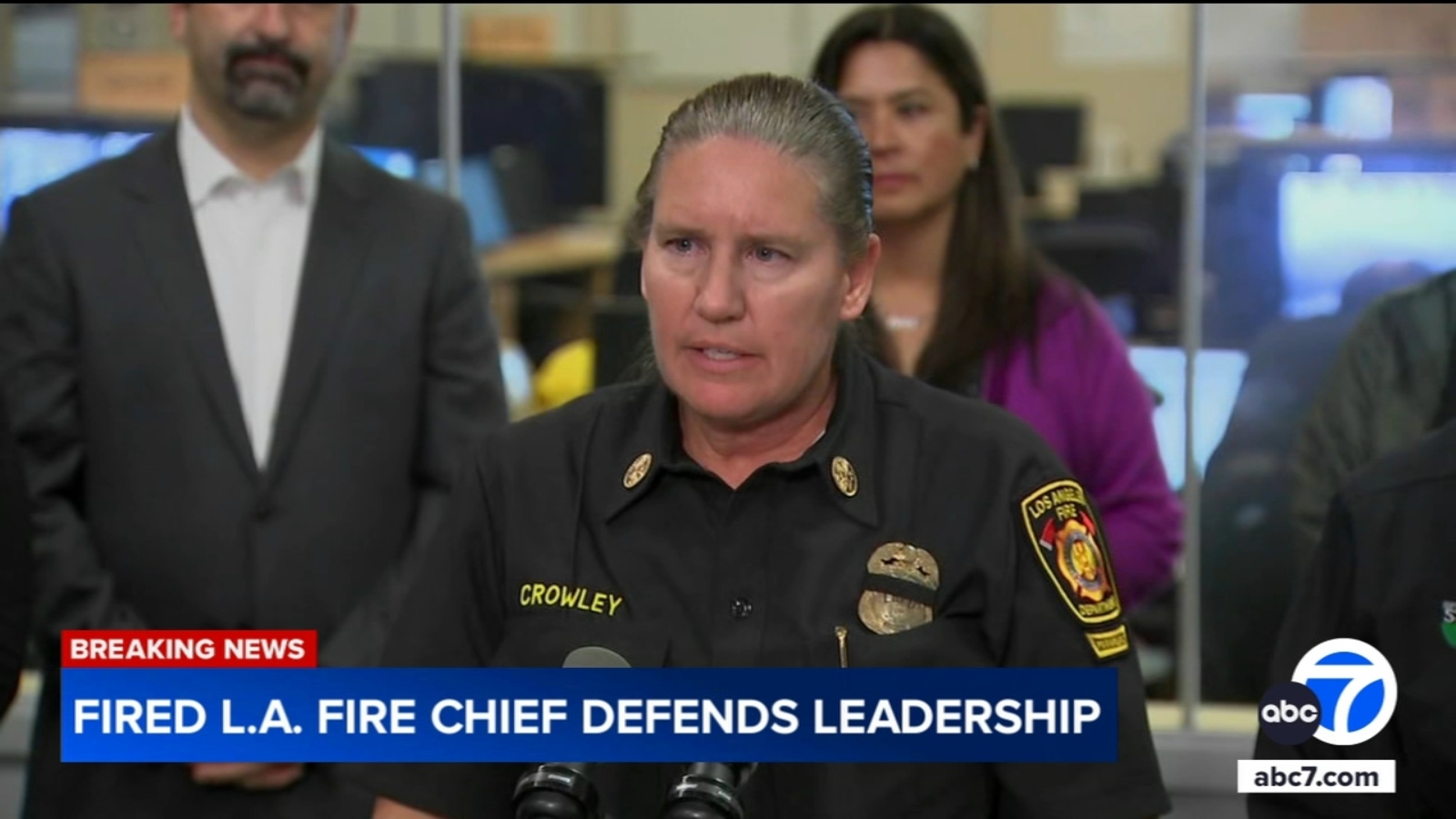

Kristin Crowley Former Lafd Chief Addresses Fallout Following Resignation

Feb 23, 2025

Kristin Crowley Former Lafd Chief Addresses Fallout Following Resignation

Feb 23, 2025

Latest Posts

-

Aston Villa Vs Chelsea 2 1 Scoreline Highlights Asensio And Rashford Performances

Feb 23, 2025

Aston Villa Vs Chelsea 2 1 Scoreline Highlights Asensio And Rashford Performances

Feb 23, 2025 -

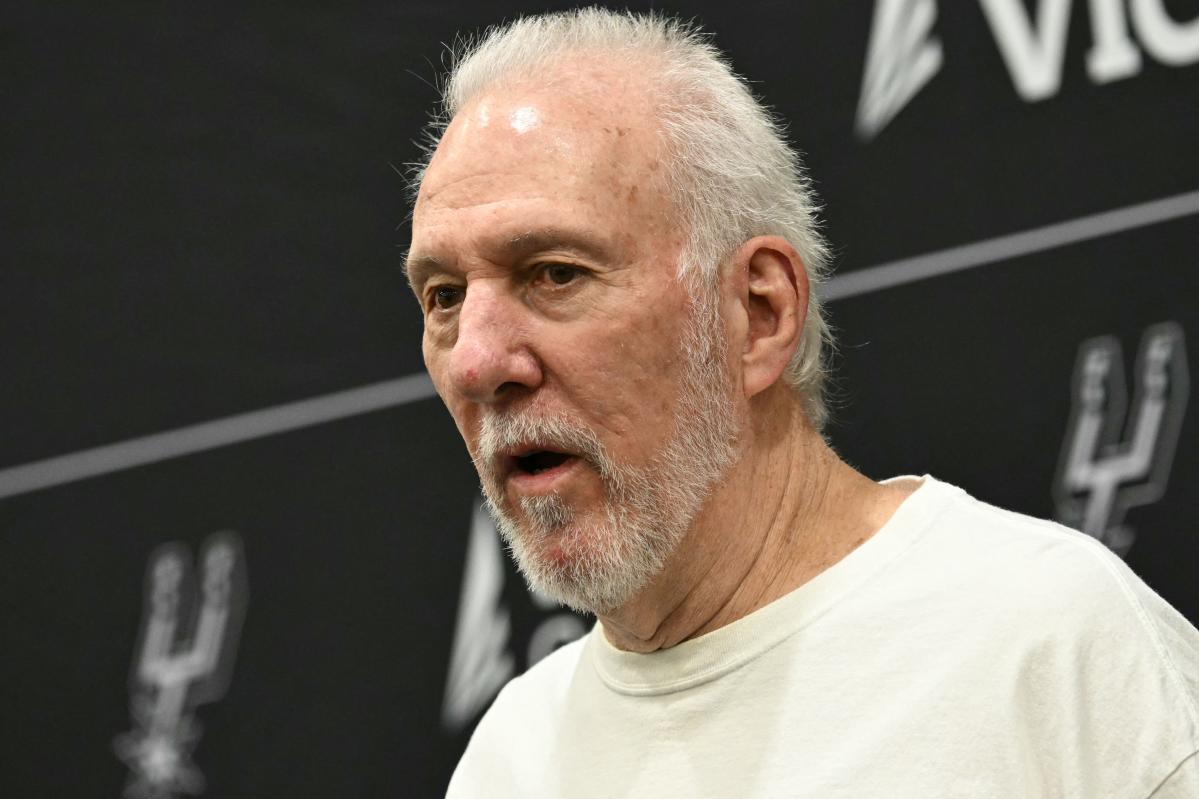

Gregg Popovichs Future With The Spurs Uncertain

Feb 23, 2025

Gregg Popovichs Future With The Spurs Uncertain

Feb 23, 2025 -

How Dynamic Pricing Will Affect Empire State Building Visits

Feb 23, 2025

How Dynamic Pricing Will Affect Empire State Building Visits

Feb 23, 2025 -

Legendary Soul Singer Jerry Iceman Butler Dies At 85

Feb 23, 2025

Legendary Soul Singer Jerry Iceman Butler Dies At 85

Feb 23, 2025 -

Electrician Josh Padleys Impressive Mike Tyson Impersonation

Feb 23, 2025

Electrician Josh Padleys Impressive Mike Tyson Impersonation

Feb 23, 2025