Elon Musk's $44 Billion Gamble: X's Potential For Recovery

Table of Contents

Elon Musk's $44 Billion Gamble: Can X (formerly Twitter) Recover?

SAN FRANCISCO — Elon Musk's tumultuous ownership of X, formerly known as Twitter, has been a rollercoaster ride of controversial decisions, mass layoffs, and plummeting advertising revenue. The $44 billion acquisition, finalized in October 2022, initially promised a revitalized platform prioritizing free speech absolutism. However, the reality has been far more complex, leaving many questioning whether X can ever recoup its massive investment and return to profitability.

The platform, once a dominant force in social media, has faced a series of setbacks since Musk took the helm. A rapid exodus of advertisers, driven by concerns about brand safety and content moderation policies, has significantly impacted X's revenue streams. Internal documents obtained by [source, e.g., The New York Times, Reuters] reveal a sharp decline in advertising revenue, with some estimates suggesting a [percentage]% drop in [time period, e.g., the first quarter of 2023]. This financial hemorrhage has prompted widespread speculation about X's long-term viability.

Musk's attempts to diversify X's revenue streams have yielded mixed results. The introduction of a paid subscription service, X Premium (formerly Twitter Blue), aimed to generate revenue from individual users. While the program has gained some subscribers, the number is far from sufficient to offset the losses from advertising. Furthermore, the rollout of X Premium has been plagued with technical glitches and accusations of insufficient user verification measures, leading to further erosion of trust. [Include data on the number of X Premium subscribers and its contribution to revenue, if available from reliable sources].

Beyond revenue challenges, X has also grappled with significant operational issues. Massive layoffs, reportedly affecting around [percentage]% of the workforce, led to widespread criticism over its impact on platform functionality and content moderation. The resulting instability and glitches further alienated users and advertisers, contributing to the platform's decline. [Cite specific examples of operational issues and negative consequences from reputable sources].

Musk's vision for X, which includes integrating it with other ventures like Tesla and SpaceX, remains largely undefined. While he has hinted at ambitious plans to build a "everything app," similar to WeChat in China, [include details on the progress and feasibility of Musk's "everything app" vision, drawing on reports and expert analysis]. The ambitious scope of this project, combined with the current financial difficulties, raises significant questions about its feasibility.

Despite the significant hurdles, some analysts remain cautiously optimistic about X's potential for a turnaround. [Quote an expert analyst's perspective on X's future, citing their affiliation and expertise]. They suggest that Musk's considerable resources and technological expertise could, in the long run, lead to innovative solutions and a revival of the platform. However, this would require a significant shift in strategy, focusing on regaining advertiser confidence and improving user experience, before the financial bleeding becomes irreversible.

The future of X remains uncertain. While Musk's vision for the platform is audacious, the path to achieving it is fraught with challenges. The $44 billion gamble hangs precariously in the balance, and the coming months will be crucial in determining whether X can escape its current crisis and reclaim its position as a leading social media platform. [Conclude with a concise summary of the key takeaway points and potential future developments].

Featured Posts

-

1 4 Billion Stolen Unprecedented Crypto Attack Targets Bybit

Feb 22, 2025

1 4 Billion Stolen Unprecedented Crypto Attack Targets Bybit

Feb 22, 2025 -

Hunter Schafer On Passport Gender Error Its 2024

Feb 22, 2025

Hunter Schafer On Passport Gender Error Its 2024

Feb 22, 2025 -

Investigation Launched Into Hunter Schafers Passport Gender Alteration Under Trump

Feb 22, 2025

Investigation Launched Into Hunter Schafers Passport Gender Alteration Under Trump

Feb 22, 2025 -

How To Watch Leicester City Vs Brentford For Free Today

Feb 22, 2025

How To Watch Leicester City Vs Brentford For Free Today

Feb 22, 2025 -

Record Deliveries Cant Lift Rivian Stock From Dip

Feb 22, 2025

Record Deliveries Cant Lift Rivian Stock From Dip

Feb 22, 2025

Latest Posts

-

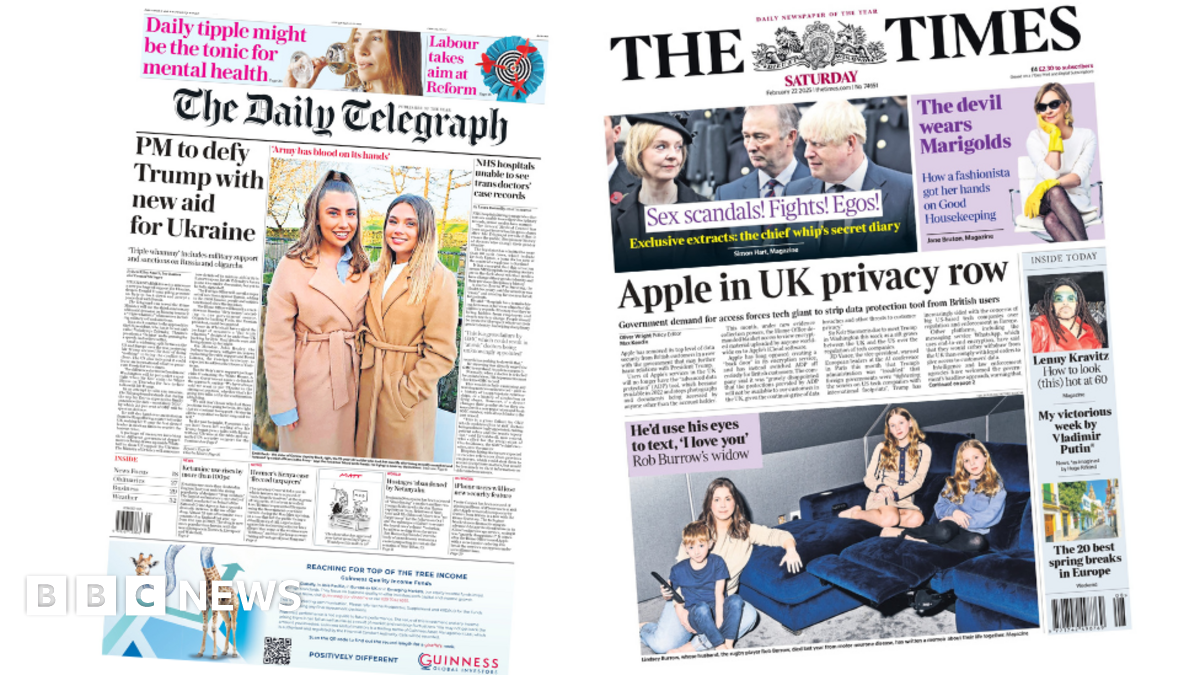

Apple Faces Uk Privacy Backlash Over Data Handling

Feb 24, 2025

Apple Faces Uk Privacy Backlash Over Data Handling

Feb 24, 2025 -

Smith Needs Hospital Treatment After Tough Buatsi Fight

Feb 24, 2025

Smith Needs Hospital Treatment After Tough Buatsi Fight

Feb 24, 2025 -

Dmitry Bivol Vs Artur Beterbiev Ii Fight Preview Predictions And Odds

Feb 24, 2025

Dmitry Bivol Vs Artur Beterbiev Ii Fight Preview Predictions And Odds

Feb 24, 2025 -

Henry Cejudo Suffers Third Consecutive Defeat At Ufc Seattle

Feb 24, 2025

Henry Cejudo Suffers Third Consecutive Defeat At Ufc Seattle

Feb 24, 2025 -

Doge And Musk Gop Representatives Hear From Constituents

Feb 24, 2025

Doge And Musk Gop Representatives Hear From Constituents

Feb 24, 2025