EV Maker Rivian Disappoints Investors With Revised Delivery Projections

Table of Contents

Rivian's Production Hiccups: Revised Delivery Projections Disappoint Investors

Rivian Automotive, Inc., the electric vehicle (EV) maker backed by Amazon and Ford, announced revised delivery projections for 2023, sending its stock price tumbling. The company now expects to produce between 50,000 and 55,000 vehicles this year, significantly lower than previous guidance and fueling investor concerns about the company's ability to scale production.

The downward revision, announced [Date of announcement - e.g., August 9, 2023] alongside the company's second-quarter earnings report, represents a substantial shortfall from the previous forecast of 50,000 units. While the lower end of the revised range remains consistent with the earlier projection, the upward adjustment has been removed, indicating a more cautious outlook. This revised projection translates to a production decrease of [Percentage decrease compared to previous guidance - needs data from the official announcement] compared to the original target.

The disappointing news immediately impacted Rivian's stock price, which [Percentage drop and specific stock price details – needs data from financial news sources e.g., "plummeted by X% to $Y per share," ]. This sharp decline underscores investor anxieties surrounding Rivian's ability to compete effectively in the increasingly crowded and competitive EV market, particularly against established giants like Tesla and a growing number of new entrants.

Rivian attributed the production shortfall to several factors, primarily citing supply chain constraints and challenges related to ramping up production at its manufacturing facility in Normal, Illinois. The company acknowledged that it faced difficulties sourcing certain components, leading to production bottlenecks and delays. [Specific details about the supply chain constraints – needs details from Rivian's official announcement or financial reports, e.g., "Specifically, the company cited delays in securing battery packs and specific semiconductor chips."]. Furthermore, [Details on production facility challenges at Normal, Illinois – needs details from Rivian's official announcement or financial reports, e.g., "the company stated that it encountered unexpected challenges in optimizing its production line at the Normal plant, resulting in slower-than-anticipated output."]

Despite the setback, Rivian remains optimistic about its long-term prospects. The company highlighted strong demand for its vehicles, particularly the R1T pickup truck and R1S SUV. [Include specific data on order backlog or demand figures from the official announcement]. This positive customer response suggests that the company’s products resonate well with consumers, but the immediate challenge lies in translating this demand into actual deliveries.

Rivian's CEO, [CEO's Name], attempted to reassure investors, stating [CEO's direct quote on the revised projections and future outlook, needs data from the official announcement or transcript of the earnings call]. However, the market's reaction suggests that investors remain unconvinced about the company's ability to overcome its production hurdles and meet future delivery targets.

The revised production forecast raises questions about Rivian's financial health and its ability to maintain its current trajectory. The company is burning through significant capital, and the lower-than-expected production numbers are likely to exacerbate investor concerns about its financial sustainability. [Include data on Rivian's cash burn rate or financial performance from the earnings report].

The coming months will be crucial for Rivian. The company's success will hinge on its ability to address the supply chain challenges, optimize its production processes, and deliver on its revised, albeit lower, production targets. Failure to do so could further erode investor confidence and potentially jeopardize its long-term viability in the fiercely competitive EV landscape. Analysts will be closely monitoring Rivian's progress, looking for signs of improvement and a return to the company's ambitious initial growth trajectory.

Featured Posts

-

Another Unconstitutional Term Trump Hints At 2024 Presidential Run

Feb 22, 2025

Another Unconstitutional Term Trump Hints At 2024 Presidential Run

Feb 22, 2025 -

Dodgers Spring Training 2025 Game 2 Cubs Game Date And Time

Feb 22, 2025

Dodgers Spring Training 2025 Game 2 Cubs Game Date And Time

Feb 22, 2025 -

Zero Day On Netflix A Comprehensive Analysis Of The Ending

Feb 22, 2025

Zero Day On Netflix A Comprehensive Analysis Of The Ending

Feb 22, 2025 -

Unconstitutional Third Term Trump Raises The Idea Again

Feb 22, 2025

Unconstitutional Third Term Trump Raises The Idea Again

Feb 22, 2025 -

Kia Forum Parking Lot Hosts Overflowing Crowd For Tate Mc Rae Album

Feb 22, 2025

Kia Forum Parking Lot Hosts Overflowing Crowd For Tate Mc Rae Album

Feb 22, 2025

Latest Posts

-

From Boozing To Cocaine A Story Of Addiction

Feb 24, 2025

From Boozing To Cocaine A Story Of Addiction

Feb 24, 2025 -

Late Goal Gives Millwall Win Over Derby County Coburns Heroics

Feb 24, 2025

Late Goal Gives Millwall Win Over Derby County Coburns Heroics

Feb 24, 2025 -

Joshua Buatsi And Callum Smiths Absolute War What It Means For Anthony Joshua

Feb 24, 2025

Joshua Buatsi And Callum Smiths Absolute War What It Means For Anthony Joshua

Feb 24, 2025 -

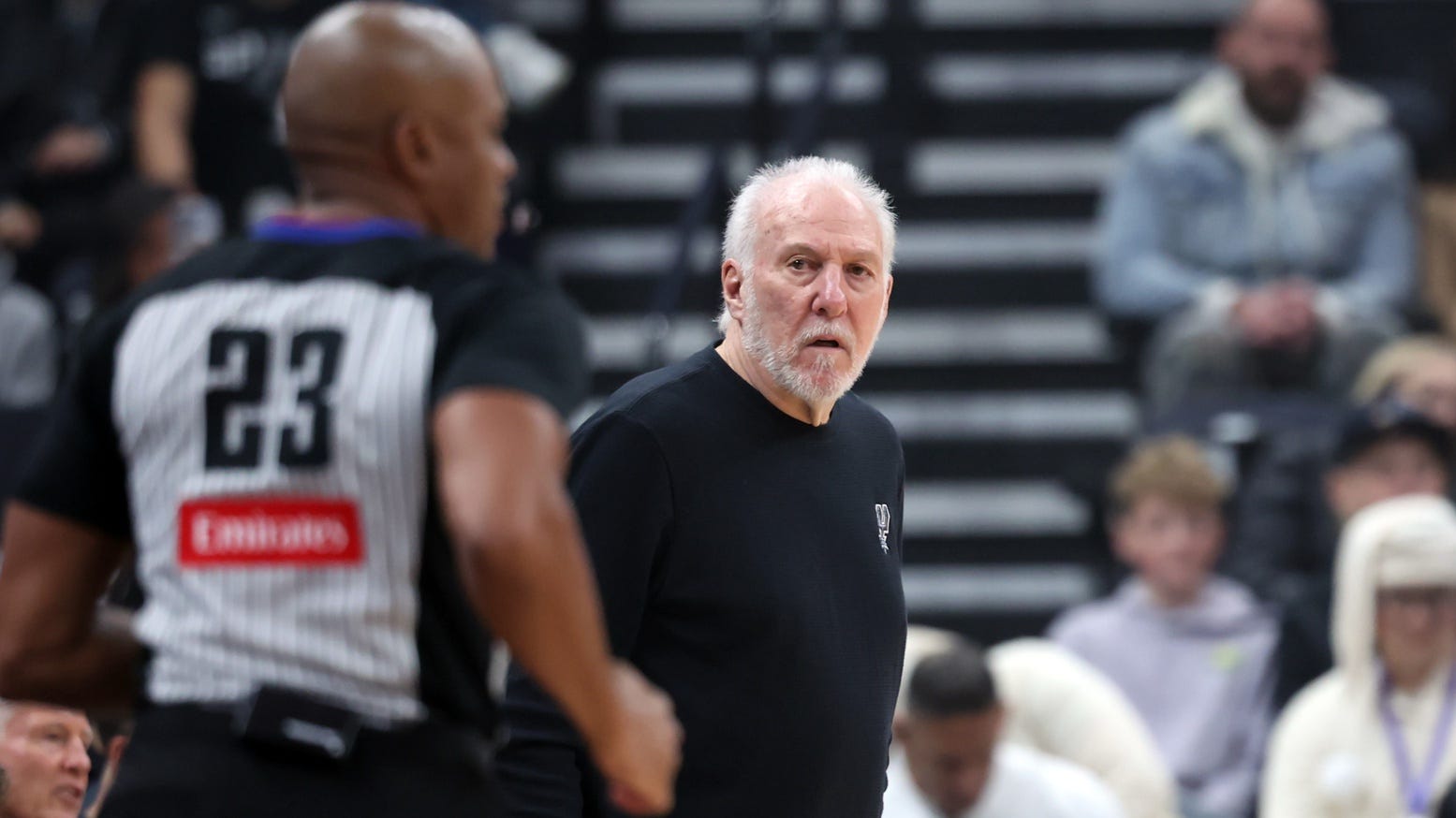

Spurs Coach Gregg Popovich No Expected Return Date For Health Issues

Feb 24, 2025

Spurs Coach Gregg Popovich No Expected Return Date For Health Issues

Feb 24, 2025 -

Como Ver El Partido La Palmas Vs Barcelona En Vivo Por Streaming

Feb 24, 2025

Como Ver El Partido La Palmas Vs Barcelona En Vivo Por Streaming

Feb 24, 2025