Expert Analysis: Why A Trump Dogecoin Dividend Is A Bad Idea

Table of Contents

Expert Analysis: Why a Trump Dogecoin Dividend Is a Bad Idea

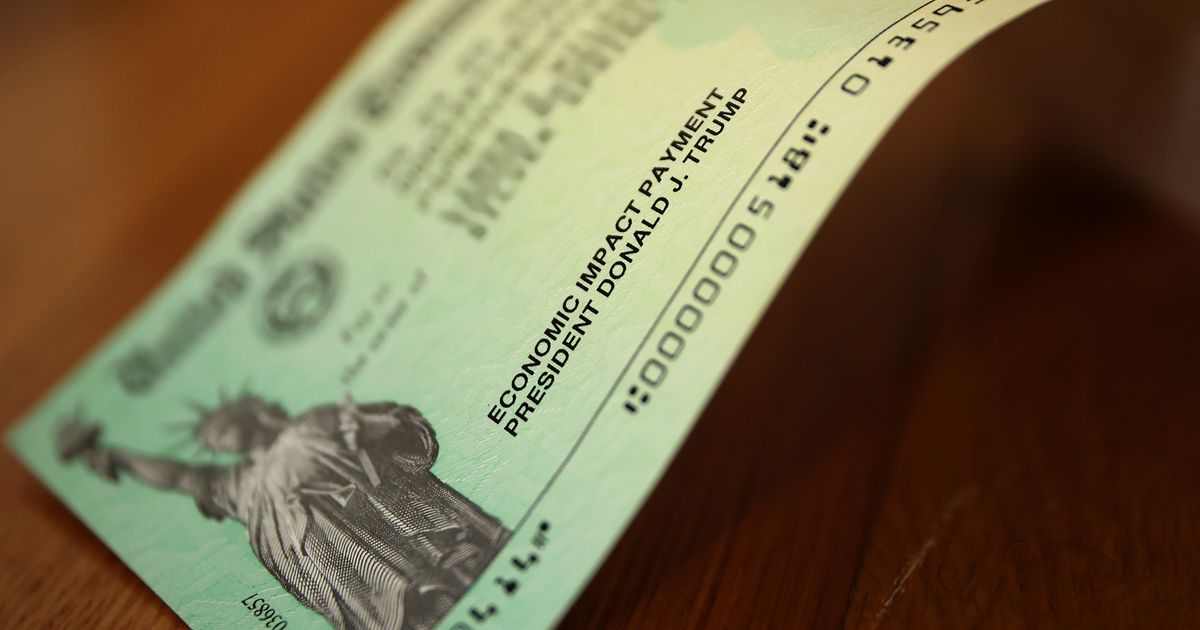

A Trump-branded Dogecoin dividend? Experts warn of a multitude of legal, financial, and ethical pitfalls should such a plan materialize.

Washington, D.C. – Speculation surrounding a potential Dogecoin dividend distributed by a Donald Trump-affiliated entity has sparked widespread concern among legal and financial experts. While concrete details remain scarce, the mere suggestion raises significant red flags across multiple domains. The potential for market manipulation, regulatory violations, and investor harm is substantial, according to several leading analysts.

The idea, seemingly floated in online discussions and lacking official confirmation from any Trump organization, proposes a distribution of Dogecoin tokens to investors or supporters. However, experts caution that such a move would likely encounter considerable obstacles.

Legal Hurdles: Securities laws would pose a significant challenge. If the distribution is deemed a security offering, it would require registration with the Securities and Exchange Commission (SEC). Failure to comply could result in hefty fines and legal repercussions for all involved parties. Furthermore, the nature of Dogecoin itself – a cryptocurrency not backed by any tangible asset – further complicates the legal landscape. Experts at the law firm [Name of Law Firm, e.g., Miller & Zois LLP] have noted the significant risk of SEC scrutiny and potential lawsuits stemming from misrepresentation or investor fraud claims. The lack of clear disclosure regarding the source of the Dogecoin, the method of distribution, and the potential risks involved would further increase the legal vulnerabilities.

Financial Risks: The volatility of Dogecoin presents a major financial risk. Dogecoin's price is notoriously susceptible to wild swings driven by speculation and social media trends, not fundamental value. Distributing it as a dividend could expose recipients to substantial financial losses if the price drops significantly after distribution. The inherent risk of investing in cryptocurrencies, amplified by the unpredictable nature of Dogecoin, makes this a highly precarious proposition for any recipients. Financial experts at [Name of Financial Institution, e.g., The Brookings Institution] have warned that such a dividend could easily backfire, leaving participants with significant losses and potentially damaging public trust in any related organizations.

Ethical Concerns: Beyond the legal and financial considerations, ethical questions abound. The lack of transparency surrounding the proposed dividend raises concerns about potential conflicts of interest and the fairness of distribution. Questions remain about who would be eligible for the dividend, the mechanism for distribution, and whether the process would be equitable and devoid of manipulation. [Name of Ethics Expert or Organization, e.g., Professor Jane Doe, Harvard Business School] has highlighted that such a plan, lacking transparency and objective criteria, raises serious ethical concerns regarding fairness and potential exploitation of supporters.

Market Impact: The sheer scale of a hypothetical Trump-branded Dogecoin dividend, even if implemented with perfect legality, could profoundly impact the cryptocurrency market. A sudden influx of Dogecoin into circulation could potentially depress its price, leading to significant losses for existing holders and creating broader market instability. Analysts at [Name of Financial News Source, e.g., Bloomberg] have modeled potential scenarios and concluded that such a large-scale distribution could destabilize the already volatile Dogecoin market.

Conclusion: The proposal of a Trump Dogecoin dividend, while lacking official confirmation, underscores the potential for significant legal, financial, and ethical challenges. Until clear, transparent details emerge, experts across various fields strongly advise caution and skepticism, warning against the considerable risks associated with any involvement. The absence of verifiable details only amplifies concerns. Further investigation and transparent communication from any involved party are essential to mitigate the considerable risks associated with this highly speculative idea.

Featured Posts

-

Elon Musk And Steve Bannons Ties To Germanys Far Right Af D Party

Feb 25, 2025

Elon Musk And Steve Bannons Ties To Germanys Far Right Af D Party

Feb 25, 2025 -

Who Is Supporting The Af D Analyzing The Involvement Of Musk And Vance

Feb 25, 2025

Who Is Supporting The Af D Analyzing The Involvement Of Musk And Vance

Feb 25, 2025 -

Trumps Challenge To Global Order And Us Bureaucracy An Analysis

Feb 25, 2025

Trumps Challenge To Global Order And Us Bureaucracy An Analysis

Feb 25, 2025 -

Internal Email From Doge Document Your Work Or Prepare To Resign

Feb 25, 2025

Internal Email From Doge Document Your Work Or Prepare To Resign

Feb 25, 2025 -

Three Years After Invasion Ukraines Ongoing Struggle For Survival

Feb 25, 2025

Three Years After Invasion Ukraines Ongoing Struggle For Survival

Feb 25, 2025

Latest Posts

-

The Conclave Timothee Chalamet And Demi Moore Among Sag Awards Winners

Feb 25, 2025

The Conclave Timothee Chalamet And Demi Moore Among Sag Awards Winners

Feb 25, 2025 -

Women Stand By Luigi Mangione Key Figures In His Legal Battle

Feb 25, 2025

Women Stand By Luigi Mangione Key Figures In His Legal Battle

Feb 25, 2025 -

Ukraines War A Renewed Existential Threat After Three Years

Feb 25, 2025

Ukraines War A Renewed Existential Threat After Three Years

Feb 25, 2025 -

Los Angeles Burned Lots Should You Invest After The Fires

Feb 25, 2025

Los Angeles Burned Lots Should You Invest After The Fires

Feb 25, 2025 -

Surprise Collaboration Lara Trump Featuring French Montana

Feb 25, 2025

Surprise Collaboration Lara Trump Featuring French Montana

Feb 25, 2025