Impact Of Dogecoin Layoffs On Tesla's Regulatory Oversight

Table of Contents

Dogecoin Layoffs and Tesla's Regulatory Oversight: An Unlikely Connection?

PALO ALTO, CA – The recent wave of layoffs at various cryptocurrency-related companies, including those indirectly impacting Dogecoin's ecosystem, has raised questions about the potential ripple effects on Tesla's regulatory landscape. While there's no direct causal link between Dogecoin layoffs and Tesla's oversight, the interconnectedness of the financial world, particularly in the volatile crypto market, warrants a closer examination. This article explores the potential indirect impacts and clarifies any misunderstandings.

The Dogecoin Layoff Context: The cryptocurrency market has experienced significant volatility in recent months, leading to several companies implementing cost-cutting measures, including layoffs. While [Specific company names and the number of layoffs attributed to the Dogecoin market downturn] are not directly tied to Tesla, the overall downturn in the crypto market's value inevitably impacts investor sentiment and confidence across the board. This broader negative sentiment could, in theory, influence regulatory scrutiny of companies with substantial cryptocurrency holdings or exposure, like Tesla.

Tesla's Regulatory Exposure: Tesla, under CEO Elon Musk, has made significant forays into the cryptocurrency market. Its well-publicized investments in Bitcoin and previous acceptance of Dogecoin as payment for some products have made it a subject of increased regulatory interest. [Specify any recent regulatory actions or inquiries faced by Tesla related to crypto]. These actions highlight the ongoing tension between the innovative spirit of the crypto market and the desire for robust regulatory frameworks to protect investors and prevent market manipulation.

Indirect Impacts: While there's no direct evidence linking the specific layoffs in the Dogecoin ecosystem to increased regulatory pressure on Tesla, a connection can be indirectly established through the following:

- Market Sentiment: Negative sentiment towards cryptocurrencies following major layoffs can impact the overall valuation of cryptocurrencies and potentially decrease investor confidence in companies heavily involved in the market. This decreased confidence might indirectly influence regulatory bodies to increase their scrutiny of companies like Tesla.

- Investor Pressure: Shareholders concerned about Tesla's cryptocurrency investments, fueled by the negative news surrounding Dogecoin layoffs and the broader crypto market downturn, might pressure the company to adopt a more cautious approach, potentially leading to changes in its crypto strategy. This shift could then trigger regulatory reviews or increased reporting requirements.

- Increased Scrutiny of Related Industries: Layoffs within the cryptocurrency space may prompt regulators to broaden their investigations into associated industries and companies with significant ties to the crypto market. This could lead to increased scrutiny of Tesla, not because of its direct involvement in the specific layoffs, but due to its prominent position in the broader ecosystem.

Absence of Direct Causation: It's crucial to emphasize that the layoffs at Dogecoin-related companies are not the direct cause of increased regulatory oversight of Tesla. Instead, they form part of a larger context of market volatility and increased regulatory attention towards cryptocurrencies. Tesla's regulatory challenges stem largely from its own actions and decisions regarding cryptocurrency adoption and investments, rather than from the specific layoffs.

Conclusion: The ripple effects of the cryptocurrency downturn and related layoffs are complex and multifaceted. While there's no direct link between Dogecoin layoffs and heightened regulatory scrutiny of Tesla, the interconnected nature of the financial world means that broader market trends and sentiment can indirectly influence regulatory actions. Further investigation is needed to fully understand the long-term implications of these events on Tesla and the cryptocurrency market as a whole. The situation underscores the need for clear and comprehensive regulations in the rapidly evolving crypto landscape to balance innovation with investor protection.

Featured Posts

-

Dont Trust Putins Propaganda The Truth Behind Journalists Name S Death

Feb 22, 2025

Dont Trust Putins Propaganda The Truth Behind Journalists Name S Death

Feb 22, 2025 -

Hunter Schafer Addresses Passport Gender Change To Male

Feb 22, 2025

Hunter Schafer Addresses Passport Gender Change To Male

Feb 22, 2025 -

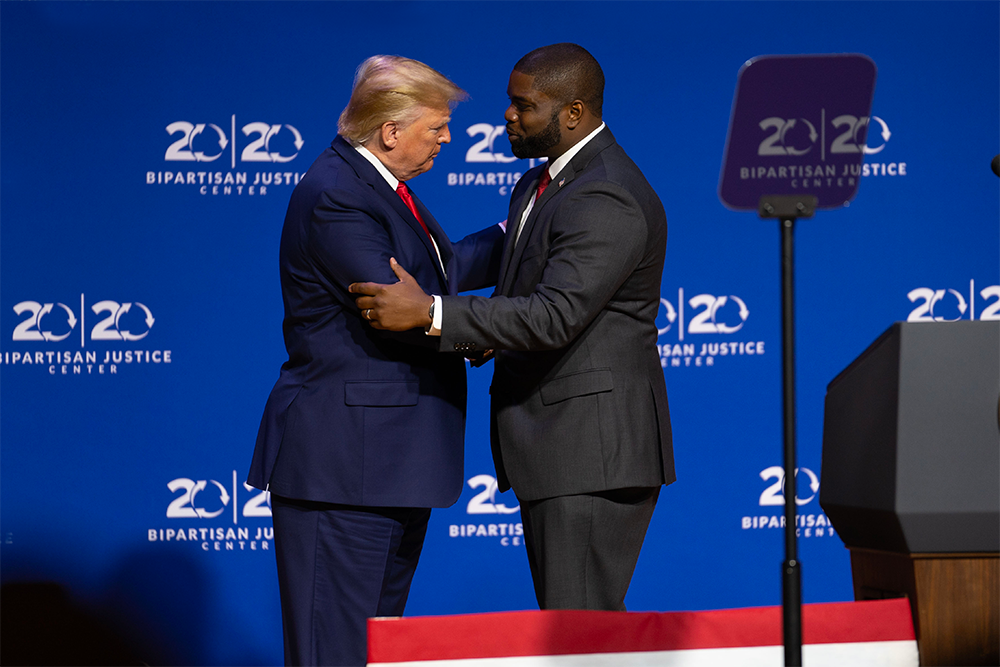

Donalds For Speaker Trumps Implicit Support

Feb 22, 2025

Donalds For Speaker Trumps Implicit Support

Feb 22, 2025 -

Complete Your Reacher Experience 7 Books To Read Now

Feb 22, 2025

Complete Your Reacher Experience 7 Books To Read Now

Feb 22, 2025 -

Knicks Vs Cavaliers 2025 Nba Matchup Odds Prediction And When To Watch

Feb 22, 2025

Knicks Vs Cavaliers 2025 Nba Matchup Odds Prediction And When To Watch

Feb 22, 2025

Latest Posts

-

Meet The Women Supporting Luigi Mangione In Court

Feb 23, 2025

Meet The Women Supporting Luigi Mangione In Court

Feb 23, 2025 -

Live Blog Aston Villa Vs Chelsea Premier League Match

Feb 23, 2025

Live Blog Aston Villa Vs Chelsea Premier League Match

Feb 23, 2025 -

West Hams Bowen Downs Arsenal In 1 0 Thriller

Feb 23, 2025

West Hams Bowen Downs Arsenal In 1 0 Thriller

Feb 23, 2025 -

Millwall Match Report In Depth Derby County Player Ratings

Feb 23, 2025

Millwall Match Report In Depth Derby County Player Ratings

Feb 23, 2025 -

Lafcs Ebobisse Opens 2025 Mls Season With Stunning Goal

Feb 23, 2025

Lafcs Ebobisse Opens 2025 Mls Season With Stunning Goal

Feb 23, 2025