IRS Blocked From Accessing DOGE Taxpayer Information Via Treasury

Table of Contents

IRS Blocked from Accessing DOGE Taxpayer Information: Treasury Department Intervention Highlights Crypto Tax Reporting Challenges

WASHINGTON, D.C. – The Internal Revenue Service (IRS) has been temporarily blocked from accessing taxpayer information related to Dogecoin (DOGE) transactions, following an intervention by the Department of the Treasury. The unprecedented move highlights the ongoing struggle the IRS faces in navigating the complexities of cryptocurrency taxation and the urgent need for clearer guidelines and technological infrastructure to handle the rapidly evolving digital asset landscape.

Sources within the Treasury Department, speaking on condition of anonymity due to the sensitivity of the matter, confirmed that the block was implemented earlier this week [Date of Block]. The decision stemmed from concerns about the potential for data breaches and the lack of robust systems within the IRS to accurately process and analyze the vast amounts of data associated with DOGE transactions. While the IRS possesses the authority to access taxpayer data through established channels, the Treasury Department raised concerns that the current infrastructure is insufficient to ensure the security and privacy of sensitive financial information related to the meme-based cryptocurrency.

The blockage specifically targets data related to DOGE transactions, reflecting the unique challenges posed by its decentralized nature and widespread adoption among individual investors. Unlike traditional financial assets, DOGE transactions are recorded on a public blockchain, which makes them technically accessible. However, the sheer volume of transactions and the complexity of linking them to specific taxpayers presents a significant hurdle for the IRS's existing systems.

This situation underscores a broader issue: the IRS's capacity to effectively enforce tax laws related to cryptocurrencies lags far behind the rapid growth of the digital asset market. The agency has acknowledged these shortcomings, requesting additional funding and personnel to address the challenge. However, the process of upgrading systems and training personnel is slow and complex, leaving a gap in enforcement capabilities.

[Insert quote from IRS spokesperson acknowledging the situation and outlining steps being taken to address it. If no official statement is available, replace with a statement from a tax expert on the implications of the situation]. "The IRS is committed to ensuring that all taxpayers comply with their tax obligations, regardless of the asset involved," [Spokesperson Name/Tax Expert Name] stated. "[Quote about strategies to improve data processing and enhance security]. This situation underscores the need for Congress to provide the necessary resources to update our technology and training protocols."

The temporary blockage of DOGE-related data access is not expected to significantly delay tax audits, as the IRS has access to other forms of taxpayer data. However, it does highlight a critical vulnerability in the system and the urgent need for legislative action and technological modernization to ensure effective and secure tax collection in the digital age. The incident also raises questions about the long-term implications for the taxation of other cryptocurrencies and the broader regulatory landscape for the digital asset industry.

[Insert quote from a crypto expert on the implications of this blockage for the broader crypto market and investor confidence. If no statement is available, summarize expert opinions on the impact.]

The Treasury Department’s intervention serves as a strong signal that the government is taking seriously the challenges of regulating the cryptocurrency market. The immediate focus is on rectifying the technical and security concerns to ensure responsible data handling. However, this incident is likely to accelerate the calls for clearer regulatory frameworks and significant investment in technology to ensure the IRS can effectively manage the tax implications of this rapidly expanding sector. The long-term solution requires a multifaceted approach, encompassing improved technology, increased staffing, and perhaps, even revisions to the tax code itself to reflect the unique characteristics of digital assets.

Featured Posts

-

Third Term For Trump Legal Experts Weigh In On Unconstitutional Idea

Feb 22, 2025

Third Term For Trump Legal Experts Weigh In On Unconstitutional Idea

Feb 22, 2025 -

Analysis Of Severance Season 2 Episode 6 Cards On The Table

Feb 22, 2025

Analysis Of Severance Season 2 Episode 6 Cards On The Table

Feb 22, 2025 -

Monkey Habitats And Conservation

Feb 22, 2025

Monkey Habitats And Conservation

Feb 22, 2025 -

Starmers Us Trip Potential Problems Worrying Government Officials

Feb 22, 2025

Starmers Us Trip Potential Problems Worrying Government Officials

Feb 22, 2025 -

Statement By Leader Jeffries On Death Of Congresswoman Representatives Last Name

Feb 22, 2025

Statement By Leader Jeffries On Death Of Congresswoman Representatives Last Name

Feb 22, 2025

Latest Posts

-

Arsenal Vs West Ham United Free Live Stream February 22nd 2025 Match Details

Feb 24, 2025

Arsenal Vs West Ham United Free Live Stream February 22nd 2025 Match Details

Feb 24, 2025 -

Derby County 0 1 Millwall Match Summary And Goals

Feb 24, 2025

Derby County 0 1 Millwall Match Summary And Goals

Feb 24, 2025 -

Pope Francis Hospital Stay Vatican Confirms Critical Condition

Feb 24, 2025

Pope Francis Hospital Stay Vatican Confirms Critical Condition

Feb 24, 2025 -

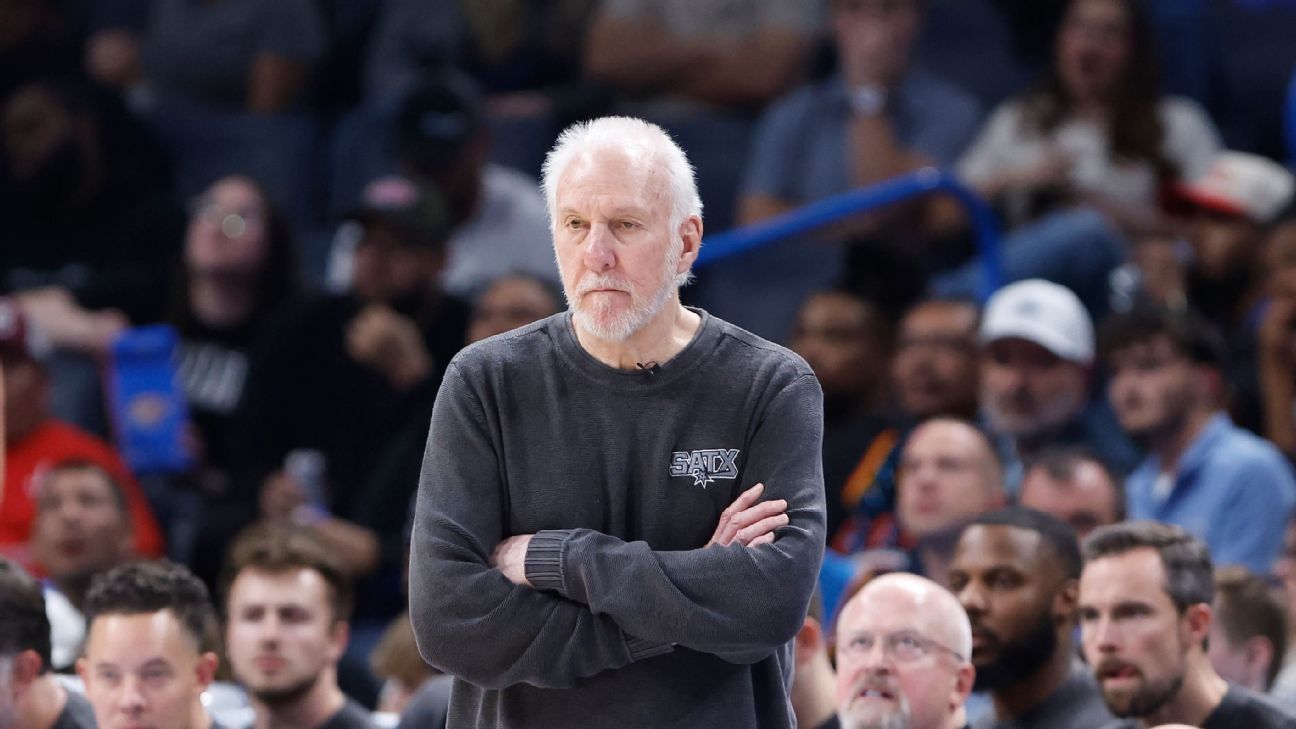

Popovichs Spurs Future Uncertain Coach Not Expected Back This Season

Feb 24, 2025

Popovichs Spurs Future Uncertain Coach Not Expected Back This Season

Feb 24, 2025 -

Best Ways To Watch Mls Soccer La Galaxy Lafc Inter Miami And More

Feb 24, 2025

Best Ways To Watch Mls Soccer La Galaxy Lafc Inter Miami And More

Feb 24, 2025