IRS Blocked From Accessing Dogecoin Taxpayer Data By Treasury

Table of Contents

IRS Blocked From Accessing Dogecoin Taxpayer Data by Treasury

WASHINGTON, D.C. – The Internal Revenue Service (IRS) has been prevented from accessing taxpayer data related to Dogecoin transactions, according to multiple sources familiar with the matter. The Treasury Department, citing concerns over privacy and the volatile nature of cryptocurrency, has blocked the IRS's request for direct access to this information. This decision comes amidst growing scrutiny of cryptocurrency taxation and the IRS's efforts to bolster its capabilities in this area.

The IRS had sought access to transaction records held by cryptocurrency exchanges and payment processors, including data specifically related to Dogecoin, a meme-based cryptocurrency that has seen significant price fluctuations in recent years. The agency argued this access was crucial to effectively enforce existing tax laws and ensure compliance, pointing to the increasing prevalence of cryptocurrency transactions in everyday commerce. Sources familiar with the internal deliberations suggest the IRS believed direct access was a far more efficient method than relying on voluntary reporting from taxpayers.

However, the Treasury Department, which oversees the IRS, raised significant objections. Concerns were expressed about potential violations of taxpayer privacy, particularly given the potentially sensitive nature of financial information related to cryptocurrency holdings. Furthermore, the Treasury Department reportedly highlighted the inherent complexities and volatility of the cryptocurrency market, arguing that current methods of tracking and valuing cryptocurrency transactions may not be adequate to accurately assess tax liability. The volatile nature of Dogecoin, known for its dramatic price swings, further exacerbated these concerns.

The blockage has created a significant challenge for the IRS. While the agency still retains the ability to pursue investigations into individual taxpayers suspected of tax evasion involving Dogecoin or other cryptocurrencies, the lack of direct access to comprehensive transaction data significantly hinders its efforts. This approach is far more time-consuming and resource-intensive, requiring the IRS to rely on individual taxpayer returns and potentially launch extensive audits.

This move by the Treasury Department also underscores the ongoing debate surrounding the regulation and taxation of cryptocurrencies. The lack of clear and consistent regulatory frameworks across the globe presents numerous challenges for tax authorities attempting to navigate the complexities of this rapidly evolving sector. This incident highlights the tension between the government’s need to collect taxes efficiently and the imperative to protect taxpayer privacy in the face of emerging technologies.

Several experts in tax law and cryptocurrency regulation have weighed in on the matter. Professor [Name of Tax Law Professor], from [University Name], commented that "[Quote about the implications of the Treasury's decision on tax compliance and cryptocurrency regulation]." Similarly, [Name of Cryptocurrency Analyst] from [Financial Institution/Analyst Firm] noted that "[Quote about the challenges of regulating and taxing cryptocurrencies given their volatility and decentralized nature]."

The Treasury Department has not issued a public statement on the matter. However, sources indicate that internal discussions are ongoing to explore alternative methods of obtaining cryptocurrency transaction data that balance the needs of tax enforcement with the preservation of taxpayer privacy. This includes exploring data sharing agreements with cryptocurrency exchanges and potentially developing new technologies and frameworks for tracking and assessing cryptocurrency transactions for tax purposes. The future of IRS access to Dogecoin and other cryptocurrency transaction data remains uncertain, leaving the effectiveness of cryptocurrency tax enforcement in question. The situation underscores the ongoing challenge of regulating a rapidly evolving digital asset landscape.

Featured Posts

-

Michigan Wolverines Extend Head Coach Dusty Mays Contract

Feb 22, 2025

Michigan Wolverines Extend Head Coach Dusty Mays Contract

Feb 22, 2025 -

Sunwing Airlines Offers 30 000 To Passengers Following Toronto Landing

Feb 22, 2025

Sunwing Airlines Offers 30 000 To Passengers Following Toronto Landing

Feb 22, 2025 -

The Last Of Us Season 2 New Cast Members Trailer Reveal And Air Date

Feb 22, 2025

The Last Of Us Season 2 New Cast Members Trailer Reveal And Air Date

Feb 22, 2025 -

Ukraine Condemns Trump For Repeating Kremlin Narratives On War Responsibility

Feb 22, 2025

Ukraine Condemns Trump For Repeating Kremlin Narratives On War Responsibility

Feb 22, 2025 -

Gas Discovered In Mountain Ranges A Scientific Breakthrough

Feb 22, 2025

Gas Discovered In Mountain Ranges A Scientific Breakthrough

Feb 22, 2025

Latest Posts

-

Jimmies Secure Victory Over Bruins To End Regular Season

Feb 24, 2025

Jimmies Secure Victory Over Bruins To End Regular Season

Feb 24, 2025 -

U Conns Bueckers Shines In Win Against Butler

Feb 24, 2025

U Conns Bueckers Shines In Win Against Butler

Feb 24, 2025 -

Only The Strong Survive Soul Singer Jerry Butler Passes Away At 85

Feb 24, 2025

Only The Strong Survive Soul Singer Jerry Butler Passes Away At 85

Feb 24, 2025 -

Shiri Bibas Hostage Case Remains Arrive In Tel Aviv For Identification

Feb 24, 2025

Shiri Bibas Hostage Case Remains Arrive In Tel Aviv For Identification

Feb 24, 2025 -

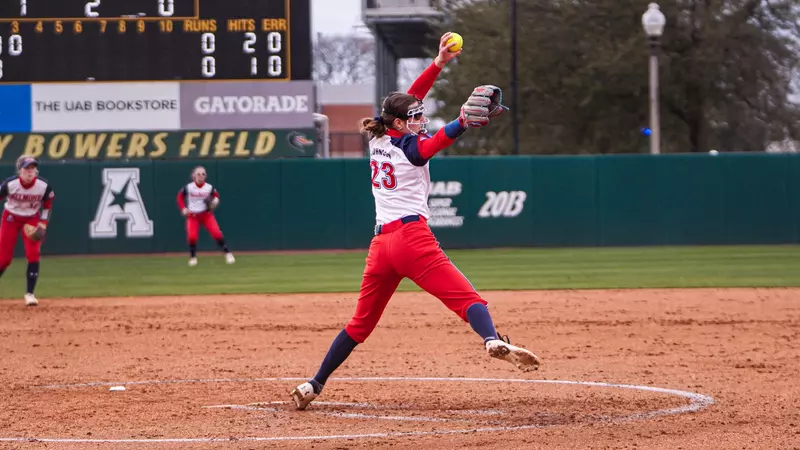

Perfect Weekend For Softball Team Now 4 0

Feb 24, 2025

Perfect Weekend For Softball Team Now 4 0

Feb 24, 2025