IRS Denied Access To Dogecoin Taxpayer Information By Treasury

Table of Contents

IRS Denied Access to Dogecoin Taxpayer Information: Treasury Department Blocks Data Sharing

WASHINGTON, D.C. – The Internal Revenue Service (IRS) has been denied access to taxpayer information related to Dogecoin transactions, according to multiple sources familiar with the matter. The Treasury Department, citing concerns over privacy and the volatile nature of cryptocurrency, has blocked the IRS's request for access to this data held by financial institutions. This decision has sparked debate over the agency's ability to effectively enforce tax laws in the rapidly evolving digital asset landscape.

The IRS had sought access to transaction records held by cryptocurrency exchanges and other financial intermediaries that facilitated Dogecoin trades. This data would have been crucial in identifying taxpayers who may have failed to properly report capital gains or losses from their Dogecoin holdings. The agency's request, submitted [in the second quarter of 2023, according to sources], was part of a broader effort to improve tax compliance in the cryptocurrency market. [Specific details regarding the number of taxpayers involved or the estimated amount of unreported taxes are currently unavailable due to the sensitive nature of the information and the ongoing internal review.].

The Treasury Department's decision to deny the IRS access to this data hinges on several key factors. Sources within the Treasury suggest that concerns about the privacy of taxpayer information played a significant role. The department reportedly expressed anxieties that the sheer volume of data involved could potentially expose sensitive personal information to unauthorized access or misuse, even with robust security measures in place.

Furthermore, the volatile nature of Dogecoin and other cryptocurrencies added to the Treasury's apprehension. The fluctuating value of Dogecoin makes accurate tax assessments challenging, and the department is reportedly hesitant to pursue aggressive tax enforcement until clearer regulatory frameworks are established. This cautious approach contrasts with the IRS's more assertive pursuit of tax compliance in the traditional financial markets.

[The Office of the Comptroller of the Currency (OCC), a key player in regulating national banks' involvement with cryptocurrencies, has not issued a formal statement regarding its position on this matter. However, sources within the OCC suggest a prevailing sentiment of caution and a desire for clearer legislative guidelines before expanding data sharing initiatives].

This situation highlights the complexities facing tax authorities in regulating the cryptocurrency market. While the IRS strives to ensure fair tax collection, it faces bureaucratic obstacles and concerns about data security. This lack of access to crucial transaction data leaves a significant gap in the IRS's ability to monitor and enforce tax compliance concerning cryptocurrencies, potentially leading to lost revenue and increased inequity in the tax system.

The controversy underscores the urgent need for comprehensive legislation and regulatory clarity regarding cryptocurrency taxation. Experts suggest that a clearer legal framework would not only address privacy concerns but also provide the IRS with the necessary tools to effectively enforce tax laws in the digital asset space. Until such legislation is enacted, situations like this are likely to continue, leaving both the IRS and taxpayers in a state of uncertainty.

[The IRS has declined to comment publicly on the matter, citing ongoing internal discussions and the sensitivity of the issue. The Treasury Department has also yet to issue an official statement. However, multiple sources confirm the existence of internal deliberations regarding future data-sharing initiatives between these agencies]. The outcome of these internal deliberations will significantly shape the future of cryptocurrency taxation in the United States.

Featured Posts

-

Watch Leicester City Vs Brentford Premier League Live Stream Info

Feb 23, 2025

Watch Leicester City Vs Brentford Premier League Live Stream Info

Feb 23, 2025 -

Britains Got Talent Ksi Meets The Judges

Feb 23, 2025

Britains Got Talent Ksi Meets The Judges

Feb 23, 2025 -

Treasury Blocks Doge Access To Personal Tax Information At Irs

Feb 23, 2025

Treasury Blocks Doge Access To Personal Tax Information At Irs

Feb 23, 2025 -

Everton Fight Back To 2 2 Draw Against Man Utd Match Stats

Feb 23, 2025

Everton Fight Back To 2 2 Draw Against Man Utd Match Stats

Feb 23, 2025 -

2 1 Victory For Aston Villa Over Chelsea Post Match Report

Feb 23, 2025

2 1 Victory For Aston Villa Over Chelsea Post Match Report

Feb 23, 2025

Latest Posts

-

Pope Francis Condition Worsens Vatican Announces Critical Status

Feb 23, 2025

Pope Francis Condition Worsens Vatican Announces Critical Status

Feb 23, 2025 -

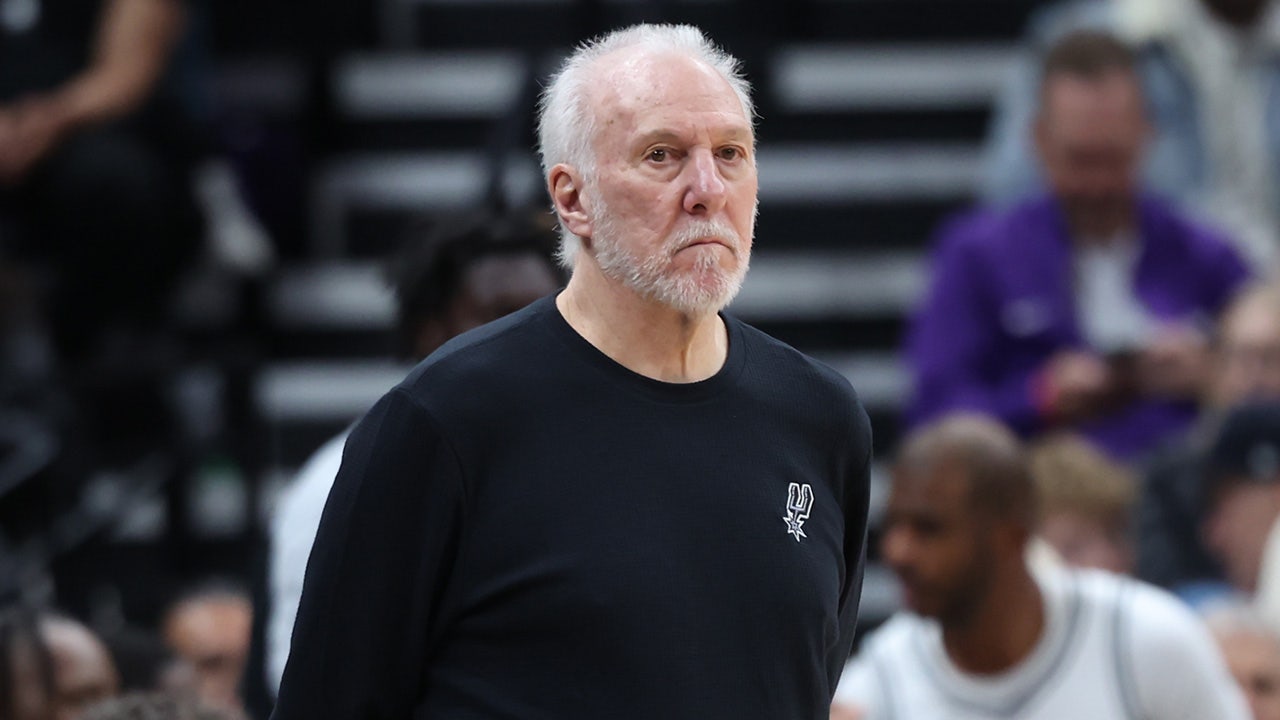

End Of An Era Gregg Popovichs Coaching Career May Be Over

Feb 23, 2025

End Of An Era Gregg Popovichs Coaching Career May Be Over

Feb 23, 2025 -

Parkers Explosive Knockout Ends Bakole Fight Early

Feb 23, 2025

Parkers Explosive Knockout Ends Bakole Fight Early

Feb 23, 2025 -

Lawyer Moves To Withdraw From Sean Combs Legal Battle

Feb 23, 2025

Lawyer Moves To Withdraw From Sean Combs Legal Battle

Feb 23, 2025 -

Vatican Provides Update Popes Condition Critical After Illness

Feb 23, 2025

Vatican Provides Update Popes Condition Critical After Illness

Feb 23, 2025