Is A DOGE Dividend A Financially Sound Idea? Experts Weigh In.

Table of Contents

Is a DOGE Dividend a Financially Sound Idea? Experts Weigh In.

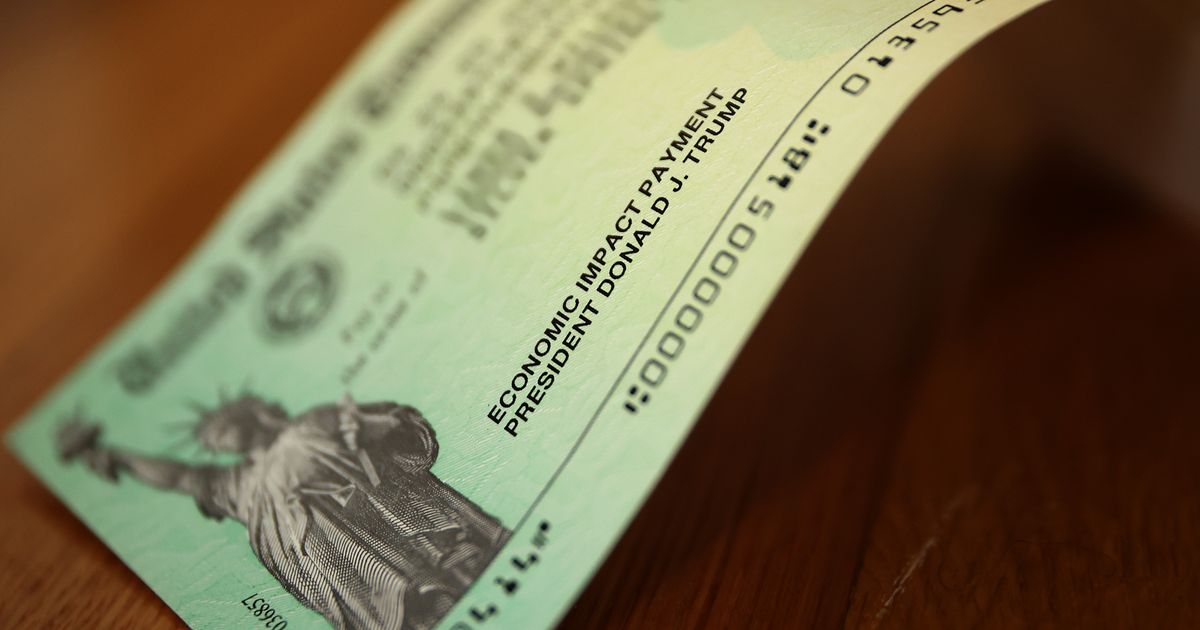

A growing number of companies are exploring the unorthodox strategy of distributing Dogecoin (DOGE) as dividends to shareholders, sparking debate among financial experts about the wisdom of this approach. While the novelty factor is undeniable, the long-term financial implications remain highly uncertain. This article examines the arguments for and against DOGE dividends, considering the volatile nature of cryptocurrency and its potential impact on investor returns and company valuations.

The Allure of the Meme Coin Dividend

The recent surge in interest in DOGE dividends stems from a confluence of factors. Firstly, the meme coin's dramatic price swings, though risky, offer the potential for significant returns. Companies considering this strategy often position it as a bold, innovative move aimed at attracting investors who are comfortable with higher-risk, higher-reward scenarios. Secondly, some proponents argue that distributing DOGE allows companies to tap into the growing cryptocurrency market and align themselves with a younger, more tech-savvy demographic. This can enhance brand image and boost engagement, particularly on social media platforms where DOGE enjoys a significant following. [Specific examples of companies that have experimented with DOGE dividends would be inserted here, if available. This would include the company name, the date of the dividend distribution, and the amount of DOGE distributed per share. Further research into SEC filings and company announcements is needed].

The Risks and Realities of Crypto Dividends

However, the financial community largely views DOGE dividends with skepticism. The cryptocurrency market is notoriously volatile, and DOGE is particularly susceptible to wild price swings driven by speculation and social media trends. This inherent volatility translates directly to significant uncertainty for shareholders receiving DOGE dividends. The value of their dividend could plummet shortly after distribution, negating any perceived benefit.

Furthermore, the lack of regulatory clarity surrounding cryptocurrency dividends presents significant legal and accounting challenges for companies. [Insert details regarding existing or proposed regulations concerning cryptocurrency dividends from relevant bodies like the SEC. Specific examples of regulatory hurdles faced by companies would strengthen this section]. The tax implications for both companies and shareholders are also complex and potentially costly, given the fluctuating nature of DOGE's value. Accurate valuation and reporting of DOGE dividends for tax purposes are significantly more challenging than with traditional dividend payouts.

[Insert quotes from at least three financial experts, including their credentials and affiliations. Their opinions on the financial soundness of DOGE dividends should be included, addressing the points raised above. For example, a quote might state "The inherent volatility of DOGE makes it a highly unsuitable asset for dividend distributions. Companies should prioritize stability and predictable returns for their shareholders." or "While the novelty might attract short-term attention, the long-term impact on investor confidence and company valuation could be detrimental."]

The Bottom Line: A Gamble, Not a Guaranteed Return

The decision to distribute DOGE as dividends presents a significant risk for companies. While it might offer a short-term boost to brand image and attract speculative investors, the potential for long-term financial harm is substantial. The volatility of DOGE, combined with regulatory uncertainties and complex tax implications, suggests that this approach lacks the financial soundness typically associated with responsible corporate dividend policies. Investors should carefully consider the risks involved before investing in companies adopting this unconventional strategy. The meme coin's allure should not overshadow the critical need for sensible financial planning and risk management. [Include a concluding statement summarizing the overall assessment of DOGE dividends as a financially sound idea, emphasizing the lack of consensus and highlighting the potential for both significant gains and devastating losses.]

Featured Posts

-

Cejudo Vs Yadong What Time Does The Fight Start

Feb 24, 2025

Cejudo Vs Yadong What Time Does The Fight Start

Feb 24, 2025 -

Wolf Pack Seek Victory After Recent Setbacks Against Opponent Name

Feb 24, 2025

Wolf Pack Seek Victory After Recent Setbacks Against Opponent Name

Feb 24, 2025 -

Rome Hospital Pope Francis Health Remains Critical Says Vatican

Feb 24, 2025

Rome Hospital Pope Francis Health Remains Critical Says Vatican

Feb 24, 2025 -

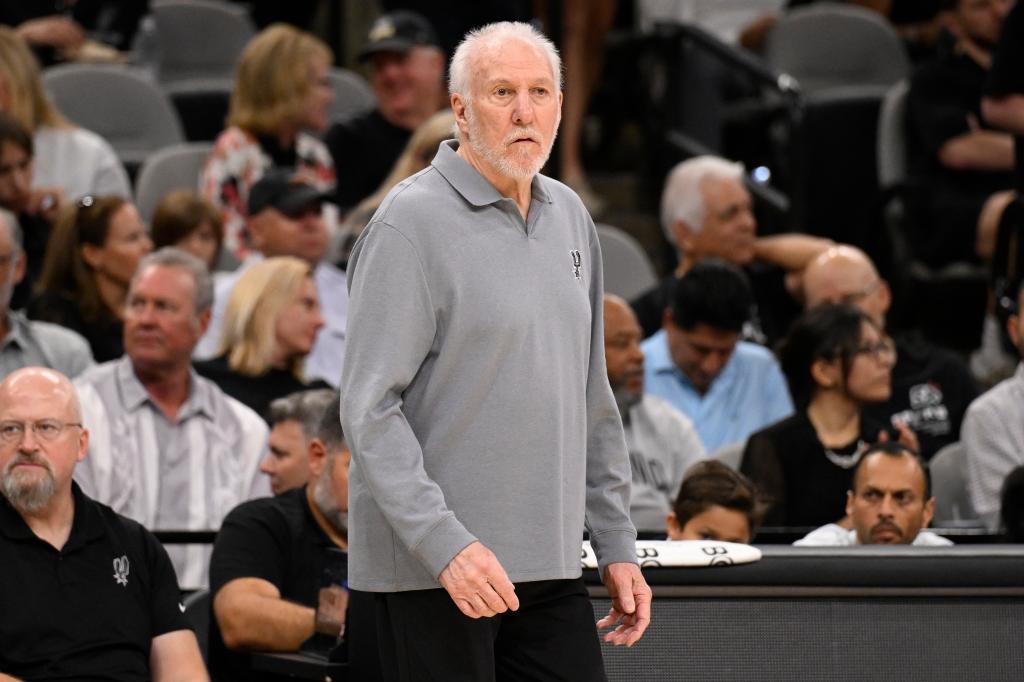

Popovichs Potential Retirement Latest Updates On Spurs Coachs Status

Feb 24, 2025

Popovichs Potential Retirement Latest Updates On Spurs Coachs Status

Feb 24, 2025 -

Josh Inglis Stars As Australia Defeats England In Champions Trophy 2025

Feb 24, 2025

Josh Inglis Stars As Australia Defeats England In Champions Trophy 2025

Feb 24, 2025

Latest Posts

-

Driver Executed Virginia Officers Police Report

Feb 24, 2025

Driver Executed Virginia Officers Police Report

Feb 24, 2025 -

Parker Defeats Bakole Retains Wbo International Heavyweight Title

Feb 24, 2025

Parker Defeats Bakole Retains Wbo International Heavyweight Title

Feb 24, 2025 -

Smith Outpoints Buatsi Claims Interim Wbo Light Heavyweight Belt

Feb 24, 2025

Smith Outpoints Buatsi Claims Interim Wbo Light Heavyweight Belt

Feb 24, 2025 -

Court Case Update Women Supporting Luigi Mangione

Feb 24, 2025

Court Case Update Women Supporting Luigi Mangione

Feb 24, 2025 -

Despite Court Order Foreign Aid Remains Disrupted Aid Groups Claim

Feb 24, 2025

Despite Court Order Foreign Aid Remains Disrupted Aid Groups Claim

Feb 24, 2025