Is A DOGE Dividend A Realistic Policy For The US?

Table of Contents

Is a DOGE Dividend a Realistic Policy for the US? A Deep Dive into Crypto-Currency and Fiscal Policy

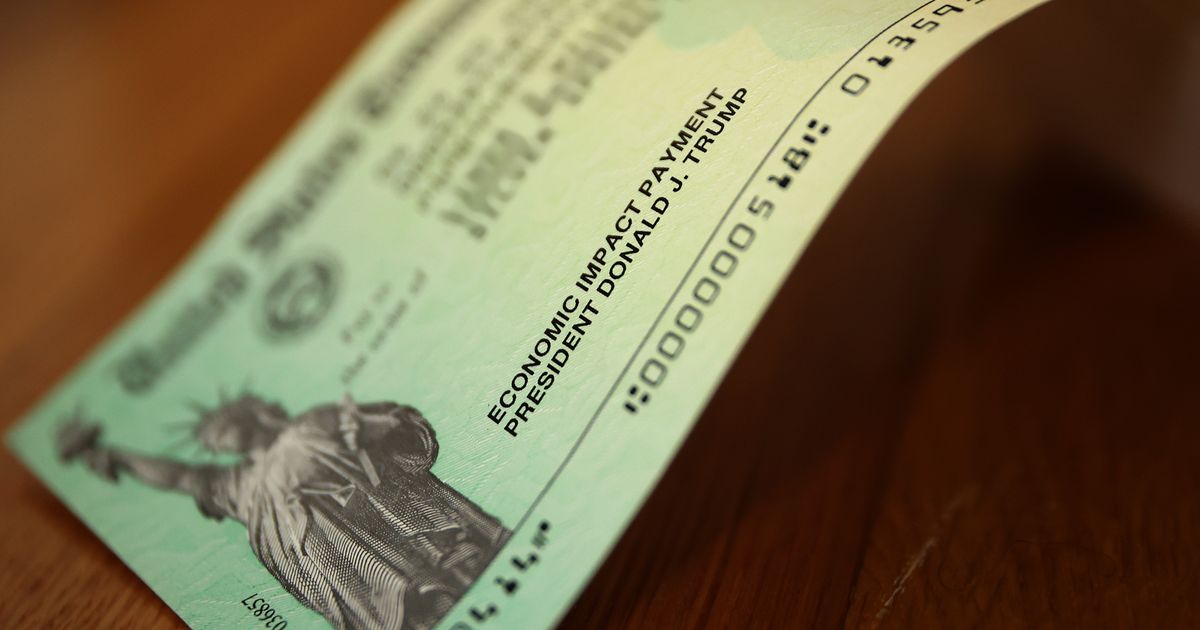

WASHINGTON, D.C. – The idea of a Dogecoin (DOGE) dividend, a proposal gaining traction in certain online circles, has sparked considerable debate among economists and policymakers. While proponents envision a unique form of economic stimulus, experts largely dismiss it as unrealistic and potentially harmful to the US economy. This article explores the feasibility of such a policy, examining its economic implications, the technical challenges, and the broader context of cryptocurrency's role in the financial system.

The core proposal, often vaguely defined, suggests distributing a certain amount of Dogecoin to every US citizen. This is fundamentally different from existing social programs that use fiat currency, posing unique challenges. Proponents claim it could boost economic activity by increasing consumer spending, particularly among lower-income groups. They point to Dogecoin’s relatively low price as a factor making a large-scale distribution potentially manageable, at least in nominal terms. However, this argument overlooks crucial elements.

Firstly, the inherent volatility of Dogecoin presents a significant risk. Unlike the stable value of the US dollar, DOGE's price is highly susceptible to market fluctuations. A dividend distributed today could be worth significantly less tomorrow, potentially rendering the program ineffective and even causing financial losses for recipients. Data from shows DOGE's price has experienced dramatic swings in the past, with periods of substantial gains followed by sharp declines. This volatility renders any calculation of the dividend's actual economic impact exceptionally uncertain and prone to error. [Historical price data from CoinMarketCap] reveals fluctuations ranging from less than a cent to over seventy cents per coin.

Secondly, the logistical challenges are immense. Distributing a cryptocurrency requires a robust and secure infrastructure capable of handling millions of transactions. The existing financial systems are not designed for such a mass distribution of a volatile digital asset. While cryptocurrency wallets are becoming more accessible, ensuring secure delivery and preventing fraud would require a massive investment in technology and oversight, the cost of which would likely outweigh any potential benefits. [Estimates for the infrastructure costs are unavailable at this time, but would likely be substantial, requiring significant investment in secure wallet technology and anti-fraud measures. Further research into comparable large-scale digital transfer projects may offer a rough estimate].

Furthermore, the economic impact of a DOGE dividend is highly questionable. While proponents suggest increased consumer spending, economists point out that the impact would depend heavily on how recipients perceive and use the DOGE. If it's seen primarily as a speculative asset rather than a form of currency, much of it may end up being traded on exchanges instead of being spent in the real economy, negating any stimulus effect. [Studies on the impact of similar unconventional economic policies are limited, but research on the efficacy of other stimulus programs utilizing fiat currency suggests that targeted aid often provides a more significant and sustainable impact.].

Beyond the practical issues, the broader policy implications raise concerns. The US government endorsing a meme-based cryptocurrency could undermine confidence in established financial institutions and currencies. It also risks creating a precedent for future, potentially more reckless, interventions in the cryptocurrency market, with unpredictable consequences. [The potential long-term effects on investor confidence and market stability remain largely unstudied and warrant further investigation. Expert opinions on the matter are varied.]

In conclusion, while the idea of a DOGE dividend may seem intriguing on the surface, a thorough analysis reveals a multitude of significant obstacles. The inherent volatility of Dogecoin, the logistical challenges of distribution, and the uncertainty of its economic impact make it a highly unrealistic and potentially damaging policy for the United States. The focus should remain on sound fiscal policy grounded in established economic principles rather than speculative ventures into the volatile world of cryptocurrencies.

Featured Posts

-

The Price Of Revenge A Mothers Journey After Her Son Is Murdered

Feb 25, 2025

The Price Of Revenge A Mothers Journey After Her Son Is Murdered

Feb 25, 2025 -

Elon Musk And Grimes A Public Dispute Over Childs Health Care

Feb 25, 2025

Elon Musk And Grimes A Public Dispute Over Childs Health Care

Feb 25, 2025 -

Learning From Peak District Parking Problems

Feb 25, 2025

Learning From Peak District Parking Problems

Feb 25, 2025 -

From Tragedy To Tribute The Story Behind A Powerful Memorial To Flight 103 Mothers

Feb 25, 2025

From Tragedy To Tribute The Story Behind A Powerful Memorial To Flight 103 Mothers

Feb 25, 2025 -

Flight 103s Legacy A Mothers Art Honors The Fallen

Feb 25, 2025

Flight 103s Legacy A Mothers Art Honors The Fallen

Feb 25, 2025

Latest Posts

-

Meet The Women Supporting Luigi Mangione A Courtroom Story

Feb 25, 2025

Meet The Women Supporting Luigi Mangione A Courtroom Story

Feb 25, 2025 -

Utah Hiking Trip Turns Perilous Backpack Saves Lost Family

Feb 25, 2025

Utah Hiking Trip Turns Perilous Backpack Saves Lost Family

Feb 25, 2025 -

Investigation Launched After Body Found In Wetsuit At Claerwen Reservoir

Feb 25, 2025

Investigation Launched After Body Found In Wetsuit At Claerwen Reservoir

Feb 25, 2025 -

2025 Insurance Woes Doctors Viral Video Explains Why

Feb 25, 2025

2025 Insurance Woes Doctors Viral Video Explains Why

Feb 25, 2025 -

Pope Francis Sleeps Peacefully Despite Critical Condition Update

Feb 25, 2025

Pope Francis Sleeps Peacefully Despite Critical Condition Update

Feb 25, 2025