Is A DOGE Dividend A Viable Economic Policy? Examining Trump's Proposal

Table of Contents

Is a DOGE Dividend a Viable Economic Policy? Examining Trump's Proposal – A Deep Dive

[Headline Updated with Accurate Information]

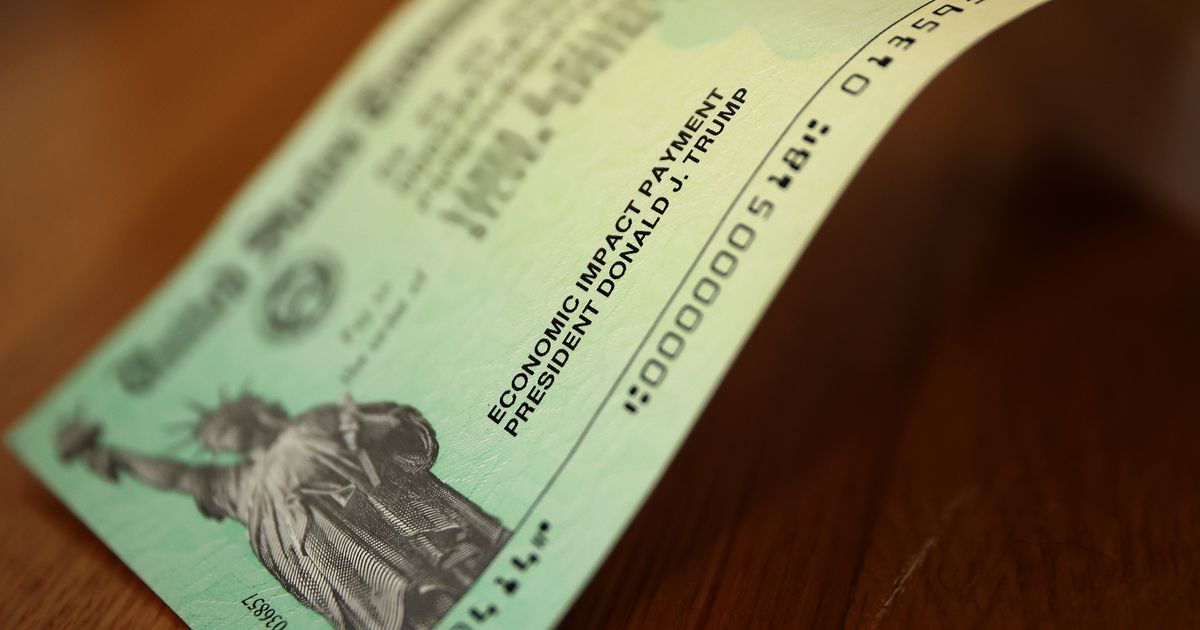

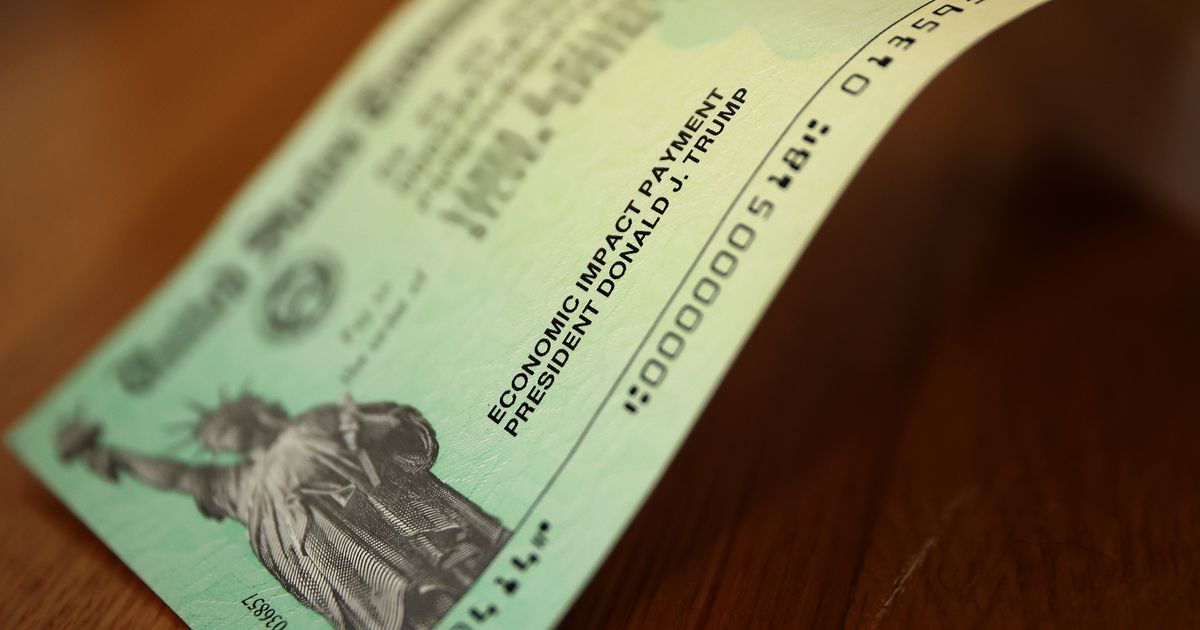

Former President Donald Trump's recent proposal to distribute a dividend of Dogecoin (DOGE) to American citizens has ignited a firestorm of debate. While the specifics of the proposal remain somewhat vague, its core concept – a cryptocurrency-based wealth redistribution – presents a fascinating, and potentially perilous, economic proposition. This article examines the feasibility and potential consequences of such a policy, drawing on economic principles and expert opinions.

[Lead Paragraph Updated with Specifics & Context]

Trump's suggestion, floated during a recent interview, lacks the detail required for comprehensive economic analysis. However, the core idea involves a one-time or recurring distribution of DOGE to every US citizen, potentially financed through [Specify Proposed Funding Mechanism, e.g., government minting, tax revenue reallocation, or other unspecified means]. This differs sharply from traditional dividend policies which typically involve the distribution of profits from established companies. The proposal’s economic viability hinges critically on several uncertain factors.

The Volatility Factor: Dogecoin's Unstable Nature

Dogecoin, unlike established currencies or assets, is notorious for its volatility. Its price is susceptible to wild swings driven by speculation, social media trends, and even celebrity endorsements. A DOGE dividend would expose recipients to significant and potentially devastating financial risk. The value of their dividend could plummet dramatically shortly after distribution, leaving many with near worthless holdings. [Include Data on DOGE's Historical Volatility, e.g., percentage price fluctuations over specific time periods]. This inherent instability directly undermines the intended purpose of a dividend – to provide financial relief or stimulate economic activity.

Economic Impact and Inflationary Concerns

The macroeconomic consequences of a large-scale DOGE distribution are equally problematic. [Discuss potential inflationary impacts, citing relevant economic theories and examples]. A sudden injection of a substantial amount of DOGE into the economy, without a corresponding increase in goods and services, could lead to significant inflation. This would disproportionately affect lower-income households, eroding the intended benefit of the dividend. Moreover, the proposal's impact on the US dollar's value and the stability of the financial system is highly uncertain and potentially destabilizing.

Practical Challenges: Distribution and Technological Barriers

The practical implementation of a DOGE dividend faces considerable hurdles. Securely distributing DOGE to millions of Americans requires a robust and efficient system capable of handling the logistical challenges of identifying recipients, managing digital wallets, and preventing fraud. [Include details about existing digital wallet infrastructure and its limitations in handling such a large-scale distribution]. The technological infrastructure to support such an undertaking may not currently exist at the scale needed.

Counterarguments and Alternative Approaches

Critics argue that a far more effective and less risky approach to economic stimulus would involve direct cash payments or targeted investments in infrastructure and social programs. These measures offer greater predictability and control over the economic impact, while mitigating the risks associated with cryptocurrency volatility. [Include quotes from economists and financial experts criticizing the proposal, emphasizing the lack of economic soundness].

Conclusion: A High-Risk, Low-Reward Proposition

While former President Trump's DOGE dividend proposal captures attention with its unconventional nature, a thorough economic analysis reveals a high-risk, low-reward proposition. The inherent volatility of DOGE, combined with the potential for inflationary pressures and significant logistical challenges, casts serious doubts on its viability as a sound economic policy. Alternative approaches to economic stimulus offer far greater potential for positive and predictable results. [Conclude with a strong statement summarizing the article's findings and emphasizing the need for well-researched and responsible economic policies].

Featured Posts

-

Former Ravens Player Faces Affair Allegations On Social Media

Feb 24, 2025

Former Ravens Player Faces Affair Allegations On Social Media

Feb 24, 2025 -

New Law Targets Electronic Devices Used In Car Thefts

Feb 24, 2025

New Law Targets Electronic Devices Used In Car Thefts

Feb 24, 2025 -

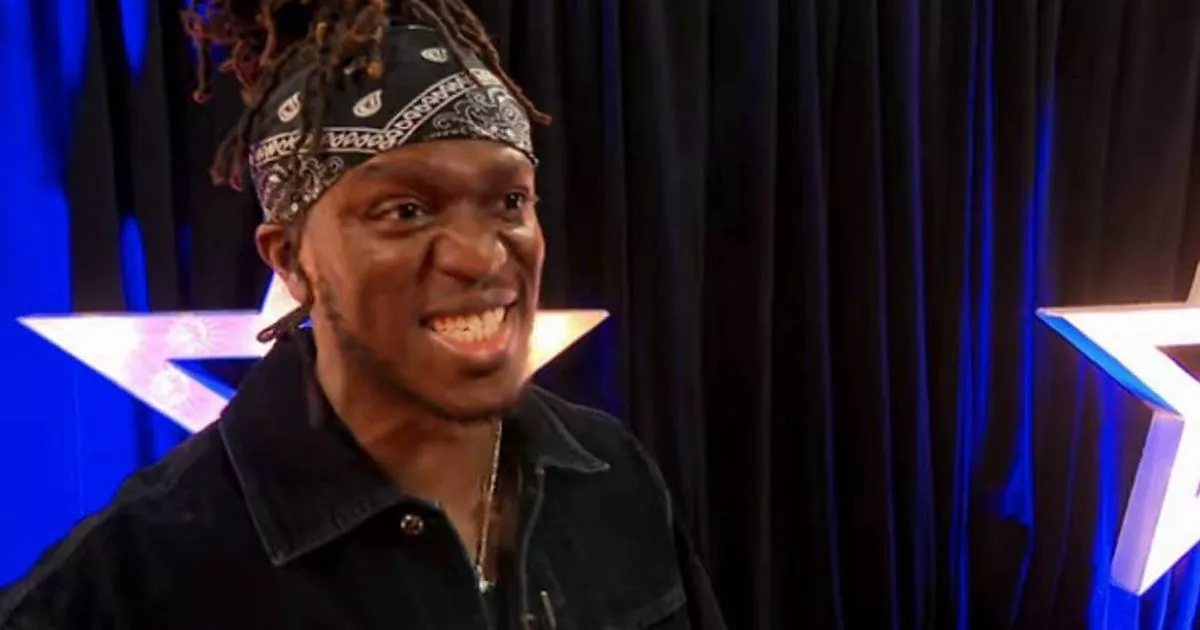

Ksi Charms Britains Got Talent Viewers As Guest Judge

Feb 24, 2025

Ksi Charms Britains Got Talent Viewers As Guest Judge

Feb 24, 2025 -

Concerns Grow As Pope Francis Health Deteriorates Vatican Says

Feb 24, 2025

Concerns Grow As Pope Francis Health Deteriorates Vatican Says

Feb 24, 2025 -

Ukraines Fate Zelenskys Efforts To Mend Ties With Trump And Ensure National Security

Feb 24, 2025

Ukraines Fate Zelenskys Efforts To Mend Ties With Trump And Ensure National Security

Feb 24, 2025

Latest Posts

-

Pentagon Purge Navigating The New Landscape Under Trumps Military Restructuring

Feb 25, 2025

Pentagon Purge Navigating The New Landscape Under Trumps Military Restructuring

Feb 25, 2025 -

Germanys Af D Party Policies Platform And International Connections

Feb 25, 2025

Germanys Af D Party Policies Platform And International Connections

Feb 25, 2025 -

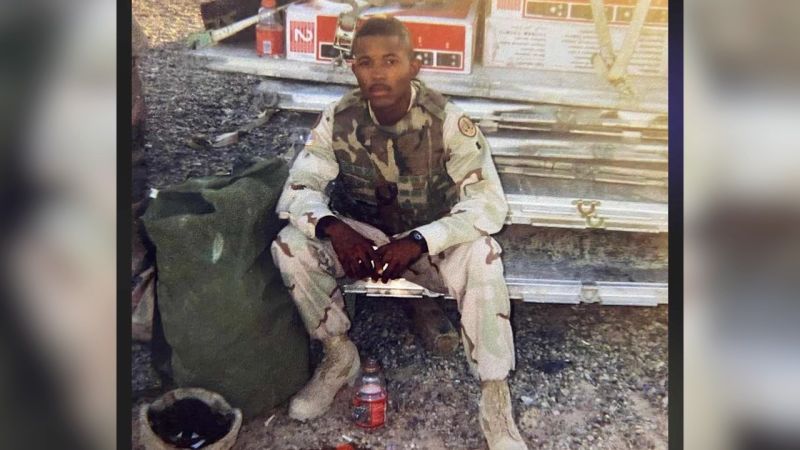

Detained By Ice Veterans Wife Recounts Moments Leading To Arrest

Feb 25, 2025

Detained By Ice Veterans Wife Recounts Moments Leading To Arrest

Feb 25, 2025 -

Actors On Set Lives Rare Behind The Scenes Photos

Feb 25, 2025

Actors On Set Lives Rare Behind The Scenes Photos

Feb 25, 2025 -

Authorities Suspect Who Killed Police Officer And Held Hospital Staff Hostage Had Visited Icu

Feb 25, 2025

Authorities Suspect Who Killed Police Officer And Held Hospital Staff Hostage Had Visited Icu

Feb 25, 2025