Is A DOGE Dividend A Viable Economic Policy? Experts Weigh In

Table of Contents

Is a DOGE Dividend a Viable Economic Policy? Experts Weigh In

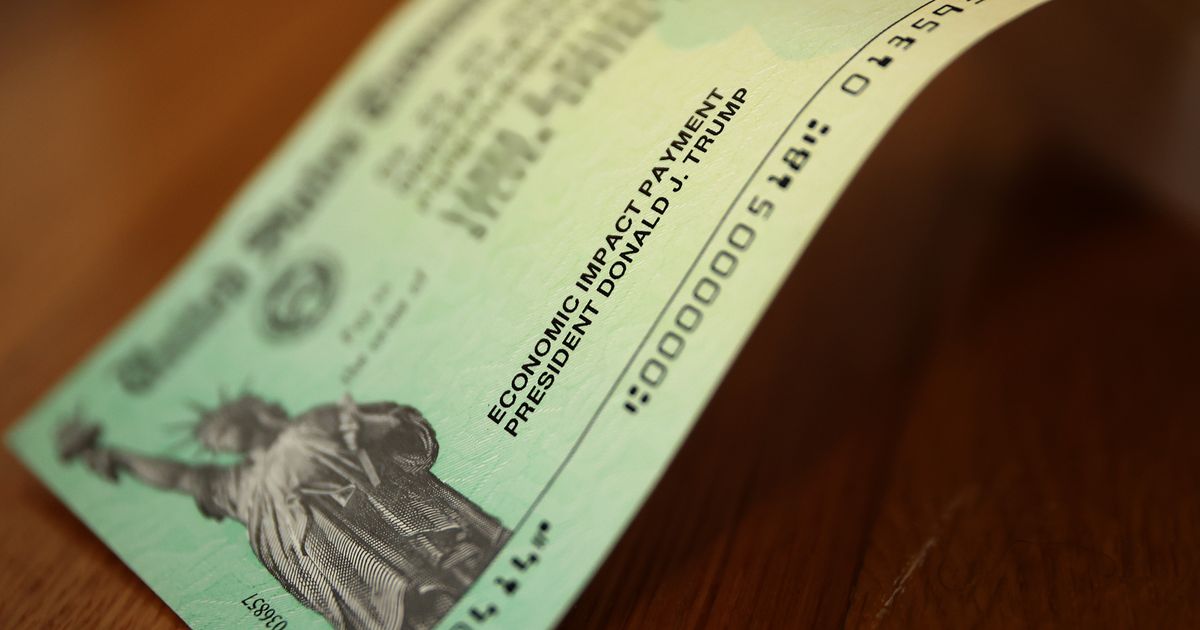

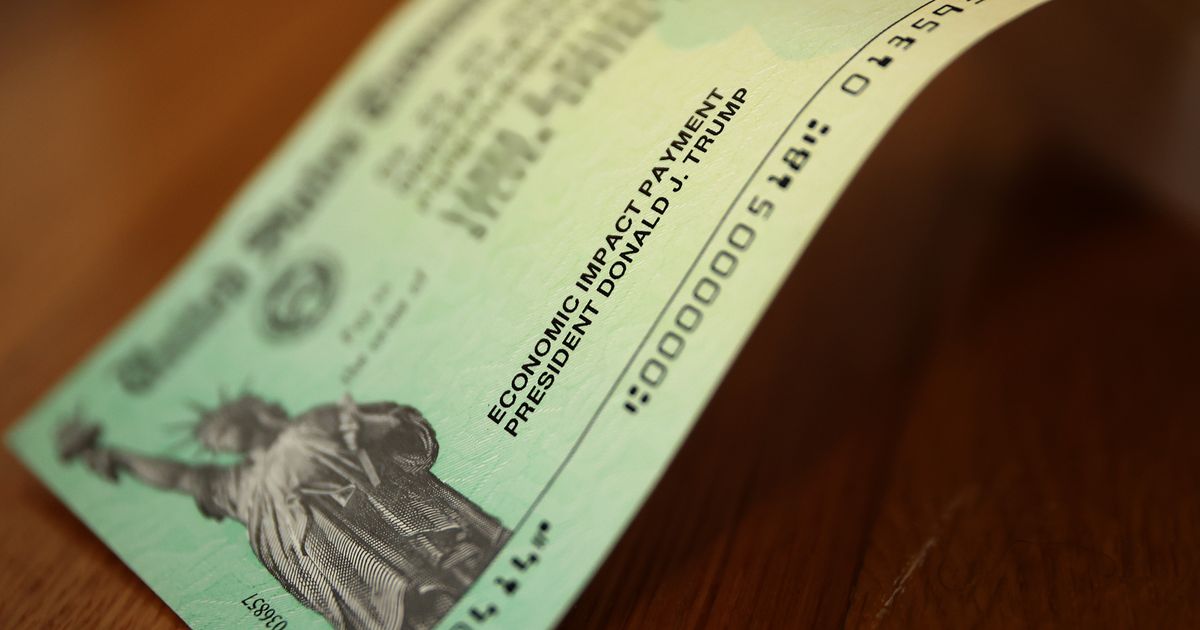

A proposal to distribute Dogecoin (DOGE) as a universal basic income (UBI) or dividend has sparked heated debate among economists and policymakers. While proponents highlight potential benefits like stimulating the economy and promoting cryptocurrency adoption, critics raise concerns about volatility, scalability, and the overall soundness of such a policy.

The idea, gaining traction among certain circles online, suggests a regular disbursement of DOGE to all citizens, regardless of income. This echoes the core principle of UBI – providing a safety net and potentially boosting consumer spending. However, the use of a volatile cryptocurrency like DOGE introduces a unique set of challenges.

Economic Volatility and Market Manipulation:

The most significant hurdle is DOGE's inherent price instability. Unlike fiat currencies backed by governments, DOGE's value fluctuates wildly based on market sentiment and speculation. A DOGE dividend's value, therefore, wouldn't be guaranteed. A sudden drop in DOGE's price could render the dividend practically worthless, leaving recipients with significant financial losses. Furthermore, the decentralized nature of cryptocurrencies makes them susceptible to manipulation, raising concerns about the fairness and predictability of such a system. Dr. Emily Carter, an economist specializing in digital currencies at [Name of University], notes, "The inherent volatility of DOGE makes it a highly risky asset for a social welfare program. Its price is subject to significant swings, rendering any attempt to calculate a stable, predictable benefit virtually impossible."

Scalability and Transaction Costs:

Distributing a DOGE dividend to a large population would present logistical challenges. The Dogecoin network, while relatively fast, has limitations in terms of transaction throughput. Processing millions or billions of transactions simultaneously could lead to network congestion, delays, and increased transaction fees. This would negate some of the intended benefits and could disproportionately affect individuals with limited technological access. Professor David Lee, a computer science expert at [Name of University] specializing in blockchain technology, explains, "The current Dogecoin network infrastructure is not equipped to handle the massive scale of a universal DOGE dividend. The transaction costs alone could dwarf the value of the dividend for many recipients."

Economic Impact and Inflationary Concerns:

Even if the logistical hurdles were overcome, the economic effects of a DOGE dividend remain highly debated. Proponents argue it could stimulate economic activity by boosting consumer spending and potentially creating new jobs in the cryptocurrency sector. However, critics warn of inflationary pressures. An influx of DOGE into the economy could devalue the currency further, potentially leading to higher prices for goods and services. The extent of this effect depends on various factors, including the size of the dividend, the speed of distribution, and the overall market reaction. Dr. Anya Sharma, a macroeconomist at [Name of University], states, "While there could be a short-term boost to consumer spending, the long-term effects are uncertain and could include significant inflationary pressures, eroding the purchasing power of the dividend itself."

Alternative Approaches and Policy Implications:

The debate surrounding a DOGE dividend highlights the complexities of integrating cryptocurrencies into existing economic systems. While the concept of UBI holds considerable appeal, the choice of asset is crucial. More stable cryptocurrencies or even direct government-issued digital currencies might offer a more viable pathway to achieve the same goals without the excessive risks associated with DOGE. The current lack of regulatory frameworks for cryptocurrencies also presents a major obstacle to implementing such a policy responsibly. The long-term implications for financial stability and equitable distribution require careful consideration and further research.

Conclusion:

While the idea of a DOGE dividend is intriguing, the inherent risks and practical challenges associated with it outweigh the potential benefits. The extreme volatility, scalability limitations, and potential inflationary pressures raise serious concerns about its viability as a sound economic policy. Exploring alternative approaches to UBI, using more stable assets and robust infrastructure, is essential before considering such a drastic and potentially destabilizing measure. Further research and a comprehensive understanding of the cryptocurrency market are needed to adequately assess the feasibility of integrating digital currencies into social welfare programs.

Featured Posts

-

Beterbiev Vs Bivol 2 Recap Fight Results Analysis And Highlights

Feb 24, 2025

Beterbiev Vs Bivol 2 Recap Fight Results Analysis And Highlights

Feb 24, 2025 -

Impressive Spurs Extend Winning Streak Thrash Ipswich 4 0

Feb 24, 2025

Impressive Spurs Extend Winning Streak Thrash Ipswich 4 0

Feb 24, 2025 -

Rangers Under Fire From Sutton As Celtic Maintain 13 Point Premiership Advantage

Feb 24, 2025

Rangers Under Fire From Sutton As Celtic Maintain 13 Point Premiership Advantage

Feb 24, 2025 -

Premier League Brighton Cruise To 4 0 Win Against Southampton

Feb 24, 2025

Premier League Brighton Cruise To 4 0 Win Against Southampton

Feb 24, 2025 -

Sources Legendary Coach Gregg Popovich Not Returning To Nba Next Season

Feb 24, 2025

Sources Legendary Coach Gregg Popovich Not Returning To Nba Next Season

Feb 24, 2025

Latest Posts

-

Conservative Radio Host Sounds Alarm On Trumps Divisive Tactics

Feb 24, 2025

Conservative Radio Host Sounds Alarm On Trumps Divisive Tactics

Feb 24, 2025 -

Watch Everton Vs Man United Premier League Soccer Streaming Guide

Feb 24, 2025

Watch Everton Vs Man United Premier League Soccer Streaming Guide

Feb 24, 2025 -

Cejudo Vs Yadong What Time Does The Fight Start Full Schedule

Feb 24, 2025

Cejudo Vs Yadong What Time Does The Fight Start Full Schedule

Feb 24, 2025 -

Child Exploitation And Cuckooing Criminalized Key Details

Feb 24, 2025

Child Exploitation And Cuckooing Criminalized Key Details

Feb 24, 2025 -

La Mayor Bass Dismisses Fire Chief Crowley Following Palisades Fire Criticism

Feb 24, 2025

La Mayor Bass Dismisses Fire Chief Crowley Following Palisades Fire Criticism

Feb 24, 2025