Is A DOGE Dividend A Viable Policy? Experts Weigh In On Trump's Proposal

Table of Contents

Is a DOGE Dividend a Viable Policy? Experts Weigh In on Trump's (Hypothetical) Proposal

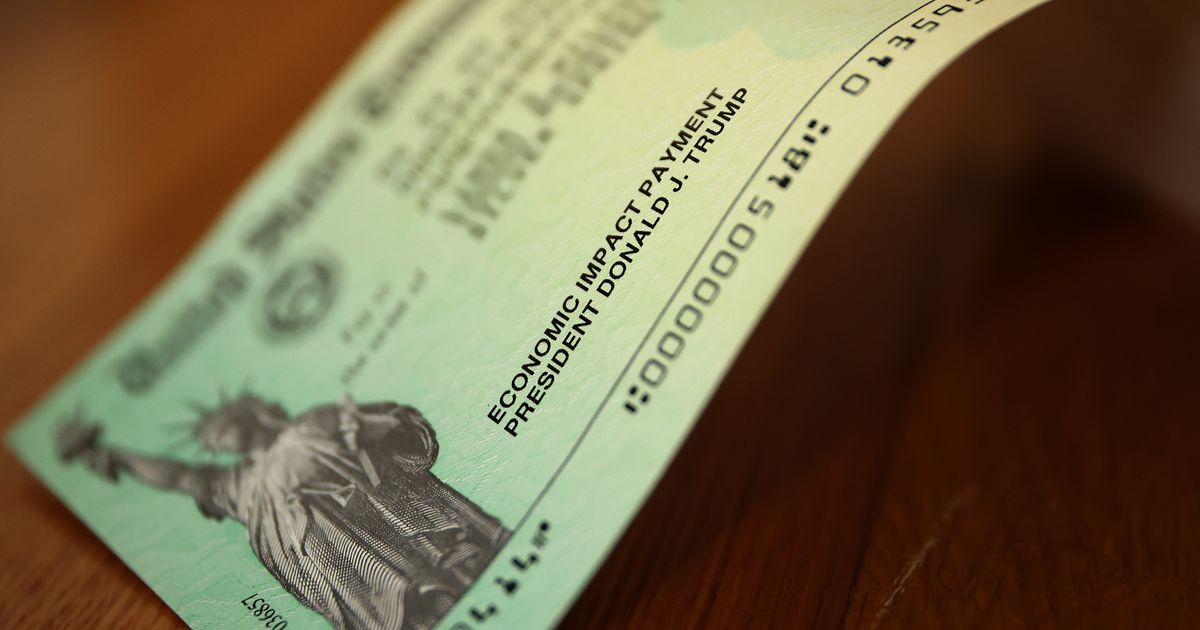

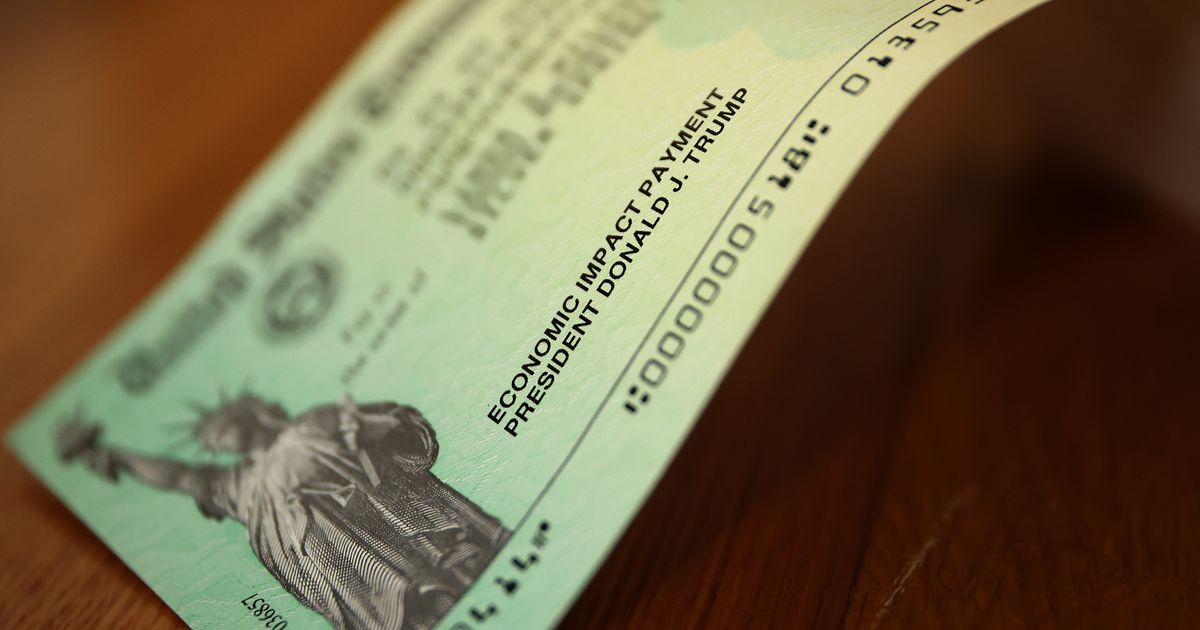

WASHINGTON, D.C. – A recent social media post by former President Donald Trump suggesting a potential Dogecoin dividend as a policy initiative has sparked a firestorm of debate among economists, cryptocurrency experts, and political analysts. While Trump has not officially endorsed the idea as part of a formal policy platform, the mere suggestion highlights the increasingly blurred lines between cryptocurrency, politics, and populist rhetoric. The proposal, as it exists only in fragmented online statements, lacks crucial details, raising serious questions about its feasibility and potential consequences.

The core concept, as interpreted from Trump's pronouncements, revolves around distributing a certain amount of Dogecoin (DOGE) to eligible U.S. citizens, potentially as a means of stimulating the economy or as a form of social welfare program. However, the specifics regarding the source of the Dogecoin, the distribution mechanism, and the overall budgetary implications remain completely undefined. This lack of clarity fuels concerns among critics.

"The idea is fundamentally flawed from an economic standpoint," argues Dr. Anya Sharma, an economist at Georgetown University. "Distributing a volatile cryptocurrency as a dividend is incredibly risky. The value of Dogecoin is highly speculative and susceptible to dramatic fluctuations, potentially leaving recipients with drastically different outcomes depending on market conditions at the time of distribution." Dr. Sharma points to the inherent volatility of cryptocurrencies, emphasizing the potential for significant financial losses for recipients if the price of DOGE plummeted after the distribution. Furthermore, she raises concerns about equitable access, particularly for those lacking the technological literacy or infrastructure needed to securely manage and utilize a cryptocurrency.

The technical challenges associated with such a large-scale distribution also present a formidable hurdle. "The sheer logistical complexity of distributing DOGE to millions, if not hundreds of millions, of Americans is staggering," explains Mark Olsen, a cybersecurity expert at the University of California, Berkeley. "This would require a robust, secure, and scalable infrastructure capable of handling a massive influx of transactions, minimizing the risk of fraud and ensuring equitable access. Current systems are simply not equipped for such an undertaking." Olsen highlights the potential for significant delays, security breaches, and technical malfunctions, adding another layer of complexity to the already questionable economic rationale.

Proponents of the DOGE dividend, though few and largely confined to online pro-Trump forums, suggest it could stimulate the economy by injecting DOGE into the market, fostering adoption, and driving up its price. This argument is largely dismissed by mainstream economists, who point to the lack of evidence supporting such claims and the potentially detrimental impact on market stability.

The absence of any official proposal from Trump's team or a detailed policy document means that a comprehensive analysis is currently impossible. Speculation surrounding the plan's origins and intentions has fueled accusations of exploiting the crypto market for political gain or simply capitalizing on the buzz surrounding Dogecoin.

The hypothetical DOGE dividend exemplifies the challenges of navigating the intersection of emerging technologies and established political processes. As cryptocurrencies continue to gain prominence, policymakers will need to grapple with their potential implications for economic policy and social welfare, demanding a careful and nuanced approach that transcends simplistic and potentially harmful proposals. The current lack of clarity and detail surrounding Trump's (hypothetical) DOGE dividend highlights the urgent need for thorough research, thoughtful debate, and robust regulatory frameworks to address the complex issues arising from the integration of cryptocurrencies into the mainstream economy. Until a formal and detailed proposal emerges, the idea remains firmly in the realm of speculation and raises far more questions than answers.

Featured Posts

-

Invisible Battlefield Russias Mounting Unacknowledged Casualties In Ukraine

Feb 25, 2025

Invisible Battlefield Russias Mounting Unacknowledged Casualties In Ukraine

Feb 25, 2025 -

Clash Of Ideologies Trump Vs Democratic States On Key Policies

Feb 25, 2025

Clash Of Ideologies Trump Vs Democratic States On Key Policies

Feb 25, 2025 -

Sales Drop Sparks Artist Outcry Kennedy Center Performances In Jeopardy

Feb 25, 2025

Sales Drop Sparks Artist Outcry Kennedy Center Performances In Jeopardy

Feb 25, 2025 -

Critical Condition Continues For Pope Francis Despite Peaceful Night

Feb 25, 2025

Critical Condition Continues For Pope Francis Despite Peaceful Night

Feb 25, 2025 -

The Women Behind Luigi Mangione Their Courtroom Presence

Feb 25, 2025

The Women Behind Luigi Mangione Their Courtroom Presence

Feb 25, 2025

Latest Posts

-

The Impact Of Trumps Proposed Usps Changes On Mail Delivery

Feb 25, 2025

The Impact Of Trumps Proposed Usps Changes On Mail Delivery

Feb 25, 2025 -

Investigation Launched Following Death Of Parisian Cyclist Paul Varry

Feb 25, 2025

Investigation Launched Following Death Of Parisian Cyclist Paul Varry

Feb 25, 2025 -

Pms Peace Proposal Faces Challenges And Opposition

Feb 25, 2025

Pms Peace Proposal Faces Challenges And Opposition

Feb 25, 2025 -

The Future Of Germany Understanding The Implications Of The Upcoming Election

Feb 25, 2025

The Future Of Germany Understanding The Implications Of The Upcoming Election

Feb 25, 2025 -

Invisible Losses Russias Mounting Casualties In Ukraine

Feb 25, 2025

Invisible Losses Russias Mounting Casualties In Ukraine

Feb 25, 2025