Is A DOGE Dividend Feasible? Examining Trump's Latest Proposal

Table of Contents

Is a DOGE Dividend Feasible? Examining Trump's Latest Proposal – A Deep Dive

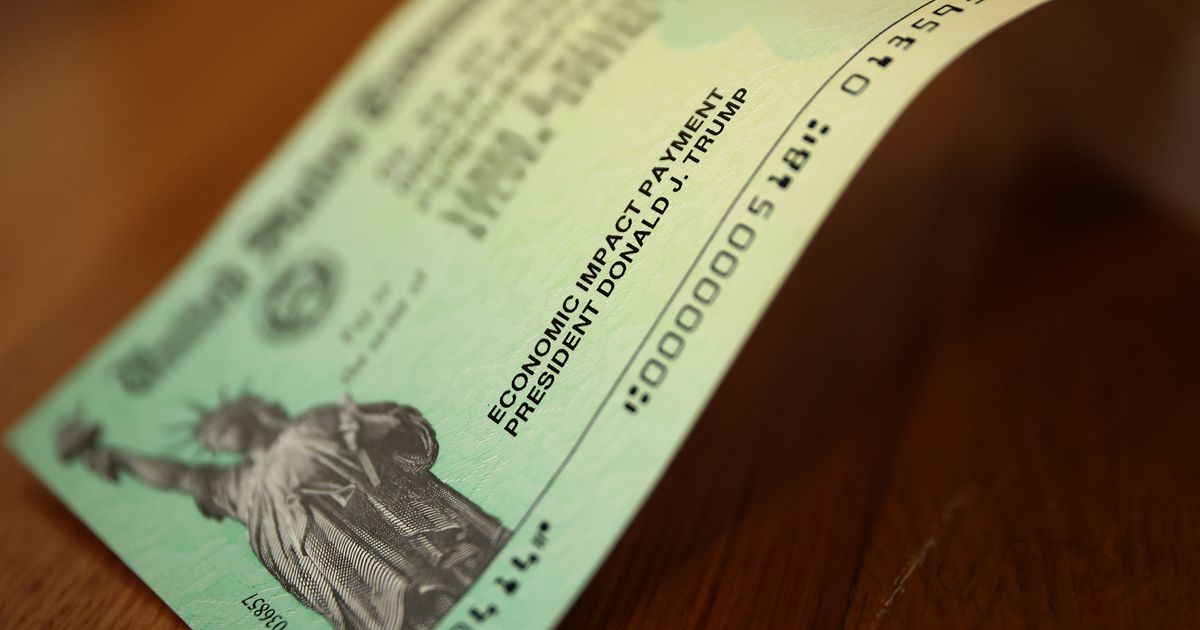

[Date of Publication] – A recent proposal by Donald Trump suggesting a Dogecoin dividend as part of a broader economic plan has ignited a firestorm of debate. The idea, floated [during/on the date of the statement/event], immediately sparked intense speculation about its feasibility and potential impact on the cryptocurrency market and the U.S. economy. While the specifics remain vague, the proposal's very existence raises crucial questions about the intersection of cryptocurrency, fiscal policy, and the political landscape.

The Proposal's Core Idea and its Shortcomings:

Trump's suggestion, as understood from [source citing the proposal's details, e.g., a campaign statement, press release, interview transcript], centers on distributing a Dogecoin dividend to American citizens. The exact amount and mechanism of distribution remain unclear, leaving room for considerable interpretation and criticism. [Insert details about the proposed amount or method of distribution if available. Otherwise, state explicitly that details are missing.]

Economists and financial analysts have quickly pointed out several significant hurdles. Firstly, the sheer volatility of Dogecoin poses a major challenge. Unlike a stable currency, Dogecoin’s value fluctuates dramatically, potentially leading to significant inequalities in the dividend's real-world value. A citizen receiving their dividend at a high price point would benefit considerably more than one receiving it during a price slump. This inherent uncertainty directly contradicts the fundamental principles of a stable and predictable economic policy.

Secondly, the logistical difficulties are immense. Distributing a cryptocurrency dividend would require a complex and potentially costly infrastructure, involving secure digital wallets for every recipient and a robust system to handle the transactions. The existing infrastructure may be inadequate to manage such a massive undertaking, potentially leading to delays, errors, and security vulnerabilities. [Insert details on any proposed systems or infrastructure if available from credible sources.]

Thirdly, the inflationary impact on Dogecoin itself could be considerable. A sudden influx of DOGE into circulation could dramatically dilute its value, potentially rendering the dividend worthless or even negatively impacting those already holding the cryptocurrency. [Cite relevant economic models or expert opinions predicting the inflationary impact].

Political and Economic Ramifications:

Beyond the purely technical challenges, the proposal has sparked a debate about the role of cryptocurrencies in governmental policy. Many critics argue that introducing such a volatile asset into the economic system would destabilize the dollar and increase economic uncertainty. [Quote an economist or financial expert supporting this viewpoint and providing their credentials].

Conversely, some proponents suggest that a Dogecoin dividend could stimulate the cryptocurrency market and potentially attract foreign investment. However, such claims lack credible empirical support and are largely speculative. [Include any counter-arguments from supporting voices, if any, and their credentials].

The proposal also raises questions about the broader political implications. Given Dogecoin's meme-based origins and its association with online communities, the suggestion has been interpreted by some as a populist attempt to appeal to a specific segment of the electorate. [Include analysis on the political strategies at play, citing political analysts or commentators].

Conclusion:

Donald Trump’s proposal for a Dogecoin dividend presents a radical departure from traditional fiscal policy. While intended to [insert Trump’s purported aim, e.g., boost the economy, stimulate the crypto market], the sheer number of logistical, economic, and political challenges suggests its feasibility is extremely low. The lack of concrete details regarding distribution, amount, and infrastructure planning only exacerbates these concerns. Further, the inherent volatility of Dogecoin makes it a highly unsuitable instrument for a government dividend program. The long-term consequences of such a proposal, even if implemented, remain uncertain and likely to be far-reaching. This proposal highlights the increasing intersection between technology, finance, and politics, emphasizing the need for careful consideration and robust analysis before integrating volatile digital assets into traditional economic systems.

Featured Posts

-

The Movie Guru Reviews The Monkey And The Gorge

Feb 23, 2025

The Movie Guru Reviews The Monkey And The Gorge

Feb 23, 2025 -

Israel Receives Remains Claimed To Be Shiri Bibas

Feb 23, 2025

Israel Receives Remains Claimed To Be Shiri Bibas

Feb 23, 2025 -

Hooters Bankruptcy Fears Rise As Customer Numbers Drop

Feb 23, 2025

Hooters Bankruptcy Fears Rise As Customer Numbers Drop

Feb 23, 2025 -

U S Ukraine Finalize Agreement On Strategic Mineral Access

Feb 23, 2025

U S Ukraine Finalize Agreement On Strategic Mineral Access

Feb 23, 2025 -

Aston Villa Vs Chelsea Live Stream Watch Premier League Match Online

Feb 23, 2025

Aston Villa Vs Chelsea Live Stream Watch Premier League Match Online

Feb 23, 2025

Latest Posts

-

Jennie And Doechii Drop Steamy Extra L Music Video For Ruby Track

Feb 23, 2025

Jennie And Doechii Drop Steamy Extra L Music Video For Ruby Track

Feb 23, 2025 -

Mayor Bass Removes La Fire Chief Crowley Amid Palisades Fire Criticism

Feb 23, 2025

Mayor Bass Removes La Fire Chief Crowley Amid Palisades Fire Criticism

Feb 23, 2025 -

Joseph Parker Stops Bakoles Title Quest With Decisive Victory

Feb 23, 2025

Joseph Parker Stops Bakoles Title Quest With Decisive Victory

Feb 23, 2025 -

Will Gregg Popovich Return To The Spurs A Health Update

Feb 23, 2025

Will Gregg Popovich Return To The Spurs A Health Update

Feb 23, 2025 -

Mls Messi Y Suarez Debutan Con El Inter Miami Ante Nyc Fc

Feb 23, 2025

Mls Messi Y Suarez Debutan Con El Inter Miami Ante Nyc Fc

Feb 23, 2025