Is A Dogecoin Dividend A Bad Idea? Experts Weigh In On Trump's Proposal

Table of Contents

Is a Dogecoin Dividend a Bad Idea? Experts Weigh In on Trump's Proposal

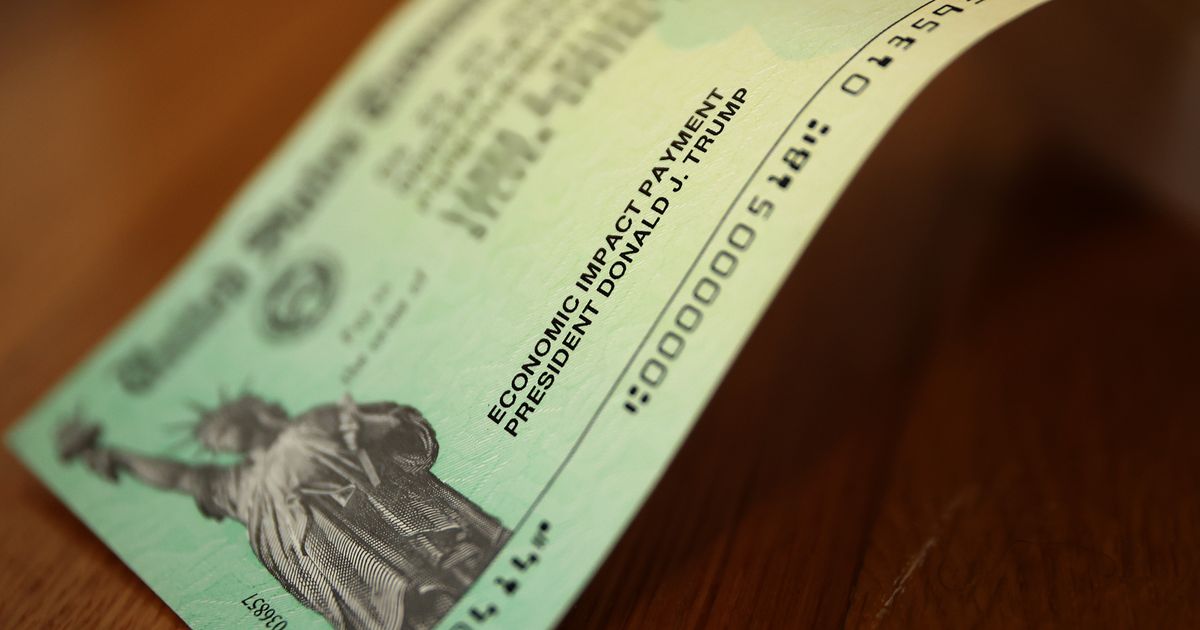

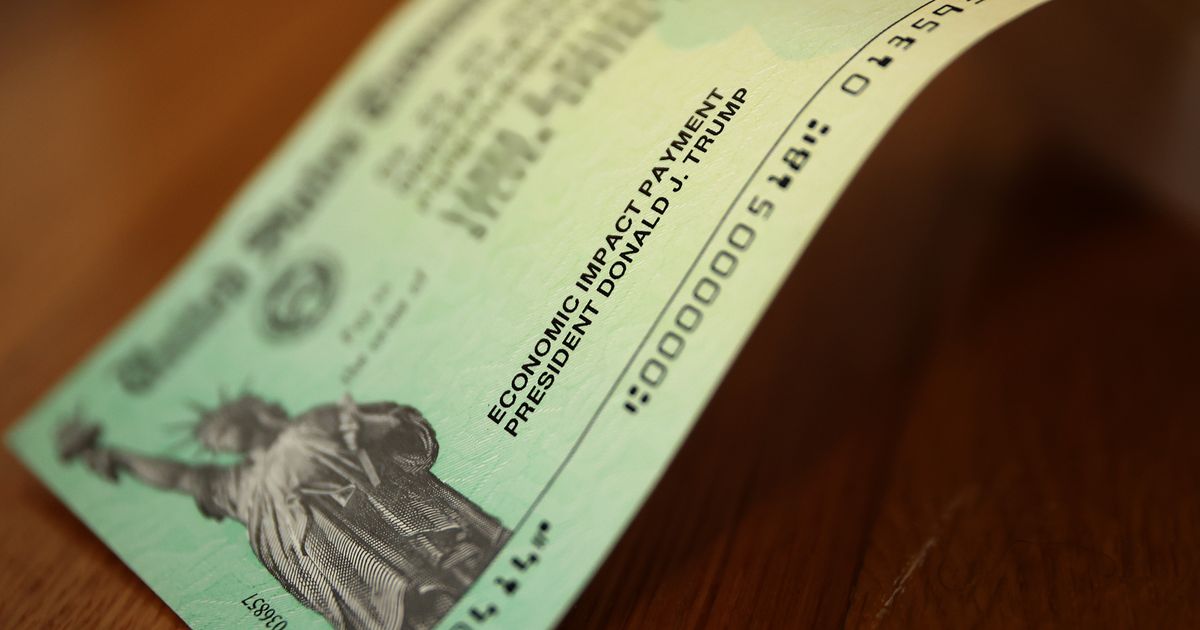

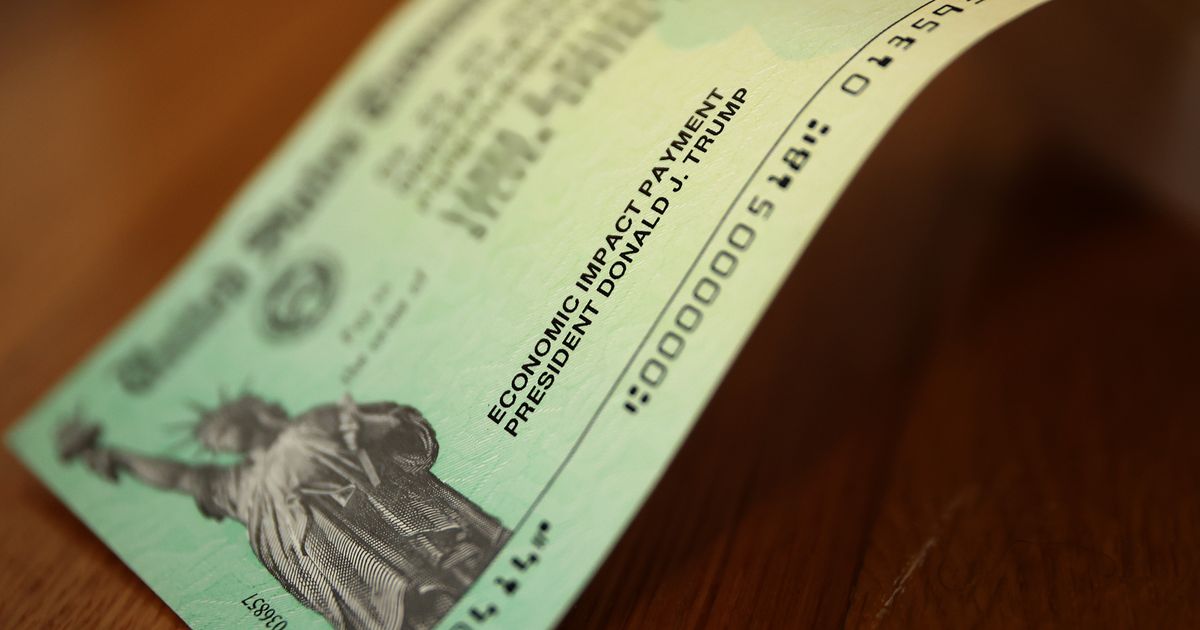

[Date of Publication] – Former President Donald Trump's recent proposal to pay a dividend in Dogecoin has sparked intense debate among economists and financial experts. The suggestion, floated during a [Specific Event or Interview where the proposal was mentioned, e.g., campaign rally in Des Moines, Iowa], immediately ignited controversy, raising questions about its feasibility, economic impact, and potential risks. While Trump's supporters have lauded the idea as a populist measure, critics argue it’s a reckless and potentially disastrous policy.

The core of the controversy lies in the volatile and unpredictable nature of Dogecoin. Unlike traditional fiat currencies or stablecoins, Dogecoin’s value fluctuates wildly, driven by speculation and social media trends rather than fundamental economic indicators. A government-backed dividend in such a volatile asset would expose taxpayers to significant risk. [Insert quote from a prominent economist or financial expert criticizing the proposal, citing specific concerns about volatility and risk].

One of the primary concerns centers on the sheer scale of such an undertaking. Distributing a Dogecoin dividend to every American taxpayer would require the government to acquire a massive amount of the cryptocurrency, potentially artificially inflating its price in the short term. However, this price inflation would likely be unsustainable, leading to a sharp correction that could wipe out billions of dollars in value, leaving taxpayers with significant losses. [Include details about the estimated cost of such a dividend, if available, and the potential impact on the national debt].

Furthermore, the logistical challenges of distributing a cryptocurrency dividend are substantial. The U.S. Treasury Department would need to navigate complex technological hurdles and ensure secure and equitable distribution to all eligible recipients. This would involve significant investment in infrastructure and expertise, raising concerns about efficiency and potential for fraud. [Include details about any existing infrastructure or technological challenges related to cryptocurrency distribution by the government, if available].

Proponents of the plan, largely aligned with Trump’s base, argue that a Dogecoin dividend would stimulate the economy by putting money directly into the hands of consumers. They point to the potential for increased spending and investment, bolstering businesses and creating jobs. [Include a quote or summary of arguments from Trump supporters or representatives, emphasizing their reasoning]. However, economists are skeptical, arguing that the unpredictable nature of Dogecoin renders this argument highly speculative. The potential for short-term gains would likely be outweighed by the substantial long-term risks of volatility and market manipulation.

Beyond the economic considerations, the proposal also raises questions about the role of government in cryptocurrency markets. Government involvement in a highly speculative asset like Dogecoin could be interpreted as an endorsement, potentially fueling even greater speculation and increasing the risk of a market bubble. [Quote from a financial regulator or expert expressing concern about the government's role in cryptocurrency markets]. This could have broader implications for the regulation of cryptocurrencies in the United States.

In conclusion, Trump's proposal to distribute a Dogecoin dividend remains a highly contentious issue with significant economic and logistical challenges. While the idea might appeal to some as a populist measure, the overwhelming consensus among financial experts is that it presents considerable risks and is likely to be far more detrimental than beneficial to the U.S. economy. The long-term consequences of such a move could be severe, potentially leading to significant financial losses for taxpayers and jeopardizing the stability of the cryptocurrency market. [Conclude with a summary of the main arguments against the proposal and its potential negative impacts].

Featured Posts

-

Elon Musk Challenges Federal Workforce Transparency Requested

Feb 25, 2025

Elon Musk Challenges Federal Workforce Transparency Requested

Feb 25, 2025 -

Germanys 2025 Election Potential Outcomes And Their Impact

Feb 25, 2025

Germanys 2025 Election Potential Outcomes And Their Impact

Feb 25, 2025 -

Lost In Utah A Father And Sons Harrowing Hiking Experience

Feb 25, 2025

Lost In Utah A Father And Sons Harrowing Hiking Experience

Feb 25, 2025 -

Beyond The Screen Rare Photos Of Actors At Work

Feb 25, 2025

Beyond The Screen Rare Photos Of Actors At Work

Feb 25, 2025 -

Covid 19 Impacts Snl 50th Maya Rudolph And Martin Shorts Absence Explained

Feb 25, 2025

Covid 19 Impacts Snl 50th Maya Rudolph And Martin Shorts Absence Explained

Feb 25, 2025

Latest Posts

-

Ukraine War Untold Russian Casualties Mount

Feb 25, 2025

Ukraine War Untold Russian Casualties Mount

Feb 25, 2025 -

Is A Dogecoin Dividend A Viable Economic Policy Trumps Proposal Under Scrutiny

Feb 25, 2025

Is A Dogecoin Dividend A Viable Economic Policy Trumps Proposal Under Scrutiny

Feb 25, 2025 -

Germanys 2025 Election Potential Outcomes And Their Impact

Feb 25, 2025

Germanys 2025 Election Potential Outcomes And Their Impact

Feb 25, 2025 -

Germanys Af D Party Influence Ideology And Prominent Backers

Feb 25, 2025

Germanys Af D Party Influence Ideology And Prominent Backers

Feb 25, 2025 -

Lockerbie Tragedy A Memorial Sculpture Forged In Grief

Feb 25, 2025

Lockerbie Tragedy A Memorial Sculpture Forged In Grief

Feb 25, 2025