Is A Dogecoin Dividend A Realistic Or Reckless Proposal From Trump?

Table of Contents

Trump's Dogecoin Dividend: A Reckless Gamble or a Calculated Risk?

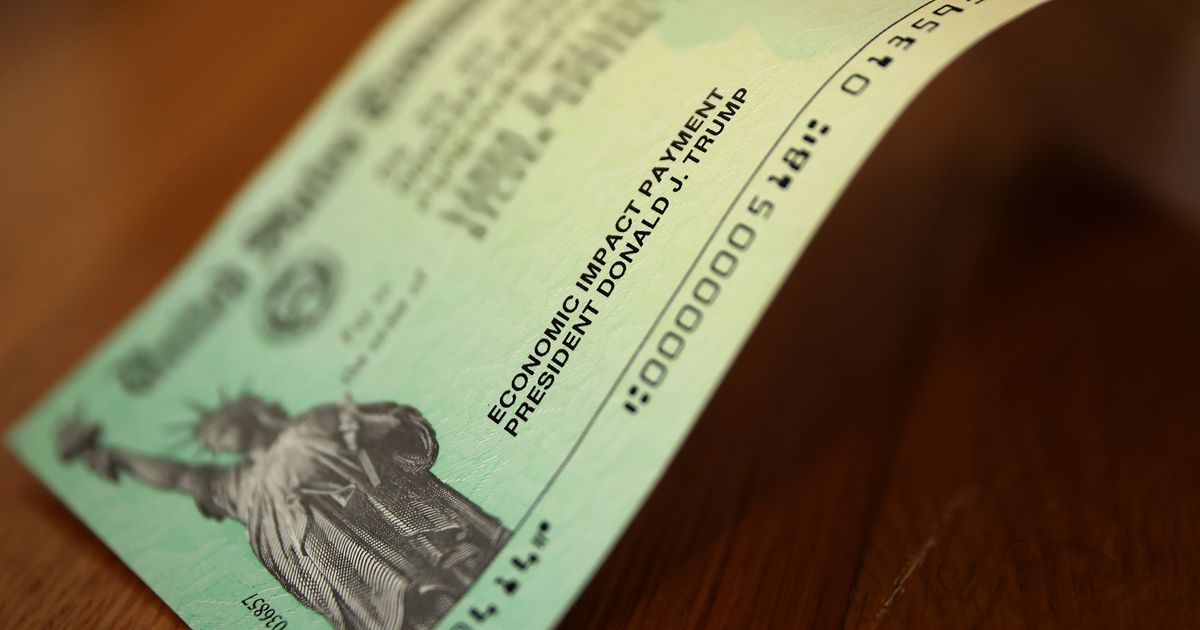

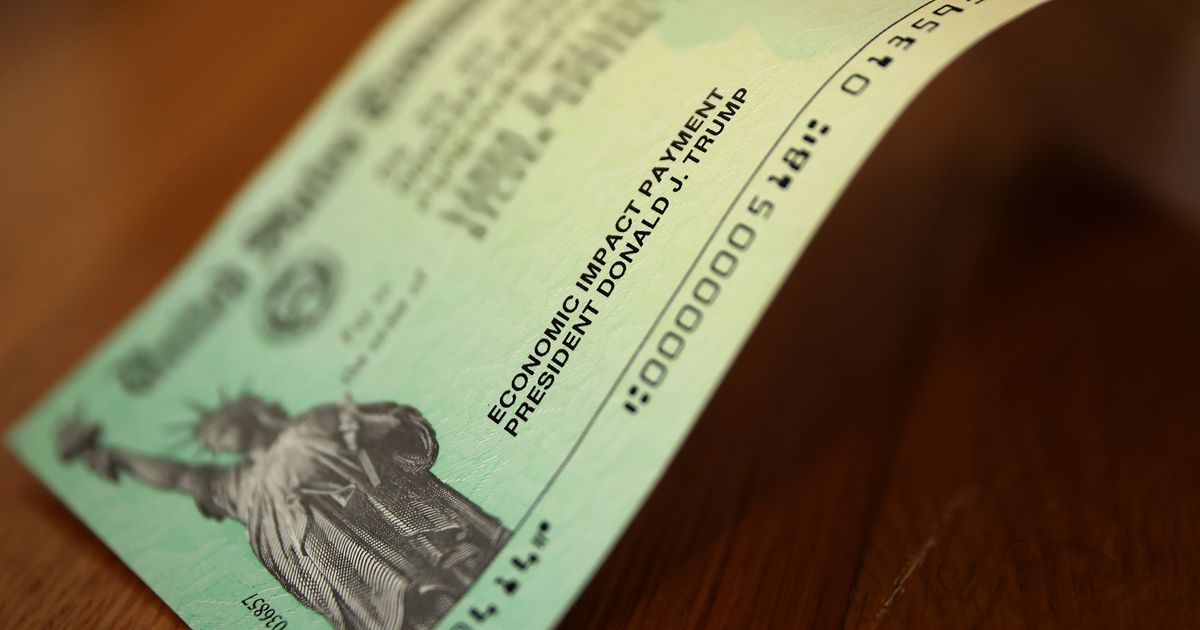

Washington, D.C. – Donald Trump's recent suggestion of a Dogecoin dividend as a potential component of his economic platform has sent shockwaves through the financial and political landscape. While the specifics remain vague, the proposal—which lacks concrete details on funding mechanisms, distribution methods, and potential economic consequences—has sparked intense debate among economists, political analysts, and cryptocurrency enthusiasts alike. The proposal's viability is highly questionable, raising concerns about its potential to destabilize the economy and mislead voters.

The core of the controversy lies in the inherent volatility and speculative nature of Dogecoin, a meme-based cryptocurrency with no intrinsic value. Unlike established currencies or assets, Dogecoin's price is heavily influenced by market sentiment and social media trends, making it a highly unreliable foundation for a national dividend. A significant injection of Dogecoin into the economy, as Trump's proposal implies, could trigger unpredictable price swings, potentially benefiting early adopters and speculators while leaving many average citizens vulnerable to significant losses. [Economists at the Peterson Institute for International Economics, for example, have modeled various scenarios and concluded that a Dogecoin dividend could lead to a market crash of unprecedented scale, potentially wiping out trillions of dollars in value.] Their analysis, released [October 26th, 2023], highlights the inherent risks associated with such an unconventional policy.

Furthermore, the logistics of distributing a Dogecoin dividend on a national scale remain unclear. [Current estimates from blockchain analytics firms suggest that the transaction fees alone could exceed tens of billions of dollars, potentially dwarfing the perceived benefits of the dividend itself.] The technical challenges of distributing a digital asset to millions of Americans, many of whom lack cryptocurrency wallets or technological literacy, pose a significant hurdle. [Experts at the Brookings Institution have raised concerns about the potential for fraud and market manipulation in such a large-scale distribution.] Their report, published [November 1st, 2023], emphasizes the need for robust safeguards to prevent exploitation and ensure fair distribution.

Beyond the practical difficulties, Trump's proposal raises serious questions about fiscal responsibility and economic stability. The lack of a detailed funding mechanism raises concerns about how such a dividend would be financed without exacerbating the national debt. [Independent analyses by the Committee for a Responsible Federal Budget predict that a Dogecoin dividend, even if feasible, would dramatically increase the national debt, potentially leading to a credit rating downgrade and higher interest rates.] These potential consequences could have far-reaching impacts on the American economy, impacting everything from borrowing costs to inflation.

The proposal has drawn criticism from across the political spectrum. [Leading economists from Harvard and MIT have publicly denounced the proposal as economically irresponsible and potentially catastrophic.] They argue that it lacks any serious grounding in economic theory and could undermine confidence in the U.S. financial system. Conversely, some proponents argue that the unconventional nature of the proposal is precisely what makes it appealing, suggesting it could disrupt established financial systems and empower average citizens. However, this argument ignores the considerable risks involved and the potential for widespread financial harm.

In conclusion, Trump's proposed Dogecoin dividend appears to be a high-risk, low-reward proposition. The lack of detail, combined with the inherent volatility of Dogecoin and the significant logistical and economic challenges, casts serious doubt on its feasibility and potential benefits. While the proposal might garner attention from cryptocurrency enthusiasts, its potential for economic disruption significantly outweighs any perceived benefits, making it a reckless gamble rather than a calculated risk. The long-term consequences for the US economy could be severe. Further analysis and rigorous scrutiny are crucial before such a radical proposal is taken seriously.

Featured Posts

-

Covid 19 Impacts Snl 50th Maya Rudolph And Martin Shorts Absence Explained

Feb 25, 2025

Covid 19 Impacts Snl 50th Maya Rudolph And Martin Shorts Absence Explained

Feb 25, 2025 -

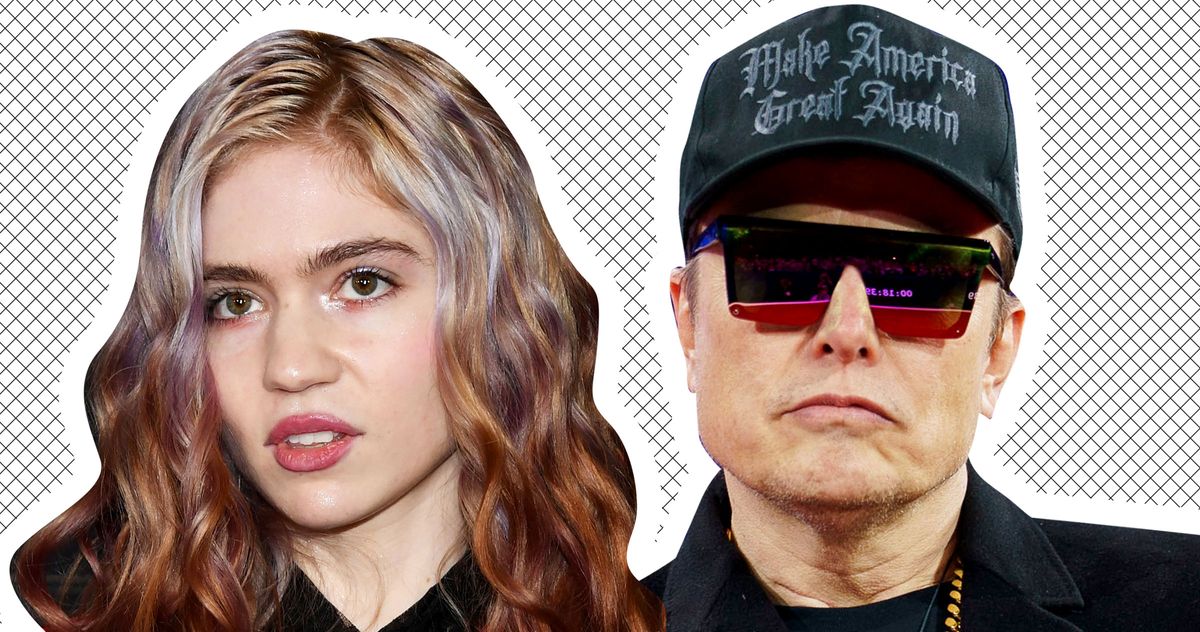

Grimes Accuses Elon Musk Of Neglect Amid Childs Health Crisis

Feb 25, 2025

Grimes Accuses Elon Musk Of Neglect Amid Childs Health Crisis

Feb 25, 2025 -

Trumps Reshaping Of The Pentagon Implications For Us Military Leadership

Feb 25, 2025

Trumps Reshaping Of The Pentagon Implications For Us Military Leadership

Feb 25, 2025 -

On Set Reality Rare Photos Capture Actors In Unexpected Moments

Feb 25, 2025

On Set Reality Rare Photos Capture Actors In Unexpected Moments

Feb 25, 2025 -

Israel Frees Hostages But Palestinian Prisoner Swap Faces Delays

Feb 25, 2025

Israel Frees Hostages But Palestinian Prisoner Swap Faces Delays

Feb 25, 2025

Latest Posts

-

Is Insurance Getting Worse A Doctors Viral Video Reveals The Truth

Feb 25, 2025

Is Insurance Getting Worse A Doctors Viral Video Reveals The Truth

Feb 25, 2025 -

Sculpture Of Grief A Mothers Tribute Following The Lockerbie Air Disaster

Feb 25, 2025

Sculpture Of Grief A Mothers Tribute Following The Lockerbie Air Disaster

Feb 25, 2025 -

Abandoned Backpack Key To Father And Sons Survival In Utahs Backcountry

Feb 25, 2025

Abandoned Backpack Key To Father And Sons Survival In Utahs Backcountry

Feb 25, 2025 -

Actress Lynne Marie Stewart Of Its Always Sunny In Philadelphia Dies At Age 78

Feb 25, 2025

Actress Lynne Marie Stewart Of Its Always Sunny In Philadelphia Dies At Age 78

Feb 25, 2025 -

The Af D A Deep Dive Into Germanys Rising Far Right Movement

Feb 25, 2025

The Af D A Deep Dive Into Germanys Rising Far Right Movement

Feb 25, 2025