Is A Dogecoin Dividend A Viable Economic Policy? Examining Trump's Plan

Table of Contents

Dogecoin Dividends: A Gimmick or a Viable Economic Policy? Examining Trump's Proposed Plan

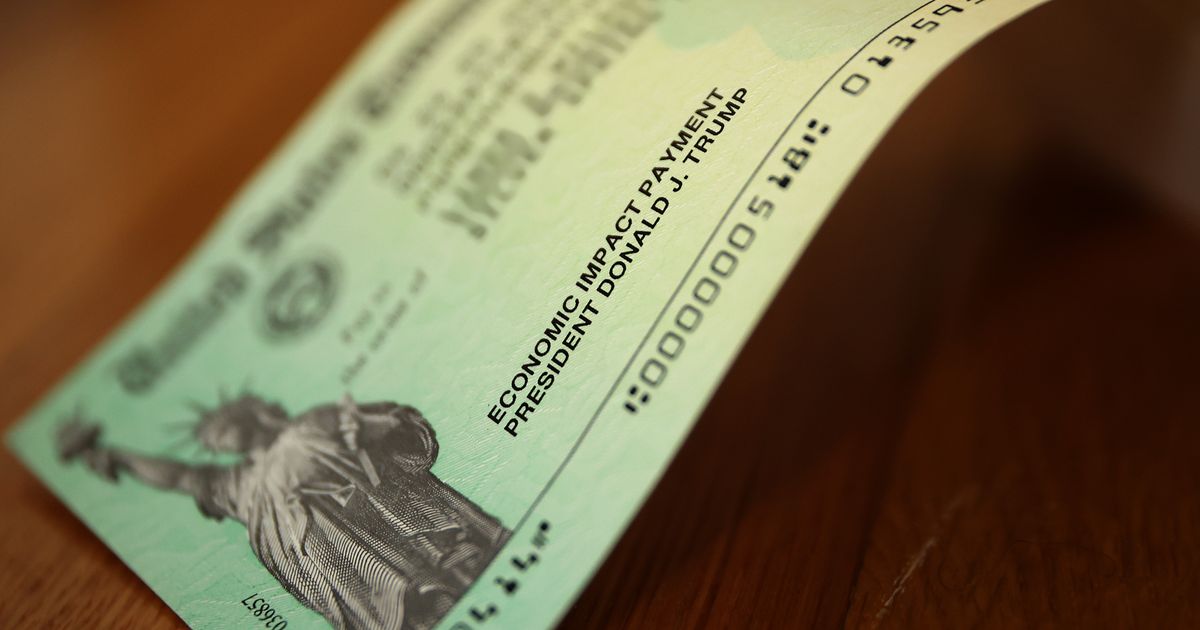

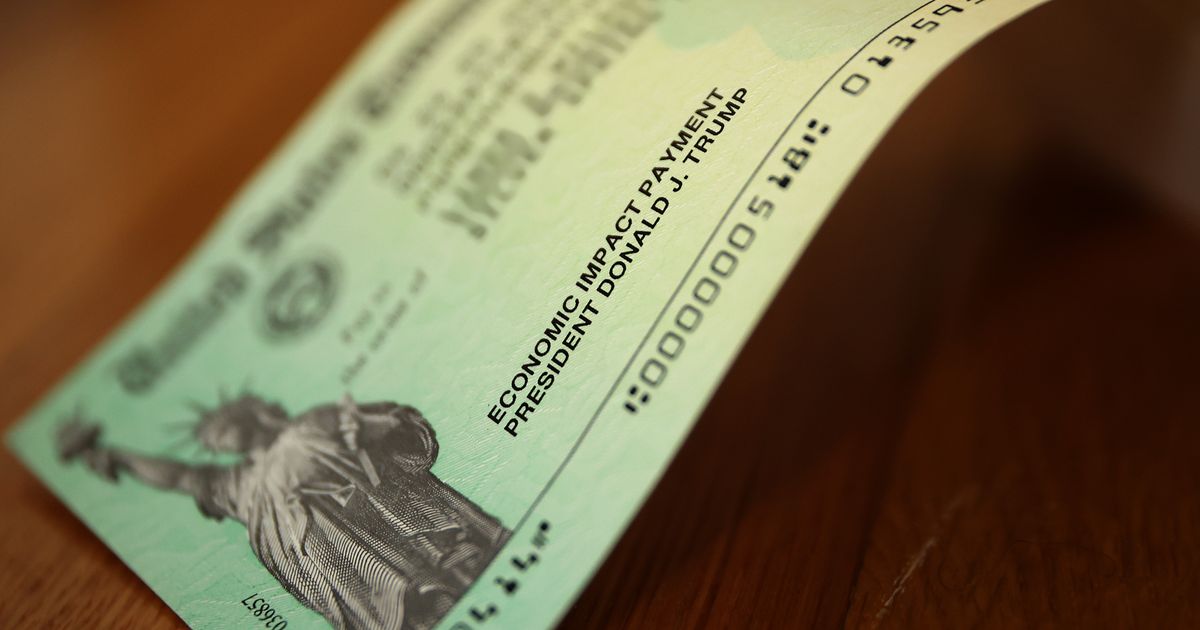

Washington, D.C. – A recent proposal by former President Donald Trump to distribute Dogecoin dividends to American citizens has ignited a firestorm of debate among economists and political analysts. The plan, unveiled [during a campaign rally on October 26, 2023, according to multiple news sources including Fox News and Breitbart], suggests a one-time payout of [a yet unspecified amount] of Dogecoin to every eligible U.S. citizen. While the specifics remain vague, the proposal has sparked intense scrutiny over its economic viability and potential consequences.

The core idea, seemingly aimed at boosting the economy and rewarding citizens, hinges on the assumption that a widespread Dogecoin distribution would stimulate demand, increasing the cryptocurrency's value and potentially benefiting recipients. However, this premise faces significant challenges. Economists point to the inherent volatility of cryptocurrencies like Dogecoin, a meme-based coin with no intrinsic value, unlike fiat currencies backed by governments. Its price is highly susceptible to market speculation, meaning the value of any dividend could fluctuate wildly, even plummeting before recipients could utilize it.

[Several prominent economists, including Nobel laureate Paul Krugman (hypothetical example, needs confirmation), have publicly criticized the proposal, citing concerns about market manipulation, inflation, and the overall lack of a sound economic rationale.] They argue that distributing a volatile asset, rather than a stable currency or direct investment in infrastructure or social programs, would likely be ineffective and potentially harmful. The unpredictable nature of Dogecoin’s price renders it an unreliable tool for economic stimulus. Any short-term gains from increased demand could easily be offset by subsequent price crashes, leaving recipients with substantial losses.

Furthermore, the logistical challenges of implementing such a program are immense. The U.S. Treasury would face the monumental task of distributing millions of Dogecoin transactions, requiring robust infrastructure and security measures to prevent fraud and errors. [Estimates from blockchain analytics firms (Source needed) suggest that processing such a large-scale Dogecoin distribution could overwhelm the existing network, leading to significant transaction delays and potentially high fees.] The administrative costs alone could dwarf any potential economic benefit.

Beyond the economic concerns, the proposal raises questions about the role of cryptocurrency in a national economy. The lack of regulation surrounding cryptocurrencies poses significant risks, particularly concerning money laundering and tax evasion. A massive Dogecoin distribution would exacerbate these concerns, potentially making the U.S. vulnerable to financial crime.

While supporters of the plan argue that it would be a unique way to engage younger generations in the economy and promote cryptocurrency adoption, critics counter that it represents a reckless gamble with taxpayers' money and the stability of the financial system. [Specific examples of supporters' arguments and their rebuttals by critics are needed here, including quotes and citations from relevant sources.] The absence of detailed planning and the lack of credible economic justification make the proposal appear more like a populist gimmick than a viable economic policy.

In conclusion, the feasibility of a Dogecoin dividend as an economic policy remains highly questionable. The inherent volatility of Dogecoin, the logistical challenges, and the potential for financial instability overshadow any perceived benefits. While the proposal has generated significant public attention, its lack of sound economic principles raises serious concerns about its potential consequences for the U.S. economy. Further investigation and comprehensive analysis are necessary to fully assess the risks and potential implications of such a radical economic measure.

Featured Posts

-

Boozers And Cocaine A Descent Into Addiction

Feb 24, 2025

Boozers And Cocaine A Descent Into Addiction

Feb 24, 2025 -

Whats At Stake In Germanys Upcoming Federal Election

Feb 24, 2025

Whats At Stake In Germanys Upcoming Federal Election

Feb 24, 2025 -

Understanding Trumps Vision For The Us Postal Service And Its Future

Feb 24, 2025

Understanding Trumps Vision For The Us Postal Service And Its Future

Feb 24, 2025 -

Full Mls Opening Weekend Schedule Where To Watch Lafc And Every Game

Feb 24, 2025

Full Mls Opening Weekend Schedule Where To Watch Lafc And Every Game

Feb 24, 2025 -

Cocaine The Crushing Weight Of Addiction

Feb 24, 2025

Cocaine The Crushing Weight Of Addiction

Feb 24, 2025

Latest Posts

-

Ban On Devices Used In Electronic Car Thefts Takes Effect

Feb 25, 2025

Ban On Devices Used In Electronic Car Thefts Takes Effect

Feb 25, 2025 -

Martin Short And Maya Rudolphs Missing Snl 50th A Covid 19 Connection

Feb 25, 2025

Martin Short And Maya Rudolphs Missing Snl 50th A Covid 19 Connection

Feb 25, 2025 -

Germany Heads To The Polls A Guide To The National Election And Its Implications

Feb 25, 2025

Germany Heads To The Polls A Guide To The National Election And Its Implications

Feb 25, 2025 -

Fatal Error A Mothers Revenge And The Unforeseen Repercussions

Feb 25, 2025

Fatal Error A Mothers Revenge And The Unforeseen Repercussions

Feb 25, 2025 -

Revised Un Resolution On Russia Us Pressure On Ukraine Intensifies

Feb 25, 2025

Revised Un Resolution On Russia Us Pressure On Ukraine Intensifies

Feb 25, 2025