Is A Dogecoin Dividend A Viable Policy? Examining Trump's Controversial Idea

Table of Contents

Dogecoin Dividends: A Trumpian Gamble or Economic Folly?

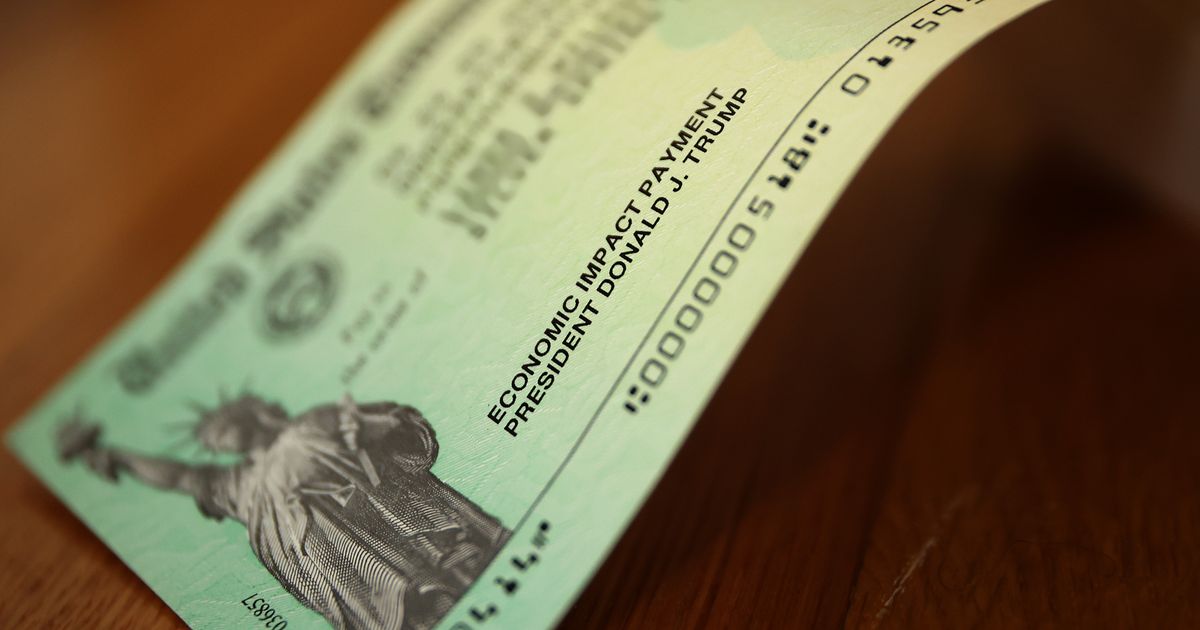

Washington, D.C. – During a recent campaign rally, Republican presidential candidate Donald Trump floated a controversial economic policy proposal: issuing Dogecoin dividends to American citizens. The idea, immediately met with widespread skepticism and ridicule, raises serious questions about its feasibility, economic impact, and overall viability. While the specifics remain vague – Trump hasn't detailed the source of funding, the dividend amount, or the distribution mechanism – the proposal demands a closer examination.

The core concept hinges on distributing Dogecoin, a meme-based cryptocurrency, to US citizens as a form of regular income supplement. Proponents might argue this would stimulate the economy by boosting consumer spending, particularly among lower-income households. They could point to the potential for increased adoption of cryptocurrencies and a boost to Dogecoin's value. However, critics immediately highlight a multitude of significant flaws.

Economic Concerns and Practical Challenges:

The most glaring issue is the lack of a defined funding mechanism. Where would the Dogecoin come from? Would the government purchase it on the open market, potentially artificially inflating its price and creating a bubble? Would it involve minting new Dogecoins, risking hyperinflation and undermining the cryptocurrency's value? Trump has offered no clear answers, leaving economists and financial analysts deeply concerned. The unpredictable nature of cryptocurrency markets also poses a considerable risk. The value of Dogecoin is notoriously volatile, subject to wild swings based on social media trends and speculative trading. Distributing a dividend in such a volatile asset would leave recipients exposed to significant losses, potentially exacerbating economic inequality rather than alleviating it.

Furthermore, the logistical challenges of distributing Dogecoin to millions of Americans are immense. This would require robust, secure, and scalable infrastructure capable of handling transactions efficiently and preventing fraud. Current cryptocurrency infrastructure may not be equipped to handle such a massive undertaking without significant technical upgrades and potential bottlenecks. Issues of digital literacy and access to technology for older or less digitally-savvy populations further complicate the picture.

Political and Social Implications:

Beyond the economic concerns, the proposal raises questions about the role of government in endorsing specific cryptocurrencies. Such a policy would represent a significant departure from established economic principles and could be seen as government endorsement of a highly speculative asset. This action could have far-reaching consequences for market regulation and could potentially invite regulatory scrutiny of other cryptocurrencies and digital assets. The perception of the government endorsing a meme-based cryptocurrency could also undermine public trust in both traditional finance and government institutions.

Alternative Policy Solutions:

Instead of focusing on Dogecoin dividends, economists often suggest alternative policies to stimulate the economy and address income inequality. These include direct cash payments, targeted tax credits for low-income families, or investments in infrastructure and education. These methods offer more predictable and controllable outcomes compared to the inherent volatility of a cryptocurrency-based dividend.

Conclusion:

Donald Trump's proposal to issue Dogecoin dividends represents a radical and untested economic policy with considerable risks and unanswered questions. While the intention might be to provide economic relief, the potential for market instability, logistical challenges, and negative social and political ramifications outweigh any perceived benefits. Without a comprehensive plan addressing the funding, distribution, and risk management aspects, the Dogecoin dividend proposal remains a highly controversial and ultimately unviable policy. The lack of detail and understanding of fundamental economic principles further casts doubt on its feasibility and raises serious concerns about its potential negative impacts on the US economy.

Featured Posts

-

Paris Street Death Highlights Dangers For Cyclists Remembering Paul Varry

Feb 25, 2025

Paris Street Death Highlights Dangers For Cyclists Remembering Paul Varry

Feb 25, 2025 -

Analysis Trumps Actions And The Implications For Us Military Leadership

Feb 25, 2025

Analysis Trumps Actions And The Implications For Us Military Leadership

Feb 25, 2025 -

Grimes And Elon Musk A Childs Medical Crisis And Parental Dispute

Feb 25, 2025

Grimes And Elon Musk A Childs Medical Crisis And Parental Dispute

Feb 25, 2025 -

Remembering Lockerbie A Mothers Monument To The Victims Of The 1988 Air Disaster

Feb 25, 2025

Remembering Lockerbie A Mothers Monument To The Victims Of The 1988 Air Disaster

Feb 25, 2025 -

Netflix Show Planning Meghan Markles Vision Board Insights

Feb 25, 2025

Netflix Show Planning Meghan Markles Vision Board Insights

Feb 25, 2025

Latest Posts

-

Actors Off Camera Behind The Scenes Photos From Film Sets

Feb 25, 2025

Actors Off Camera Behind The Scenes Photos From Film Sets

Feb 25, 2025 -

Pharaoh Thutmose Ii Archaeological Find Hints At A Second Tomb

Feb 25, 2025

Pharaoh Thutmose Ii Archaeological Find Hints At A Second Tomb

Feb 25, 2025 -

Elon Musk And Steve Bannons Ties To Germanys Far Right Af D

Feb 25, 2025

Elon Musk And Steve Bannons Ties To Germanys Far Right Af D

Feb 25, 2025 -

The Trump Factor Will A Restored Relationship Help Zelensky Secure Ukraine

Feb 25, 2025

The Trump Factor Will A Restored Relationship Help Zelensky Secure Ukraine

Feb 25, 2025 -

Artists Weigh Kennedy Center Boycott As Sales Plummet

Feb 25, 2025

Artists Weigh Kennedy Center Boycott As Sales Plummet

Feb 25, 2025