Is A Dogecoin Dividend A Viable Policy? Examining Trump's Proposal

Table of Contents

Is a Dogecoin Dividend a Viable Policy? Examining Trump's Proposal – A Deep Dive

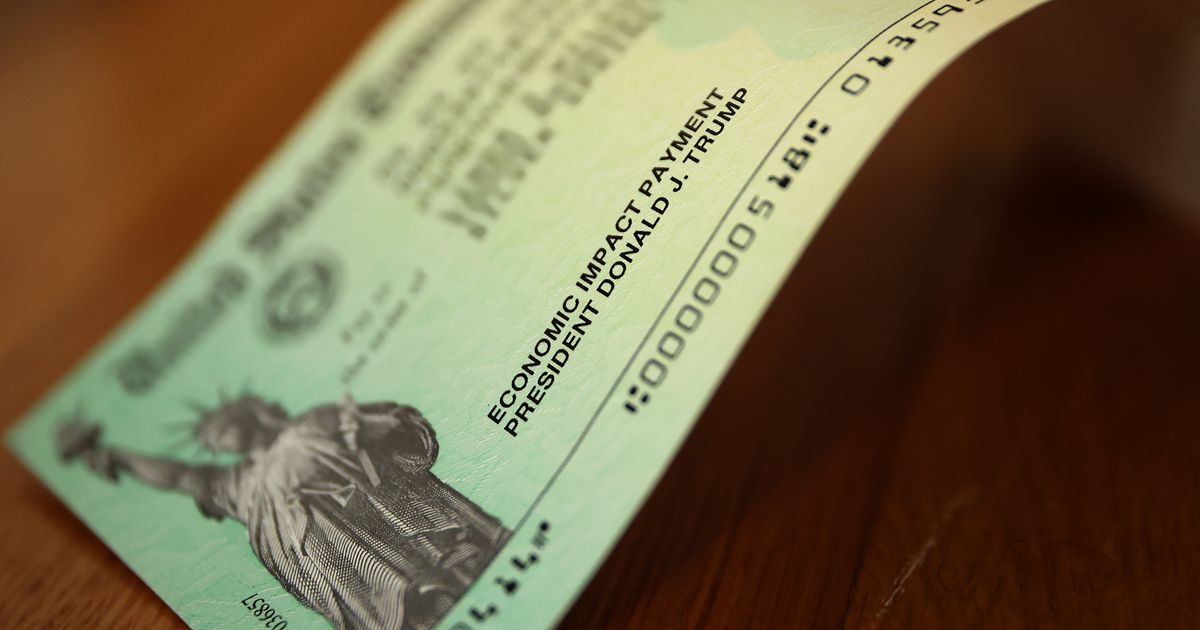

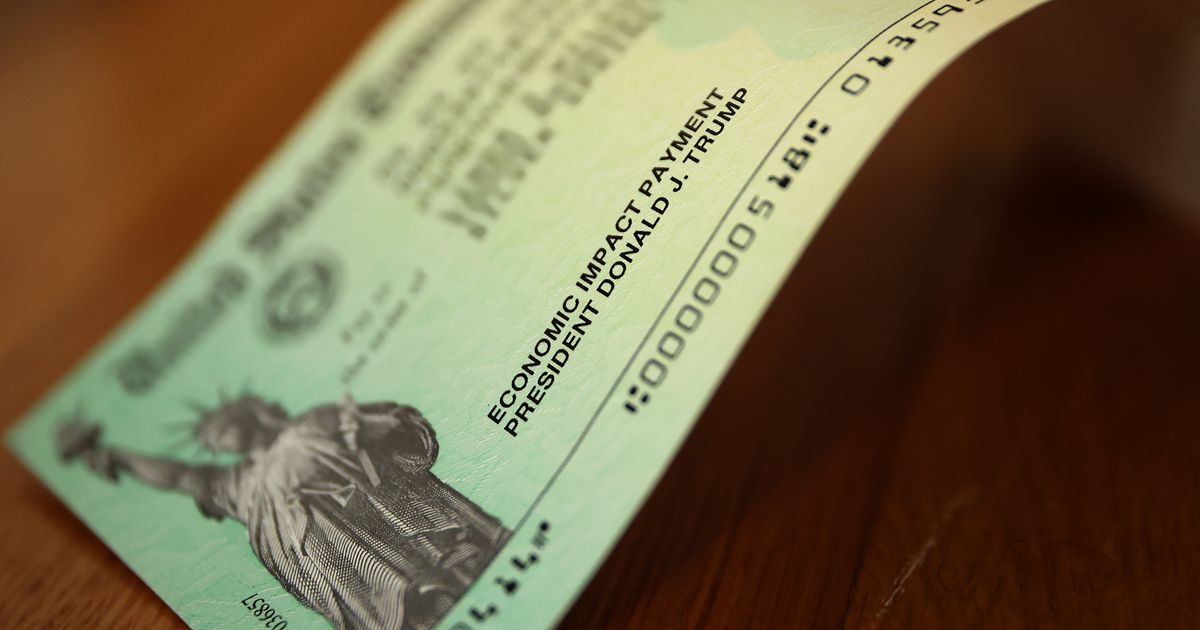

A controversial proposal by a leading presidential candidate to issue a Dogecoin dividend has sparked intense debate among economists and the public. This article examines the feasibility and potential consequences of such a policy.

[Replace with accurate date and time of proposal announcement]: Former President Donald Trump recently ignited a firestorm of controversy with his proposal to distribute a Dogecoin dividend to all American citizens. [Replace with the exact quote from Trump regarding the proposal and source]. The announcement, made [Replace with platform and context of announcement, e.g., during a campaign rally in Des Moines, Iowa; on his Truth Social account], immediately sent shockwaves through the cryptocurrency market and the broader political landscape.

The Proposal's Core Elements: While the details remain scarce, the core tenet of the proposal involves the U.S. government distributing a set amount of Dogecoin (DOGE) to every eligible American citizen. [Replace with any specific amounts mentioned, or lack thereof, and the proposed method of distribution]. This unprecedented policy would represent a significant departure from traditional fiscal policy and raise numerous complex questions.

Economic Viability and Challenges: The most immediate concern revolves around the economic feasibility of such an undertaking. The market capitalization of Dogecoin is [Replace with current market cap and source] Distributing even a small fraction of the existing supply to over 300 million people would require [Replace with calculations demonstrating the economic impact, including potential market manipulation and inflationary pressures]. This could trigger significant volatility in the cryptocurrency market, potentially causing massive losses for investors and destabilization in the broader financial system.

Furthermore, the proposal raises concerns about:

- Fairness and Equity: The distribution of a cryptocurrency, inherently subject to market fluctuations, is far from equitable. Those who receive the dividend could experience significant gains or losses depending on market conditions, exacerbating existing wealth inequality rather than alleviating it.

- Practical Implementation: Distributing DOGE would require a sophisticated and secure infrastructure capable of handling millions of transactions. The technical challenges are substantial, particularly given the decentralized nature of cryptocurrencies. The cost of implementing such a system would be substantial. [Insert estimated costs or links to studies on similar projects if available].

- Legal and Regulatory Uncertainty: The legal implications of such a policy are unclear. The U.S. government's role in endorsing and distributing a cryptocurrency raises serious questions about regulatory compliance, tax implications, and potential legal challenges. [Replace with relevant legal analysis, expert opinions or links to legal documents].

- Market Manipulation: The sheer scale of government involvement in the Dogecoin market could be interpreted as market manipulation, potentially attracting regulatory scrutiny from both domestic and international bodies.

Political Ramifications: The proposal's political implications are equally profound. It has divided the electorate, with supporters viewing it as an innovative way to stimulate the economy and empower citizens, while critics label it as economically unsound, fiscally irresponsible, and a potentially dangerous gamble with public funds.

Expert Opinions: [Insert quotes from various economists, financial experts, and political analysts, providing a balanced perspective on the proposal's viability and potential consequences. Cite their credentials and affiliation.]

Conclusion: Donald Trump's Dogecoin dividend proposal is a radical departure from conventional economic policy. While the intent might be to empower citizens, the economic viability, practical implementation, and potential legal and political ramifications remain significant obstacles. A thorough cost-benefit analysis, considering all potential risks and benefits, is necessary before any serious consideration of such a policy can be entertained. The proposal underscores the need for careful consideration of the implications of incorporating cryptocurrencies into mainstream economic policy. Further research and debate are crucial to understanding the full scope of its potential impact.

Featured Posts

-

Ruben Amorims Impact Analyzing Evertons Draw With Man Utd

Feb 24, 2025

Ruben Amorims Impact Analyzing Evertons Draw With Man Utd

Feb 24, 2025 -

Confirmed Rangers Youngster Completes Loan Transfer

Feb 24, 2025

Confirmed Rangers Youngster Completes Loan Transfer

Feb 24, 2025 -

Mls 2025 Season Full Schedule Key Dates And Tv Broadcast Details

Feb 24, 2025

Mls 2025 Season Full Schedule Key Dates And Tv Broadcast Details

Feb 24, 2025 -

Joao Pedro And Kaoru Mitoma Star In Brightons Southampton Rout

Feb 24, 2025

Joao Pedro And Kaoru Mitoma Star In Brightons Southampton Rout

Feb 24, 2025 -

Understanding Trumps Vision For The Us Postal Service A Delivery Analysis

Feb 24, 2025

Understanding Trumps Vision For The Us Postal Service A Delivery Analysis

Feb 24, 2025

Latest Posts

-

Key Dates Candidates And Issues Germanys 2025 Election Preview

Feb 24, 2025

Key Dates Candidates And Issues Germanys 2025 Election Preview

Feb 24, 2025 -

Ban On Electronic Devices To Curb Rise In Car Thefts

Feb 24, 2025

Ban On Electronic Devices To Curb Rise In Car Thefts

Feb 24, 2025 -

Suspect In Police Officer Death Took Pennsylvania Hospital Staff Hostage New Details Emerge

Feb 24, 2025

Suspect In Police Officer Death Took Pennsylvania Hospital Staff Hostage New Details Emerge

Feb 24, 2025 -

At 78 Voletta Wallace Mother Of The Notorious B I G Passes Away

Feb 24, 2025

At 78 Voletta Wallace Mother Of The Notorious B I G Passes Away

Feb 24, 2025 -

Clash Of Ideologies How Democratic States Are Blocking Trumps Initiatives

Feb 24, 2025

Clash Of Ideologies How Democratic States Are Blocking Trumps Initiatives

Feb 24, 2025